- EUR/USD Price Analysis: Dribbles on the way to 1.1120-30 resistance confluence

Notícias do Mercado

EUR/USD Price Analysis: Dribbles on the way to 1.1120-30 resistance confluence

- EUR/USD portrays sluggish markets as bulls keep the reins near multi-month high.

- Overbought RSI, sluggish MACD challenges further upside but 21-DMA puts a floor under the price.

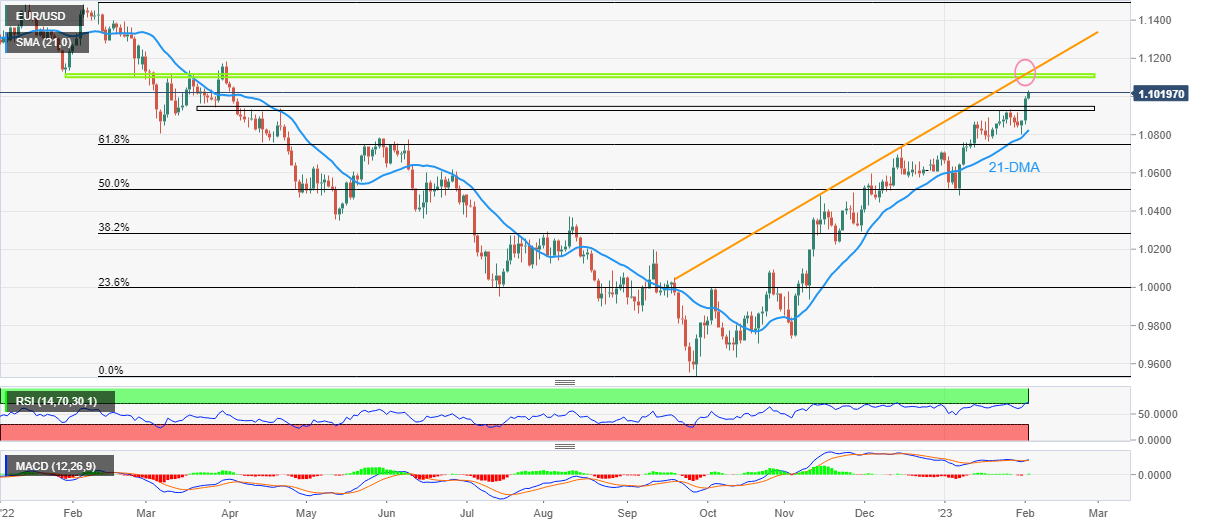

- Convergence of horizontal area from late January 2022, five-month-old ascending trend line appears a tough nut to crack for bulls.

EUR/USD clings to mild gains around 1.1020 as buyers keep the reins during the third consecutive day heading into Thursday’s European session. In doing so, the major currency pair remains firmer at the highest levels since early April 2022.

That said, the overbought RSI (14) and sluggish MACD signals seem to challenge the EUR/USD bulls of late.

Even if the European Central Bank (ECB) manages to propel the prices, a joint of the 13-month-old horizontal area and an ascending trend line from late September 2022 appears a tough nut to crack for the EUR/USD bulls, around 1.1120-30.

It’s worth noting that the EUR/USD pair’s run-up beyond 1.1130 needs validation from the March 2022 peak surrounding 1.1185 before challenging the mid-2022 top of 1.1495.

On the flip side, pullback moves could rest near the 1.0950-25 support area comprising multiple levels marked since late March 2022.

Following that, the 21-DMA level surrounding 1.0825 could probe the EUR/USD bears.

In a case where EUR/USD remains bearish past 1.0825, the 61.8% Fibonacci retracement level of the pair’s February-September 2022 downturn near 1.0745 could act as the last defense of the buyers.

EUR/USD: Daily chart

Trend: Limited upside expected