- Gold Price Forecast: XAU/USD sitting tight over the abyss ahead of US CPI

Notícias do Mercado

Gold Price Forecast: XAU/USD sitting tight over the abyss ahead of US CPI

- Gold price is getting set for the key event this week.

- US Consumer Price Index's countdown has begun.

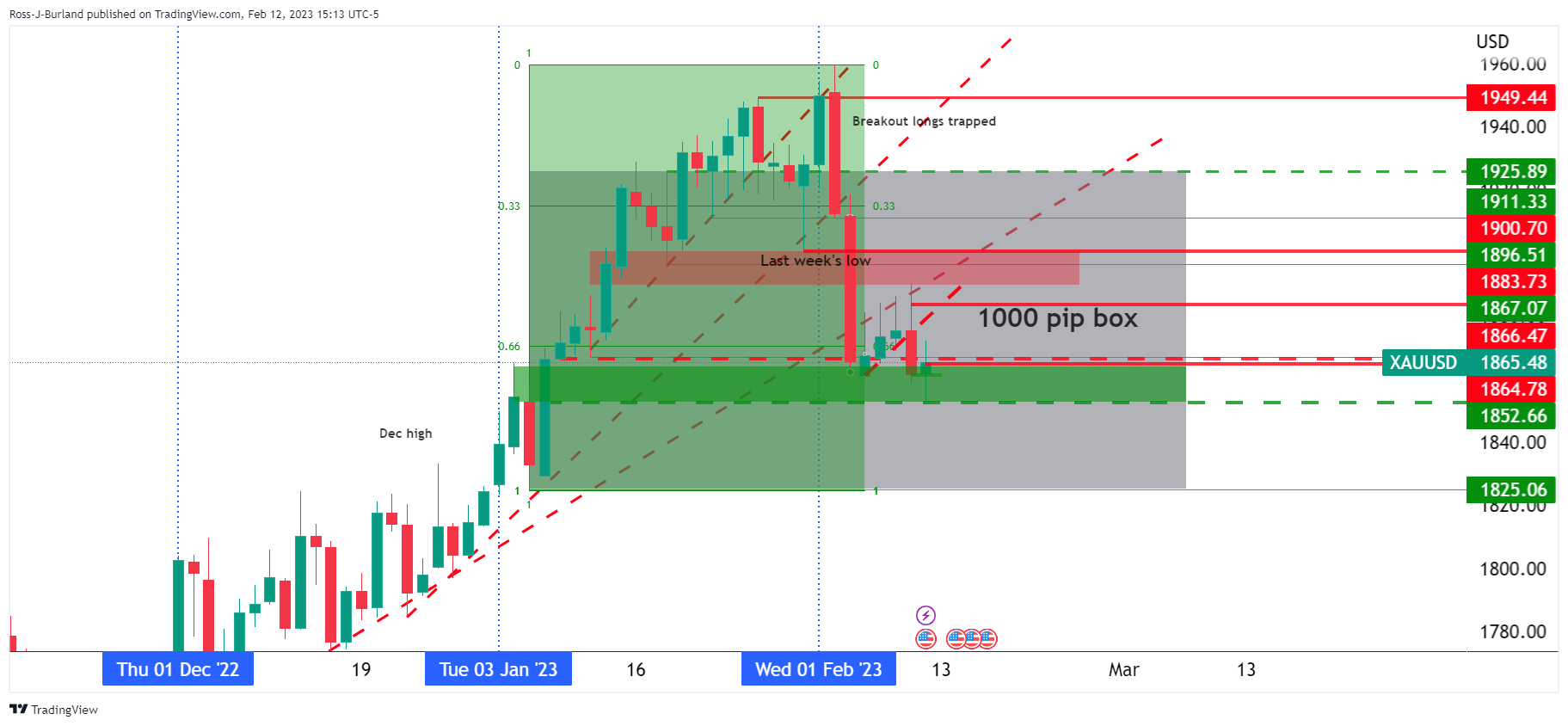

Gold decoupled from the US Dollar's trajectory on Monday, sinking at the same time as the greenback as investors get set for this week's key event in the US Consumer Price Index. However, if the CPI data were to be a dovish outcome, then the Gold price stands to benefit and should the bears be in the market heading into the data, a short squeeze could eventuate as illustrated below.

The price is currently on the front side of the bearish trend following the breakout of the symmetrical triangle on Monday as the following analysis illustrates:

Gold H1 charts

Zoomed in ...

Gold dovish and hawkish biases on US CPI

The price is currently on the front side of the bearish trend following the breakout of the symmetrical triangle on Monday. The move was a continuation of shorts from Thursday's sell-off, Day 1 shorts. The market has since picked up more supply and tested down low in the 100 pip box near $1,850.

There are prospects of a move lower from the 50% mean reversion of the prior bearish impulse while on the front side of the dynamic resistance and ahead of the US CPI data. A target for the bulls would be the opening balance highs near $1,865.

Meanwhile, on an uber-hawkish outcome of the data, the $1,825 target is exposed on a break of $1,850:

If this were to play out off the bat, it would complete that prior analysis thesis as posted over the past few weeks in a running commentary on the market structure:

-

Chart of the Week: XAU/USD trapped bulls into the Fed and NFP

-

Chart of the Week: XAU/USD breakout traders triggered in, bear traps being laid down

-

Chart of the Week: How much can the bulls milk in the short squeeze?