- EUR/USD Price Analysis: Bearish channel, 200-HMA challenge latest run-up

Notícias do Mercado

EUR/USD Price Analysis: Bearish channel, 200-HMA challenge latest run-up

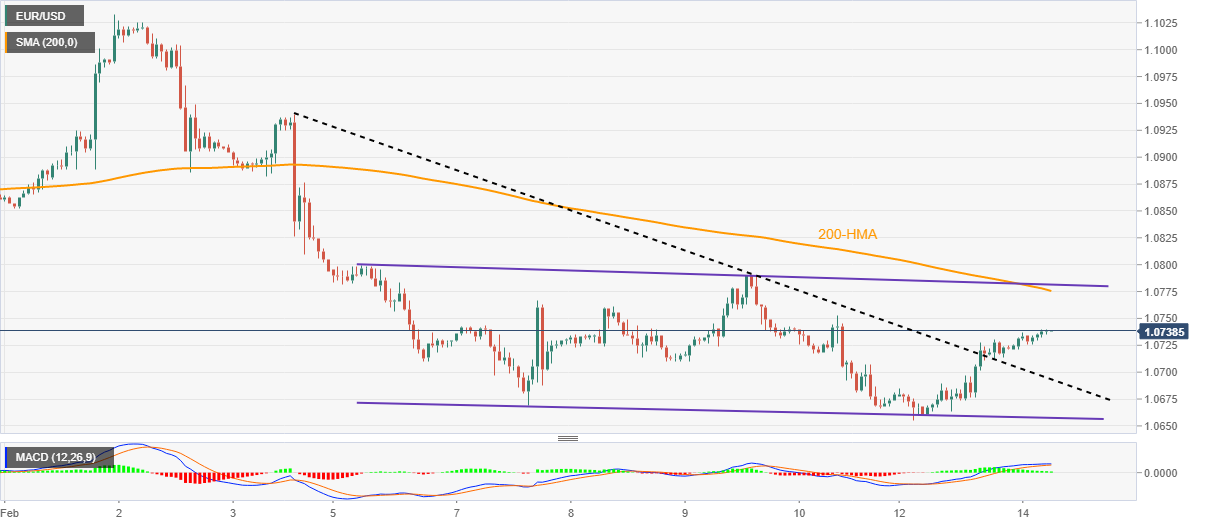

- EUR/USD picks up bids to refresh intraday high, prints two-day uptrend inside weekly bearish channel.

- Clear upside break of one-week-old descending trend line, bullish MACD signals favor buyers.

- Downside remains elusive unless breaking 1.0660 support line.

EUR/USD bulls keep the reins as markets brace for the preliminary readings of the fourth quarter (Q4) Eurozone Gross Domestic Product (GDP) and the US Consumer Price Index (CPI) for January during early Tuesday. That said, the major currency pair renews its intraday high near 1.0740 by the press time.

Also read: EUR/USD advances towards 1.0770 as USD Index struggles to find cushion ahead of US CPI

The quote’s latest advances could be linked to the successful break of the descending resistance line from February 03, now support around 1.0700. Also favoring the EUR/USD buyers are the bullish MACD signals.

It’s worth noting, however, that a convergence of the 200-Hour Moving Average (HMA) joins the top line of a one-week-old descending trend channel to offer a tough nut to crack for the EUR/USD bulls around 1.0780.

Following that, the 1.0800 round figure may act as an extra filter towards the north before directing the pair towards the monthly peak of around 1.1035.

On the flip side, a clear break of the resistance-turned-support line, close to 1.0700 at the latest, isn’t an open welcome to the EUR/USD bears as the aforementioned channel’s lower line acts as the last defense of the Euro pair buyers around 1.0655.

Should the EUR/USD pair remains bearish past 1.0655, the odds of witnessing a slump toward January’s low near 1.0485 can’t be ruled out.

EUR/USD: Hourly chart

Trend: Further upside expected