- EUR/JPY Price Analysis: Beas looking for a break of sturtcure near 142.80/00

Notícias do Mercado

EUR/JPY Price Analysis: Beas looking for a break of sturtcure near 142.80/00

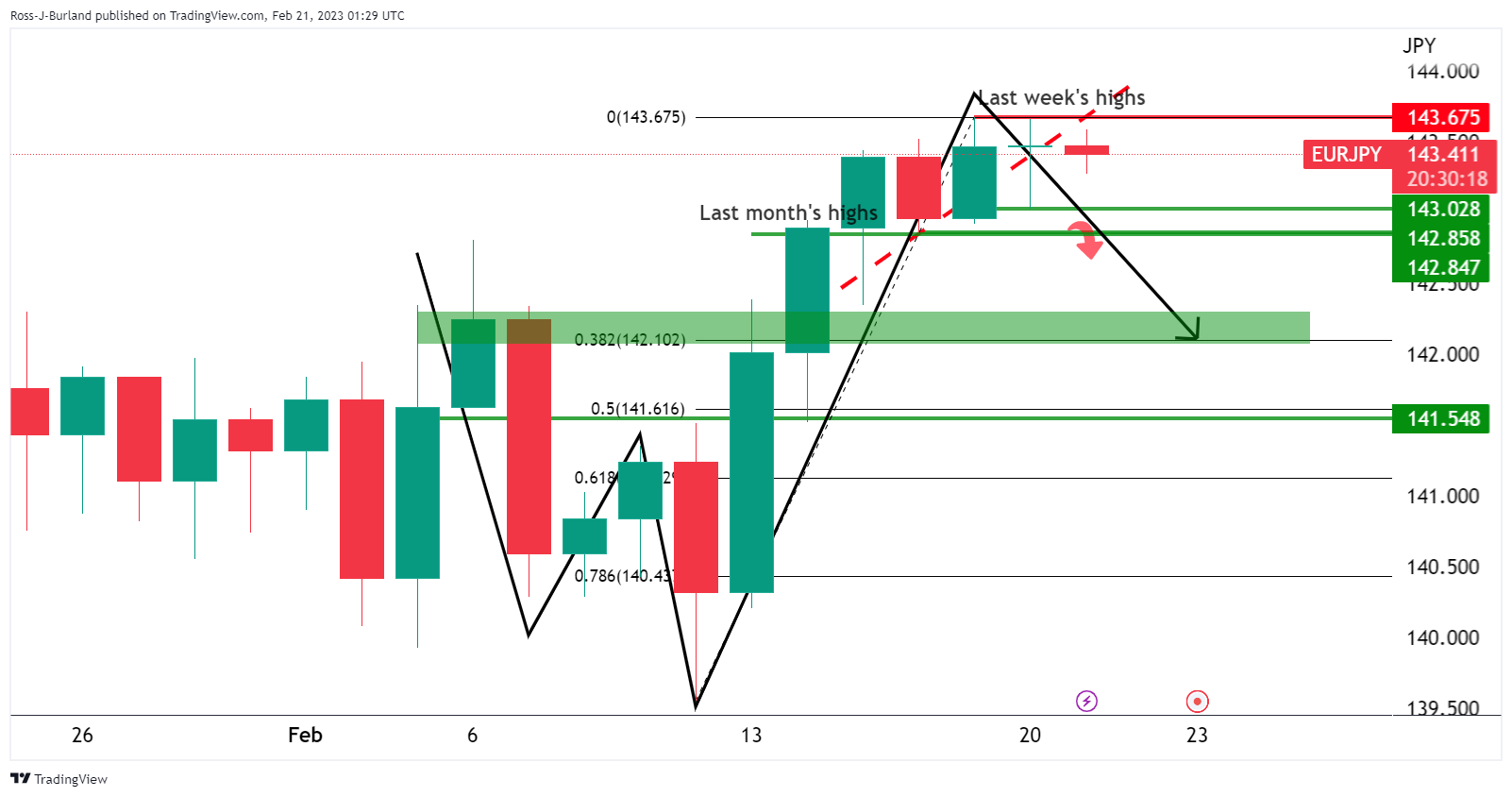

- EUR/JPY bullish run is stalling and a long squeeze could be put on.

- The daily chart's W-formation is compelling and a 38.2% Fibonacci comes in at 142.10.

- A 50% mean reversion target comes in at around 141.60 and a 61.8% Fibonacci retracement is near 141.10.

EUR/JPY is flat in Tokyo and sticking to the opening ranges for the week following a low liquidity day in the US holiday markets. However, from a technical standpoint, the coiled conditions could be the foundations for some explosive moves in the forthcoming days as the following analysis will illustrate.

EUR/JPY H1 chart

From an hourly perspective, EUR/JPY is coiled at what could be a meanwhile top in the broader bullish trend as per the daily chart below.

A thesis could be that volumes might get trapped up high as higher time frame traders and investors chase the breakout of the prior month's highs. In such a scenario, a long squeeze could be put on a break of the key support structure that is located between 143.00 and the 142.80s. If this area were to break, it would clear the way for lower lows in what could turn out to be a sizeable correction as the following shows:

EUR/JPY daily chart

The daily chart's W-formation is compelling and a 38.2% Fibonacci scale drawn on the prior bullish impulse aligns with the resistance area for early February near 142.10. A 50% mean reversion target comes in at around 141.60 and a 61.8% Fibonacci retracement aligns with the neckline of the W-formation near 141.10.