- GBP/USD Price Analysis: Bulls spring to life on backside of bear trend

Notícias do Mercado

GBP/USD Price Analysis: Bulls spring to life on backside of bear trend

- GBP/USD target 1.2270 for the days ahead.

- GBP/USD bears need to get below 1.1900.

Forex markets are unforgiving and prices are two-way as volume kicks in again following the slow start to the week on Monday that was put down to a US holiday. GBP/USD rallied from a 50% mean reversion of Friday's bullish run and broke to 1.2150 on Tuesday, breaking a key resistance around 1.2050 which has invalidated the prior downside bias for the time being as the following top-down analysis will illustrate:

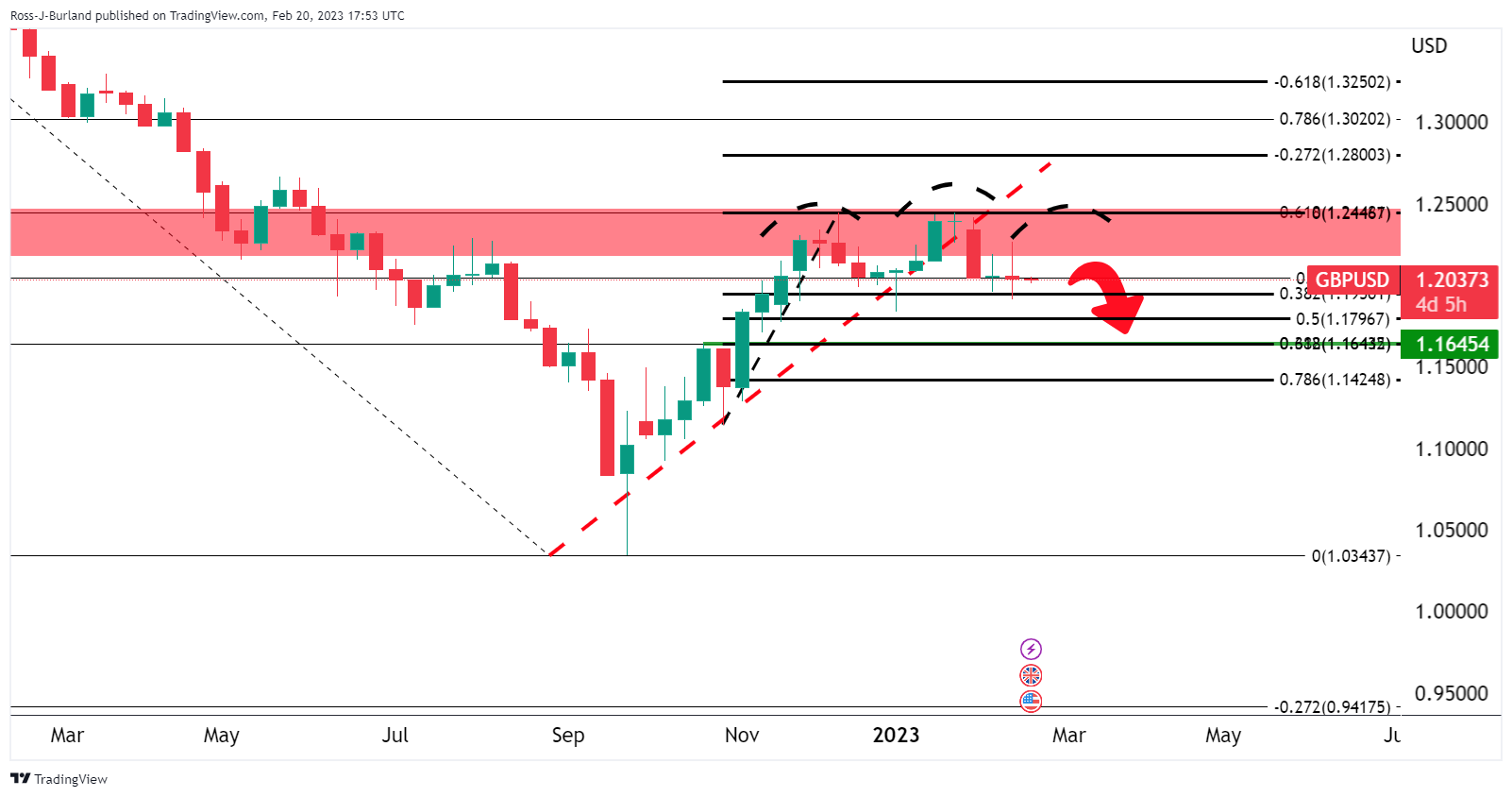

At the start of the week, it was shown in the following article that there was a case for lower due to the formation of the weekly head and shoulders:

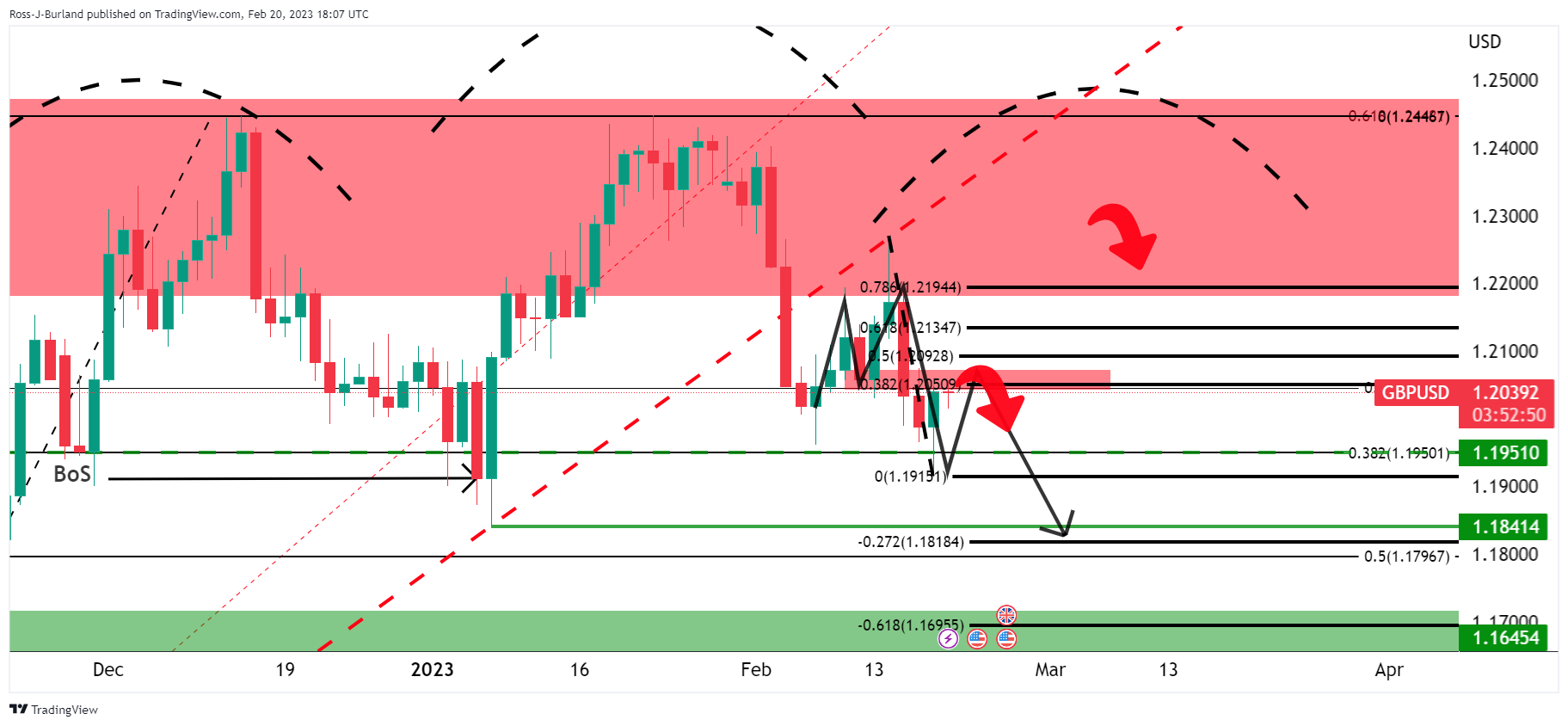

While the thesis remains valid, the meanwhile price action is pointing to a bullish continuation of the correction of the the final days of last week's bearish leg:

Zoomed in ...

The M-formation's neckline was broken on Tuesday, invalidating the bearish thesis from the start of the week's analysis:

In the meantime, instead, the bulls are in control and are now needing to rely on the 1.2070s as a possible newly formed support structure as illustrated below:

1.2270 is eyed as an upside target for the days ahead of the market and does not just remain in a consolidative structure bounded by 1.1900 and 1.2150.