- AUD/USD Price Analysis: Bulls eye a correction to test dynamic resistance

Notícias do Mercado

AUD/USD Price Analysis: Bulls eye a correction to test dynamic resistance

- AUD/USD bulls are lurking for the initial balance this week.

- US Dollar is sky-high and could be due for a correction.

The US Dollar climbed to seven-week peaks on Friday, leaving the Aussie on the backfoot after data showed US inflation accelerated while consumer spending rebounded last month.

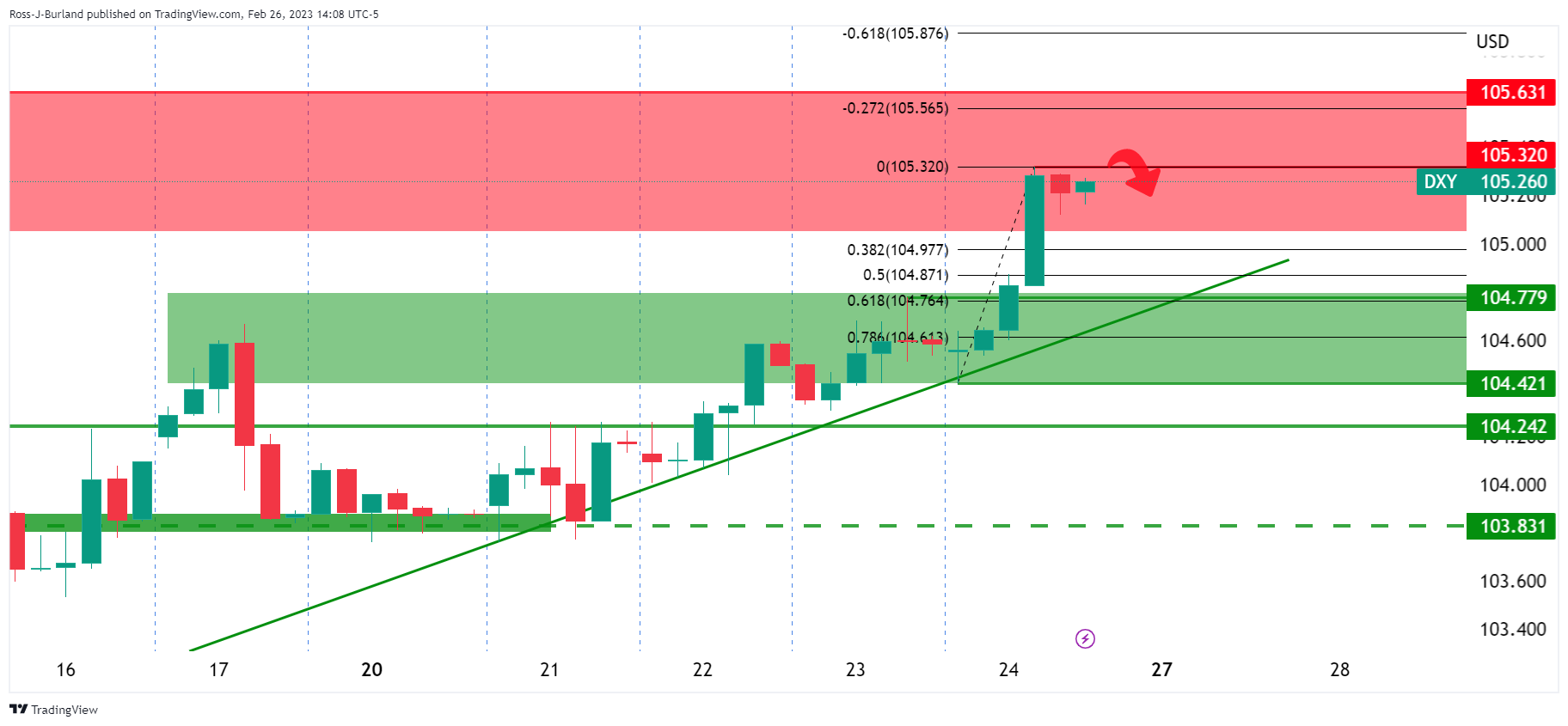

With the Federal Reserve sentiment in the driving seat, the data will be key this week ahead of the second Friday of the month's US Nonfarm Payrolls. ISM surveys will follow last Friday's Personal Consumption Expenditures (PCE) price index, tracked by the Fed for monetary policy which rose 0.6% last month after gaining 0.2% in December. In the 12 months through January, the PCE price index accelerated 5.4% after rising 5.3% in December. This sent the US Dollar heavily bid as follows:

US Dollar charts

However, we are now in correction territory on the US Dollar which makes for a bullish outlook for the initial balance this week for AUD/USD.

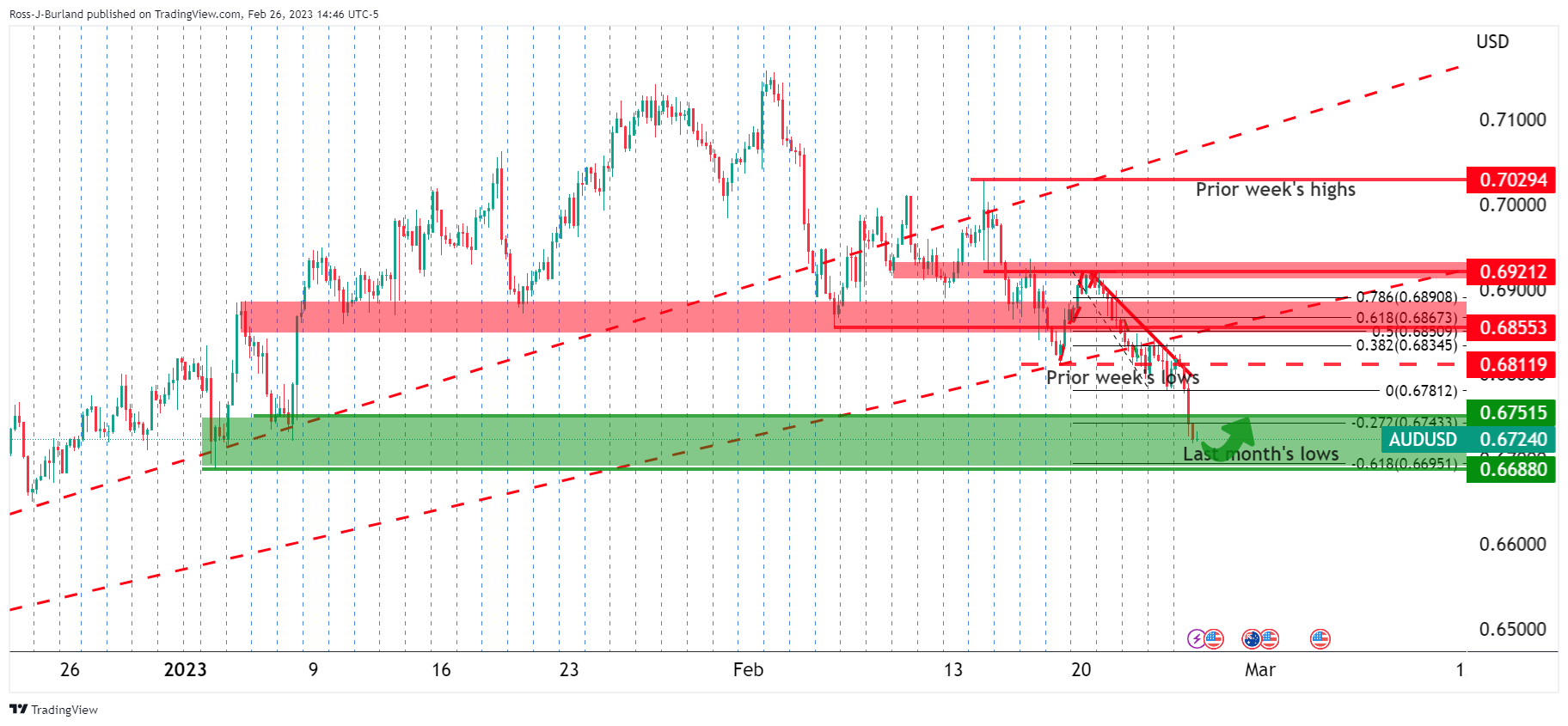

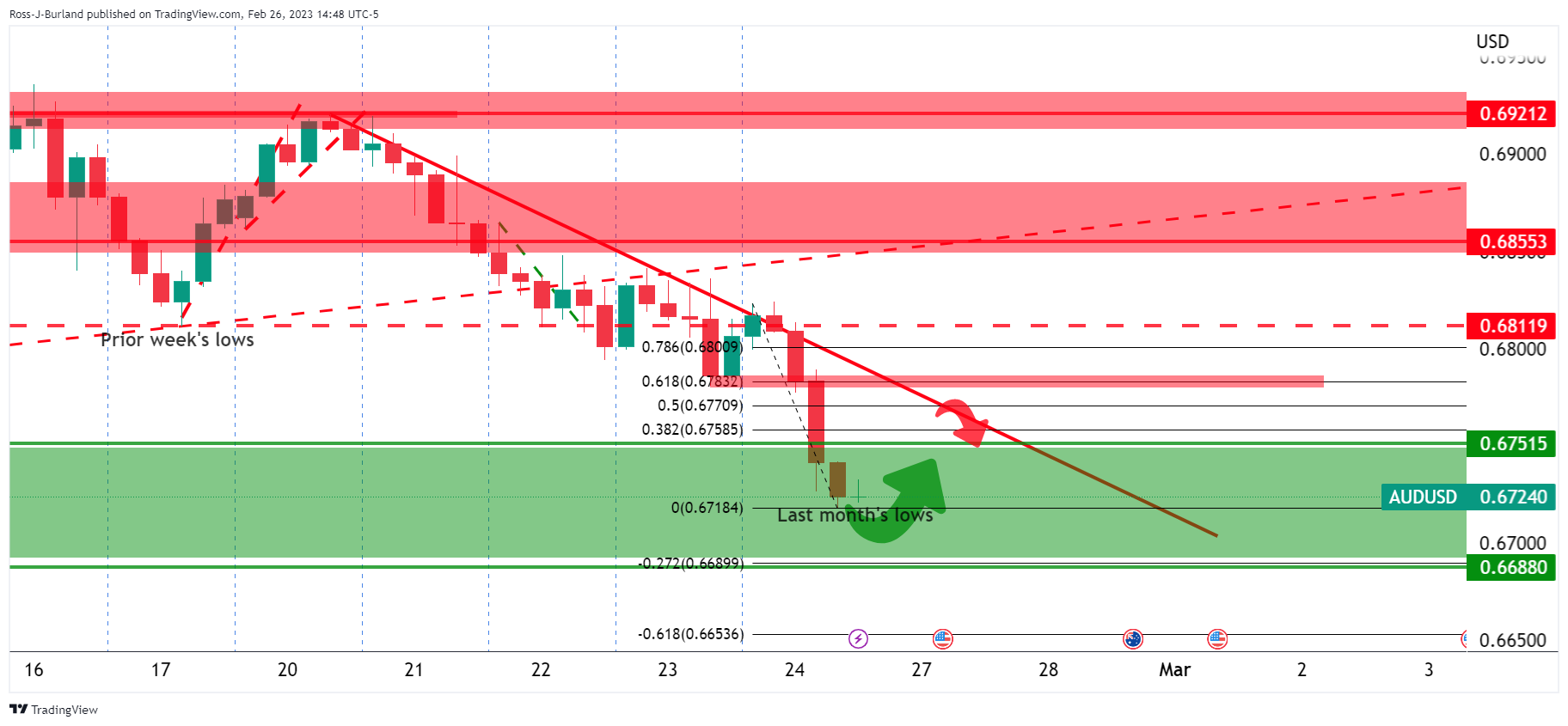

AUD/USD H4 charts

AUD/USD, while potentially on course for a full test of last month's lows, is now in a correction zone and the trendline resistance is compelling for a target of liquidity.