- AUD/NZD Price Analysis: Aussie Retail Sales direct bulls towards 1.0960 key hurdle

Notícias do Mercado

AUD/NZD Price Analysis: Aussie Retail Sales direct bulls towards 1.0960 key hurdle

- AUD/NZD picks up bids to extend week-start rebound from monthly low.

- Australia Retail Sales rose past market forecasts and prior readings to print 1.9% growth in January.

- Convergence of 100-EMA, previous support line from late December 2022 challenge buyers.

- Upbeat oscillators, firmer Aussie data suggest further upside.

AUD/NZD bulls keep the reins around the mid-1.0900s while stretching the week-start recovery moves following the strong Australia Retail Sales data on early Tuesday. In doing so, the cross-currency pair approaches the short-term key resistance confluence.

That said, Australia’s seasonally adjusted Retail Sales rose 1.9% MoM versus 1.5% market forecasts and -3.9% previous readings, which in turn allowed the Aussie pair to refresh the intraday high near 0.6750.

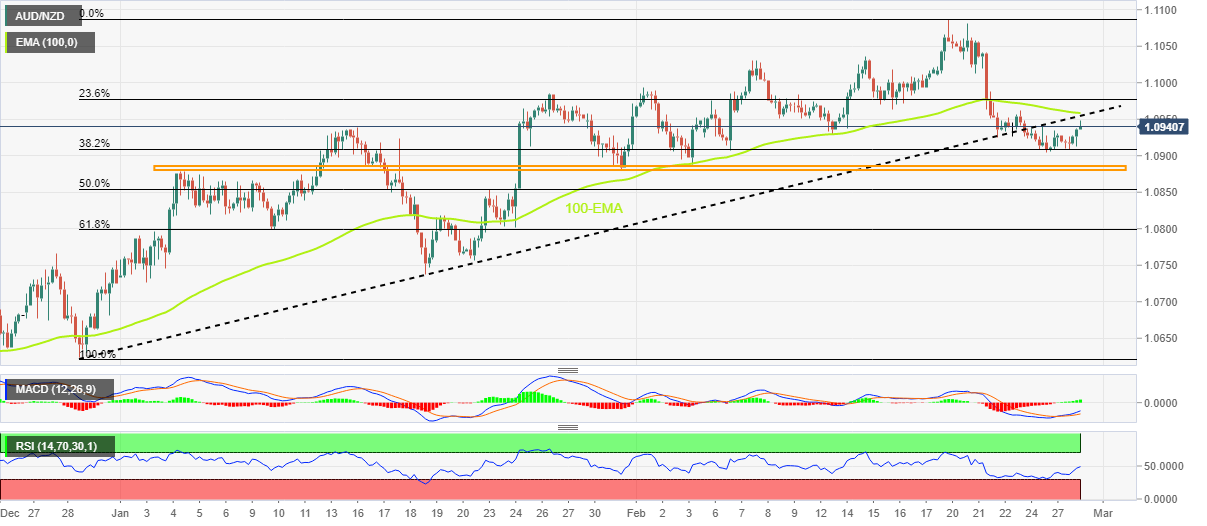

Not only the upbeat Aussie data but the quote’s rebound from the 38.2% Fibonacci retracement level of the pair’s run-up between late 2022 and early February 2023, as well as the bullish MACD signals and upbeat RSI (14), also keep the AUD/NZD buyers hopeful.

However, a convergence of the 100-bar Exponential Moving Average (EMA) and the previous resistance line from late December 2022, around 1.0960, appears the key hurdle for the AUD/NZD bulls to cross to convince the buyers.

Following that, a run-up towards the 1.1000 psychological magnet and then to the monthly high surrounding 1.1090 can’t be ruled out.

Alternatively, the stated 38.2% Fibonacci retracement level puts a floor under the AUD/NZD prices of around 1.0900.

Following that, a seven-week-old horizontal support zone near 1.0880 will be crucial for the pair traders to watch as a break of which could convince sellers to retake control.

AUD/NZD: Four-hour chart

Trend: Further upside expected