- AUD/USD Price Analysis: Bulls eye daily trendline resistance and a confluence near 0.6800

Notícias do Mercado

AUD/USD Price Analysis: Bulls eye daily trendline resistance and a confluence near 0.6800

- AUD/USD is correcting and the bulls might have only just got going.

- AUD/USD bulls eye the 78.6% Fibonacci near 0.6800.

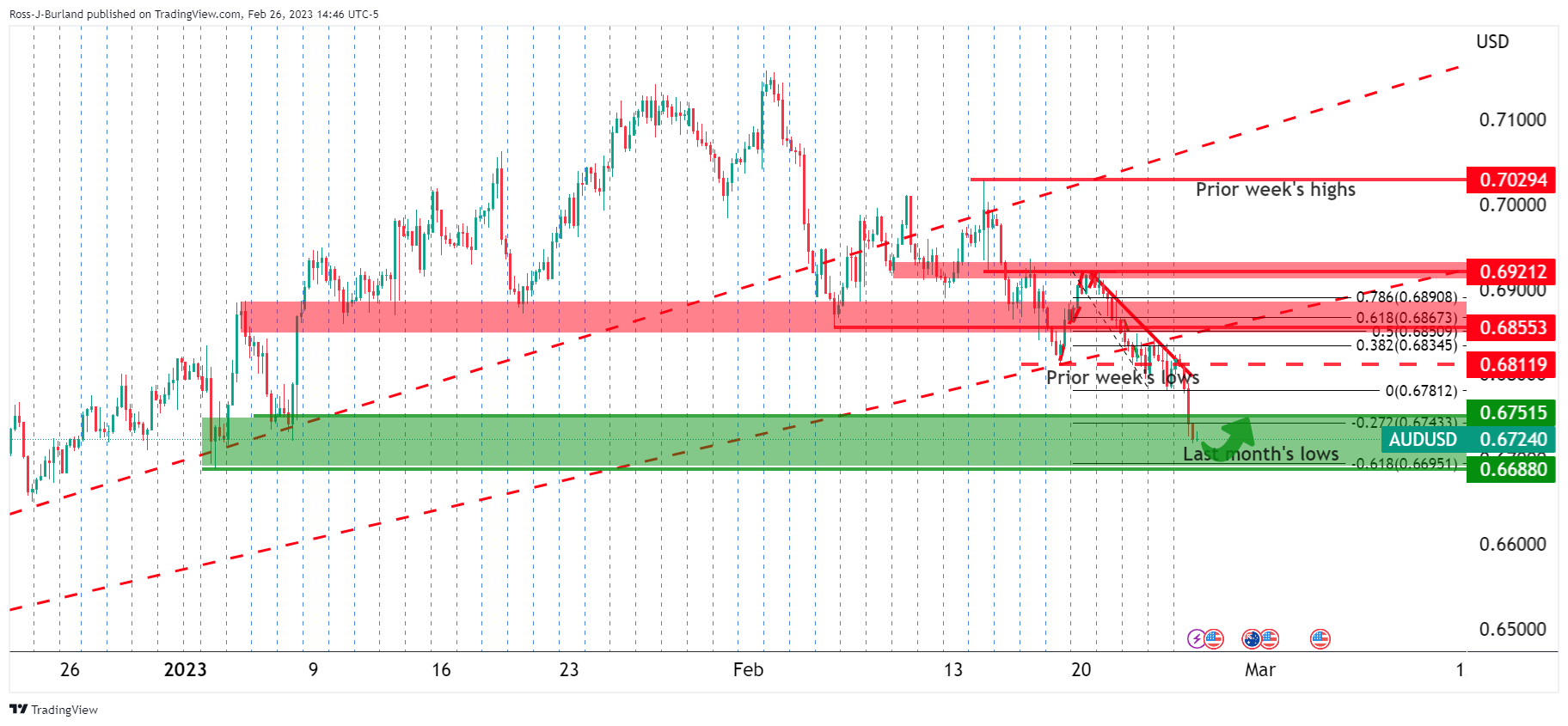

AUD/USD is making a positive effort for the initial balance of the week, moving up into shorts that built from a breakout below 0.7000 in the middle of the month. The moves follow the pre-market open analysis from Monday Asia, here:

- AUD/USD Price Analysis: Bulls eye a correction to test dynamic resistance

AUD/USD prior analysis

It was explained that while potentially on course for a full test of last month's lows, AUD/USD was in a correction zone and the trendline resistance was compelling for a target of liquidity.

AUD/USD update

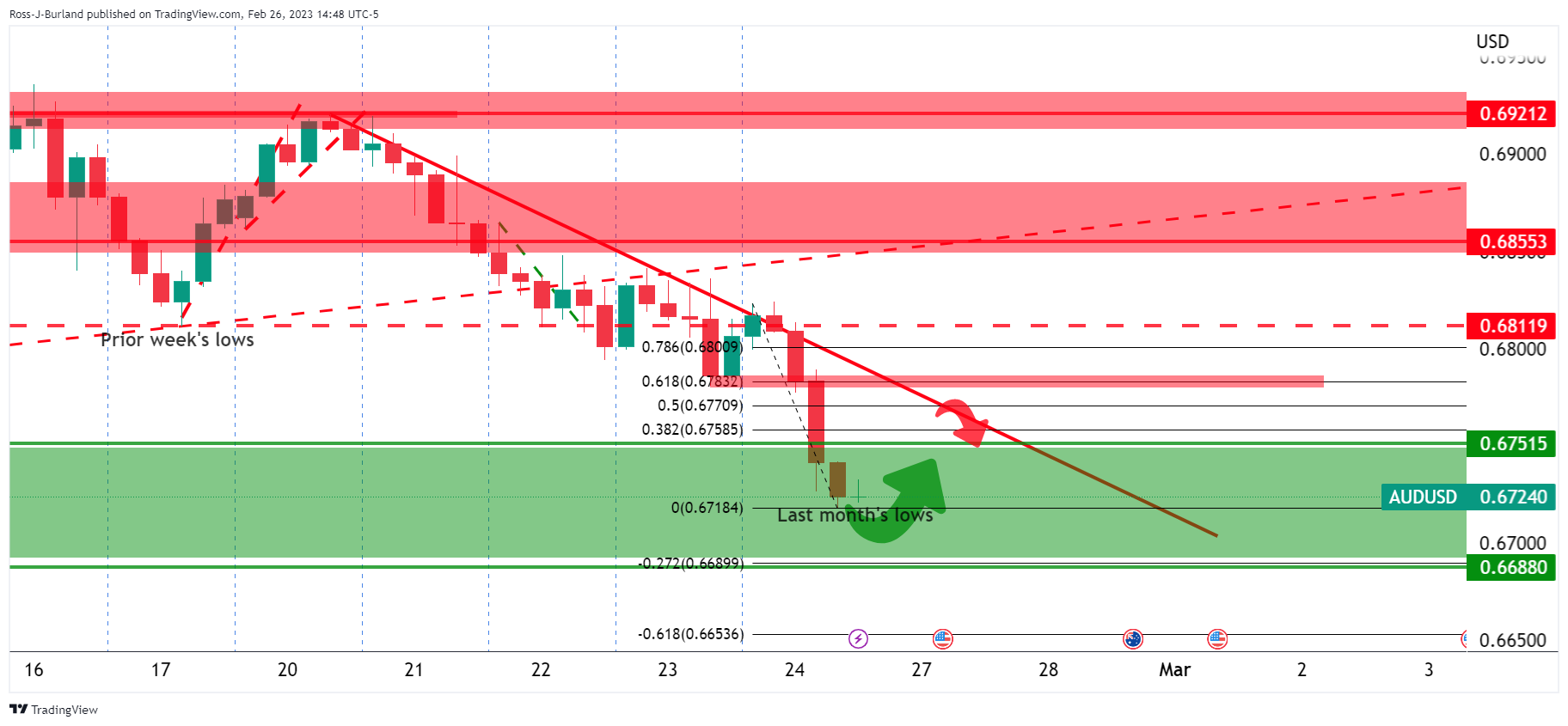

AUD/USD has reached toward a 50% mean reversion area and is starting to come under pressure. However, that is not to say that the correction is on the way out. Instead, it could be building up into a geometrical pattern:

A target of the 78.6% Fibonacci higher up near 0.6800 would align with the daily trendline resistance as follows: