- EUR/USD comes under pressure near 1.0600 post- EMU CPI and ahead of ECB

Notícias do Mercado

EUR/USD comes under pressure near 1.0600 post- EMU CPI and ahead of ECB

- EUR/USD fades part of the recent strong uptick and returns below 1.0700.

- EMU Flash inflation figures surprised to the upside in February.

- Initial Claims, Fed’s Waller come next across the pond.

The European currency sees its recent upside momentum trimmed and forces EUR/USD to retreat to the 1.0630/25 band on Thursday.

EUR/USD appears offered following EMU data, ECB

EUR/USD recedes to the low-1.0600s on the back of the resumption of the buying interest in the greenback, particularly following the so far unabated rally in US yields and hawkish messages from Fed speakers (Kashkari on Wednesday).

Despite the weekly erratic performance, the pair manages well to keep the trade in the positive territory after bottoming out in the 1.0535/30 band last week.

No reaction in the FX universe after Chairwoman Lagarde reiterated that a 50 bps rate hike remains on the table at the March meeting, at the time when she added that decisions on the future rate path will be data dependent, although how far up rates could go remains uncertain. She also noted that inflation remains too high and that she does not see a recession in the region.

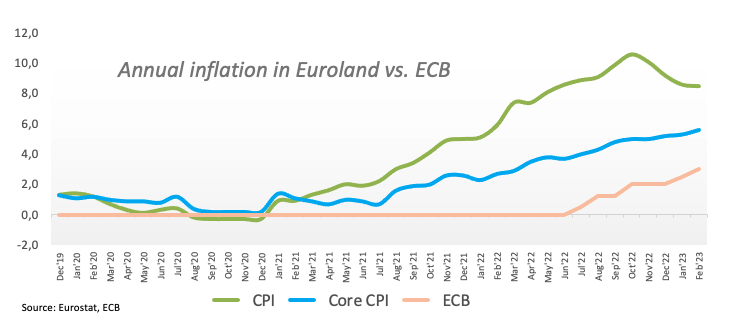

In the docket, advanced inflation figures in the Euroland now see the headline CPI rising 8.5% in the year to February and 5.6% when it comes to the Core CPI. Later in the session, the ECB will publish its Accounts of its February gathering.

In the US, usual weekly Initial Claims are due along with the speech by FOMC C.Waller.

What to look for around EUR

EUR/USD faces some selling pressure and gives aways part of Wednesday’s advance to the vicinity of 1.0700 the figure.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: EMU Flash Inflation Rate, Unemployment Rate, ECB Accounts (Thursday) – Germany Balance of Trade, Final Services PMI, EMU Final Services PMI (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.43% at 1.0620 and faces the immediate support at 1.0532 (monthly low February 27) seconded by 1.0481 (2023 low January 6) and finally 1.0327 (200-day SMA). On the upside, the breakout of 1.0714 (55-day SMA) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2).