- EUR/USD regains the smile and the area above 1.0600

Notícias do Mercado

EUR/USD regains the smile and the area above 1.0600

- EUR/USD prints decent gains beyond the 1.0600 level.

- ECB De Guindos reiterated that inflation is expected to fall by H2 2023.

- US ISM Non-Manufacturing takes centre stage later in the NA session.

Renewed selling pressure in the greenback allows EUR/USD to pick up pace and reclaim the area beyond 1.0600 the figure at the end of the week.

EUR/USD now looks at US data

EUR/USD keeps the choppy price action well and sound so far this week amidst an equally vacillating performance in the greenback, while yields on both sides of the ocean now give away some gains and investors continue to monitor messages from both the ECB and the Fed.

On the latter, ECB’s Vice-President De Guindos suggested earlier that headline inflation should fall below 6% at some point in mid-year, at the time when he reiterated that decisions on future rate hikes will remain data-dependent and that the economy of the region is doing better than expected.

His colleague Vasle left the door open to further rate raises after the March event, a view shared by Board member Müller. In addition, Müller was unable to predict how far up rates may go.

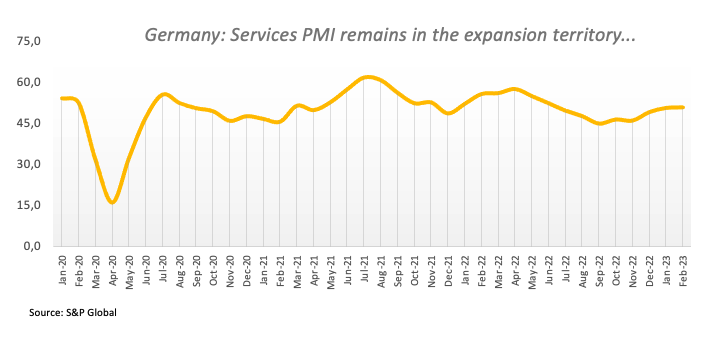

In the domestic calendar, final figures saw Services PMI in Germany and the broader Euroland at 50.9 and 52.7, respectively, for the month of February. In addition, Producer Prices in the euro area contracted 2.8% MoM in January and rose 15% from a year earlier and earlier data saw Germany’s trade surplus widen to €16.7B in January.

In the US, all the attention will be on the release of the ISM Manufacturing seconded by the final prints of the Manufacturing PMI. In addition, FOMC’s Logan, Bostic, Barkin and Bowman are all due to speak later in the NA session.

What to look for around EUR

EUR/USD regains some balance and looks to extend the trade beyond the 1.0600 yardstick amidst the broad-based consolidative mood.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany Balance of Trade, Final Services PMI, EMU Final Services PMI (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.16% at 1.0614 and the breakout of 1.0714 (55-day SMA) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2). On the other hand, there is an immediate support at 1.0532 (monthly low February 27) seconded by 1.0481 (2023 low January 6) and finally 1.0326 (200-day SMA).