- Brent Crude Oil to average $101 over H2 as OPEC+ delivers surprise production cuts – ING

Notícias do Mercado

Brent Crude Oil to average $101 over H2 as OPEC+ delivers surprise production cuts – ING

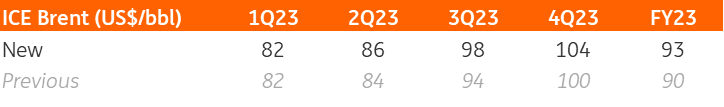

A number of OPEC+ members shocked the market over the weekend by announcing further voluntary supply cuts. Economists at ING have subsequently updated their oil forecasts.

OPEC+ shocks market with supply cuts

“A handful of OPEC+ members surprised the market over the weekend by announcing further voluntary cuts amounting to around 1.66m b/d from May to December 2023. These surprise cuts mean a tighter market this year. As a result, we have had to revise higher our oil forecasts for the remainder of 2023.”

“A tighter market means that we now expect higher oil prices. Prior to these announced cuts we were forecasting Brent to average $97/bbl over the second half of the year. However, we now expect the market to average $101/bbl over this period.”

Source: ING Research