- USD/CAD Price Analysis: Bulls need acceptance from 1.3520 hurdle and Canada Employment data

Notícias do Mercado

USD/CAD Price Analysis: Bulls need acceptance from 1.3520 hurdle and Canada Employment data

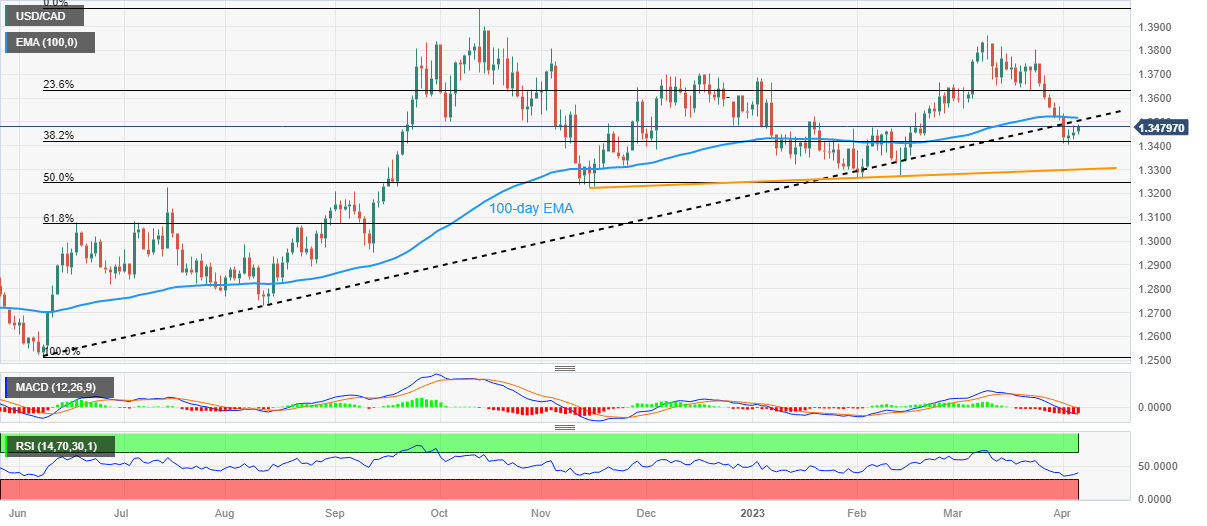

- USD/CAD extends recovery from seven-week low, grinds higher of late.

- Convergence of previous support line from June 2022, 100-day EMA challenges Loonie pair’s recovery.

- 38.2% Fibonacci retracement level, five-month-old ascending trend line lures sellers.

- Canada’s monthly employment data for March bears downbeat forecasts and can weigh on prices.

USD/CAD refreshes intraday high near 1.3485 as it pares the weekly gains during a three-day uptrend on early Thursday. The pair’s latest run-up could be linked to a pre-data consolidation amid broad US Dollar strength ahead of the employment data from Canada and the US.

Also read: USD/CAD bulls eye 1.3500 on softer Oil price, firmer US Dollar, focus on Canada employment data

In doing so, the Loonie pair extends Tuesday’s U-turn from the 38.2% Fibonacci retracement of its upside from June-October 2022. The quote’s recovery also takes clues from the latest rebound in the RSI (14) from below 50 levels.

However, a convergence of the 100-day Exponential Moving Average (EMA) and a 10-month-old support-turned-resistance line, around 1.3520 at the latest, appears a tough nut to crack for the Loonie pair buyers.

In a case where the USD/CAD price remains firmer past 1.3520, it can rise towards the 23.6% Fibonacci retracement level of 1.3635 and then to the December 2022 peak of 1.3700.

On the flip side, a downside break of the stated 38.2% Fibonacci retracement level of 1.3425 can restrict the short-term USD/CAD downside.

If the USD/CAD breaks 1.3425 support, an upward-sloping support line from mid-November 2022, around 1.3300 by the press time, can act as the last defense of the USD/CAD buyers.

Overall, USD/CAD is likely to witness a pullback unless bulls manage to cross the 1.3520 hurdle and see welcome data from Statistics Canada.

USD/CAD: Daily chart

Trend: Limited recovery expected