- Crude Oil Futures: Further decline looks unlikely

Notícias do Mercado

19 abril 2023

Crude Oil Futures: Further decline looks unlikely

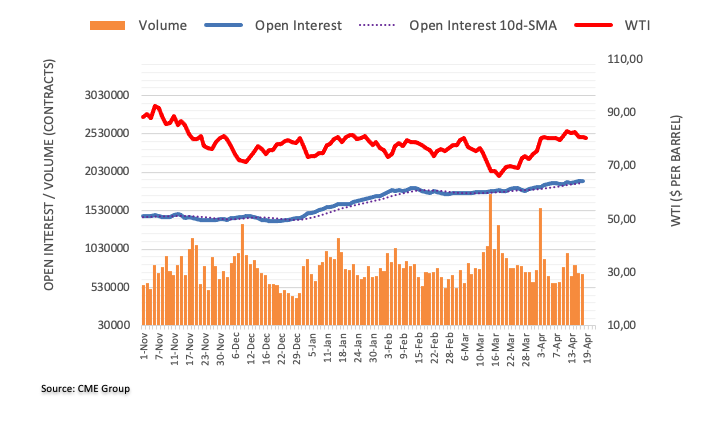

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions by around 5.7K contracts on Tuesday following two daily builds in a row. Volume followed suit and dropped for the second consecutive session, this time by around 19.5K contracts.

WTI remains supported by $80.00

Prices of the barrel of the WTI extended the corrective decline on Tuesday. The bearish move was on the back of shrinking open interest and volume and removes strength from potential future retracements. In the meantime, the $80.00 mark per barrel continues to hold the downside in the commodity for the time being.

O foco de mercado

Abrir Conta Demo e Página Pessoal