- Gold Price Forecast: XAU/USD bears move in to test key support

Notícias do Mercado

Gold Price Forecast: XAU/USD bears move in to test key support

- Gold price sits in the consolidative territory after two-way price action.

- Federal Reserve sentiment is the driving force with eyes on key support.

The Gold price is down some 0.5% on the day, sliding below the $2,000 mark as the US Dollar perks up again. US Treasury yields are moving higher towards a one-month peak, with markets now pricing in an 85% chance of a 25-basis-points rate hike at the Federal Reserve's May 2-3 meeting.

Hawkish tones have crept their way back in this week following, initially, Friday´s comments from Federal Reserve Governor Christopher Waller said that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up. Today, we have heard from St. Louis Federal Reserve chief James Bullard who said on Tuesday that the Fed should continue raising interest rates as recent data shows inflation remains persistent while the broader economy seems poised to continue growing, even if slowly. There has also been a series of data including hot consumer spending for the past quarter and the April survey of business activity in New York state that was rising for the first time in five months. Consequently to all of this, the US Dollar rose from a low of 101.656 and was reaching a high of 102.228, making the greenback bullion less attractive to overseas buyers as higher rates blunt non-yielding bullion's appeal.

Meanwhile, the Federal Reserve blackout period ´´starts on April 22 before the central bank's May 2-3 meeting. Analysts at Brown Brothers Harriman have explained that WIRP suggests 90% odds of 25 bp hike May 3, up from 70% at the start of last week and 50% at the start of the week before that. After that, odds of a hike June 14 sit near 20%. More importantly, a rate cut by year-end is no longer priced in.´´

As the broad US Dollar creeps higher, analysts at TD Securities explained that ´´the Gold price is flirting with key trigger levels that could catalyze the next round of large-scale algo liquidations, in line with our view of elevated risks of a tactical retreat. A break below the $1,975 range should see CTAs shed -4% of their max size in the yellow metal, with even more substantial liquidations expected below the $1,945 range.´´

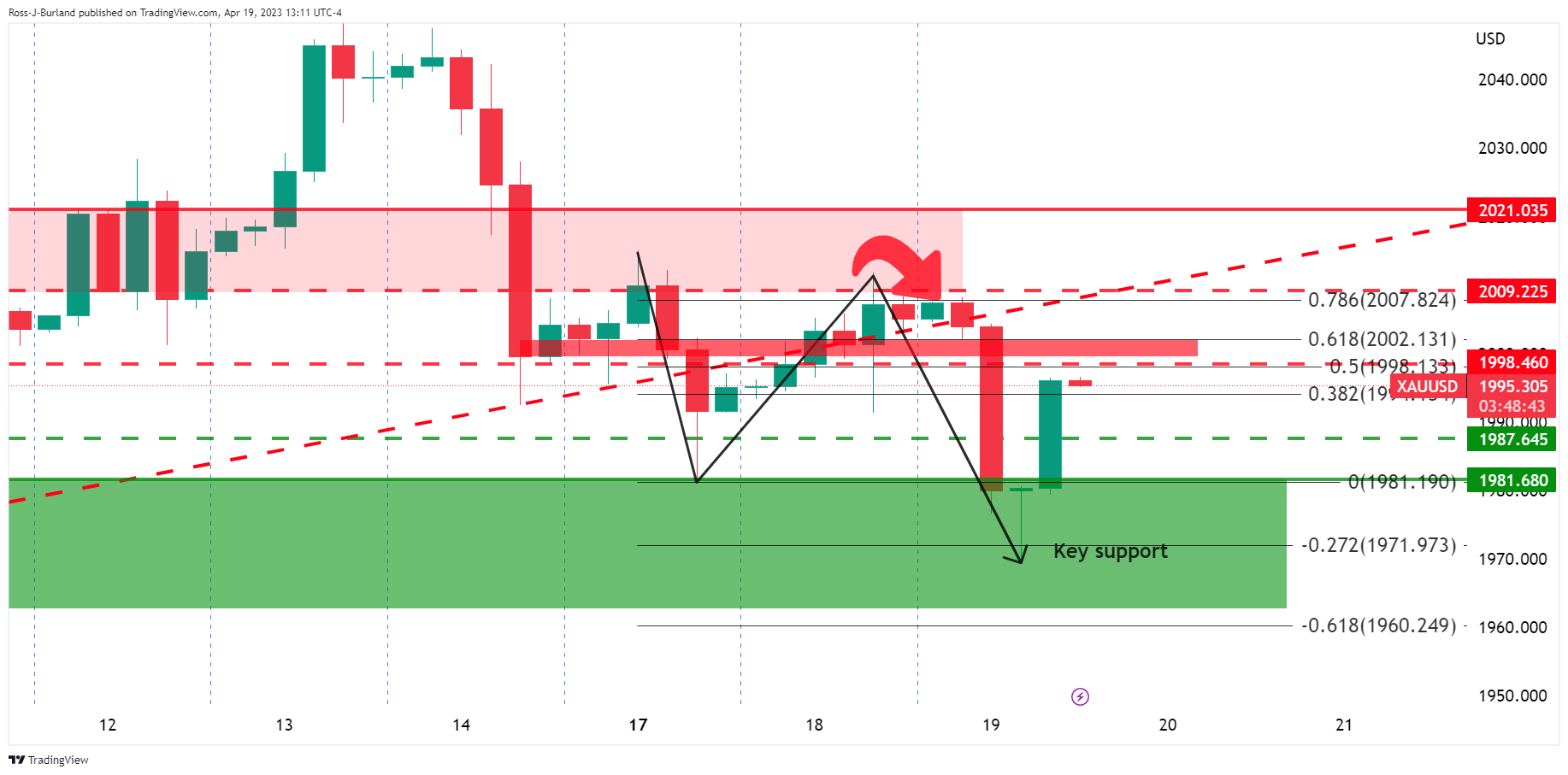

Gold price technical analysis

After a bullish correction into the 78.6% Fibonacci, bears guarding $2,000 moved in, and a subsequent downside continuation into key support played out. The price has been firmly rejected from there and a period of consolidation could be on the cards.