- RBNZ: Annualized Q1 Sectoral Factor Model Inflation softens to 5.7%

Notícias do Mercado

RBNZ: Annualized Q1 Sectoral Factor Model Inflation softens to 5.7%

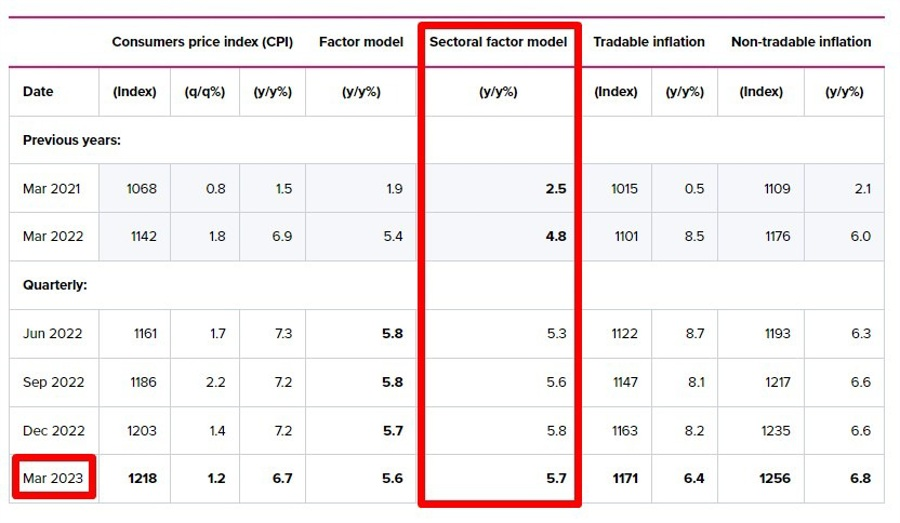

The Reserve Bank of New Zealand (RBNZ) released its Sectoral Factor Model Inflation gauge for the first quarter of 2023 this Thursday.

The gauge eased slightly to 5.7% YoY in Q1 202, compared with the 5.8% clip booked in Q4 2022.

The New Zealand Statistics (NZ Stats) released figures that showed the Consumer Price Index at 6.7%, lower than economists and the central bank had forecast.

Both measures are closely watched by the RBNZ.

FX Implications

The Kiwi dollar is hit further by the RBNZ inflation gauge. NZD/USD is falling hard to test the 0.6150 level, as of writing, losing 0.73% on the day.

About the RBNZ Sectoral Factor Model Inflation

The Reserve Bank of New Zealand has a set of models that produce core inflation estimates. The sectoral factor model estimates a measure of core inflation based on co-movements - the extent to which individual price series move together. It takes a sectoral approach, estimating core inflation based on two sets of prices: prices of tradable items, which are either imported or exposed to international competition, and prices of non-tradable items, which are those produced domestically and not facing competition from imports.