- USD/JPY Price Analysis: Bulls taking a reincheck as bears eye 132.80s

Notícias do Mercado

USD/JPY Price Analysis: Bulls taking a reincheck as bears eye 132.80s

- USD/JPY bears are in the market front side of the bearish trend.

- Bears are a meanwhile extension to the downside.

- Bulls are lurking on longer-term time frames.

As per the prior analysis, USD/JPY bears carving out a bias front side of bearish trend, the market remains in the hands of the bears, for the meantime, as the following analysis will illustrate.

The key notes for the near-term outlook are as follows:

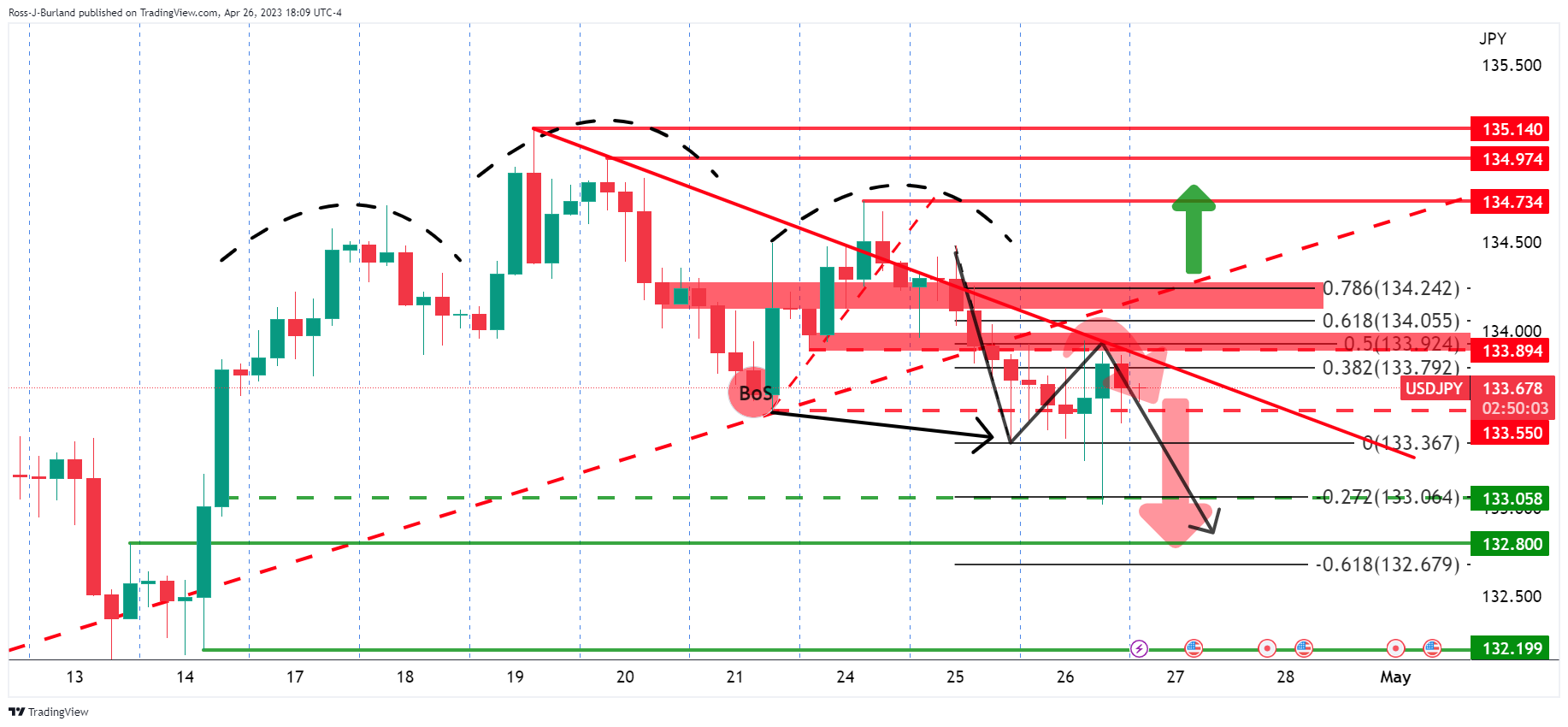

- We have the head and shoulders formed.

- We have seen a break of the 4-hour structure.

- There has been a correction into the bearish trendline resistance meeting the 38.2% ratio.

- A downside continuation with 132.80 eyed.

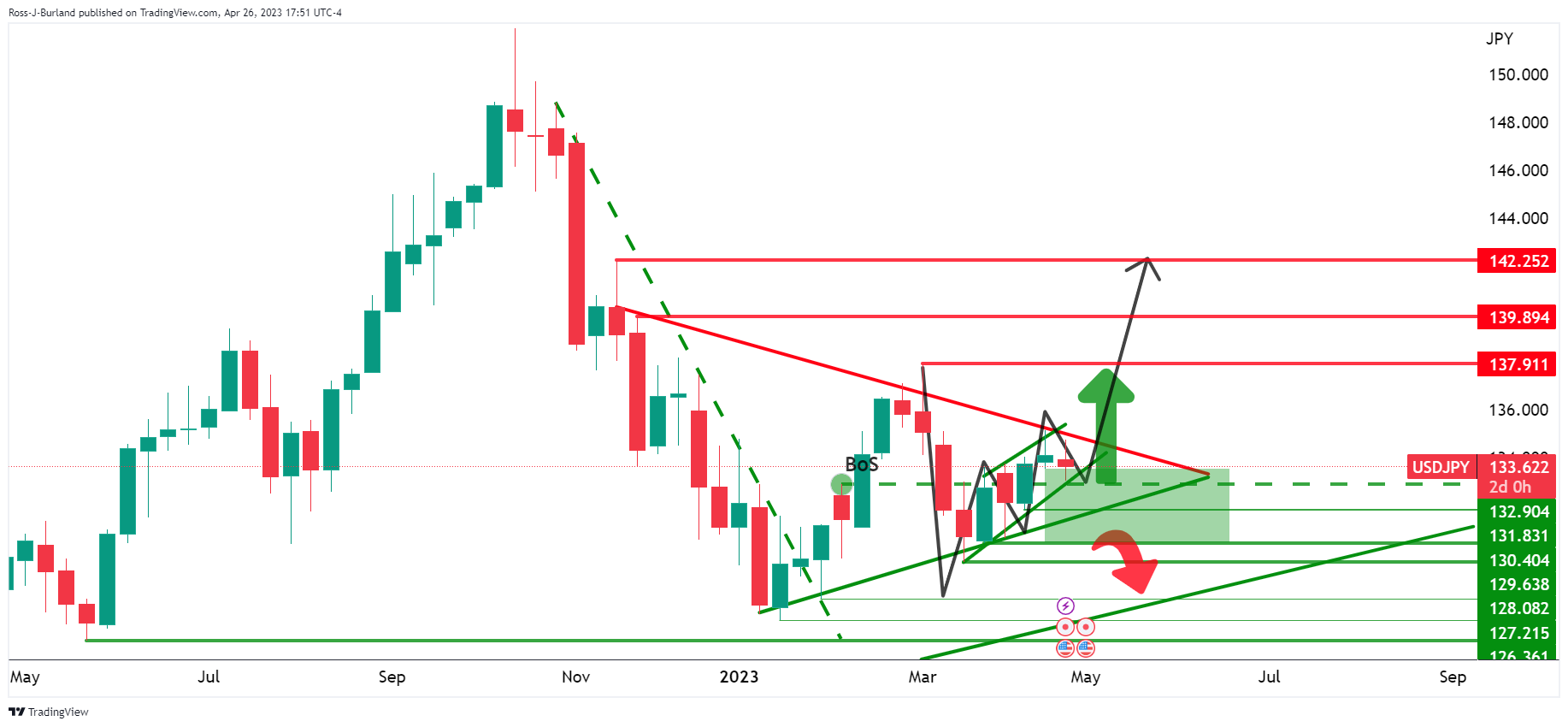

USDJPY weekly charts

Zooming in on the weekly chart, we can see that a W-formation is taking shape with the potential for the correction to run deeper into the Fibonacci scale. The 38.2% ratio has already been met where trendline support meets the lows, so a bullish impulse could take shape from this point. However, monitoring for a deeper more to the 50% mean reversion could offer the patient bulls a discount.

USD/JPY H4 chart

We have the head and shoulders formed with the price on the back side of the prior rising trendline support that is now expected to act as a counter-trendline. We also have seen a break of the 4-hour structure and a correction into the bearish trendline resistance meeting the 38.2% ratio. Bears could engage here which would possibly result in a downside continuation with 132.80 eyed.