- Ex-BoJ dep gov Wakatabe: Will be surprised if BoJ changes YCC Friday

Notícias do Mercado

Ex-BoJ dep gov Wakatabe: Will be surprised if BoJ changes YCC Friday

The ex-Bank of Japan deputy gov Masazumi Wakatabe said he will be surprised if the BoJ changes Yield Curve Control on Friday.

Bank of Japan officials have been vocally wary of tweaking or scrapping their yield control stimulus at the policy meeting this week that concludes tomorrow so soon after the banking crisis overseas. BOJ officials instead see a need to keep their cap on government bond yields in place for now to support the economy.

The two-day meeting will be the first under Governor Kazuo Ueda who is forecast to keep policy settings unchanged. The bigger news will come in his press conference and the extent to which he hints at an overhaul to come.

USD/JPY update

USD/JPY Price Analysis: Bulls taking a rein check as bears eye 132.80s

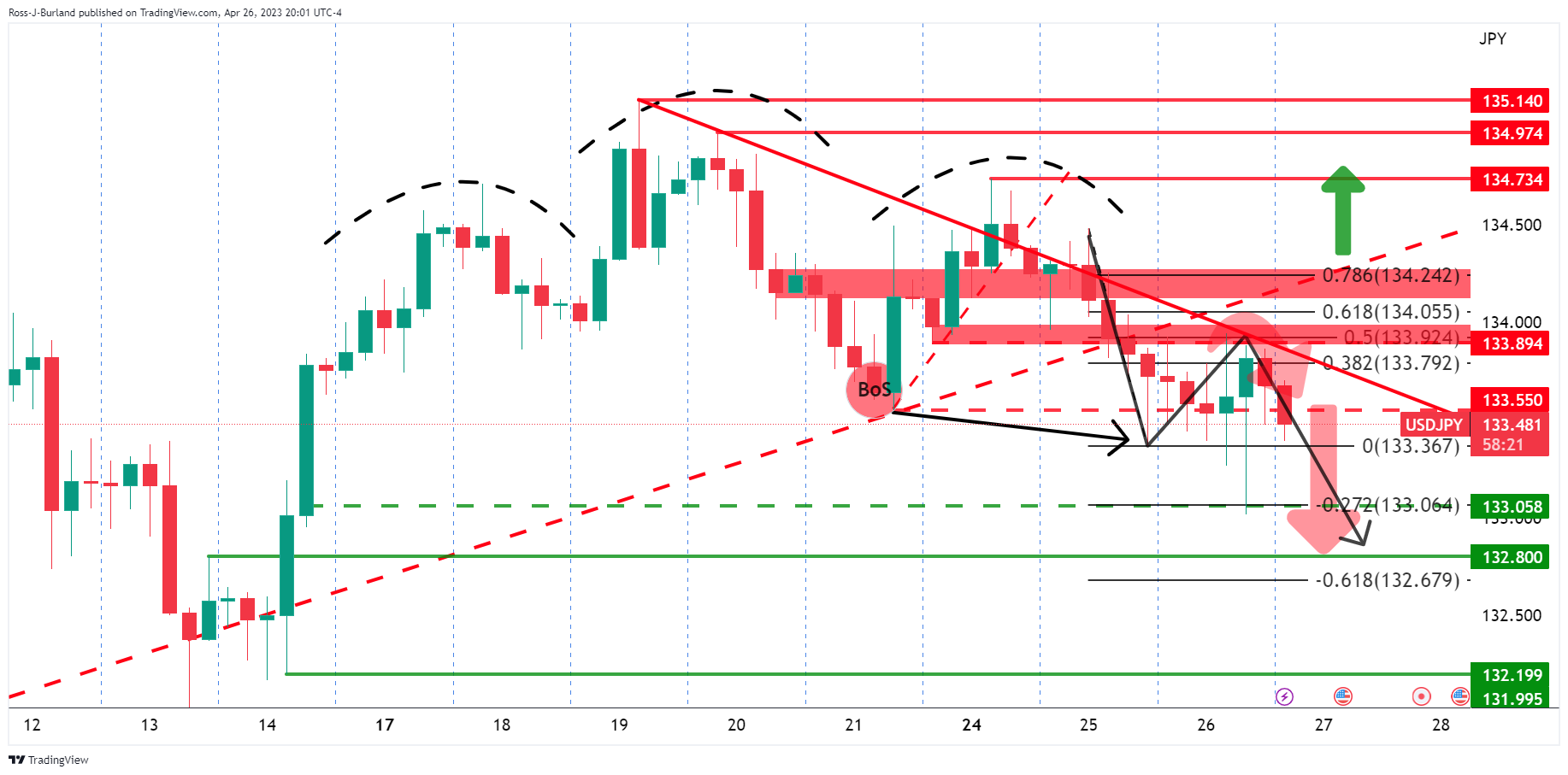

USD/JPY H4 chart

We have the head and shoulders formed with the price on the back side of the prior rising trendline support that is now expected to act as a counter-trendline. We also have seen a break of the 4-hour structure and a correction into the bearish trendline resistance meeting the 38.2% ratio. Bears are engaged here which will possibly result in a downside continuation with 132.80 eyed.