- EUR/USD reverses losses and re-targets 1.1000 post US-CPI

Notícias do Mercado

EUR/USD reverses losses and re-targets 1.1000 post US-CPI

- EUR/USD regains upside traction and looks at 1.1000.

- Final CPI in Germany rose 7.2 YoY, 0.4% MoM in April.

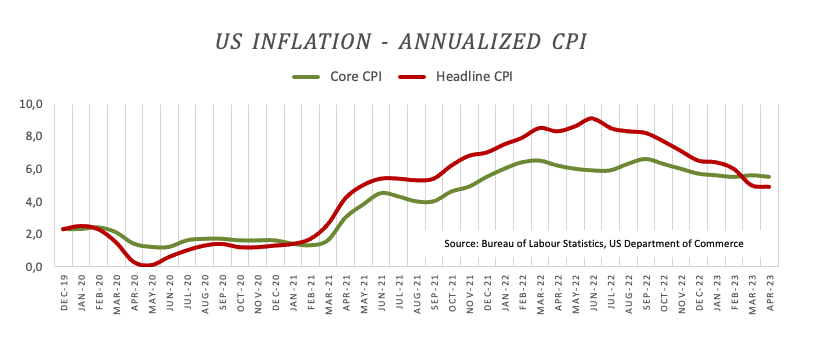

- US headline CPI dropped more than expected in April.

Sellers now hit the Greenback and help EUR/USD regain upside traction and re-shift the focus to the key barrier at 1.1000 the figure on Wednesday.

EUR/USD picks up pace on soft US CPI

EUR/USD reclaims ground lost earlier in the European session and returns to the positive territory near the key 1.1000 barrier.

Indeed, the pair manages to gather extra steam on the back of the bout of selling pressure in the Buck after US inflation figures showed disinflationary pressures continue to build in the economy.

On the latter, inflation tracked by the headline CPI rose 4.9% in the year to April and held steady at 5.5% when it comes to the Core CPI, which excludes food and energy costs.

Earlier in the domestic calendar, final inflation figures in Germany saw the CPI rise 7.2% in the year to April and 0.4% vs. the previous month. In addition, Industrial Production in Italy contracted 0.6% MoM in March and 3.2% from a year earlier.

What to look for around EUR

EUR/USD looks to regain some fresh buying interest following CPI-led weakness in the US dollar on Wednesday.

The movement of the euro's value is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany Final Inflation Rate (Wednesday).

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.28% at 1.0989 and faces the next up-barrier at 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022). On the other hand, the next contention level aligns at 1.0941 (monthly low May 2) followed by 1.0909 (weekly low April 17) and finally 1.0831 (monthly low April 10).