- Gold Price Forecast: XAU/USD bounces off $2,010 support amid cautious optimism – Confluence Detector

Notícias do Mercado

Gold Price Forecast: XAU/USD bounces off $2,010 support amid cautious optimism – Confluence Detector

- Gold price clings to mild gains during the first positive day in three.

- Corrective bounce in market sentiment adds strength to recovery from $2,010 support confluence.

- Hopes of US debt ceiling extension, absence of major risk-negative headlines keep XAU/USD on intraday buyers’ radar.

- Gold buyers need to gain validation from US default updates, banking news and US Retail Sales.

Gold price (XAU/USD) licks its wounds after a three-day downtrend, not to forget posting the biggest weekly loss since late September 2022. In doing so, the XAU/USD benefits from the US Dollar’s consolidation amid hopes of no US default, as well as mixed comments from the Federal Reserve (Fed) official. Also weighing on the US Dollar could be the news suggesting downbeat US data surrounding inflation and consumer confidence.

However, the Gold price remains on the bear’s radar amid hopes of witnessing more drama about the US debt ceiling extension, as well as fears of more banking fallouts and drowning of the deposits.

Moving on, short-term Gold price moves should rely on Tuesday’s US policymakers’ negotiations about the US debt ceiling extension. Also important are more clues about the US inflation and US Retail Sales data for April, as well as Fed Chair Jerome Powell’s speech.

Also read: Gold Price Forecast: 21 DMA holds the fort, what’s next for XAU/USD?

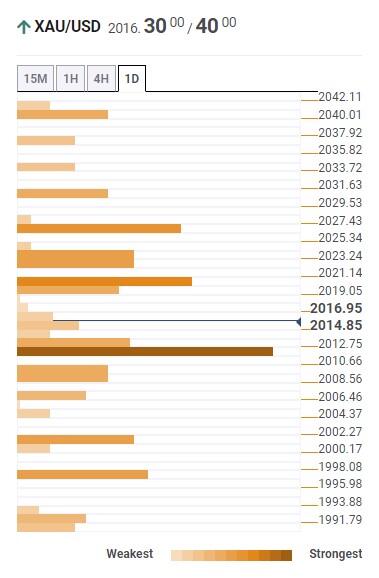

Gold Price: Key levels to watch

As per our Technical Confluence Indicator, Gold price remains firmer past the key $2,010 support confluence comprising Fibonacci 61.8% on one-week, 38.2% on one-month and middle band of the Bollonger on hourly chart.

With this, the XAU/USD snaps three-day downtrend while approaching $2,021 immediate upside hurdle encompassing the middle band of the Bollinger on four-hour play.

Following that, the 50-SMA on four-hour, near $2,030, may prod the Gold buyers before directing them to the key $2,050 hurdle comprising multiple tops marked since mid-April.

Meanwhile, a downside break of $2,010 won’t hesitate to direct the Gold price toward the $2,000 psychological magnet, also including the Pivot Point one-day S1 and the previous daily low.

Should the XAU/USD remains below $2,000, the $1,995 may act as an intermediate halt during the likely slump toward the previous monthly low of near $1,969.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.