- GBP/JPY Price Analysis: Faces pullback as rising wedge emerges despite bullish indicators

Notícias do Mercado

GBP/JPY Price Analysis: Faces pullback as rising wedge emerges despite bullish indicators

- Despite technical indicators predicting further upside, GBP/JPY sees consecutive negative sessions; it currently trades at 173.44.

- Potential pullback looms, with immediate support at the Tenkan-Sen line of 173.43 and further at 173.00.

- For bullish continuation, GBP/JPY needs to claim the 174.00 mark.

GBP/JPY registers back-to-back negative sessions, sponsored by risk aversion; though technical indicators suggest further upside, price action means the rally is losing steam. As the Asian session begins, the GBP/JPY trades at 173.44, up a minuscule 0.01%.

GBP/JPY Price Analysis: Technical outlook

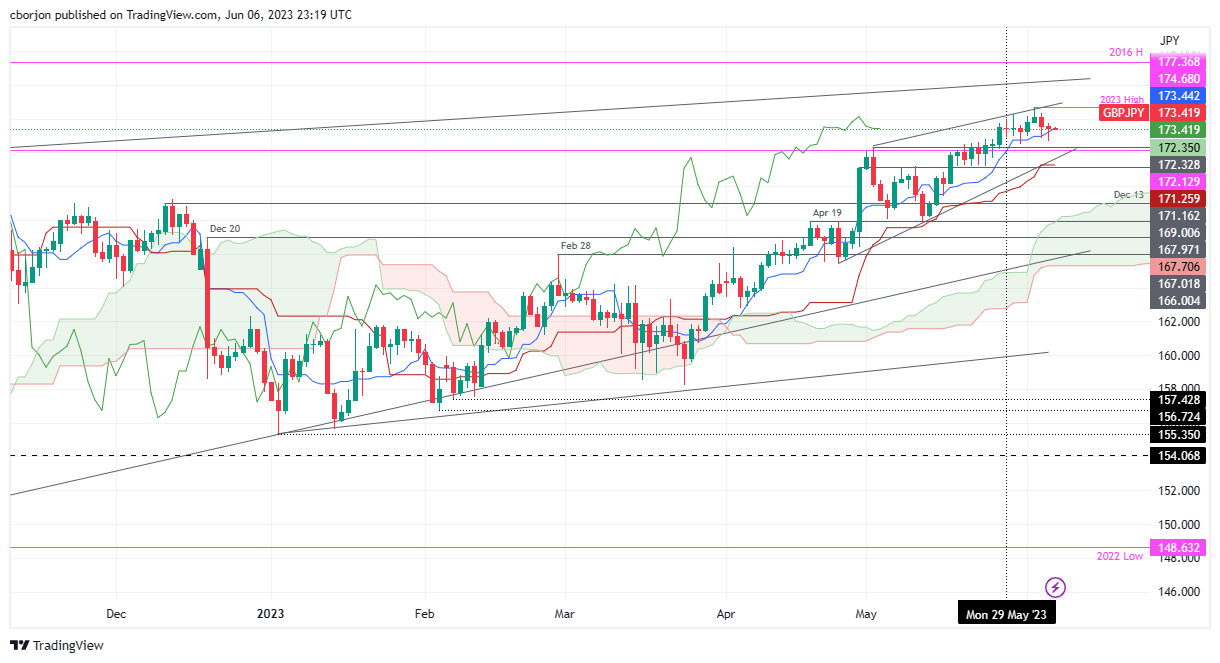

The GBP/JPY is upward biased thought; it could be subject to a pullback, as the GBP/JPY is forming a rising wedge. On the downside, prices remain capped by the Tenkan-Sen line at 173.43, which would act as immediate support, but with a decisive break below the latter, the GBP/JPY could dive towards the 173.00 figure. The following support would be the May 2 high at 172.33, followed by the Kijun-Sen line at 171.26.

The GBP/JPY must claim the 174.00 mark for a bullish continuation. A breach of the latter will expose the YTD high at 174.68, with buyers eyeing 2016 high at 177.37.

GBP/JPY Price Action – Daily chart