- AUD/USD sits tight ahead of key US events, bears are lurking

Notícias do Mercado

AUD/USD sits tight ahead of key US events, bears are lurking

- AUD/USD bears eye a downside correction around key US events.

- US CPI and the Federal Reserve are coming up as a major risk to AUD/USD.

AUD/USD is flat on Tuesday in anticipation of key events from the US this week, starting with today's Consumer Price Index. The May US inflation rate will be a key focus while the Federal Reserve interest rate decision follows on Wednesday as investors remained cautious on Monday.

The Federal Reserve is expected to keep rates on hold for the first time since January 2022. Analysts at TD Securities explained that a decision is likely to come down to the wire, ''but we maintain our long-held view that the Fed will tighten rates by a final 25bp in June to a range of 5.25%-5.50%.''

''If the Fed decides to 'skip' the June meeting, we expect the decision to be accompanied by communication that leans hawkish (ie. statement, dot plot, and presser), signaling a likely hike in July,'' the analysts argued.

As for the Consumer Price Index today, the analysts said, ''core prices likely stayed firm in May, with the index rising a strong 0.4% MoM for a second straight month, also matching the m/m avg since June 2022.''

''Goods inflation likely stayed positive, with shelter prices remaining the key wildcard (expect slowing). Retreating gas prices (-6% MoM) will drag non-core inflation. Our MoM forecasts imply 4.0%/5.3% YoY for total/core prices.''

RBA is hawkish

Meanwhile, as for the Reserve Bank of Australia, Standard Chartered notes that the central bank\ has now turned decidedly hawkish again, after being clearly dovish as recently as March and April, which caused us to tone down our rate-hike calls.

''It then reverted to a hawkish stance in both May and June. June’s meeting statement indicated that upside risks to inflation have increased and removed the reference to medium-term inflation expectations being well anchored''

''While the door is open for more hikes, it remains difficult to assess if the RBA will continue to hike consecutively. Since the April pause, the central bank has hiked by 25bps each in May and June. Given that RBA meets every month (except for January) and it is still trying to achieve a soft landing, we think it may skip in July to assess the key quarterly inflation print (26 July). Thereafter, we think it will hike by 25bps each in August and September, to bring the policy rate to 4.6% (our previous projection was 3.85%).,'' the analysts concluded.

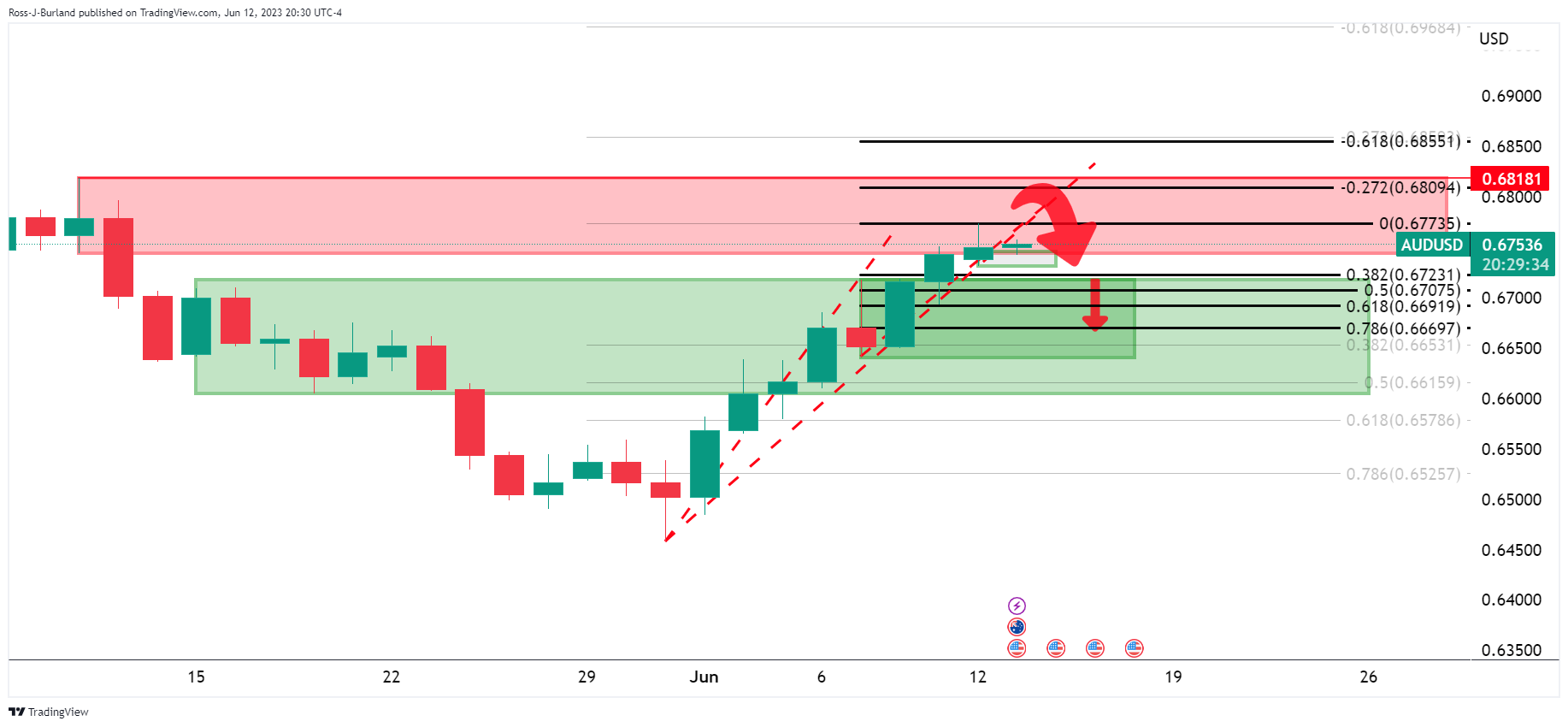

AUD/USD daily chart

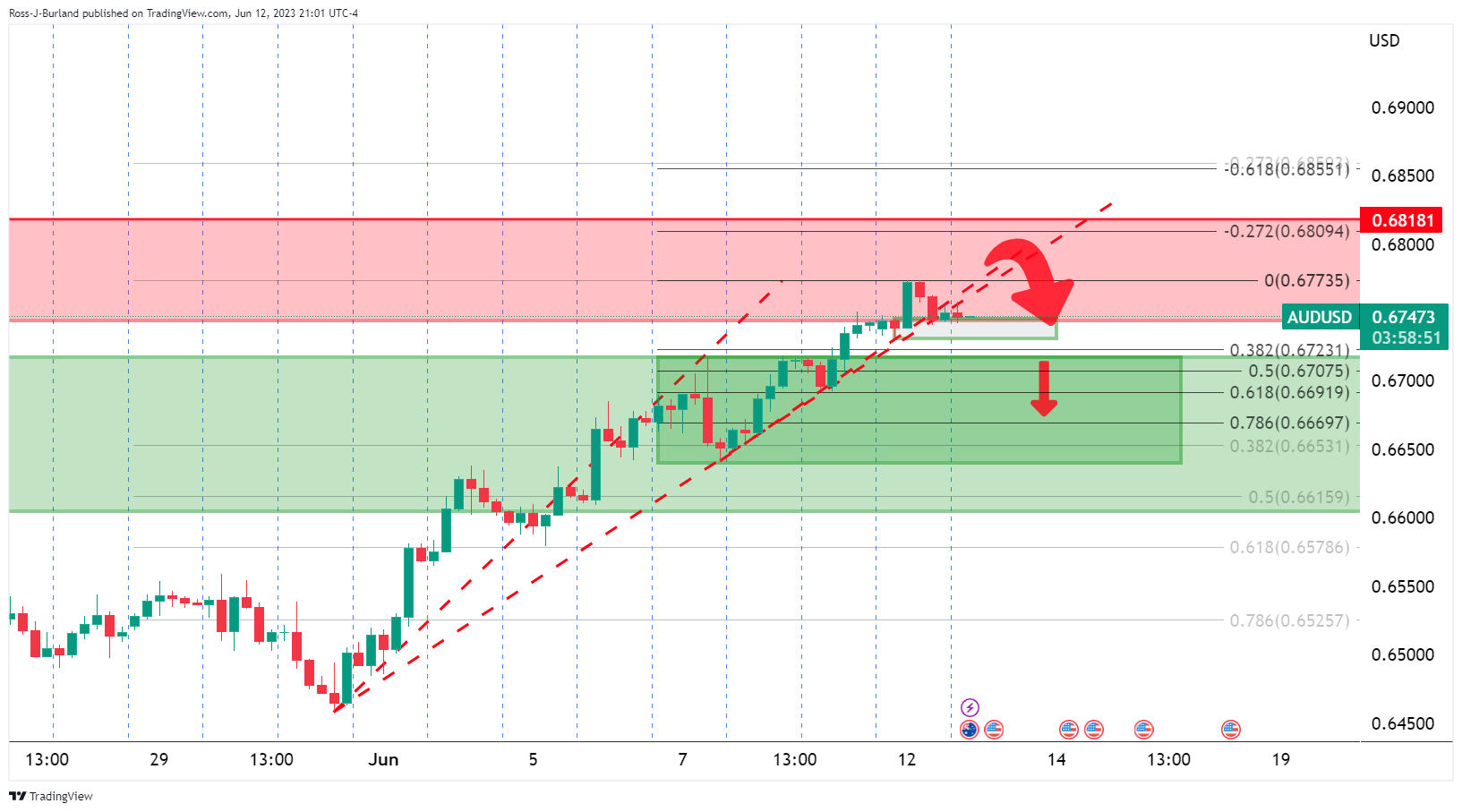

A bearish correction could come into play as the chart above shows. From a 4-hour perspective, the pair is on the backside of the prior bullish trendlines and this leaves a bearish bias on the charts for the days ahead: