- EUR/USD Price Analysis: Bulls in the market ahead of the Fed, what are the implications?

Notícias do Mercado

EUR/USD Price Analysis: Bulls in the market ahead of the Fed, what are the implications?

- EUR/USD bears and bulls go head to head into the Fed.

- Upside bias on weekly could be diminished by Fed.

EUR/USD has been decisively bid on the day in the build-up to the Federal Reserve which leaves the long squeeze a viable scenario for the sessions ahead if not as a consequence of the outcome of the Fed itself. On the flip side, there is a key area on the charts up ahead that could come under pressure in and around the event as the following charts will illustrate:

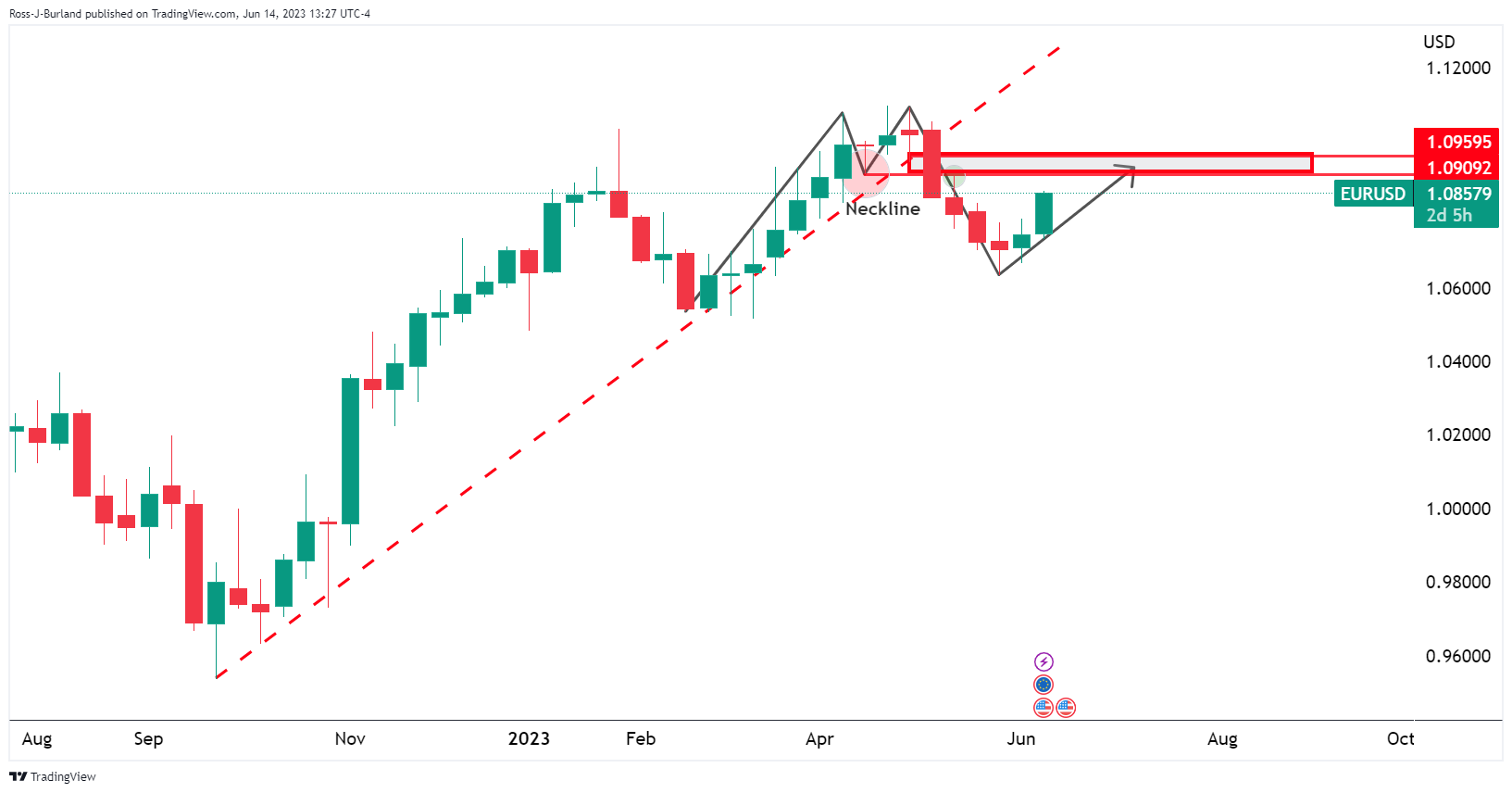

EUR/USD weekly and daily charts

The weekly M-formation offers the neckline as a target through 1.09 the figure. This could easily be reached over the Fed event. On the other hand, the in-the-money longs could be put under heat beforehand and that would equate to a downside correction prior to the next bullish impulse.

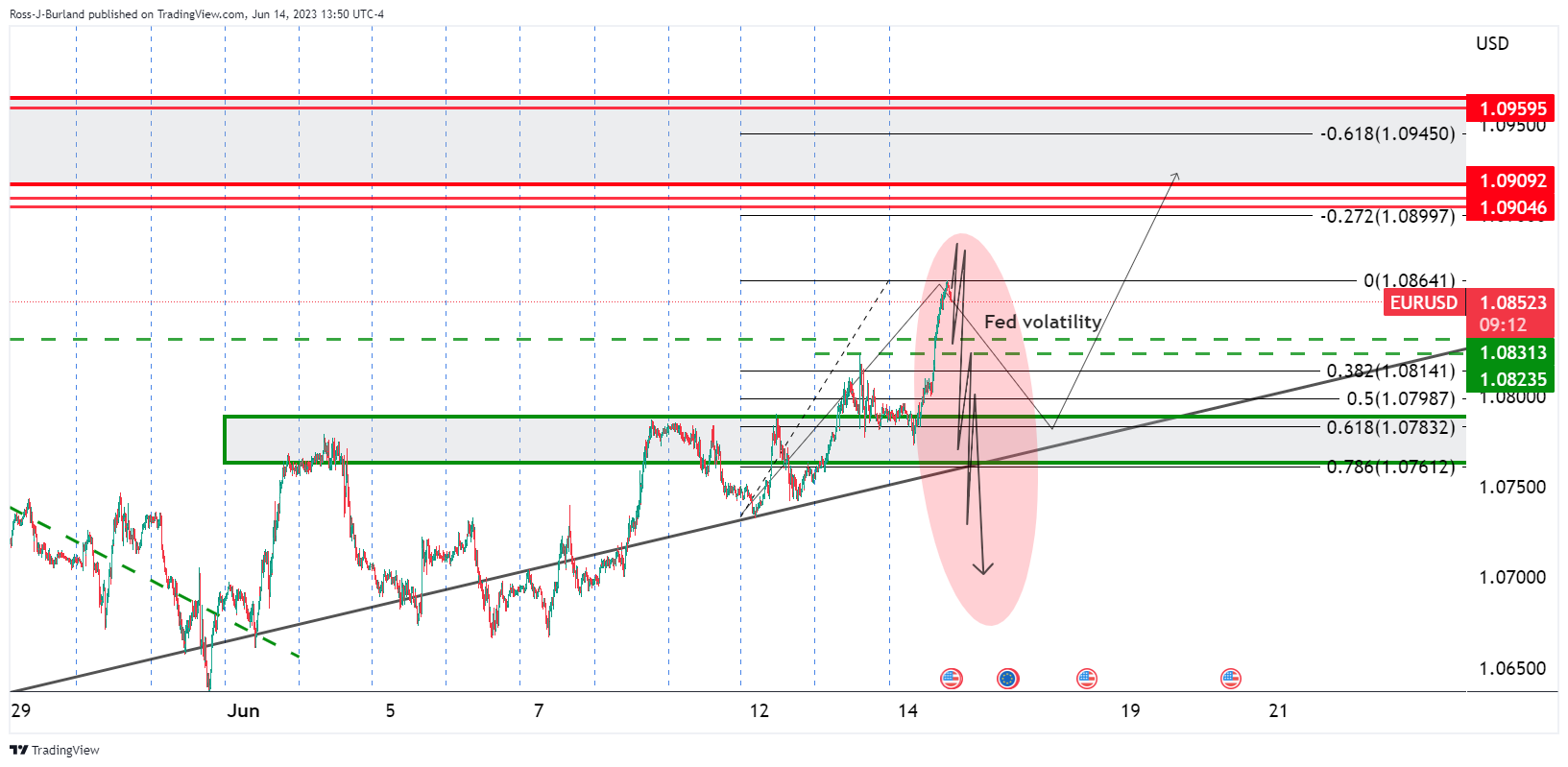

Moving down to the daily chart, this would bring in the Fibonacci scale as follows:

It is likely that the price action over the course of the Fed will be volatile and both sides of the range could easily be traded over the various stages of the event:

On the other hand, we may see capitulation of the bulls if the US dollar finds a bid: