- WTI Price Analysis: Bears make their moves during the Fed, break support structure

Notícias do Mercado

WTI Price Analysis: Bears make their moves during the Fed, break support structure

- WTI fell out of the hands of the bulls and is now moving into a bearish scenario.

- WTI bulls will target $69.00 and bears have eyes on $67.50/00 overall.

West Texas Intermediate, WTI, crude oil dropped on Wednesday, breaking key support structure on the downside as a pause in US interest rate hikes accompanied a bearish forecast for more hikes on the way. This has rocked risk sentiment and weighed on the commodity sector. Also, an outsized rise in US oil inventories squashed any bullish prospects for the oil price that might have otherwise derived from the demand forecast from the International Energy Agency leaving the price below key resistance as the following technical analysis illustrates:

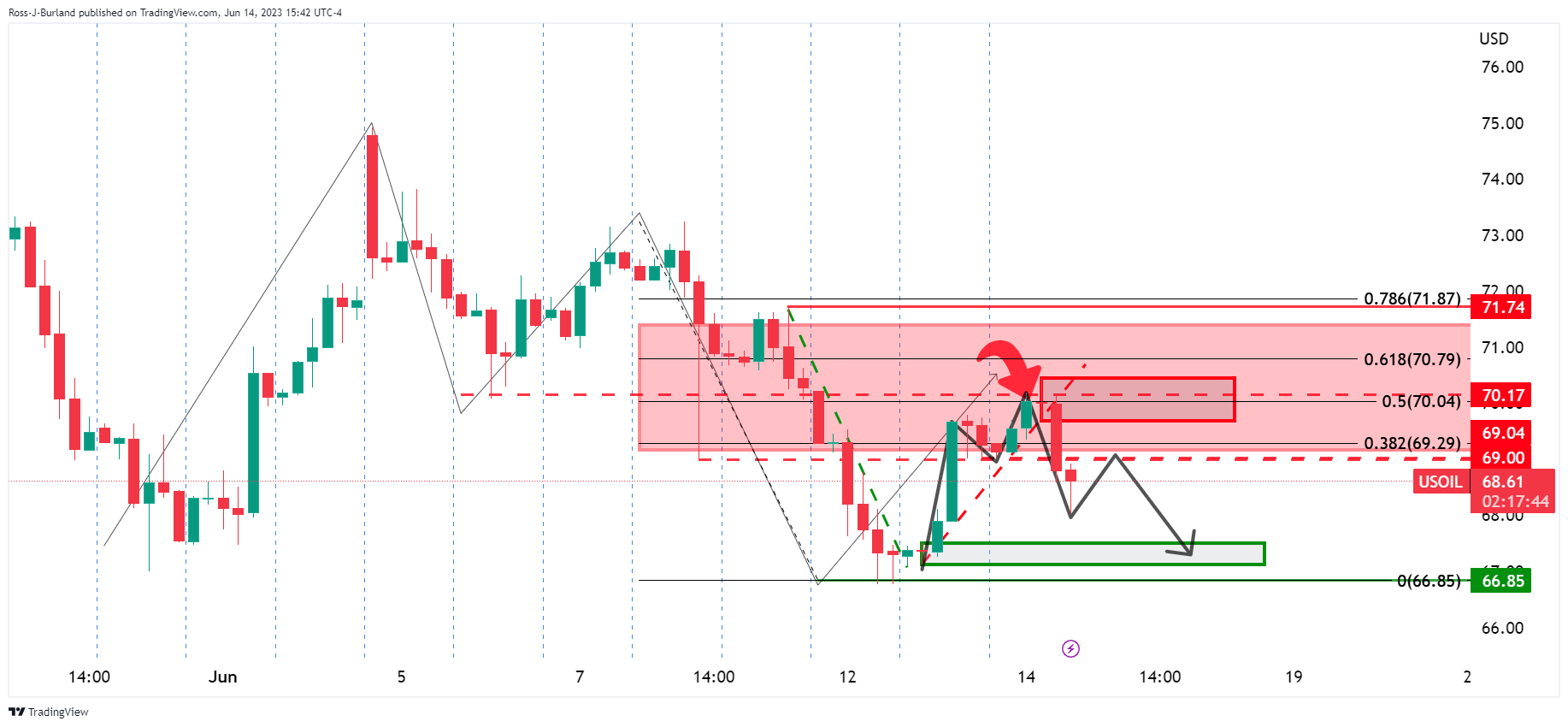

WTI daily M-formation

The daily M-formation is a reversion pattern and we have seen the price head into the neckline and meet resistance there.

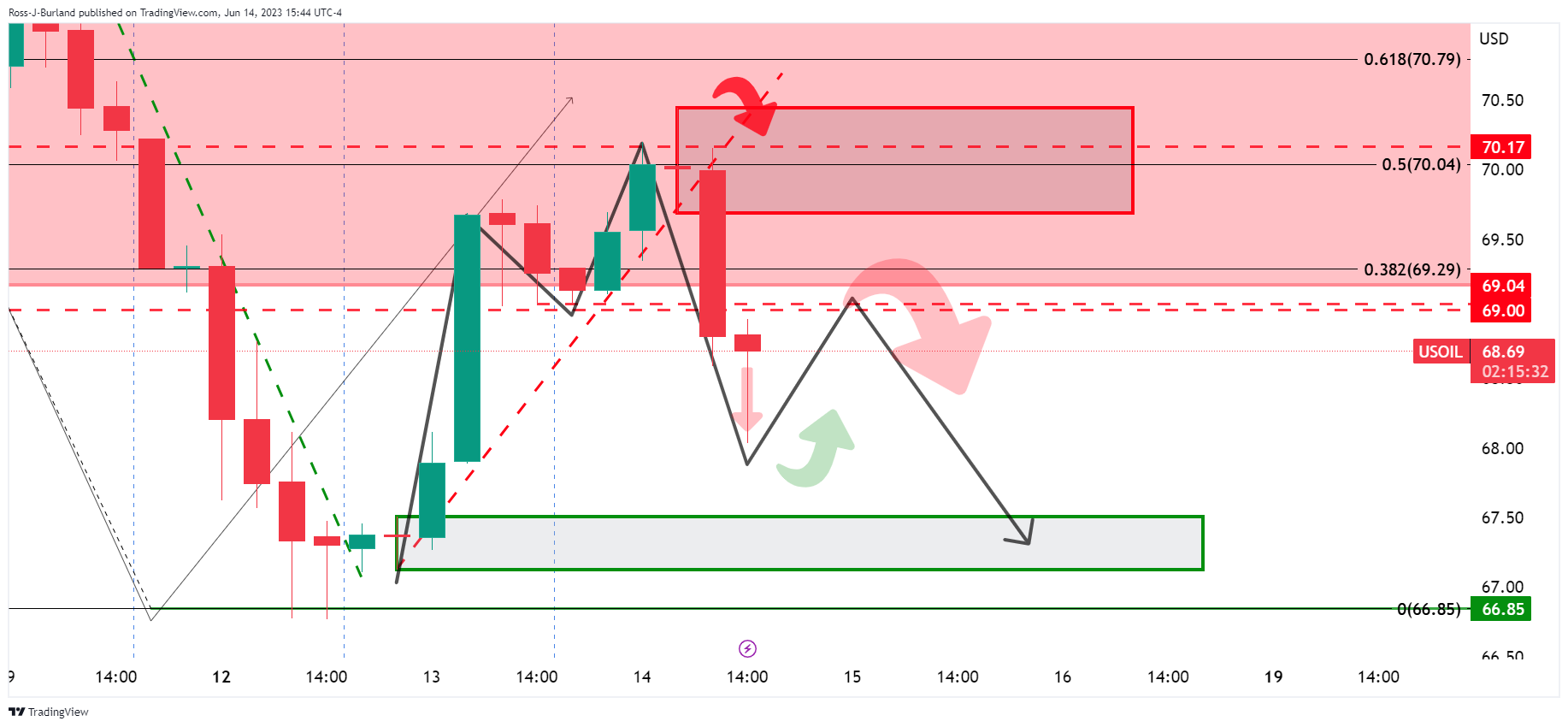

WTI 4HR M-formation

We now have an M-formation in development on the 4-hour chart. However, it might be premature to expect a 4-hour bullish candle to form and head into the neckline just yet as we might need to see some more downside from this bearish impulse. After all, it has only just broken out of the bullish trend on Wednesday. If the bears are committed we could see lower lows still to come.

In that sense, the current four-hour candle that still has two hours until the close could fill in the wick before $69.00 is retested. There may even be lower lows to follow before any significant correction on the 4-hour chart unfolds.

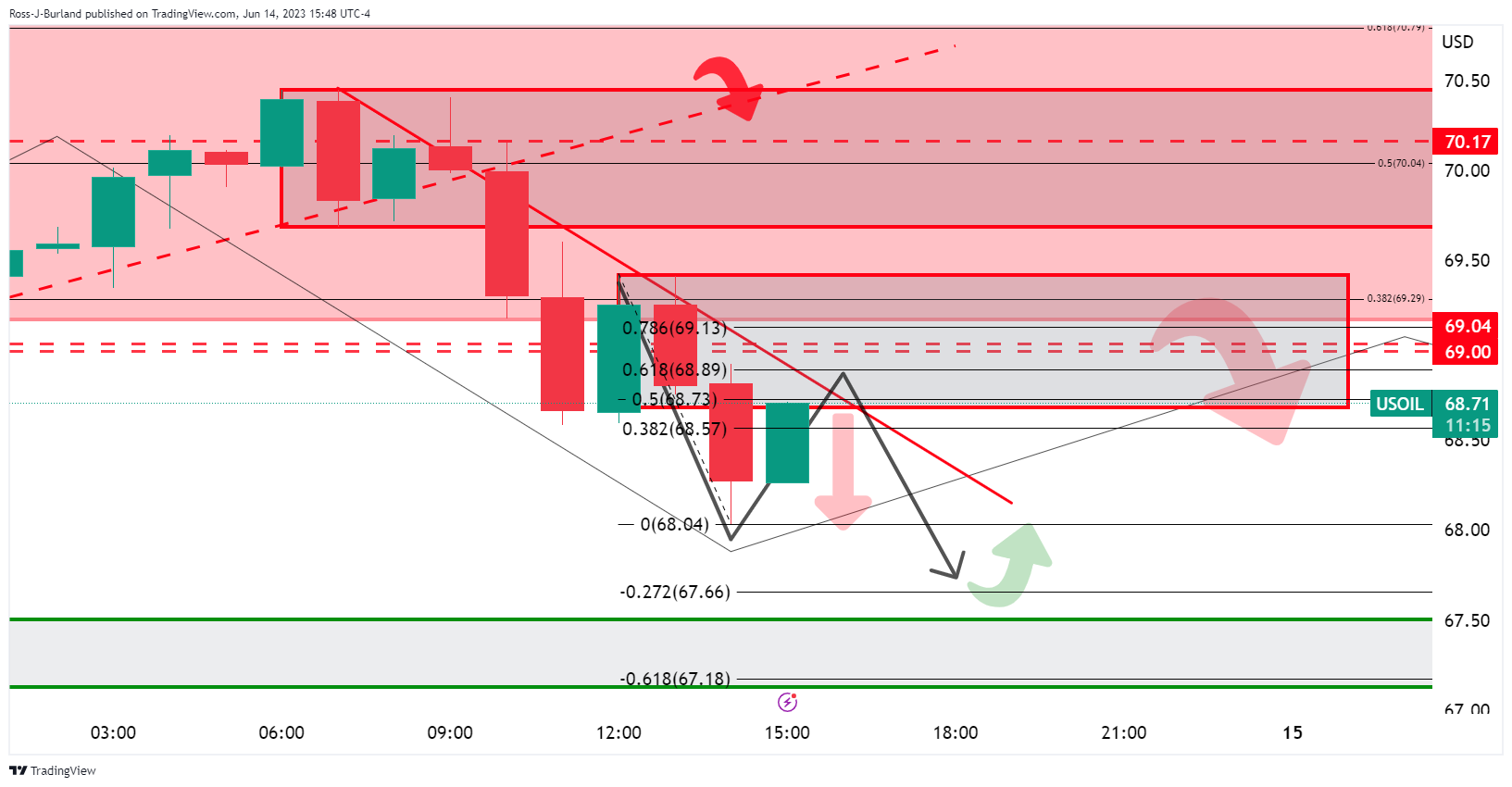

WTI H1 chart

On the hourly chart, the price is headed into resistance as per the dynamic trendline resistance. This could lead to the 4-hour wick being filled and lower lows before a break out of the bearish trend occurs and a bullish corrective thesis starts to take shape that will target $69.00.Bears have eyes on $67.50/00 overall.