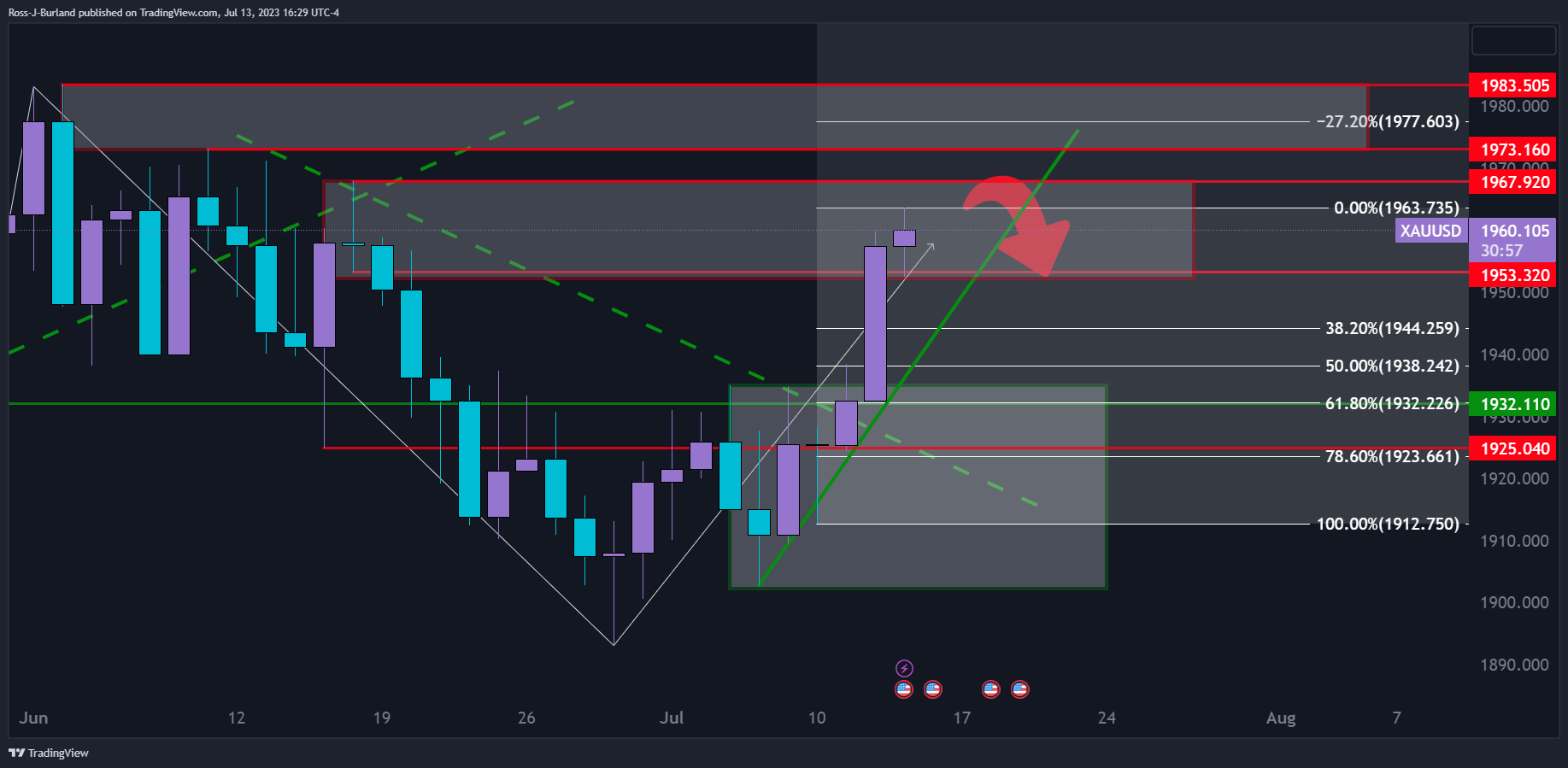

- Gold Price Forecast: XAU/USD bears eye a move to a 61.8% Fibo, but bulls test key resistance

Notícias do Mercado

Gold Price Forecast: XAU/USD bears eye a move to a 61.8% Fibo, but bulls test key resistance

- Gold price could be on the verge of a correction as per resistance, but the bulks are still in control.

- A move through the current resistance of the $1,970s opens risk for a test of the $1,983 highs.

- Gold price bears eye the 61.8% ratio to the downside in line with $1,932 support.

Gold prices edged higher on Thursday while the Greenback continued lower as data continue to dictate the market's sentiment. US Treasury yields were the driver on yet another report that showed slowing US price pressures, pushing investors to add risk.

This benefitted the Gold price that was already glowing on the United States reported inflation report that showed that the Consumer Price Index rose by just 3% annualized in June, which was down from a 4% rate in May. On Thursday, the price pressures were shown to have eased in June, with the Producer Price index rising 0.1% annualized from 1.1% in May.

The DXY is already down for the sixth straight day and traded at its lowest since April 2021 near 99.97. A close below 100.00 will open risk for a test of the late March 2022 low near 97.685. Looking to US Treasury yields, the 2-year traded as low as 4.622% today and has fallen nearly half a percentage point from last week’s peak near 5.12%.

Gold technical analysis

The daily charts show that the price is now in a resistance area and could be on the verge of a correction. The 61.8% Fibonacci retracement area is eyed as support to $1,932.