- EUR/GBP Price Analysis: Bulls take control, eye the 0.8680 mark

Notícias do Mercado

EUR/GBP Price Analysis: Bulls take control, eye the 0.8680 mark

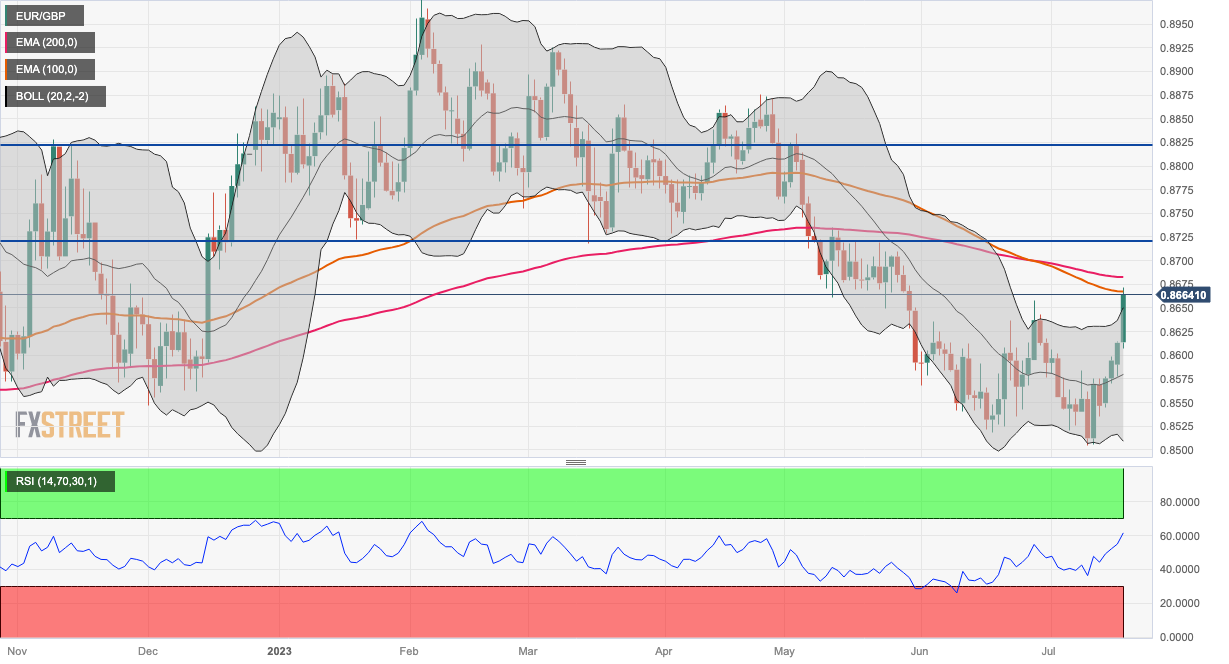

- EUR/GBP gains momentum and extends its upside to 0.8670.

- The cross will meet the next resistance near the 0.8680 area; the 0.8580 region acts as an initial support level.

- The Relative Strength Index (RSI) stands above 60, supporting buyers for now.

The EUR/GBP pair extends its upside and surges above the key resistance level at 0.8600 on Wednesday. The cross currently trades around 0.8670, up to 0.66% on the day.

According to the daily chart, EUR/GBP is set to break above the upper boundary of the Bollinger Band. A decisive break above the latter will see a fresh move higher to 0.8680, representing the 200-day Exponential Moving Average (EMA). Further north, the cross will challenge the next barrier at 0.8720 (Low of March 15, 2023) en route to 0.8830 (High of November 9, 2022).

On the flip side, EUR/GBP will meet an initial support level of 0.8580 (the midline of the Bollinger Band), followed by 0.8550 (Low of December 1, 2022). The additional downside filter to watch is 0.8510, the lower limit of the Bollinger Band and low of July 11.

The Relative Strength Index (RSI) stands above 60, suggesting that the path of least resistance for the EUR/GBP cross is to the upside.

EUR/GBP daily chart