- EUR/USD Price Analysis: Correction picking up from last week's highs, eyes on 1.1100

Notícias do Mercado

EUR/USD Price Analysis: Correction picking up from last week's highs, eyes on 1.1100

- EUR/USD bears are in the market and on the verge of a key lower time frame breakout.

- Daily chart correction could be significant with eyes on 1.1100 initially.

The US Dollar bounced on Wednesday as Fed funds futures traders continue to be pricing in 32 basis points of additional tightening and while inflation in the United Kingdom cooled more than economists expected in June. This has seen EUR/USD continue to correct lower as the following analysis shows:

EUR/USD daily charts

There is plenty of ways to go to the downside if the bears can stay in control. The blue areas are price imbalances in a strongly displaced market.

EUR/USD H4 charts

The price has broken 4-hour support structure so there is a bearish bias here as well.

The M-formation is a reversion pattern that has so far pulled the price back in towards the neckline.

We can see that the price has rallied to a 38.2% Fibonacci level. The question is how far does this correction have before the bears move back in to sell at premium levels?

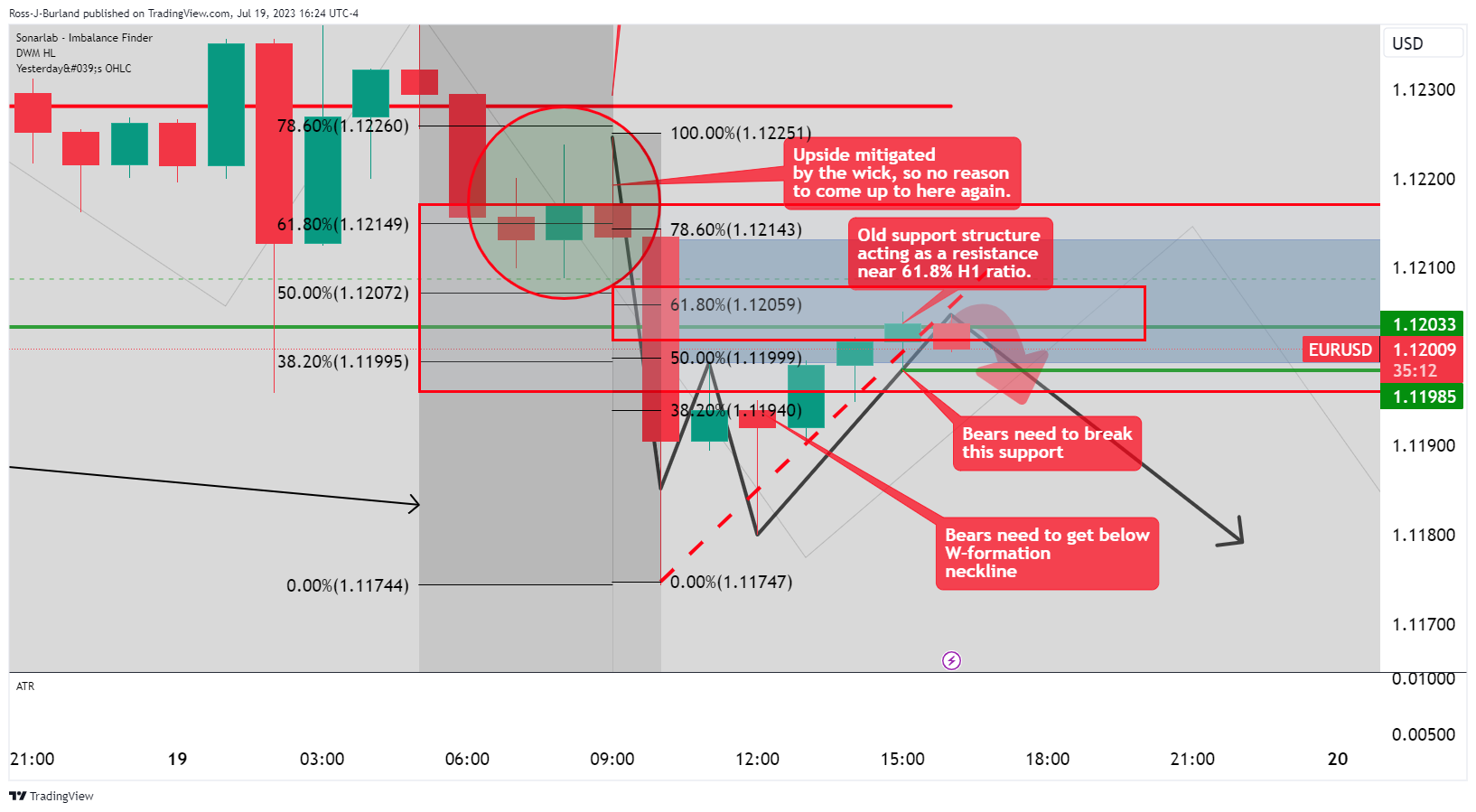

EUR/USD H1 chart

The hourly chart is key. A break of 1.12 could seal the deal for the bears whereby the W-formation's neckline will come under pressure.