- Silver Price Analysis: Bears await their premium

Notícias do Mercado

Silver Price Analysis: Bears await their premium

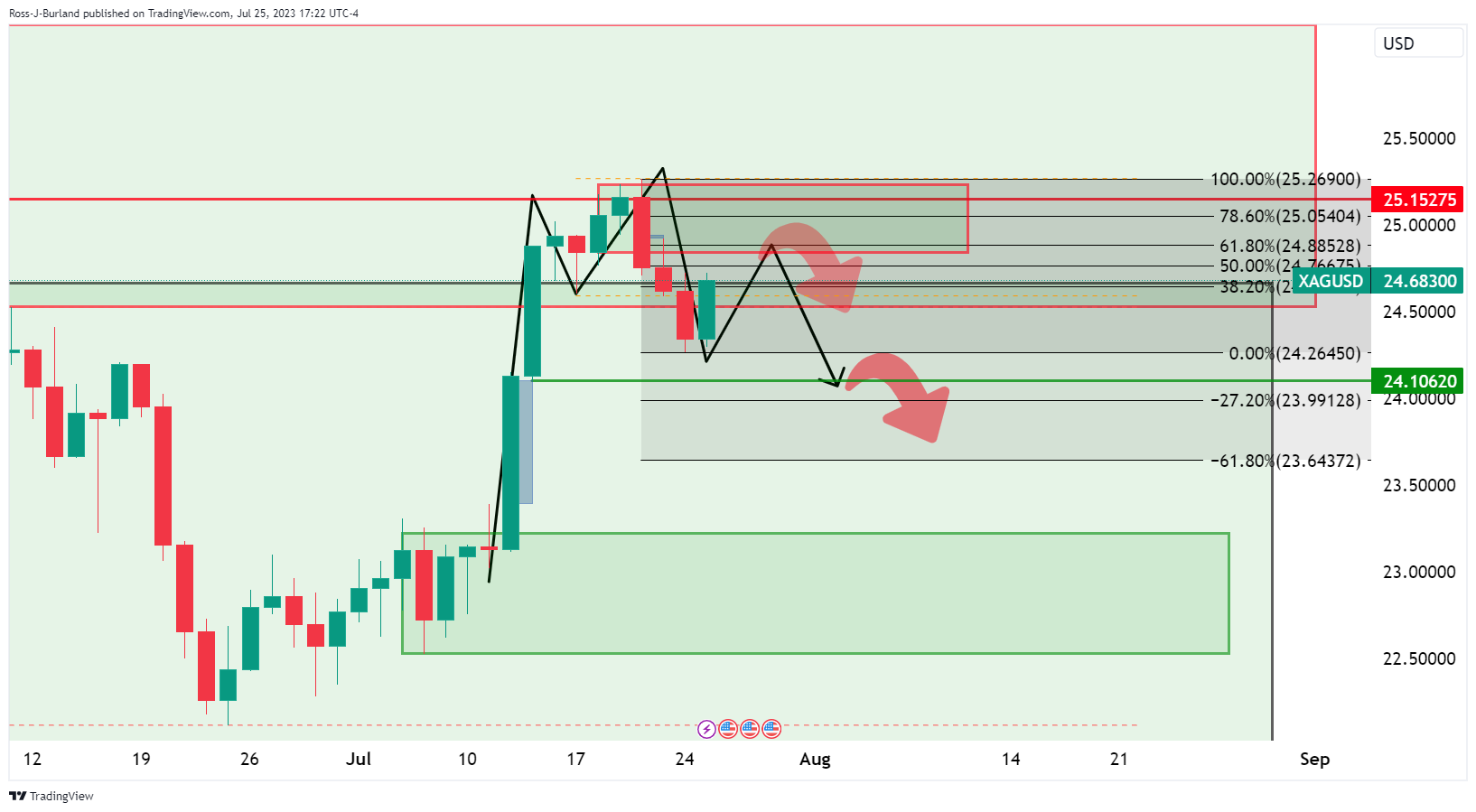

- A correction into Silver's Fibonacci scale is underway.

- A break of $24.1062 opens risk of a move into test $23.0000 and below.

Silver traded positively ahead of the Federal Open Market Committee announcement on Wednesday where it is widely expected to hike 25bp.

''A follow-up hike is partially priced in over H2, but we think tomorrow will be the last hike this cycle. That said, we also expect the FOMC statement and Fed Chair Powell’s press conference to err on the hawkish side where he may re-iterate that back-to-back rate rises are on the table if required. Crucially, he needs to stress that fed funds will remain elevated for an extended period to squeeze inflation,'' analysts at ANZ explained ahead of the event. However, signs that inflation is abating have seen investors increasingly bet on interest rates peaking soon which could be a positive outcome for the precious metals.

Meanwhile, from a technical perspective, Silver could be about to collapse as follows:

Silver daily chart

The price came into the old resistance area and has been rejected leaving an M-formation on the charts.

A correction into the Fibonacci scale is underway, but there could be resistance through a 50% mean reversion. A break of $24.1062 opens risk of a move into test $23.0000 and below.