- NZD/USD Price Analysis: Further downside past 0.6100 appears more impulsive

Notícias do Mercado

NZD/USD Price Analysis: Further downside past 0.6100 appears more impulsive

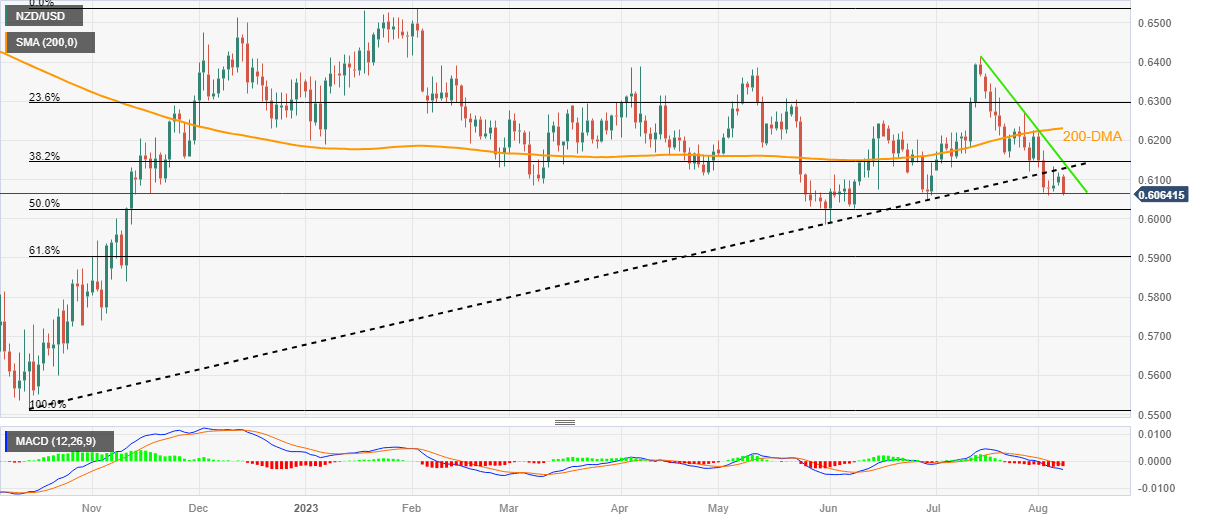

- NZD/USD extends pullback from 10-month-old previous support amid bearish MACD signals.

- Three-week-old descending resistance line, 200-DMA act as additional upside filters.

- Kiwi bears approach 50% Fibonacci retracement, June’s low amid further downside.

- Risk catalysts eyed for clear directions, sellers are likely to keep the reins amid slightly offbeat sentiment.

NZD/USD stands on slippery ground as it renews its intraday low near 0.6060 heading into Tuesday’s European session, printing the biggest daily loss, so far, in a week.

In doing so, the Kiwi pair justifies late previous week’s inability of the bulls to retake control after breaking an upward-sloping support line from October on August 02.

Not only the sustained reversal from the multi-month-old support-turned-resistance but the quote’s sustained trading below the three-week-old descending resistance line and the 200-DMA, respectively near 0.6145 and 0.6230, also challenge the NZD/USD buyers.

It’s worth noting that the Kiwi pair’s recovery beyond 0.6230 appears elusive unless crossing July’s peak of around 0.6415.

On the flip side, a 50% Fibonacci retracement of October 2022 to February 2023 upside, near 0.6025, can restrict the short-term downside of the NZD/USD price.

Following that, June’s low of 0.5985 and the 61.8% Fibonacci retracement level surrounding 0.5900 will lure the Kiwi bears.

To sum up, NZD/USD remains on the bear’s radar and appears set to challenge the yearly low marked in June surrounding 0.5985 as the US Dollar extends the week-start recovery amid sour sentiment.

Also read: NZD/USD keeps the red below 0.6100 on stronger USD, reacts little to Chinese trade data

NZD/USD: Daily chart

Trend: Further downside expected