- EUR/JPY Price Analysis: Hovers around a two-week high as a double-top emerges

Notícias do Mercado

EUR/JPY Price Analysis: Hovers around a two-week high as a double-top emerges

- EUR/JPY trades at 158.22, up 0.02%, after US inflation data suggests the Fed may hold off on a rate hike.

- Ichimoku Cloud indicates an upward bias, but price action suggests the pair is in consolidation.

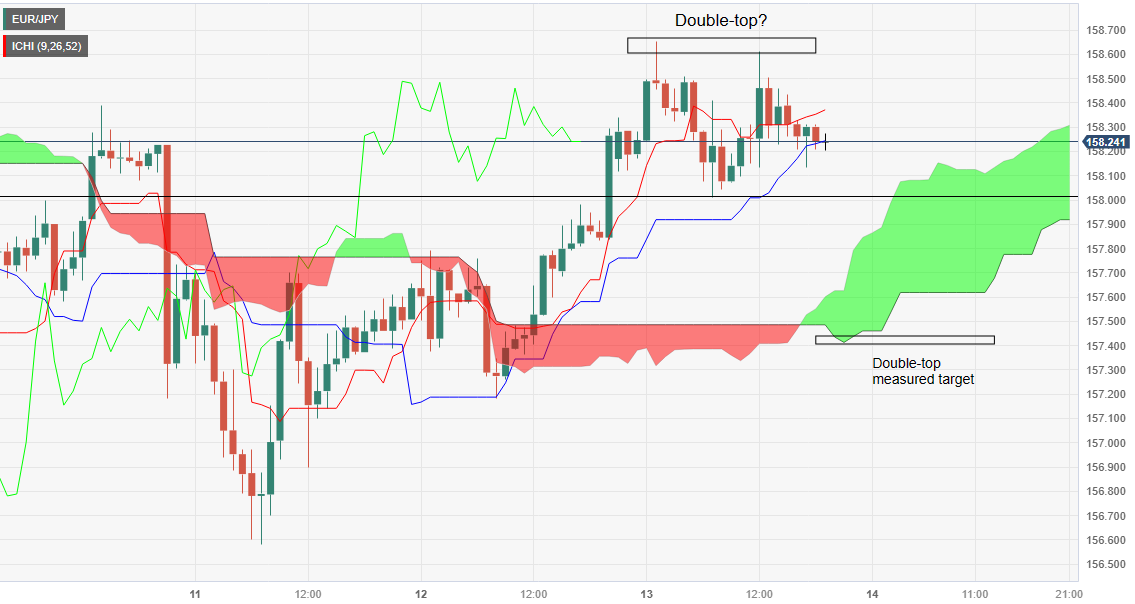

- Hourly chart shows a potential double top around 158.60; a break below 158.00 could confirm the bearish pattern.

The EUR/JPY clings to minuscule gains after reaching a two-week high of 158.65, following the release of US inflation data, which was mixed and cemented the US central bank case to skip a rate hike. The cross-currency pair changes hands at 158.22, climbing 0.02%.

EUR/JPY Price Analysis: Technical outlook

According to the Ichimoku Cloud (Kumo), the pair is upward biased, but the space contraction between price action and the Kumo suggests the EUR/JPY is consolidating. From a price action standpoint, the cross is neutral to downward biased, unable to crack the latest swing low of 156.58. Once done, the bias would shift to a downward bias, yet it needs to clear the Kumo.

Short term, the EUR/JPY hourly chart portrays the formation of a double top, as the pair peaked at around the 158.60 area. To confirm its validity, sellers must break the last lower low at 158.00. Once cleared, the next support would be the Senko-span A at 157.91, followed by the 157.83 swing low. The double-top measured profit objective would be the bottom of the Kumo at 157.40.

EUR/JPY Price Action – Hourly chart