- Crude Oil Futures: Extra rebound loses traction

Notícias do Mercado

10 outubro 2023

Crude Oil Futures: Extra rebound loses traction

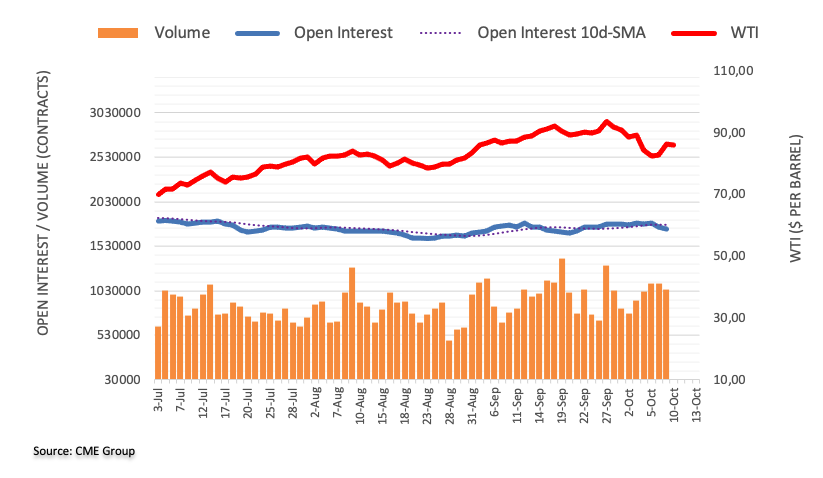

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions for the second session in a row on Monday, this time by around 18.8K contracts. In the same line, volume added to the previous daily drop and went down by around 60.7K contracts.

WTI: Another visit to $82.00 should not be ruled out

Prices of WTI rose sharply at the beginning of the week. The strong uptick, however, was amidst diminishing open interest and volume and hints at the likelihood that further gains could run out of steam in the very near term. In the meantime, the resumption of the selling bias could drag prices back to the $82.00 region per barrel.

O foco de mercado

Abrir Conta Demo e Página Pessoal