- Gold Futures: Further correction on the cards

Notícias do Mercado

24 outubro 2023

Gold Futures: Further correction on the cards

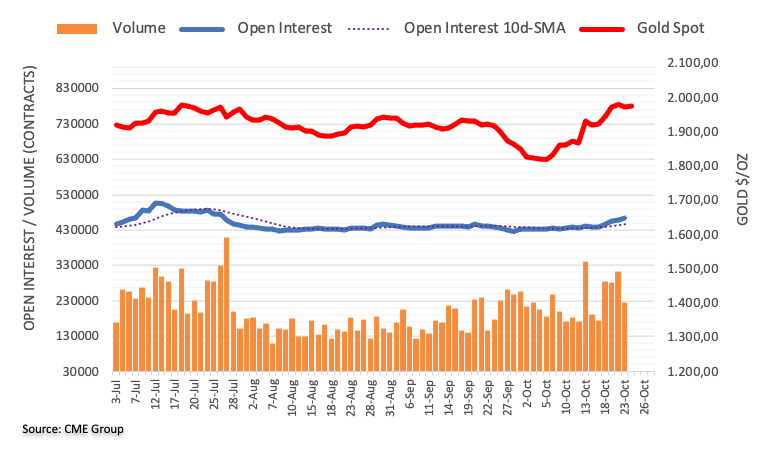

CME Group’s flash data for gold futures markets noted traders increased their open interest positions for the fifth consecutive sessions on Monday, this time by around 3.7K contracts. On the other hand, volume remained choppy and shrank by around 87.2K contracts.

Gold remains capped by $2000 so far

Gold started the week on the defensive amidst rising open interest, which suggests the extra losses could be in store for the commodity in the very near term. In the meantime, occasional bullish attempts in the precious metal appear limited by the key $2000 mark per troy ounce for the time being.

O foco de mercado

Abrir Conta Demo e Página Pessoal