Notícias do Mercado

-

23:27

Currencies. Daily history for Sep 1'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3127 -0,04%

GBP/USD $1,6607 +0,07%

USD/CHF Chf0,9194 +0,13%

USD/JPY Y104,31 +0,23%

EUR/JPY Y136,93 +0,19%

GBP/JPY Y173,23 +0,28%

AUD/USD $0,9331 -0,04%

NZD/USD $0,8377 +0,23%

USD/CAD C$1,0875 -0,01%

-

23:00

Schedule for today, Tuesday, Sep 2’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia Building Permits, m/m July -5.0% +1.7%

01:30 Australia Building Permits, y/y July +16.0%

01:30 Australia Current Account, bln Quarter II -5.7 -13.8

01:30 Japan Labor Cash Earnings, YoY July +1.0% Revised From +0.4% +0.9%

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

04:30 Australia RBA Rate Statement

05:45 Switzerland Gross Domestic Product (QoQ) Quarter II +0.5% +0.5%

05:45 Switzerland Gross Domestic Product (YoY) Quarter II +2.5%

08:30 United Kingdom PMI Construction August 62.4 61.5

09:00 Eurozone Producer Price Index, MoM July +0.1% 0.0%

09:00 Eurozone Producer Price Index (YoY) July -0.8% -1.1%

13:45 U.S. Manufacturing PMI (Finally) August 58.0 58.0

14:00 U.S. Construction Spending, m/m July -1.8% +0.9%

14:00 U.S. ISM Manufacturing August 57.1 57.0

23:30 Australia AIG Services Index August 49.3

-

16:33

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies, with markets in the U.S. closed for a public holiday

The U.S. dollar traded mixed against the most major currencies in quiet trade. Tensions over Ukraine continued to weigh on markets.

U.S. markets are closed for the Labor Day holiday on Monday.

The euro traded mixed against the U.S. dollar. Mixed economic data from the Eurozone weighed on the euro. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 50.7 in August from 50.8 in July. Analysts had expected the manufacturing PMI to remain unchanged.

German final manufacturing PMI dropped to 51.4 in August from 52.0 in July. Analysts had expected the manufacturing PMI to remain unchanged.

French final manufacturing PMI rose to 46.9 in August from 46.5 in July.

German gross domestic product (GDP) declined 0.2% in the second quarter, in line with expectations.

On a yearly basis, German GDP increased 0.8% in in the second quarter, in line with expectations.

Investors have concerns that sanctions against Russia would have a negative impact on the economic growth in the Eurozone.

The British pound traded mixed against the U.S. dollar after the mixed economic data from the UK. The U.K. manufacturing purchasing managers' index fell to 52.5 in August from 54.8 in July. That was the lowest reading for 14 months. July's figure was revised down from 55.4

Mortgage approvals in the UK decreased to 66,569 from a revised 67,085 in June. Analysts had expected 66,000 approvals.

Net lending to individuals in the UK climbed to £3.4 billion in July from £2.5 billion in June, beating expectations for a decline to £2.4 billion in July.

The Swiss franc traded mixed against the U.S. dollar. The Swiss manufacturing PMI declined to 52.9 in August from 54.3 in July, missing expectations for a fall to 53.8.

The New Zealand dollar traded mixed against the U.S dollar. In the overnight trading session, the kiwi rose against the greenback due to the strong overseas trade data from New Zealand. New Zealand's overseas trade index climbed 0.3% in the second quarter, after a 1.8% increase in the first quarter. Export volumes dropped 5.3%, while import volumes gained 3.6%.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the U.S. currency despite the weaker-than-expected economic data from Australia. Company operating profits in Australia fell 6.9% in the second quarter, missing expectations for a 1.8% drop, after a 2.0% rise in the first quarter. The first quarter's figure was revised down from a 3.1% gain.

The Australia Industry Group released its manufacturing index for Australia. The index decreased to 47.3 in August from 50.7 in July. The figure below the mark of 50 means contraction.

The Japanese yen traded mixed against the U.S. dollar. Capital spending in Japan rose 3.0% in the second quarter, after a 7.4% increase in the first quarter.

-

14:45

Option expiries for today's 1400GMT cut

USD/JPY 103.25 (USD 925m) 103.40 104.20

EUR/USD 1.3135 1.3185-95 1.3290-3300 (EUR 400m)

GBP/USD 1.6635

AUD/USD 0.9320

USD/CAD 1.0800 (USD 651m) 1.1000 (USD 851m)

NZD/USD 0.8400

-

13:00

Orders

EUR/USD

Offers $1.322-40, $1.3200, $1.3150

Bids $1.3110-00, $1.3080, $1.3050, $1.3020, $1.3000

GBP/USD

Offers $1.6720, $1.6700, $1.6650

Bids $1.6580, $1.6550, $1.6500

AUD/USD

Offers $0.9415/20, $0.9400, $0.9370/80

Bids $0.9300, $0.9280, $0.9255/50

EUR/JPY

Offers Y138.20, Y137.90/00, Y137.50

Bids Y136.50, Y136.20, Y136.00

USD/JPY

Offers Y105.50, Y105.00, Y104.50

Bids Y10400, Y103.80, Y103.50, Y103.20, Y103.00

EUR/GBP

Offers stg0.7970, stg0.7950, stg0.7920

Bids stg0.7850, stg0.7820, stg0.7800

-

13:00

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the mixed economic data from the UK

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Manufacturing PMI August 51.7 51.2 51.1

01:30 Australia Company Operating Profits Quarter II +3.1% -1.8% -6.9%

01:45 China HSBC Manufacturing PMI (Finally) August 50.3 50.3 50.2

06:00 Germany GDP (QoQ) (Finally) Quarter II -0.2% -0.2% -0.2%

06:00 Germany GDP (YoY) (Finally) Quarter II +0.8% +0.8% +0.8%

06:30 Australia RBA Commodity prices, y/y August -12.1% -11.5%

07:30 Switzerland Manufacturing PMI August 54.3 53.8 52.9

07:48 France Manufacturing PMI (Finally) August 46.5 46.5 46.9

07:53 Germany Manufacturing PMI (Finally) August 52.0 52.0 51.4

07:58 Eurozone Manufacturing PMI (Finally) August 50.8 50.8 50.7

08:30 United Kingdom Purchasing Manager Index Manufacturing August 55.4 55.1 52.5

08:30 United Kingdom Net Lending to Individuals, bln July 2.5 2.4 3.4

08:30 United Kingdom Mortgage Approvals July 67 66 67

The U.S. dollar traded mixed against the most major currencies. Tensions over Ukraine continued to weigh on markets.

U.S. markets are closed for the Labor Day holiday on Monday.

The euro traded slightly higher against the U.S. dollar after the mixed economic data from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 50.7 in August from 50.8 in July. Analysts had expected the manufacturing PMI to remain unchanged.

German final manufacturing PMI dropped to 51.4 in August from 52.0 in July. Analysts had expected the manufacturing PMI to remain unchanged.

French final manufacturing PMI rose to 46.9 in August from 46.5 in July.

German gross domestic product (GDP) declined 0.2% in the second quarter, in line with expectations.

On a yearly basis, German GDP increased 0.8% in in the second quarter, in line with expectations.

Investors have concerns that sanctions against Russia would have a negative impact on the economic growth in the Eurozone.

The British pound traded mixed against the U.S. dollar after the mixed economic data from the UK. The U.K. manufacturing purchasing managers' index fell to 52.5 in August from 54.8 in July. That was the lowest reading for 14 months. July's figure was revised down from 55.4

Mortgage approvals in the UK decreased to 66,569 from a revised 67,085 in June. Analysts had expected 66,000 approvals.

Net lending to individuals in the UK climbed to £3.4 billion in July from £2.5 billion in June, beating expectations for a decline to £2.4 billion in July.

The Swiss franc traded mixed against the U.S. dollar after the Swiss manufacturing PMI. The Swiss manufacturing PMI declined to 52.9 in August from 54.3 in July, missing expectations for a fall to 53.8.

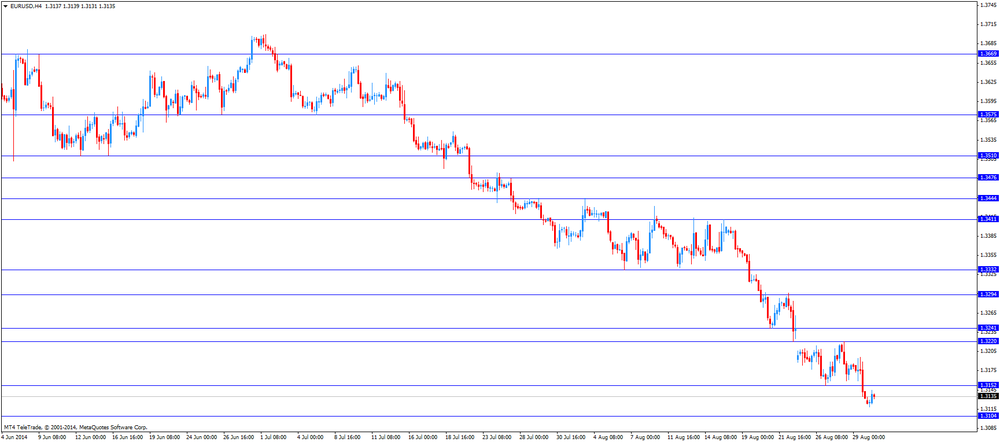

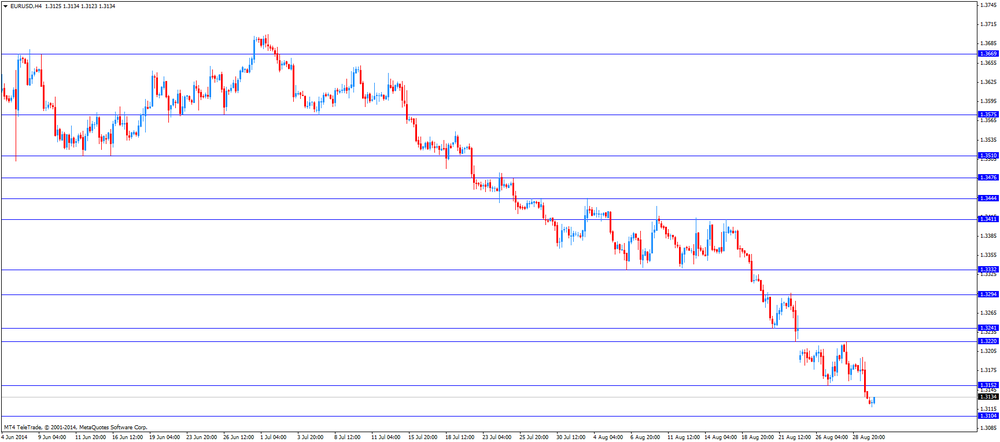

EUR/USD: the currency pair rose to $1.3145

GBP/USD: the currency pair traded mixed

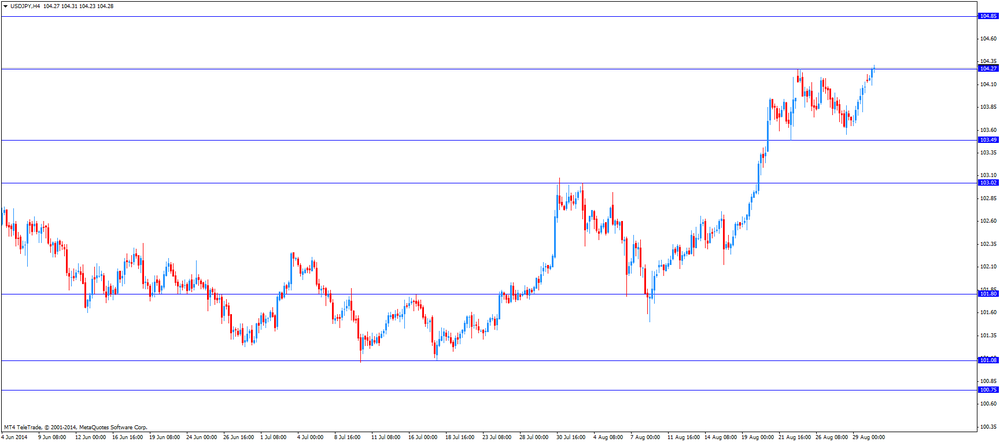

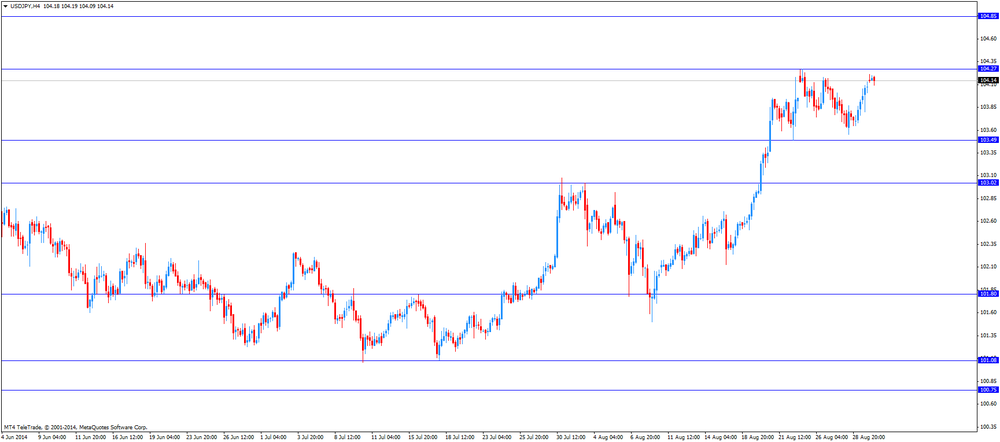

USD/JPY: the currency pair increased to Y104.31

The most important news that are expected (GMT0):

12:00 Canada Bank holiday

12:00 U.S. Bank holiday

-

09:59

Option expiries for today's 1400GMT cut

USDJPY 103.25 (USD 925m) 103.40 104.20

EURUSD 1.3135 1.3185-95 1.3290-3300 (EUR 400m)

GBPUSD 1.6635

AUDUSD 0.9320

USDCAD 1.0800 (USD 651m) 1.1000 (USD 851m)

NZDUSD 0.8400

-

09:44

Foreign exchange market. Asian session: the New Zealand dollar increased against the U.S dollar due to the strong overseas trade data from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Manufacturing PMI August 51.7 51.2 51.1

01:30 Australia Company Operating Profits Quarter II +3.1% -1.8% -6.9%

01:45 China HSBC Manufacturing PMI (Finally) August 50.3 50.3 50.2

06:00 Germany GDP (QoQ) (Finally) Quarter II -0.2% -0.2% -0.2%

06:00 Germany GDP (YoY) (Finally) Quarter II +0.8% +0.8% +0.8%

06:30 Australia RBA Commodity prices, y/y August -12.1% -11.5%

07:30 Switzerland Manufacturing PMI August 54.3 53.8 52.9

07:48 France Manufacturing PMI (Finally) August 46.5 46.5 46.9

07:53 Germany Manufacturing PMI (Finally) August 52.0 52.0 51.4

07:58 Eurozone Manufacturing PMI (Finally) August 50.8 50.8 50.7

08:30 United Kingdom Purchasing Manager Index Manufacturing August 55.4 55.1 52.5

08:30 United Kingdom Net Lending to Individuals, bln July 2.5 2.4 3.4

08:30 United Kingdom Mortgage Approvals July 67 66 67

The U.S. dollar traded mixed against the most major currencies. Tensions over Ukraine continued to weigh on markets.

U.S. markets are closed for the Labor Day holiday on Monday.

The New Zealand dollar increased against the U.S dollar due to the strong overseas trade data from New Zealand. New Zealand's overseas trade index climbed 0.3% in the second quarter, after a 1.8% increase in the first quarter. Export volumes dropped 5.3%, while import volumes gained 3.6%.

The Australian dollar traded higher against the U.S. dollar despite the weaker-than-expected economic data from Australia. Company operating profits in Australia fell 6.9% in the second quarter, missing expectations for a 1.8% drop, after a 2.0% rise in the first quarter. The first quarter's figure was revised down from a 3.1% gain.

Commodity prices in Australia declined 11.5% in August, after a 12.1 drop in July.

The Australia Industry Group released its manufacturing index for Australia. The index decreased to 47.3 in August from 50.7 in July. The figure below the mark of 50 means contraction.

The Japanese yen traded mixed against the U.S. dollar after the capital spending data from Japan. Capital spending in Japan rose 3.0% in the second quarter, after a 7.4% increase in the first quarter.

EUR/USD: the currency pair fell to $1.3118

GBP/USD: the currency pair rose to $1.6606

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:00 Canada Bank holiday

12:00 U.S. Bank holiday

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , August 52.5 (forecast 55.1)

-

09:30

United Kingdom: Net Lending to Individuals, bln, July 3.4 (forecast 2.4)

-

09:30

United Kingdom: Mortgage Approvals, July 67 (forecast 66)

-

09:00

Eurozone: Manufacturing PMI, August 50.7 (forecast 50.8)

-

08:55

Germany: Manufacturing PMI, August 51.4 (forecast 52.0)

-

08:50

France: Manufacturing PMI, August 46.9 (forecast 46.5)

-

08:30

Switzerland: Manufacturing PMI, August 52.9 (forecast 53.8)

-

07:01

Germany: GDP (YoY), Quarter II +0.8% (forecast +0.8%)

-

07:00

Germany: GDP (QoQ), Quarter II -0.2% (forecast -0.2%)

-

06:17

Options levels on monday, September 1, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3262 (3176)

$1.3224 (3079)

$1.3193 (700)

Price at time of writing this review: $ 1.3125

Support levels (open interest**, contracts):

$1.3092 (5472)

$1.3065 (6385)

$1.3031 (3530)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 67966 contracts, with the maximum number of contracts with strike price $1,3400 (6758);

- Overall open interest on the PUT options with the expiration date September, 5 is 63918 contracts, with the maximum number of contracts with strike price $1,3100 (6385);

- The ratio of PUT/CALL was 0.94 versus 0.96 from the previous trading day according to data from August, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.6900 (2308)

$1.6800 (2560)

$1.6701 (1037)

Price at time of writing this review: $1.6600

Support levels (open interest**, contracts):

$1.6498 (2061)

$1.6400 (992)

$1.6300 (702)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 31113 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 32008 contracts, with the maximum number of contracts with strike price $1,6800 (4025);

- The ratio of PUT/CALL was 1.03 versus 0.98 from the previous trading day according to data from August, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:45

China: HSBC Manufacturing PMI, August 50.2 (forecast 50.3)

-

02:30

Australia: Company Operating Profits, Quarter II -6.9% (forecast -1.8%)

-

01:59

China: Manufacturing PMI , August 51.1 (forecast 51.2)

-

00:50

Japan: Capital Spending, Quarter II +3.0%

-

00:29

Australia: AIG Manufacturing Index, August 47,3

-