Notícias do Mercado

-

21:16

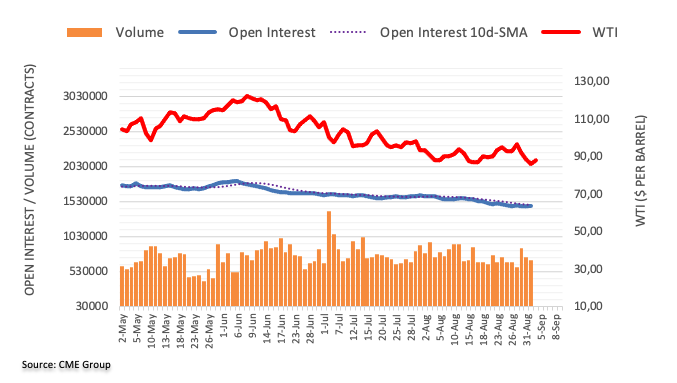

United States CFTC Oil NC Net Positions dipped from previous 246.2K to 229.2K

-

21:15

United Kingdom CFTC GBP NC Net Positions: £-29.2K vs previous £-28K

-

21:15

United States CFTC Gold NC Net Positions dipped from previous $125.8K to $117.7K

-

21:15

United States CFTC S&P 500 NC Net Positions up to $-239.6K from previous $-262.3K

-

21:15

Japan CFTC JPY NC Net Positions: ¥-41.5K vs previous ¥-38.8K

-

21:15

Australia CFTC AUD NC Net Positions up to $-57.4K from previous $-60K

-

21:14

European Monetary Union CFTC EUR NC Net Positions: €-47.7K vs previous €-44.1K

-

21:01

Argentina Tax Revenue (MoM): 1731.3195B (August) vs previous 1745.178B

-

18:32

United States Baker Hughes US Oil Rig Count fell from previous 605 to 596

-

16:51

Bank of Canada to bring rates into restrictive territory next week – TD Securities

Next week, the Bank of Canada will have its monetary policy meeting. Market consensus is for an increase in the key rate to 3.25%. Analysts at TD Securities look for the BoC to deliver a 75 basis point hike, bringing rates into restrictive territory. They see little incentive for smaller hikes CPI running well above target and the economy in excess demand. The BoC's messaging will be the larger source of uncertainty; we expect the Bank to emphasize that rates are now restrictive and signal that future hikes will be more modest in size.

Key Quotes:

“The economic situation clearly calls for restrictive policy rates, and we see a clear path for the BoC to hike by 75bps in September. We expect the pace of tightening to slow in October however, which may imply some moderation in the Bank's forward-looking language in the September communique.”

“Ahead of the BoC, we note that USDCAD has started to run ahead of the global drivers we track for the pair. Our tools peg USDCAD around 1.30. In turn, while we could see some action above 1.32 in the short-term, we prefer to fade those rallies given the divergence in risk sentiment and other drivers.”

“The market is pricing a terminal rate for this hiking cycle around 3.875%, we see fair value closer to 3.65% taking our call of 3.5% for the terminal plus allowing for the probability of realizing higher than 3.5% (where we see the risks to our forecast), a 4% terminal price would give us substantial conviction to fade.”

-

16:38

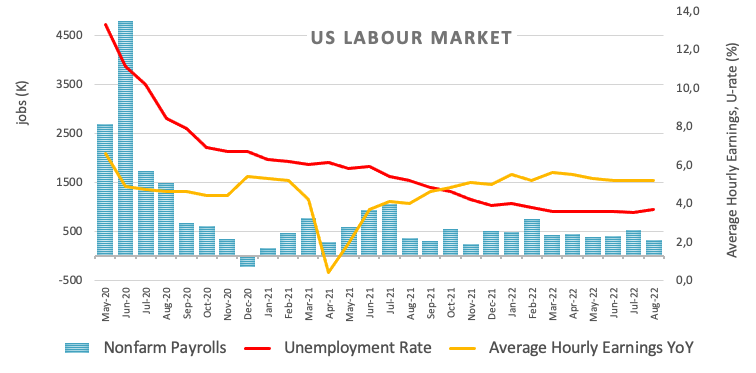

US: Weaker jobs report in all the right ways – Wells Fargo

The US official employment report showed the US economy added 315K jobs in August, slightly above expectations of 300K; the unemployment rate rose unexpectedly from 3.5% to 3.7%. According to analysts at Wells Fargo, today's data in isolation tilt the scales toward a 50 basis points interest rate hike at the Fed's September meeting but does not on its own settle the matter. While the August jobs report keeps hope alive that the Fed may be able to pull off the elusive soft-landing, there remains significant work ahead in quelling the inflation pressures coming from the labor market, explained analysts.

Key Quotes:

“The labor market cooled in all the right ways in August, at least as far as the Fed is concerned. Nonfarm payrolls rose by 315K last month, close in line with consensus expectations and with industry gains once again widespread. The pace marks a downshift from the downwardly revised 402K average recorded the prior three months, but is nonetheless a robust gain in its own right.”

“While the more moderate gain in payrolls suggests somewhat weaker demand for workers, a more balanced picture of the labor market is emerging thanks also to improving supply.”

“August's slowdown in hiring helps bridge the gap that had opened up between nonfarm payroll growth and labor market measures in recent months.”

“Today's report in isolation tilts the scales toward a 50 bps hike at the September FOMC meeting, but does not on its own settle the matter. With the Fed laser-focused on inflation, the August CPI will offer the last major piece of the 50 vs. 75 bps puzzle. But we don't see anything in the August employment report to alter the general path ahead: rate hikes are highly likely to extend beyond September and stay restrictive for a prolonged period. We expect to see more definitive signs of the labor market weakening ahead as a result, as the FOMC increasingly acknowledges that a cooler jobs market will be necessary in quelling inflation for the long haul.”

-

16:22

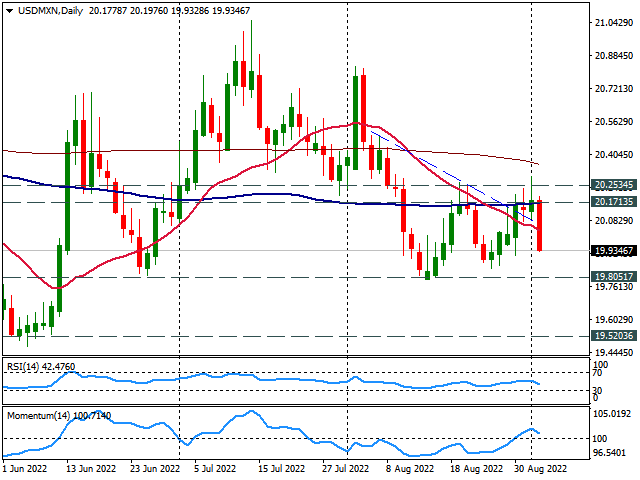

USD/MXN Price Analysis: Sharp decline after being unable to break 20.25

- USD/MXN fails to break critical resistance at 20.25.

- Below 20.00, next strong support stands at 19.80.

The USD/MXN is falling sharply on Friday, amid a broad-based decline of the US Dollar. The decline of the pair takes place after being unable to break a key resistance area around 20.25.

So far, USD/MXN bottomed at 19.92 and is it about to test the 19.90 short-term support. Technical indicators favor the downside, with RSI turning shout, like Momentum which still remains above 100. Price is back under the 20-day Simple Moving Average.

Since mid-August, the pair is moving sideways in a range between 19.80 and 20.25. If reached, the 19.80 zone is likely to offer a rebound. A break lower, would point to the next support around 19.65.

The 20.25 has become critical to the upside. A break above should clear the way to more gains, targeting initially the 20.45 zone.

USD/MXN daily chart

-

16:00

Denmark Currency Reserves dipped from previous 533.4B to 531.7B in August

-

16:00

USD/JPY retreats from multi-decade highs after NFP

- US economy adds 315K jobs in August, Unemployment rate rises to 3.7%.

- USD/JPY pulls back amid a weaker US dollar after NFP.

- Yen remains under pressure, now on risk appetite.

The USD/JPY is falling modestly on Friday, after hitting earlier at 140.79, the highest level since 1998. A weaker US Dollar across the board weighed on the pair following the official US employment report.

US yields retreat sharply

Non-farm payrolls rose by 315K in August against expectations of a 300K increase. The unemployment rate rose unexpectedly from 3.5% to 3.7%, however, the labor participation rate also rose.

After the report, US yields dropped sharply favoring the decline in USD/JPY. The US 10-year yield fell to 3.17% and the 2-year fell from 3.52% to 3.40%. At the same time, equity prices in Wall Street rose. The Dow Jones was rising by 0.81% and the Nasdaq by 0.79%.The Japanese yen failed to stage a broad-based recovery on the back of the improvement in risk sentiment.

Despite falling on Friday, USD/JPY is about to post the third consecutive weekly gain and the highest close since 1998. The divergence between the Bank of Japan and the Federal Reserve’s monetary policy continues to drive the pair to the upside. At their next meeting, the BoJ is expected to keep the ultra-expansive stance while the Fed is seen raising rates by 50 or 75 basis points.

Technical levels

-

15:00

United States Factory Orders (MoM) registered at -1%, below expectations (0.2%) in July

-

14:46

USD/CAD slides to 1.3100 neighbourhood, downside potential seems limited

- USD/CAD retreats further from a multi-week high and is pressured by a combination of factors.

- Rebounding crude oil prices underpin the loonie and prompt some selling amid a weaker USD.

- The intraday USD selling picks up pace following the release of the mixed US monthly jobs data.

- Hawkish Fed expectations, recession fears to limit the USD losses and lend support to the pair.

The USD/CAD pair extends its steady intraday descent and drops to the 1.3115-1.3110 area, or a fresh daily low during the early North American session. Spot prices retreat further from the highest level since July 14 touched the previous day and for now, seem to have snapped a three-day winning streak.

A goodish recovery in crude oil prices underpins the commodity-linked loonie. This, along with a broad-based US dollar weakness, prompts some selling around the USD/CAD pair on Friday. The USD retracement slide from a two-decade high set on Thursday picks up pace following the release of the mixed US monthly jobs report. Apart from this, an intraday decline in the US Treasury bond yields and the risk-on impulse exert additional downward pressure on the safe-haven greenback.

That said, a combination of factors should help limit deeper losses for the USD/CAD pair and warrant some caution before placing aggressive bearish bets. Investors remain concerned that a deeper global economic downturn and fresh COVID-19 lockdown would dent fuel demand, which should act as a headwind for crude oil prices. Apart from this, expectations that the Fed will stick to its aggressive policy tightening path should limit the USD downfall and lend support to the major.

In fact, the markets are still pricing in a greater chance of a supersized 75 bps rate hike move at the next FOMC monetary policy meeting on September 20-21. This, in turn, favours the USD bulls and supports prospects for the emergence of some dip-buying around the USD/CAD pair. Hence, it will be prudent to wait for a strong follow-through decline before confirming that the recent strong move up witnessed over the past three weeks or so has run out of steam and positioning for further losses.

Technical levels to watch

-

14:45

US dollar is meeting offers following a mixed US NFP report

- US dollar is under pressure and scrutiny following the mixed US NFP report.

- The bears are looking to the weekly chart for clues as to where the dollar could be correcting towards.

The US dollar, as measured vs. a basket of major currencies in the DXY index, fluttered on the release of the US Labor Department's closely watched Nonfarm Payrolls employment report. While the data showed an increase of 315,000 jobs last month after surging 526,000 in July, the disappointments came in the form of Average Hourly Earnings which rose 0.3% compared with expectations of 0.4% and the Unemployment Rate which missed expectations of 3.5% vs. 3.7% actual. However, the stronger than expected Participation Rate could go some way toward explaining this miss given the increase in the number of people joining the labour force last month.

- Labour Force Participation Rate July: 62.4% vs. estimated 62.2%; previous 62.1%.

Despite mixed data, traders see a 75% chance of a third straight 75 basis points rate hike in September and expect rates to peak at 3.90% in March 2023. The US dollar has since recovered from the knee-jerk sell-off and lows of the day down at 109.049 and is trying to hang on to the correction in the 109.20s at the time of writing. It had recovered to 109.46, so it remains slightly pressured still. US yields are under pressure as well, with the 2-year US Treasury yield down over 2.57% at the lows of 3.406%

Despite today's disappointments, the US dollar index had rallied to a fresh 20-year high on Thursday of 109.99, bolstered by robust US data which leaves the DXY on track for a 0.5% weekly gain still on a closing basis. However, given that the data has a little something for everyone, it eases some pressure on the Federal Reserve looking to cool down labour demand and the overall economy to bring inflation back to its 2% target which is a factor that can weigh on the greenback for the forthcoming days as markets continue to digest the implications. Traders will now look to the August Consumer Price Index report due in the middle of this month for clues on the next rate increase ahead of when the Fed meets.

DXY H1 chart

From a technical standpoint, the index is trying to establish around a 61.8% Fibonacci retracement level of the prior hourly bullish impulse. If the bulls commit, then there will be prospects of a bullish extension for the day ahead and open next week with sights beyond the 110.00 level. On the other hand, should the support area give way, a deeper correction of the weekly bullish run could be on the cards for next week:

The W-formation on the weekly chart is a reversion pattern and there are prospects of a correction into the prior highs that meet with the 38.2% Fibo retracement.

-

14:39

Fed to stay course despie moderate slowdown of employment growth – Commerzbank

US employment loses some momentum. But in the view of economists at Commerzbank, the Federal Reserve is set to stick to its plan despite signs of a weakening.

Job growth remains strong despite pace has slowed

“Even though the pace of job growth has slowed somewhat, at over 300 thousand it remains strong for this phase of the business cycle (and one should keep in mind that job growth of around 75 thousand per month is enough to supply the growing working-age population with jobs).”

“Fed Chairman Powell, in his speech at Jackson Hole, has put the markets on notice that monetary policy will continue to step on the brakes. It is therefore unlikely that the central bank will use this moderate slowdown of employment growth as an opportunity to raise key rates by only 50 bps in September.”

“We are sticking to our forecast of a 75 bps rate hike.”

-

14:30

EUR/USD Price Analysis: Further range bound in store near term

- EUR/USD regains composure and surpasses the parity level.

- Extra consolidation appears favoured for the time being.

EUR/USD fades part of Thursday’s strong sell-off and manages to regain the area above the key parity level at the end of the week.

Further consolidation looks the most likely scenario in EUR/USD in the near term at least, always within the 1.0100-0.9900 range and ahead of the key ECB and FOMC events later in the month.

The breakout of the weekly high at 1.0090 (August 26) could spark further gains to 1.0202 (August17 high). Alternatively, the 0.9900 neighbourhood is expected to hold the bearish impulse for the time being.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0794.

EUR/USD daily chart

-

14:18

USD/TRY remains bid and close to the all-time high around 18.25

- USD/TRY comes under pressure after flirting with 18.25.

- The downtrend in the Turkish currency remains unchanged.

- Next of note in the docket comes Monday’s CPI release.

The Turkish lira poked with all-time lows vs. the dollar after USD/TRY briefly rose past 18.25 earlier on Friday’s session.

USD/TRY further upside could retest 20.00… soon

USD/TRY maintains the buying interest for the third session in a row despite faltering just below the all-time peak above 18.25 at the end of the week.

Indeed, the selling bias in the Turkish lira is expected to remain well in place for the foreseeable future and could even gather extra steam in the next periods considering the increasing divergence between the Federal Reserve and the Turkish central bank (CBRT).

Indeed, the dollar is seen firmer vs. the risk complex and the EM FX universe against the current backdrop of rising expectations of extra tightening by the Fed, as inflation in the US economy looks far from abating.

Nothing scheduled in the Turkish docket on Friday, whereas US Nonfarm Payrolls came a tad above estimates at 315K for the month of August. The US Unemployment Rate, in the meantime, crept higher to 3.7%.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and approaches the all-time high around 18.25. The uptrend in spot has been intensified following the unexpected interest rate cut by the CBRT on August 18.

In the meantime, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, there seems to be no other immediate alternative to attract foreign currency other than via tourism revenue, in a context where official figures for the country’s FX reserves remain surrounded by increasing skepticism among investors.

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.14% at 18.2187 and faces the immediate target at 18.2574 (2022 high September 2) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.6120 (55-day SMA) and finally 17.1903 (weekly low July 15).

-

14:11

GBP/USD remains confined in a range near mid-1.1500s post-NFP, seems vulnerable

- GBP/USD prolongs its range-bound price action following the release of the US monthly jobs data.

- The USD dips in reaction to an unexpected rise in the US unemployment rate and softer wage growth.

- The markets are still expecting a 75 bps Fed rate hike in September, which limits the USD downside.

- A bleak outlook for the UK economy continues to undermine sterling and favours bearish traders.

The GBP/USD pair continues with its struggle to gain any meaningful traction and remains confined in a narrow range through the early North American session. The pair is currently placed around the mid-1.1500s and moves little following the release of the US monthly jobs report.

The slightly better-than-anticipated headline NFP print, showing that the US economy added 312K jobs in August, was offset by an unexpected rise in the unemployment rate - to 3.7% from 3.5% previous. Adding to this, Average Earnings growth slowed to 0.3% during the reported month, down notably from July's upwardly revised 0.5%. The US dollar added to its intraday losses in reaction to the data, though hawkish Fed expectations help limit deeper losses.

In fact, the markets are still pricing in a greater chance of a supersized 75 bps Fed rate hike move at the September policy meeting. This remains supportive of elevated US Treasury bond yields, which, in turn, should assist the USD to stall its corrective pullback from a two-decade high touched on Thursday. Apart from this, a bleak outlook for the UK economy further contributes to keeping a lid on any meaningful upside for the GBP/USD pair, at least for now.

Nevertheless, spot prices remain well within the striking distance of the lowest level since March 2020 set the previous day and seem vulnerable to sliding further. Bearish traders, however, might prefer to wait for a convincing break below the 1.1500 psychological mark before positioning for an extension of the depreciating move. Nevertheless, the fundamental backdrop suggests that the path of least resistance for the GBP/USD pair is to the downside.

Technical levels to watch

-

14:04

EUR/CHF: Positive franc outlook as inflation becomes a permanent upside risk – MUFG

After two consecutive months of decline, EUR/CHF staged a recovery toward the end of August that saw the franc close weaker for the month. Nonetheless, economists at MUFG Bank believe that the rebound will not last and expect lower levels for the EUR/CHF pair.

EUR’s rebound unlikely to last

“With recession risks still high, we doubt the EUR rebound will prove lasting. Even if natural gas prices move lower, the lift to confidence will be marginal given the high level of uncertainty over supplies from Russia in 2023 and beyond.”

“The rhetoric from the SNB also indicates a central bank growing increasingly concerned over the threat of inflation and hence there are risks the SNB could match the ECB’s actions if the ECB does turn more hawkish through the remainder of the year. But what seems as likely is the ECB failing to deliver what is priced into the market as recession in the eurozone bites.”

“Toward the end of August SNB President Jordan stated that the signs were increasing that structural changes globally could lead to ‘persistently higher inflationary pressures in the coming years’. If the SNB believes a structural change is underway, then the attitude to CHF appreciation will change and the entire framework of the monetary policy strategy in Switzerland could also change. This to us points to lower EUR/CHF levels until the energy crisis in Europe abates.”

-

14:00

Singapore Purchasing Managers Index above forecasts (49.9) in August: Actual (50)

-

13:56

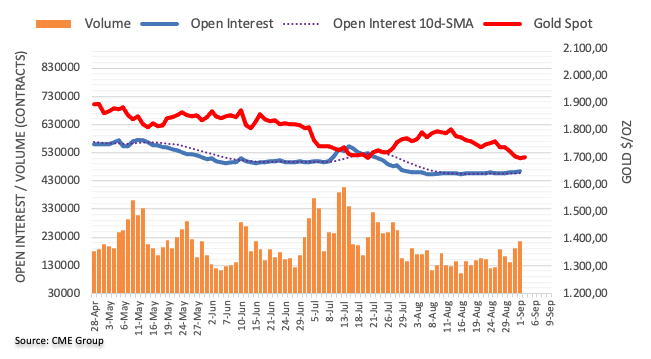

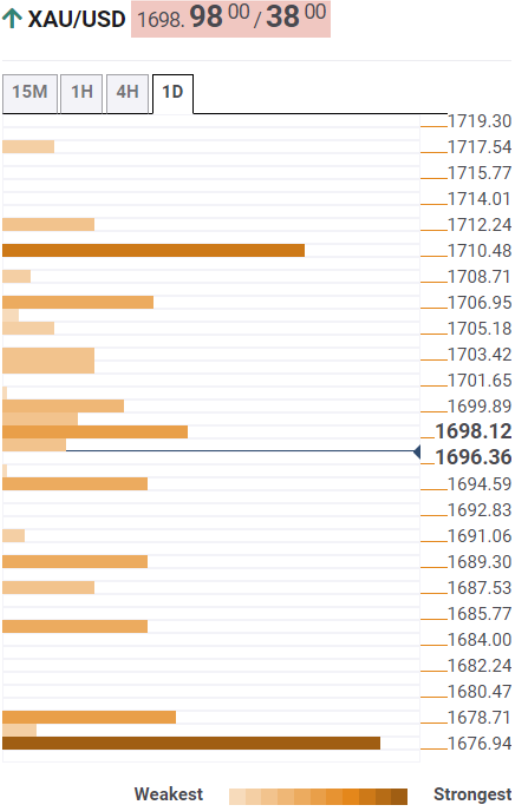

Gold Price Forecast: XAU/USD extends bullish correction on higher US Unemployment Rate

- Gold rallies as the US dollar and yields sell off after the NFP miss in the details.

- The headline was a touch above expectations but the UR and earnings disappointed.

- Fed funds futures traders are still pricing in a September rate hike of 75 basis points after the jobs report.

The gold price is higher on the Nonfarm Payrolls on the knee-jerk. The US dollar has sold-off and US yields are volatile while US stocks rally. The outcome of the data was mixed but the Unemployment came in at 3.7% vs. 3.5% expected and Average Hourly Earnings missed the mark as well, at 0.3% month on month vs. 0.4% expected. This data, behind the headline beat of 315k vs. 300k expected, is less inflationary and therefore the market initially dialled down its expectations of a 75 basis point hike from the Federal Reserve at the next meeting later this month. In this regard, however, it is worth noting that the Participation Rate was higher, potentially explaining the higher Unemployment Rate.

Payrolls have continued to advance strongly in August, but at a more moderate pace following the eye-popping 528k increase registered in July, which was a five-month high. Wage growth has slowed modestly after registering an unexpected 0.5% jump last month, nevertheless, Fed swap pricing of the terminal cycle rate has dropped to around 3.91%. The 2-year Treasury yield has fallen on the data within a 3.518%-3.449% range but is down 1.28% on the day so far. However, fed funds futures traders are still pricing in a September rate hike of 75 basis points after the jobs report which may limit the fall in yields, the greenback and put a cap on the yellow metal.

Prior to the data, the US dollar was headed for its third weekly gain in a row and was near two-decade highs against other major currencies, as measured by the DXY which tracks the currency against six counterparts. The US currency has been on the front foot since Federal Reserve Chair Jerome Powell said at the Jackson Hole symposium in Wyoming a week ago that rates would need to be high "for some time" to combat inflation. The index rallied to a fresh 20-year high on Thursday of 109.99, bolstered by robust U.S. data showing a fall in unemployment claims. Despite the data, DXY is still on track for a 0.5% weekly gain on a closing basis.

After all, Fedspeak has successfully catalyzed a repricing in rates markets, which have now largely priced-out odds that rate cuts will immediately follow the rate hiking cycle, as analysts at TD Securities noted.

''This leaves current pricing for rates near-fair, which suggests that the catalyst for the move lower in precious metals pricing is now fundamentally running out of steam. Notwithstanding, with every tick lower in gold prices, we continue to see odds of a major capitulation event growing, which could coincide with a break below a multi-decade uptrend in the yellow metal near $1675/oz.''

Gold technical analysis

Meanwhile, however, there is a bullish argument on the charts for the yellow metal.

The price is correcting from a strong sell-off on the daily timeframe. The bulls are moving in on a 38.2% Fibonacci retracement and a bullish close today, Friday, could leave prospects for a deeper correction over the start of next week, taking the price into the resistance as illustrated on the above chart.

-

13:42

AUD/USD hits fresh daily high post-NFP, lacks follow-through beyond mid-0.6800s

- AUD/USD adds to intraday recovery gains and refreshes daily high in reaction to mixed US jobs report.

- The US economy added 312K jobs in August and the unemployment rate unexpectedly rose to 3.7%.

- Hawkish Fed expectations should help limit any meaningful USD downside and cap gains for the pair.

The AUD/USD pair extends its recovery move through the early North American session and jumps to a fresh daily high, around mid-0.6800s in reaction to the mixed US jobs report.

The headline NFP print showed that the US economy added 312K jobs in August against the 300K anticipated, though the reading was well below the 526K reported in the previous month. Adding to this, the unemployment rate unexpectedly rose to 3.7% from the 3.5% previous. Furthermore, softer-than-estimated Average Hourly Earnings drag the US dollar away from a two-decade high touched the previous day. This is seen as a key factor that provides a modest lift to the AUD/USD pair.

Spot prices have now reversed the overnight losses to the lowest level since July 18, though any further recovery still seems elusive. Despite a slight disappointment from the US employment details, growing acceptance that the Fed will stick to its aggressive policy tightening path might continue to act as a tailwind for the USD. Apart from this, concerns about a deeper global economic downturn might further contribute to capping the upside for the AUD/USD pair, at least for now.

Even from a technical perspective, the intraday positive move stalls near the 100-hour SMA, currently around mid-0.6800s, which should now act as a pivotal point for intraday traders. This makes it prudent to wait for strong follow-through buying before confirming that the AUD/USD pair has formed a near-term bottom and positioning for any further appreciating move.

Technical levels to watch

-

13:40

EUR/USD extends gains north of parity on NFP

- EUR/USD remains bid above the parity level on Friday.

- US Nonfarm Payrolls rose by 315K jobs in August.

- The unemployment rate ticked higher to 3.7%.

EUR/USD keeps the daily bid bias unchanged and manages to retest the 1.0030 region in the wake of the release of Nonfarm Payrolls for the month of August.

EUR/USD looks well supported near 0.9900

EUR/USD keeps the positive stance on Friday after the release of the Nonfarm Payrolls showed the US economy added 315K jobs during August, surpassing initial estimates for a gain of 300K jobs. The July reading was revised down slightly to 526K (from 528K).

Further data saw the Unemployment Rate edge higher to 3.7% (from 3.5%) and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 5.2% from a year earlier. Additionally, the Participation Rate, improved a tad to 62.4% (from 62.1).

Next on the US docket will come July’s Factory Orders.

EUR/USD levels to watch

So far, the pair is gaining 0.67% at 1.0013 and further upside could retest 1.0090 (weekly high August 26) ahead of 1.0202 (high August 17) and finally 1.0203 (55-day SMA). On the flip side, the breach of 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low).

-

13:35

NZD/USD: Better prospects for the kiwi in 2023 – MUFG

During August, the New Zealand dollar depreciated further against the US dollar from 0.6266 to 0.6134. Economists at MUFG Bank expect the kiwi to recover in the next year.

NZD/USD to remain under downward pressure in the short-term

“With the Fed expected to be more active to year-end, we would expect NZD/USD to remain under downward pressure.”

“Next year, assuming NZ does not slow notably, we’d expect NZD/USD to recover as Fed tightening concludes.”

-

13:31

United States Unemployment Rate above expectations (3.5%) in August: Actual (3.7%)

-

13:31

United States Average Hourly Earnings (MoM) below expectations (0.4%) in August: Actual (0.3%)

-

13:31

United States Average Hourly Earnings (YoY) came in at 5.2%, below expectations (5.3%) in August

-

13:31

United States Labor Force Participation Rate came in at 62.4%, above forecasts (62.1%) in August

-

13:31

Canada Labor Productivity (QoQ) rose from previous -0.5% to 0.2% in 2Q

-

13:31

United States Nonfarm Payrolls came in at 315K, above forecasts (300K) in August

-

13:30

United States Average Weekly Hours registered at 34.5, below expectations (34.6) in August

-

13:30

Breaking: US Nonfarm Payrolls rise by 315,000 in August vs. 300,000 expected

Nonfarm Payrolls in the US rose by 315,000 in August, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed July's increase of 526,000 (revised from 528,000) and came in slightly better than the market expectation of 300,000.

Follow our live coverage of market reaction to the US jobs report.

Further details of the publication revealed that the Unemployment Rate rose to 3.7% from 3.5%. The annual wage inflation, as measured by the Average Hourly Earnings, stayed unchanged at 5.2%, compared to the market expectation of 5.3%. Finally, the Labor Force Participation Rate improved to 62.4% from 62.1% in July.

Market reaction

The US Dollar Index edged lower with the initial reaction and was last seen losing 0.4% on the day at 109.18.

-

13:30

United States U6 Underemployment Rate above forecasts (6.7%) in August: Actual (7%)

-

13:29

USD/CAD: Tighter financial conditions leave the loonie vulnerable over short-term – MUFG

The Canadian dollar weakened in August with that weakness unfolding in the second half of the month. Economists at MUFG Bank expect the loonie to remain weak through the remainder of the year before recovering in 2023.

Global equity market weakness lifts USD/CAD

“The comment from Fed President Kashkari effectively welcoming declines in equity markets does not bode well for risk assets more generally. That has implications for CAD given its strong positive correlation with US and global equity market performance.”

“The speed of the tightening of monetary policy is likely to continue to weigh on the housing sector and with financial market conditions set to tighten further, we assume CAD will remain weak through the remainder of the year before recovering in 2023.”

-

13:18

USD/TRY to head higher towards 25 over the next 12 months – Danske Bank

The Central Bank of the Republic of Turkey's (CBRT’s) unexpected move to cut rates by 100 bps in August triggered a new bout of lira weakness with USD/TRY breaching the 18 level. Economists at Danske Bank think twin deficits and global financial tightening could push USD/TRY towards 25 in 12 months.

Burden on Turkey’s public finances will grow while growth momentum is slowing down

“We think the combination of global financial tightening, rising budget deficits and substantial refinancing needs at the private sector in the context of already-tight FX liquidity could push USD/TRY to 25 in the next 12M.”

“In the absence of a policy turnaround ahead of the June 2023 election, the burden on Turkey’s public finances will grow while growth momentum is slowing down.”

“In the longer term, Turkey’s economy could have a lot to gain (or lose) depending on how successfully it navigates the new geopolitical world order.”

-

13:15

US Dollar Index Price Analysis: Short-term top around 110.00?

- DXY corrects lower after hitting 20-year tops around 110.00.

- Occasional weakness in the dollar could be a buying opportunity.

DXY gives away part of Thursday’s strong advance to new cycle highs just below the 110.00 mark.

The short-term bullish view in the dollar remains well in place for the time being and propped up by the 7-month support line, today around 105.65. The surpass of recent peaks, however, could face the next barrier at the weekly highs at 111.90 (June 6 2002) and 113.35 (May 24 2002).

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.99

DXY daily chart

-

13:02

Brazil Industrial Output (YoY) below forecasts (-0.3%) in July: Actual (-0.5%)

-

13:01

Brazil Industrial Output (MoM) came in at 0.6% below forecasts (0.7%) in July

-

12:39

Thailand: Door open for another rate hike by the BoT – UOB

UOB Group’s Economist Enrico Tanuwidjaja comments on the likelihood of further tightening by the Bank of Thailand (BoT) later in the year.

Key Takeaways

“Thai economy grew less than expected in 2Q22 but pickup in consumer spending was a welcome start for possibly faster pace of growth momentum this quarter and next.”

“Persistent current account deficit to the tune of USD15bn to-date has weighed THB down but we expect with stronger tourism receipts, reversal into surplus is abound and is positive for THB.”

“Slower 2Q growth but unabating inflationary pressures is unlikely to deter Sep’s rate hike but we reckon BOT to pause in Nov to assess the incoming data before considering further monetary policy tightening.”

-

12:35

EUR/JPY Price Analysis: Next on the upside now comes 142.30

- EUR/JPY fades Thursday’s pullback and regains 140.00 and above.

- Further upside could see the 142.30 region revisited.

EUR/JPY resumes the weekly recovery and manages to surpass the key barrier at the 140.00 mark on Friday.

Extra gains in the cross are favoured once it clears the 140.00 region. Beyond this area, another test of the weekly peak at 142.32 (July 21) should re-emerge on the horizon ahead of the 2022 high at 144.27 (June 28).

While above the 200-day SMA at 134.48, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

12:31

India FX Reserves, USD dipped from previous $564.05B to $561.05B in August 26

-

12:03

When is the US monthly jobs report (NFP) and how could it affect EUR/USD?

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data for August. The popularly known NFP report is scheduled for release at 12:30 GMT and is expected to show that the economy added 300K jobs during the reported month, down from the 528K in July. The unemployment rate, however, is expected to hold steady at 3.5% in August. Apart from this, investors will take cues from Average Hourly Earnings, which could offer fresh insight into the possibility of a further rise in inflationary pressures.

Analysts at TD Securities sounded more optimistic and wrote: “We expect the series to have continued to advance strongly in August (370K), but at a more moderate pace following the eye-popping 528K increase registered in July, which was a five-month high. We look for the solid gain in employment to also be reflected in another decline in the unemployment rate to 3.4% (second consecutive one-tenth decline). We are assuming an improvement in the participation rate to 62.2% after falling to 62.1% in July. We are also looking for wage growth to slow modestly to a still robust 0.4% MoM after registering an unexpected 0.5% jump last month. The MoM leap should result in a one-tenth increase in the YoY measure to 5.3% in August.”

How could the data affect EUR/USD?

Ahead of the key data risk, traders opt to take some profits off their US dollar bullish positions after the recent run-up to a two-decade high. This, in turn, pushes the EUR/USD pair back above the parity mark. A disappointing labour market report might prompt some long-unwinding around the USD, though the immediate market reaction is more likely to be short-lived. Growing recession fears and economic headwinds stemming from fresh COVID-19 lockdowns in China and the war in Ukraine should help limit any meaningful corrective slide for the safe-haven buck.

Conversely, stronger data will reaffirm expectations that the Fed will continue to tighten its monetary policy at a faster pace to tame inflation. This should be enough to push the US Treasury bond yields higher, alongside the USD. Apart from this, concerns over an extreme energy crisis in Europe suggest that the path of least resistance for the EUR/USD pair is to the downside and any attempted recovery could get sold into.

Eren Sengezer, Editor at FXStreet, offers a brief technical overview and writes: “EUR/USD has climbed above the 50-period SMA on the four-hour chart and the Relative Strength Index (RSI) indicator recovered toward 50 early Friday. Although these technical developments don't necessarily point to a bullish tilt in the near-term outlook, they show that sellers remain cautious for the time being.

Eren also outlines important technical levels to trade the EUR/USD pair: “On the upside, 1.0000 (psychological level, 20-period SMA) aligns as immediate resistance ahead of 1.0020 (Fibonacci 23.6% retracement of the latest downtrend) and 1.0060 (100-period SMA). Supports are located at 0.9980 (50-period SMA), 0.9920 (end-point of the downtrend) and 0.9900 (psychological level).

Key Notes

• Nonfarm Payrolls Preview: Five reasons to expect a win-win release for the dollar

• NFP Preview: Forecasts from eight major banks, employment growth still strong

• EUR/USD Forecast: Can euro extend recovery on a weak NFP print?

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

-

11:37

Indonesia: Inflation seen picking up pace in September – UOB

Economist at UOB Group Enrico Tanuwidjaja assesses the recently published inflation figures in Indonesia.

Key Takeaways

“Aug’s headline inflation fell by 0.2% m/m and eased slightly to 4.7% y/y (4.9% in Jul) while core inflation rose to 3.0% y/y (prior 2.9%).”

“Inflation in Aug continued to be driven by elevated level of food and transport prices, as well as the housing, water, and electricity costs.”

“We keep our 2022 inflation forecast (average) at 4% but now with upside risks on the back of highly probable fuel price hikes in due course. As such, we maintain our view for BI to hike rates to reach 4.50% by year-end.”

-

11:33

USD/JPY sits near 24-year peak, just below mid-140.00s ahead of US NFP report

- USD/JPY hits a 24-year high on Friday and now seems to have entered a consolidation phase.

- The Fed-BoJ policy divergence offsets modest USD weakness and continues to lend support.

- A modest USD weakness seems to cap the upside ahead of the crucial US jobs report (NFP).

The USD/JPY pair attracts some dip-buying near the 139.85 region and climbs to a fresh 24-year high on Friday. The pair now seems to have entered a bullish consolidation phase and is seen oscillating in a narrow band, just mid-140.00s through the first half of the European session.

The Japanese yen continues to be weighed down by the divergent stance adopted by the Bank of Japan and other major central banks, including the Federal Reserve. This, in turn, is seen as a key factor acting as a tailwind for the USD/JPY pair. It is worth mentioning that the BoJ has repeatedly said that it remains committed to the ultra-loose monetary policy. In contrast, the Fed is expected to tighten its policy further to tame inflation.

In fact, the markets are currently pricing in a greater chance of a supersized 75 bps rate hike at the September FOMC meeting. The bets were reaffirmed by the recent hawkish remarks by several Fed officials, which helped push the rate-sensitive 2-year US government bond to a 15-year peak. Moreover, the yield on the benchmark 10-year US government rose to more than a two-month peak, widening the US-Japan rate differential and weighing heavily on the JPY.

That said, hints at a possible government intervention to prop up the yen seem to hold back bulls from placing fresh bets. In fact, Hirokazu Matsuno, Japanese Chief Cabinet Secretary, told reporters that currency market volatility is heightening recently and sudden exchange-rate fluctuations are not desirable. Adding to this, a modest US dollar pullback from a two-decade high further contributes to keeping a lid on any further gains for the USD/JPY pair, at least for now.

Investors also seem reluctant and prefer to move to the sidelines ahead of the US monthly jobs data, due later during the early North American session. The popularly known NFP report will provide a fresh insight into the labour market conditions in the wake of rising interest rates and stubbornly high inflation. This, in turn, might influence Fed rate hike expectations and drive the USD demand. Nevertheless, the fundamental backdrop suggests that the path of least resistance for the USD/JPY pair is to the upside and any pullback might be seen as a buying opportunity.

Technical levels to watch

-

11:02

Ireland Gross Domestic Product (YoY): 11.1% (2Q) vs 11%

-

11:02

Ireland Gross Domestic Product (QoQ) declined to 1.8% in 2Q from previous 10.8%

-

11:01

Ireland Gross Domestic Product (QoQ): 11.1% (2Q) vs 10.8%

-

10:48

AUD/USD climbs back above 0.6800 mark amid modest USD weakness, NFP awaited

- AUD/USD gains positive traction and reverses a part of the overnight slide to a multi-week low.

- The USD moves away from a two-decade high and turns out to be a key factor lending support.

- Aggressive Fed rate hike bets to limit the USD losses and cap the pair ahead of the NFP report.

The AUD/USD pair attracts some buying on Friday and recovers a part of the previous day's losses to the 0.6770 area, or the lowest level since July 18. The pair builds on its steady intraday ascent and moves back above the 0.6800 mark, hitting a fresh daily high during the first half of the European session.

The US dollar edges lower and retreats further from a two-decade high touched on Thursday, which, in turn, offers some support to the AUD/USD pair. A softer tone surrounding the US Treasury bond yields keeps the USD bulls on the defensive amid some repositioning trade ahead of the US monthly jobs data. Apart from this, signs of stability in the financial markets further undermine the safe-haven buck and benefit the risk-sensitive aussie.

That said, growing recession fears, economic headwinds stemming from fresh COVID-19 lockdowns in China and the war in Ukraine should cap any optimistic moves. Furthermore, expectations that the Fed will continue to tighten its monetary policy to tame inflation should act as a tailwind for the US bond yields and lend support to the greenback. This, in turn, warrants caution before placing aggressive bullish bets around the AUD/USD pair.

It is worth mentioning that the markets are pricing in a supersized 75 bps rate hike at the September FOMC meeting and the bets were reaffirmed by the recent hawkish remarks by several Fed officials. Traders now look to the US NFP report, which will provide a fresh insight into the economy's health and influence the USD price dynamics. This, in turn, will drive the AUD/USD pair ahead of the Reserve Bank of Australia (RBA) meeting next week.

Technical levels to watch

-

10:38

India: GDP figures surprised to the upside – UOB

Head of Research at UOB Group Suan Teck Kin, CFA, reviews the latest GDP figures in the Indian economy.

Key Takeaways

“India’s real GDP in the Apr-Jun quarter (1QFY22-23) surged 13.5% y/y from 4.1% in the prior quarter, in line with our expectation of 14% but well below Bloomberg survey’s 15.3% and Reserve Bank of India’s (RBI) forecast of 16.2%. The gain was boosted by a low base and record increase in private consumption expenditure and increase in investment demand.”

“While the strong headline figure places India’s performance as the best among Asian countries in the quarter, the pace is expected to moderate ahead. We project 6.3% y/y in the Jul-Sep quarter (2QFY22-23), and at 7.0% for FY22-23 (or 6.8% for CY2022) from 8.7% in FY21-22.”

“With the RBI focused on containing inflationary pressures, we continue to see the central bank adding on another 50bps rate increases in the two remaining meetings in 2022 to bring the repo rate to 5.90% by the end of the year, and to pause thereafter. The next RBI policy meeting will be held in 28-30 Sep.”

-

10:36

EUR/USD regains the smile and looks to retake the parity zone

- EUR/USD manages to bounce off weekly lows near 0.9900.

- The greenback appears offered following Thursday cycle tops.

- Market participants will closely follow the release of August NFP.

The single currency regains some composure and prompts EUR/USD to trim part of the strong drop to the vicinity of 0.9900 recorded in the previous session.

EUR/USD now focuses on Payrolls

Following Thursday’s deep pullback, EUR/USD now trades with decent gains and re-targets the key parity level in a context where investors seem to be cashing up part of the recent advance in the greenback to new cycle peaks near the 110.00 hurdle when gauged by the US Dollar Index (DXY).

In the meantime, speculation around a 75 bps rate hike by the ECB at the September meeting remains on the rise and it has been exacerbated after signs that inflation in the region is not giving up, as per the latest flash CPI figures for the month of August.

In the domestic calendar, Germany’s trade surplus shrank a tad to €5.4B in July and Producer Prices in the broader Euroland rose 4.0% MoM in July and 37.9% over the last twelve months.

Across the pond, the US labour market report will take centre stage seconded by Factory Orders.

What to look for around EUR

EUR/USD picks up renewed pace with the immediate target at the psychological parity zone in the wake of Thursday’s sharp sell-off.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence. However, potential shifts to a more hawkish stance from ECB’s policy makers regarding the bank’s rate path could be a source of strength for the euro.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Balance of Trade, EMU Producer Prices (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.40% at 0.9948 and further upside could retest 1.0090 (weekly high August 26) ahead of 1.0202 (high August 17) and finally 1.0203 (55-day SMA). On the flip side, the breach of 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low).

-

10:14

Gold Price Forecast: XAU/USD moves away from multi-week low, retakes $1,700 ahead of NFP

- Gold edges higher on Friday and moves away from a multi-week low touched the previous day.

- A modest USD pullback from a two-decade high, retreating US bond yields offer some support.

- Hawkish Fed expectations should cap any meaningful upside ahead of the US jobs data (NFP).

Gold gains some positive traction on Friday and recovers a major part of the previous day's losses to the sub-$1,690 levels - the lowest since July 21. The steady intraday ascent lifts spot prices to a fresh daily high, further beyond the $1,700 mark during the first half of the European session.

The US dollar edges lower and moves away from a two-decade high touched the previous day amid some repositioning trade ahead of the closely-watched US monthly jobs report. Apart from this, a softer tone surrounding the US Treasury bond yields further contributes to the modest USD downtick, which, in turn, is seen as lending support to the dollar-denominated commodity. That said, any meaningful positive move still seems elusive amid hawkish Fed expectations.

In fact, the markets seem convinced that the US central bank will continue to tighten its policy to tame inflation and have been pricing in a supersized 75 bps rate hike at the September meeting. The bets were reaffirmed by the recent hawkish remarks by several Fed officials. This should act as a tailwind for elevated US bond yields and limit any meaningful USD corrective slide, capping gains for the non-yielding yellow metal, at least for time being.

Investors might also prefer to move to the sidelines and wait for a fresh catalyst. Hence, the focus will remain glued to the US NFP report, due for release later during the early North American session. The data might influence Fed rate hike expectations and will play a key role in influencing the USD price dynamics. This, in turn, should assist investors to determine the near-term trajectory for gold ahead of the crucial FOMC meeting on September 20-21.

Technical levels to watch

-

10:00

European Monetary Union Producer Price Index (YoY) registered at 37.9% above expectations (35.8%) in July

-

10:00

European Monetary Union Producer Price Index (MoM) above expectations (2.5%) in July: Actual (4%)

-

09:51

US ISM Chief Fiore sees clear price stability trend – MNI

Institute for Supply Management (ISM) Chair Timothy Fiore said in an MNI interview on Thursday that "there's clearly a trend towards getting to price stability. We're leveling off through the end of the year.”

Key quotes

"We're not out of equilibrium if prices dropped down to 45 and up."

US manufacturing will see steady growth through the end of the year and added the sub-indexes are "changing for the good."

"As lead times were pushed out, buyers had to jump into the market and now they're trying to make sure that as they close the year they don't get stuck with excess inventory."

"That could mean prices will drop at some point but I don't think it's in the next two to three months."

"Employment gains in August should translate into stronger expansion in production growth in September.”

"We made gains simply because the quits rate slowed down because some are getting a little concerned about the economy.”

“The ratio of hiring to firing has also been stable for several months.”

Related reads

- US: ISM Manufacturing PMI unchanged at 52.8 in August vs. 52 expected

- US Dollar Index retreats from cycle highs near 110.00 ahead of Payrolls

-

09:47

USD/CNH: Upside bias diminished below 6.8700 – UOB

FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang note the bullish bias in USD/CNH could lose momentum in case 6.8700 is breached.

Key Quotes

24-hour view: “Our expectations for USD to ‘trade with an upward bias towards 6.9325’ was incorrect as it dropped briefly to 6.8882 before rebounding to close at 6.9154 (+0.12%). Despite the decline, downward momentum has not improved. The current movement is likely part of consolidation phase and we expect USD to trade sideways between 6.8900 and 6.9250 for today.”

Next 1-3 weeks: “We turned positive USD two weeks ago. USD subsequently soared to 6.9325 but has not been able to make any further headway to the upside. While upward momentum has waned somewhat, only a break of 6.8700 (no change in ‘strong support’ level from yesterday) would indicate that USD is not strengthening further.”

-

09:43

US Dollar Index retreats from cycle highs near 110.00 ahead of Payrolls

- The index comes under pressure and recedes from 110.00.

- The risk complex regains some composure and trims recent losses.

- All the attention remains on the August’s Nonfarm Payrolls due later.

The greenback, in terms of the US Dollar Index (DXY), gives away part of the recent advance to fresh cycle highs in the 110.00 region (September 1).

US Dollar Index looks to key data

The index now comes under pressure and sheds some ground following Thursday’s advance to levels last seen back in June 2002 in the 110.00 neighbourhood.

The recent strong climb in the dollar has been underpinned by the equally intense move higher in US yields, particularly in the short end of the curve, which was at the same underpinned by persistent expectations of the continuation of the normalization process by the Federal Reserve.

On the latter, the probability of a 75 bps rate raise at the September event is now at nearly 75% as per CME Group’s FedWatch Tool.

Still looking at the next Fed’s rate hike, Friday’s focus of attention is expected to remain on the release of US Nonfarm Payrolls for the month of August due later in the NA session. Consensus expects the economy to have added 300K jobs during last month and the jobless rate to stay unchanged at 3.5%.

Additional data will also see Factory Orders for the month of July.

What to look for around USD

Despite the ongoing knee-jerk, the greenback keeps the bullish outlook well in place in the area of 20-year highs near the 110.00 zone.

Bolstering the dollar’s strength appears the firm conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market. This view was recently reinforced by Chair Powell’s speech at the Jackson Hole Symposium.

Extra volatility in the dollar, however, should not be ruled out considering the ongoing debate around the size of the September’s interest rate hike by the Federal Reserve.

Looking at the more macro scenario, the greenback appears propped up by the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, Factory Orders (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation over a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

US Dollar Index relevant levels

Now, the index is retreating 0.18% at 109.43 and faces the next support at 107.58 (weekly low August 26) seconded by 106.69 (55-day SMA) and then 104.63 (monthly low August 10). On the upside, a breakout of 109.97 (2022 high September 1) would aim for 110.00 (round level) and finally 112.17 (high May 31 2002).

-

09:42

AUD/USD: Solid fundamentals to lead to some rebound by year-end and into 2023 – MUFG

The Australian dollar weakened modestly in August. Economists at MUFG Bank expect to see AUD weakness for now before recovery in 2023.

Jobs market in Australia will support growth going forward

“We would expect the solid fundamentals to lead to some rebound by year-end and into 2023.”

“The jobs market in Australia will support growth going forward with the labour participation rate at the highest level in 112 years. Stronger wage growth is likely and that will ensure continued monetary tightening with risks to the upside relative to the RBA guidance.”

“Economic growth is expected to slow due to tighter policy and slower global growth with the RBA estimating 3.25% growth in 2022 and 1.75% in 2023 and 2024.”

“More favourable growth in China in 2023 should also help ensure higher AUD/USD levels next year even with growth more subdued.”

-

09:42

ECB Survey: European consumers see inflation in next 12 months at 5%.

The European Central Bank (ECB) conducted a survey of consumer expectations for inflation, with the key results noted below.

Perceived inflation over the previous 12 months continued to increase, with the median rate now standing at 7.9%, up from 7.2% in June.

Compared to June, consumer expectations for inflation over the next 12 months remained unchanged at 5%, while those for inflation three years ahead rose.

Consumers see inflation in 3 years at 3% vs 2.8% in June.

Consumers again slightly lowered their expectations for the growth in price of their homes over the next 12 months to 3.2%.

Expectations for mortgage interest rates 12 months ahead continued to drift up to 4.3% and now stand 1.0% higher than at the beginning of 2022.

Expectations declined for economic growth over the next 12 months and rose for unemployment in 12 months’ time.

Market reaction

The above survey findings have little to no impact on the shared currency, as EUR/USD consolidates its rebound around 0.9975 ahead of the critical US NFP report. The pair is up 0.32% on a daily basis.

-

09:26

USD/CAD slides below mid-1.3100s amid rebounding oil prices, USD pullback ahead of NFP

- USD/CAD retreats further from multi-week high and is pressured by a combination of factors.

- A goodish rebound in oil prices underpins the loonie and exerts pressure amid a weaker USD.

- Rising bets for more aggressive Fed rate hikes to limit the USD losses and lend some support.

- Traders might also refrain from placing aggressive bets ahead of the key US jobs report (NFP).

The USD/CAD pair extends the overnight pullback from levels just above the 1.3200 mark and edges lower on Friday, snapping a three-day winning streak to a seven-week high. The steady intraday descent drags spot prices back below mid-1.3100s during the early European session and is sponsored by a combination of factors.

Crude oil prices stage a goodish recovery move on Friday and reverse a major part of the previous day's losses back closer to the monthly low touched in August. This, in turn, underpins the commodity-linked loonie, which, along with a modest US dollar weakness, exerts some downward pressure on the USD/CAD pair.

A softer tone surrounding the US Treasury bond yields keeps the USD bulls on the defensive amid some repositioning trade ahead of the US monthly jobs data, due later this Friday. Apart from this, signs of stability in the financial markets further drag the safe-haven buck away from a two-decade high set on Thursday.

The downside for the USD/CAD pair, however, seems cushioned amid expectations for a more aggressive policy tightening by the Fed, which should continue to act as a tailwind for the greenback. Moreover, concerns that a global economic downturn will dent fuel demand should cap oil prices and lend support to the major.

Hence, it will be prudent to wait for strong follow-through selling before positioning for any further depreciating move for the USD/CAD pair. Traders might also refrain from placing aggressive bets and prefer to wait for the release of the closely-watched US NFP report, which will play a key role in driving the USD demand.

Apart from this, the broader risk sentiment, might influence the greenback and provide some impetus to the USD/CAD pair. Traders will also take cues from oil price dynamics to grab short-term opportunities on the last day of the week and ahead of the Bank of Canada (BoC) monetary policy meeting on September 7.

Technical levels to watch

-

09:22

USD/RUB: Rouble to gradually weaken in the year ahead – MUFG

The rouble has been consolidating within a relatively narrow range over the summer with USD/RUB trading just above the 60.00 level. Economists at MUFG Bank expect the RUB to move downward in 2023.

RUB has benefitted from record current account surpluses

“The rouble is continuing to derive support from higher energy prices. Russia has already reduced the supply of natural gas through the Nord Stream 1 pipeline to around 20% of full capacity. Higher energy prices have helped Russia to post record trade surpluses this year.”

“The CBR has now more than fully reversed the initial emergency rate hike delivered just after the Ukraine conflict started. It sends a further clear signal that the CBR its now more concerned about disinflation risks including those posed by a stronger rouble. However, we do not expect lower yields in Russia to trigger a significantly weaker rouble while capital controls remain in place limiting outflows.”

“Beyond the near-term, we expect the rouble to gradually weaken in the year ahead.”

-

09:17

USD/JPY keeps the upside momentum well and sound – UOB

FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang suggest USD/JPY could advance to 141.50 on a close above 1405.50.

Key Quotes

24-hour view: “Yesterday, we held the view that ‘the rapid improvement in momentum is likely to lead to further USD strength towards 140.00’. We highlighted that ‘a breach of this major resistance is not ruled out’ and ‘the next resistance is at 140.50’. Our view was not wrong as USD soared to a high of 140.22. Further USD strength is likely even though overbought conditions suggest USD may not be able to maintain a foothold above 140.50. On the downside, a breach of 139.35 (minor support is at 139.65) would indicate that the current upward pressure has eased.”

Next 1-3 weeks: “We turned positive USD on Monday (29 Aug, spot at 138.30). As USD soared, in our latest narrative from yesterday (01 Sep, spot at 139.35), we highlighted that the surge in momentum suggests that USD could advance to 140.00, 140.50. Our view was not wrong as USD cracked 140.00 during NY hours and rose to 140.22. Upward momentum remains strong and a break of 140.50 would shift the focus to 141.50. On the downside, a breach of 138.60 (‘strong support’ level was at 138.00 yesterday) would indicate that USD is unlikely to advance further.”

-

09:07

Norway Registered Unemployment n.s.a meets expectations (1.6%) in August

-

09:07

Norway Registered Unemployment s.a declined to 59.3K in August from previous 59.6K

-

09:00

Brazil Fipe's IPC Inflation below forecasts (0.34%) in August: Actual (0.12%)

-

08:59

USD/TRY: Inappropriate policy continues to pose downside risks for the lira – MUFG

During August, the Turkish lira weakened against the US dollar from 17.92 to 18.18. In the view of economists at MUFG Bank, risks remain heavily tilted to the downside for the TRY.

Turkey’s weak economic fundamentals still favour further lira weakness

“Turkey’s economy appears to be overheating with domestic demand still robust, the trade balance widening sharply and very elevated inflation.”

“The CBRT’s decision to lower rates will further undermine confidence in domestic policy settings and in the lira.”

“The policy rate in Turkey now appears even more inappropriate. After adjusting for inflation of 79.6% in July, the real policy rate has fallen even deeper into negative territory. It should keep downward pressure on the lira.”

-

08:55

USD/INR to reach 15,200 by Q4 before moving down to 15,000 and 14,750 in Q1 and Q2 next year – MUFG

USD/IDR reached a low below 14,700 on 12th August but was soon rebounding again with dollar strength reviving. Economists at MUFG expect the pair to edge higher till the end of the year before moving back down in 2023.

Further rate hikes to bring the 7D RR to 5.00%

“We expect another 75 bps of rate hikes for the rest of the year and another 50 bps in 2023, to bring the 7D RR to 5.00%. However, this may not offset the USD strength from aggressive Fed rate hikes.”

“We forecast USD/IDR at 15,100 and 15,200 by Q3 and Q4, moving down to 15,000 and 14,750 in Q1 and Q2 next year.”

-

08:48

EUR/USD: Firm NFP print to add renewed downside pressure – OCBC

EUR/USD came within a touching distance of 0.9900 on Thursday but managed to stage a rebound early Friday. A firm Nonfarm Payrolls could pose renewed downside pressure on the pair, economist at OCBC Bank report.

0.9910-1.0000 range likely intra-day

“Consolidative trades likely ahead of US data event risk – payrolls. A firmer print there could pose renewed downside pressure on EUR.”

“Support at 0.9910, 0.9850 levels.”

“Resistance at 1.0010 (23.6% fibo retracement of Aug high to low), 1.0080 levels (38.2% fibo).”

“0.9910-1.0000 range likely intra-day.”

See – NFP Preview: Forecasts from eight major banks, employment growth still strong

-

08:47

NZD/USD recovers early lost ground to over a two-year low, remains below 0.6100 mark

- NZD/USD stages an intraday recovery from over a two-year low touched earlier this Friday.

- A modest USD pullback from a two-decade high turns out to be a key factor offering support.

- Aggressive Fed rate hike bets to limit the USD losses and cap the pair ahead of the NFP report.

The NZD/USD pair recovers a few pips from its lowest level since May 2020, around mid-0.6000s touched this Friday and climbs back closer to the daily high during the early European session. Spot prices, however, seem to struggle to capitalize on the move and remain below the 0.6100 mark.

The US dollar moves away from a two-decade high touched on Thursday and turns out to be a key factor offering some support to the NZD/USD pair. A softer tone surrounding the US Treasury bond yields keeps the USD bulls on the defensive amid some repositioning trade ahead of the US monthly jobs report later this Friday. Apart from this, signs of stability in the financial markets further seem to undermine the safe-haven buck and benefit the risk-sensitive kiwi.

That said, growing recession fears, economic headwinds stemming from fresh COVID-19 lockdowns in China and the war in Ukraine should cap any optimism. Furthermore, expectations that the Fed will stick to its aggressive policy tightening path should act as a tailwind for the US bond yields and lend support to the greenback. This makes it prudent to wait for strong follow-through buying before positioning for any meaningful near-term recovery for the NZD/USD pair.

Investors might also prefer to move on the sidelines and await the closely-watched US NFP report, due for release later during the early North American session. The data will provide a fresh insight into the labour market conditions and the overall health of the economy, which should influence Fed rate hike expectations. This, in turn, will play a key role in driving the USD demand and help investors to determine the next leg of a directional move for the NZD/USD pair.

Technical levels to watch

-

08:43

Forex Today: Dollar consolidates gains as focus shifts to US August jobs report

Here is what you need to know on Friday, September 2:

Fueled by the upbeat macroeconomic data releases from the US, the US Dollar Index (DXY) surged to its highest level in nearly two decades at around 110.00 on Thursday. With investors taking a step back ahead of the US August jobs report, the DXY consolidates its gains near 109.50. Reflecting the cautious market mood, US stock index futures trade mixed in the early European session and the benchmark 10-year US Treasury bond yield stays in negative territory below 3.25%.

The US Department of Labor announced on Thursday that the weekly Initial Jobless Claims declined to 232K, compared to the market expectation of 248K, last week. Additionally, the ISM Manufacturing PMI survey revealed that the business activity in the manufacturing sector continued to expand at a healthy pace in August. More importantly, the Employment Component jumped to 54.2 in August from 49.9 in July, reviving optimism for an upbeat labour market report on Friday.

The US Bureau of Labor Statistics is expected to report an increase of 300,000 in Nonfarm Payrolls (NFP) in August following July's impressive growth of 528,000. The annual wage inflation is forecast to edge higher to 5.3% with the Labor Force Participation Rate remaining unchanged at 62.1%.

Nonfarm Payrolls Preview: Five reasons to expect a win-win release for the dollar.

EUR/USD came within a touching distance of 0.9900 on Thursday but managed to stage a rebound early Friday. The pair was last seen trading in positive territory slightly below parity.

GBP/USD touched its weakest level in over two years at 1.1500 on Thursday before claiming above 1.1550 early Friday.

Gold dropped below $1,700 for the first time since late July on Thursday but advanced beyond that level in the European morning on Friday.

US August Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises.

Boosted by rising US yields and the broad-based dollar strength, USD/JPY reached its highest level in 24 years above 140.00. Japanese Finance Minister Shunichi Suzuki said on Friday that he would not comment on every day-to-day move in foreign exchange markets but reiterated that they would take action if necessary.

Bitcoin stays relatively quiet on the last trading day of the week and moves up and down in a tight channel slightly above $20,000. Ethereum closed the second straight in positive territory and was last seen posting small daily gains at around $1,600.

-

08:30

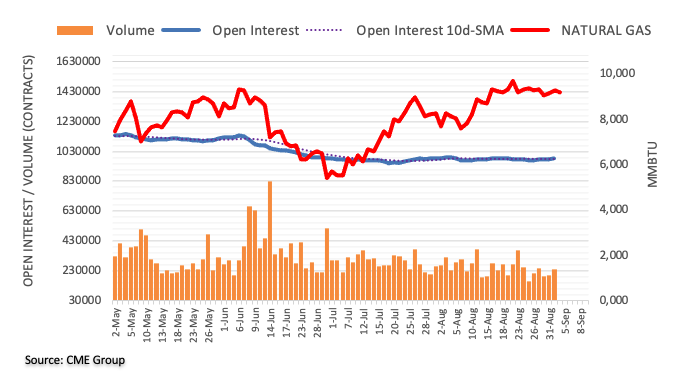

Natural Gas Futures: Further rebound in store

According to advanced prints from CME Group for natural gas futures markets, open interest reversed two daily drops in a row and increased by around 2.7K contracts on Thursday. In the same line, volume added to the previous build and went up by around 38.7K contracts.

Natural Gas targets recent highs around $10.00

Prices of natural gas extended the rebound on Thursday amidst rising open interest and volume. Against that, further upside now looks likely while the next hurdle of note remains at the 2022 high around the $10.00 mark per MMBtu.

-

08:17

USD/JPY: Any sharp near-term move to 142/143 to put intervention back on the agenda – ING

USD/JPY pushed above 140 on Thursday without much fanfare. The pair's acceleration above 140 may revamp risk of FX interventions as the last time USD/JPY was above 140 in the late 1990s, the Japanese were intervening, economists at ING report.

Getting too weak for comfort?

“Investors have downscaled fears over possible Japanese FX intervention to sell USD/JPY. While we all acknowledge that Japanese authorities would be trying to turn back the tide here (USD/JPY is above 140 for good macro reasons) we should not discount intervention completely.”

“Any sharp near-term move to the 142/143 would probably spark a much sharper verbal protest from Japanese authorities and put intervention back on the agenda.”

-

08:13

GBP/USD consolidates its recent fall to over 2-year low, eyes US NFP for fresh impetus

- GBP/USD enters a bearish consolidation phase and oscillates in a narrow range on Friday.

- A combination of factors prompts some USD profit-taking and offers support to the pair.

- A bleak outlook for the UK economy continues to weigh on the GBP and caps the upside.

- Hawkish Fed expectations should limit any deeper USD pullback ahead of the NFP report.

The GBP/USD pair struggles to capitalize on the overnight late bounce from levels just below the 1.1500 psychological mark and oscillates in a narrow band on Friday. The pair is placed around mid-1.1500s and remains well within the striking distance of its lowest level since March 2020 touched on Thursday.

The US dollar eases a bit from a fresh two-decade peak set the previous day, which turns out to be a key factor offering some support to the GBP/USD pair. Signs of stability in the financial markets, along with a softer tone surrounding the US Treasury bond yields, undermine the safe-haven buck. That said, hawkish Fed expectations should help limit any deeper USD pullback.

In fact, the markets seem convinced that the US central bank will stick to its policy tightening path to tame inflation and have been pricing in a supersized 75 bps rate hike at the September FOMC meeting. The bets were reaffirmed by the recent hawkish remarks by several Fed officials. This, in turn, should act as a tailwind for the US bond yields and lend support to the greenback.

Apart from this, a bleak outlook for the UK economy might have dampened the prospects for further rate hikes by the Bank of England. This is reinforced by the fact that the British pound, so far, has struggled to attract any buyers despite rising bets for a 75 bps BoE rate hike in September. This, in turn, suggests that the path of least resistance for the GBP/USD pair is to the downside.

Traders, however, seem reluctant and prefer to wait for the release of the closely-watched US monthly jobs data. The popularly known NFP report will provide a fresh insight into the economy's health in the face of rising rates and stubbornly high inflation. This, in turn, should influence the near-term USD price dynamics and determine the next leg of a directional move for the GBP/USD pair.

Technical levels to watch

-

08:12

Decent NFP report enough to keep the bullish sentiment on the dollar alive – ING

The US Dollar Index (DXY) touched 110.00 on Thursday. In the view of economists at ING, a decent Nonfarm Payrolls report may be enough to keep supporting the dollar.

Dollar rally does not require exceptional jobs data

“The question now is whether jobs data will be enough to trigger another bullish dollar reaction. Our suspicion here is that the market may not really need a big surprise to fully price in a 75 bps hike in September, and a respectable jobs report may be enough to trigger another leg higher in the dollar today.”

“A break above 110.00 in DXY may unlock further upside for the dollar.”

See – NFP Preview: Forecasts from eight major banks, employment growth still strong

-

08:07

USD/JPY to see a major correction in Q4, ending the year at 127 – BofA

USD/JPY has surged above 140. The pair is expected to stay elevated before staging a major correction into the fourth quarter, economists at the Bank of America Global Research report.

USD/JPY to remain elevated until US inflation starts to decelerate

“We expect USD/JPY to remain elevated until US inflation starts to decelerate.”

“We expect USD/JPY to remain above 135 through the summer and corrected into 2023 from 4Q22. However, the structural JPY weakness should reemerge longer-term. We expect USD/JPY to end 2022 at 127.”

-

08:03

EUR/USD set to retest the 0.99 level – ING

EUR/USD has recovered a bit of ground in overnight trading. But in the view of economists at ING, the pair is ready to retest 0.9900.

Eurozone PPI figures for July will likely have limited market implications

“The main data release to watch today in the eurozone is PPI figures for July, which should mark a clear acceleration although will likely have limited market implications.”

“We see the potential for another round of dollar appreciation today after the NFP, which may force a re-test of 0.9900 in EUR/USD before markets close for the weekend.”

See – NFP Preview: Forecasts from eight major banks, employment growth still strong

-

08:02

Spain Unemployment Change up to 40.428K in August from previous 3.23K

-

07:55

Silver Price Analysis: XAG/USD bounces off two-year low to poke $18.00 ahead of US NFP

- Silver price snaps five-day downtrend, reverses from the lowest levels since July 2020.

- Sluggish markets ahead of US NFP, DXY retreat underpins XAG/USD corrective bounce.

- Bears stay hopeful amid fears of recession, hawkish Fed bets.

Silver price (XAG/USD) consolidate weekly loss at the lowest levels since July 2020, picking up bids to refresh intraday high around $17.95 during early Friday morning in Europe. In doing so, the bright metal snaps a five-day downtrend as the traders prepare for the monthly US employment data.

The short-covering moves could also be linked to the stimulus hopes from China, as well as a pullback of the US Dollar Index (DXY) from the highest levels in two decades.

Chinese authorities show readiness to adopt various monetary policy tools, other than the rate cuts, to renew market optimism amid the covid woes. The policymakers also appear okay with giving special attention to the aiming real-estate sector.

On the other hand, the DXY drops 0.20% intraday to 109.45 by the press time, reversing from the highest levels since 2002.

Even so, fears surrounding the global economic slowdown, led by China’s covid woes and geopolitical tussles surrounding Europe, seem to weigh on the XAG/USD price. Also exerting downside pressure are the hawkish Fedspeak and firmer US data that underpin the market’s hopes of the Fed’s aggression towards raising rates despite recession fears.