Notícias do Mercado

-

23:42

USD/CHF fades bounce off three-month low near 0.9150 ahead of Fed

- USD/CHF struggles to extend the biggest run-up in seven weeks.

- Firmer Swiss inflation data, upbeat equities joined softer Treasury yields to portray corrective bounce off multi-day low.

- Pre-Fed trading lull probes bulls, US ADP Employment Change, ISM Services PMI can entertain traders.

USD/CHF grinds higher around 0.9150, following the notable bounce off a three-month low. That said, the quote consolidates the biggest daily jump since mid-September amid the pre-Fed anxiety and a lack of major data/events.

The risk barometer pair jumped heavily the previous day following Switzerland’s upbeat Consumer Price Index (CPI) and Retail Sales data for October and September respectively. The headline inflation figure cross 1.1% market consensus to 1.2% YoY whereas the Retail Sales jumped past upwardly revised 0.8% previous readouts to 2.5% on the yearly basis.

Other than the strong data at home, mildly optimistic market sentiment, mainly led by the firmer equities, also underpinned the USD/CHF run-up. The Wall Street benchmarks posted a positive daily closing with the fresh record highs of DJI30 and S&P 500. Behind the moves could be the upbeat earnings and hopes that the US Federal Reserve (Fed) may rethink before announcing a heavy consolidation to the easy money policies.

That being said, the S&P 500 Futures print mild losses amid the cautious mood before the Fed meeting. The same joins an absence of major catalysts to move the markets. S&P 50 Futures, on the other hand, adds 0.7 basis points (bps) around 1.55% by the press time.

Moving on, US ADP Employment Change and ISM Services PMI for October may entertain USD/CHF traders ahead of the Fed’s verdict. While the US data prints are likely to arrive as mixed, market players anticipate a $15 billion tapering from the US central bank, any mismatch can propel the quote.

Read: Fed Interest Rate Decision Preview: Inflation, employment and interest rates

Technical analysis

In addition to the 200-DMA level surrounding 0.9155, a downward sloping trend line from October 12, close to 0.9175, also challenge USD/CHF buyers.

-

23:21

Silver Price Analysis: 50-DMA probes XAG/USD bears on the way to $22.80

- Silver bears take a breather following the heaviest fall in five weeks.

- Pre-Fed trading lull allows 50-DMA to question further downside.

- Clear break of a multi-day-old support line, bearish MACD favor sellers.

Silver (XAG/USD) struggles to defend the bounce off a three-week low, recently sidelined around $23.50, during Wednesday’s Asian session.

That said, the 50-DMA level surrounding $23.40 probes the bright metal’s immediate downside amid cautious sentiment ahead of the US Federal Reserve (Fed) meeting.

Even so, a successful break of an ascending trend line from October 29 and a bearish cross by the MACD line keep silver sellers hopeful to visit a horizontal area comprising multiple levels marked since August 20, around $22.90-80.

It should be noted, however, that the metal’s weakness past $22.80 may find multiple supports near above $22.00, a break of which will direct the quote towards the yearly bottom surrounding $21.42.

Meanwhile, corrective pullback needs to cross the support-turned-resistance line, at $24.05 by the press time, to recall the buyers.

Following that, October’s high of $24.82 and September’s peak near $24.85 will be in focus.

Silver: Daily chart

Trend: Further weakness expected

-

23:20

EUR/JPY recovers well from sell-off into the FOMC

- EUR/JPY holds steady ahead of the main FOMC event today.

- Eurozone data is also in focus and so too will be equities.

EUR/JPY rallied in Europe from a low of 131.47 to a high of 132.10 recovering from the drop in EUR/USD that slipped from 1.1610 to 1.1580. Equity market sentiment remained upbeat, the Russell 2000 joining the S&P 500 in printing record highs which helped to keep the equity tracking cross supported. At the time of writing, EUR/JPY is trading at 131.98 and is exte to remain subdued with Japanese holidays and the forthcoming conclusion of the Federal Open Market Committee meeting.

In data overnight, Manufacturing was slightly weaker than expected in October for the euro area. Manufacturing slowed in Germany and France but lifted in Italy. The main weakness in the series last month was in output, which fell 2.4pts to 53.3. Meanwhile, the Markit Services PMIs for Europe and the UK will be the final release for the month. September’s Euro Area unemployment rate report will reflect continued recovery.

FOMC in focus

As for the main event, the FOMC has the market positioned for a tapering announcement following guidance from the central bank which has managed expectations perfectly in terms of preparing the markets for what is likely to be speed tapering.

'Most officials seem to agree that it’s better to get tapering over as quickly as possible in order to leave the Fed maximum flexibility to hike rates when needed,'' analysts at Brown Brothers Harriman explained. ''We believe that the most likely path for tapering has already been flagged by the Fed, which would reduce asset purchases by $15 bln per month ($10 bln UST and $5 bln MBS).''

Equities will be a key component to the performance in EUR/JPY today and the outcome of the Fed will be crucial in terms of things of a rate hike and the implications for stock markets built up on cheap money. With that being said, there could be more fireworks in US jobs data this week. The employment component of 52.0 is the highest since July when 57k manufacturing jobs were added out of 1.09 mln total NFP gain. All in all, this was a very solid report,'' analysts at Brown Brothers Harriman said. ISM services PMI will be reported Wednesday and so too will the ADP jobs report. The current consensus is 450k and we suspect it will creep higher.

-

23:16

AUD/NZD marching towards 1.0400 after positive NZ economic data

- New Zealand Unemployment Rate fell 0.5%, down to 3.4%.

- Australian PMI’s figures were better than expected, though overshadowed by the NZ employment numbers.

- AUD/NZD dipped to 1.0417 on the release of the NZ employment figures.

As the Asian session begins, the AUD/NZD slumps 0.15% during the day, trading at 1.0430 at the time of writing. Better than expected macroeconomic data out of New Zealand and Australia is the driver of the session, favoring the prospects of the New Zealand dollar.

New Zealand Unemployment Rate fell 0.5%, down to 3.4%, matching 2007 record low

On Wednesday, Statistics of New Zealand revealed employment figures for the third quarter. Employment Change rose by 2%, higher than the 0.4% estimated, whereas the Unemployment Rate for the same period increased to 3.4%, better than the 3.9% foreseen by analysts.

“The number of unemployed fell by 18,000 over the quarter to 98,000, which, combined with 54,000 more people in employment, drove the unemployment rate down,” Statistics of NZ said.

The drop in the unemployment figure would likely exert pressure on the RBNZ to raise rates faster, after a jump in inflation to 4.9% in the September reading.

At the same time, the RBNZ Governor Adrian Orr was hosting a media conference on financial stability, as the employment figures crossed the wires, declining to comment on the implications for monetary policy. He said that “labor market data, and economic data in general, was highly volatile at present.”

In the meantime, the Australian economic docket featured Markit PMI’s for October. The Services PMI came at 51.8 versus a 45.5 in September. For the same period, the Markit Composite PMI expanded to 52.2, higher than the 46.5 seen in the previous month.

FX Market Implications

The AUD/NZD dropped 36 pips, from 1.0453 to 1.0417, once New Zealand employment figures crossed the wires.

-

23:01

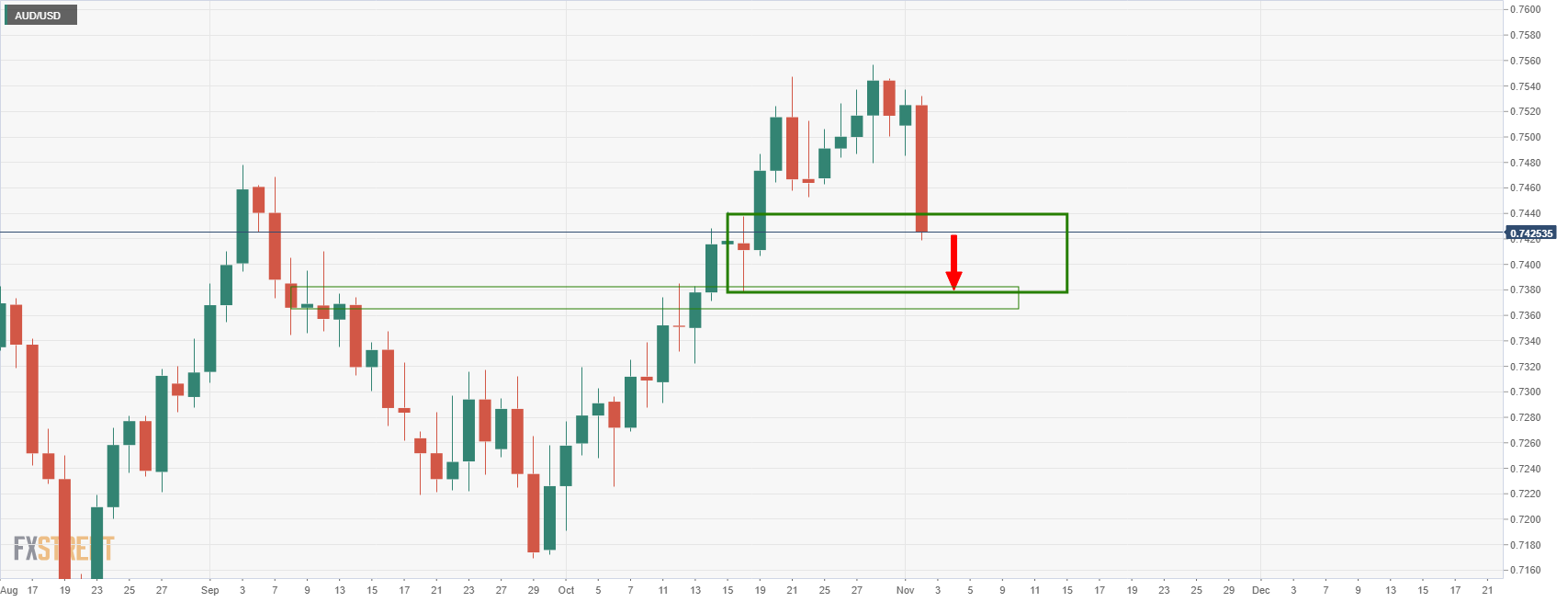

AUD/USD steadies above 0.7400 after RBA-led slump, focus on Fed

- AUD/USD seesaws in a 15-pip trading range after the biggest daily fall in five months.

- RBA’s rejection to rate hike before 2024, YCC move pleased bears earlier.

- Pre-Fed trading lull battles firmer equities, gold’s retreat.

- Second-tier Aussie data will join US ADP Employment Change, ISM Services PMI to entertain traders.

AUD/USD remains sidelined above 0.7400, recently retreating from 0.7430, following the heaviest daily slump since June. That said, the quote stays within a 15-pip trading range between 0.7420 and 0.7435 during the initial Asian session on Wednesday.

With the Reserve Bank of Australia’s (RBA) double whammy of attacks on the hawks, AUD/USD prices dropped heavily post monetary policy decision. Adding to the bearish sentiment were chatters surrounding China’s indirect warning of bad winter and market fears ahead of the US Federal Reserve (Fed) meeting, up for moving markets during today’s North American session.

RBA not only dropped the Yield Curve Control (YCC) but also pushed back the rate hikes till 2024 during the previous day’s monetary policy meeting, allowing traders to consolidate October’s heavy gains. On the other hand, China’s Commerce Ministry urged families to have enough storage of food during the winter on Tuesday.

On the contrary, US stimulus chatters and easing covid numbers in Australia allowed AUD/USD to stabilize around a three-week low. Also putting a floor under the prices was the firmer equities, on the back for strong earnings, as well as downbeat US Treasury yields.

It’s worth noting that the market’s cautious mood ahead of the Fed meeting and an absence of major data/events in Australia helps the Aussie traders to lick their wounds of late.

Looking forward, the quote is likely to remain sidelined, may witness corrective pullback on firmer second-tier housing data at home, ahead of the Fed’s verdict. Though, expectations of Fed tapering may keep exerting the downside pressure on the prices and may please bears should the announcement crosses the $15 billion trimming per the market consensus.

Read: Fed Interest Rate Decision Preview: Inflation, employment and interest rates

Before the Fed, US ADP Employment Change for October and ISM Services PMI for the said month may also entertain traders.

Technical analysis

AUD/USD confirmed a rising wedge bearish chart pattern following the RBA’s verdict to give up the bond yield targeting, as well as pushing back any rate hikes until 2024. Also confirming the quote’s further weakness is the bear’s dominance past convergence of 0.7460 level, comprising the 100-SMA and an ascending trend line from September 29. Looking ahead, three-week-old horizontal support near 0.7380 will precede the 200-SMA level near 0.7360 to lure the sellers.

-

22:50

Australia Commonwealth Bank Composite PMI fell from previous 52.2 to 52.1 in October

-

22:50

Australia Commonwealth Bank Services PMI below expectations (52) in October: Actual (51.8)

-

22:23

Australia AiG Performance of Construction Index rose from previous 53.3 to 57.6 in October

-

22:20

RBNZ’s Orr: The labor market data is extremely volatile at the moment

Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr gave his opinion on the recently released strong Q3 NZ jobs report while speaking on the bi-annual Financial Stability Review (FSR).

“The labor market data is extremely volatile at the moment,” said the RBNZ Boss..

RBNZ's Orr also said, per Reuters, "GDP figures becoming increasingly difficult to understand given COVID-19 volatility."

Adding to that were the comments from the RBNZ Deputy Governor Geoff Bascand suggesting if risks are low, debt-to-income limitations may not be necessary.

FX reaction

NZD/USD remains inactive despite the strong data and comments from RBNZ officials as the pre-Fed trading lull dominates the market sentiment.

Read: NZD/USD stays around 0.7100 despite strong New Zealand Q3 Employment data

-

22:07

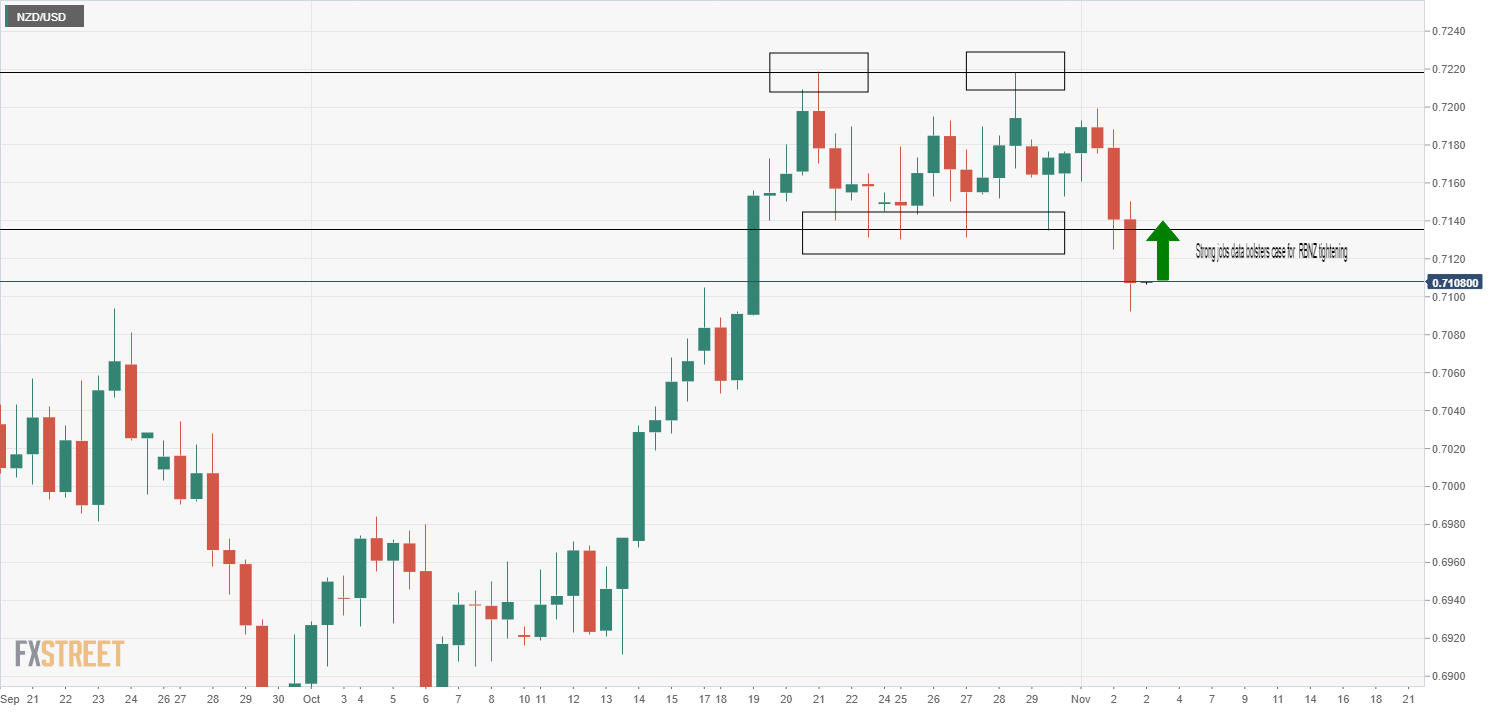

NZD/USD stays around 0.7100 despite strong New Zealand Q3 Employment data

- NZD/USD consolidates the heaviest daily fall in five weeks.

- New Zealand Unemployment Rate dropped to 3.4%, Employment Change rose 2.0% in Q3.

- Pre-Fed sentiment may offer dull markets but US ADP, ISM Services PMI can offer intermediate moves.

NZD/USD pays a little heed to the strong Q3 New Zealand (NZ) jobs data, licking wounds near a two-week low surrounding 0.7100. That said, the kiwi pair dropped the most in five weeks the previous day before the bears took a breather during the early Wednesday morning in Asia.

That said, NZ Q3 Employment Change provided a strong beat to the 0.4% expected and 1.0% prior with the 2.0% figures while the Unemployment Chang also dropped heavily past 4.0% previous readouts and 3.9% market consensus to 3.4% during the stated period.

Read: New Zealand Unemployment beats forecasts, NZD firms

Earlier in the day, the Reserve Bank of New Zealand’s bi-annual Financial Stability Review (FSR) report said, “We expect banks to be more cautious about high debt-to-income loans given the risks of rising interest rates and the economic outlook.”

It’s worth mentioning that New Zealand’s fortnightly release of the GDT Price Index jumped 4.3% versus 2.2% prior.

The Kiwi pair’s refrain from reacting to the upbeat fundamentals at home could be linked to the RBNZ’s already announced rate hike and the Reserve Bank of Australia’s (RBA) firm commitment to hold the benchmark rates unchanged before 2024, as announced the previous day. On the same line could be the market’s wait for the US Federal Reserve’s (Fed) monetary policy announcement amid tapering tantrums. Furthermore, China’s appeal to local governments to help families store enough foods for this winter pushed the traders towards skepticism and weighed on the NZD/USD prices. Alternatively, firmer equities and hopes of US stimulus restrict immediate declines of the Kiwi pair, not to forget upbeat fundamentals at home.

Amid these plays, the Wall Street benchmarks closed positive with the DJI 30 and S&P 500 refreshing record top while the US 10-year Treasury yields dropped to 1.55%.

Looking forward, the pre-Fed trading lull could challenge the NZD/USD moves but monthly releases of the US ADP Employment Change and ISM Services PMI may entertain intraday traders. Should the Fed announce a higher-than-expected $15 billion per month tapering, the Kiwi pair has further south to trace.

Read: Fed Interest Rate Decision Preview: Inflation, employment and interest rates

Technical analysis

NZD/USD not only broke a two-week-old trading range but also slipped below 61.8% Fibonacci retracement (Fibo.) of May-August downside, around 0.7120, which in turn suggests further downside by the pair. However, the 200-DMA level near 0.7100 becomes a tough nut to crack for the bears before targeting August month’s high and 50% Fibonacci retracement, respectively around 0.7090 and 0.7060. Alternatively, the 61.8% Fibo. level near 0.7120 will precede the lower end of the stated range, close to 0.7130, will probe the NZD/USD pair’s short-term rebound. Following that, September’s high of 0.7171 could lure the bulls.

-

21:47

USD/CAD reclaims 1.2400 amid risk-on market sentiment, ahead of the Fed

- USD/CAD bounces off 1.2350 daily lows, trimming Monday’s losses.

- Risk-on market sentiment in equity markets, in the FX market, safe-haven assets have the upper hand.

- USD/CAD bullish above 1.2528, otherwise sellers are in control.

USD/CAD climbs during the New York session, up 0.30%, trading at 1.2406 at the time of writing. As the North American session winds down, the market sentiment is upbeat, with the S&P 500 and the Dow Jones Industrial printing new all-time highs, while the Nasdaq Composite finished in the green.

Earlier in the Asian session, the USD/CAD pair was changing hands around the 1.2350 area, Tuesday’s low. But once European traders got to their desks, the pair broke to the upside, printing a daily high at 1.2420, retreating later, settling at current levels.

That said, FX markets dynamics were more risk-averse in contrast to equity markets. Safe-haven currencies like the greenback and the Japanese yen got a boost as investors got ready for the Federal Reserve meeting.

Investors expect a bond taper announcement by the US central bank, as telegraphed by the parade of Fed speakers in the last month. Also, Fed Chairman Jerome Powell, in a Bank of International Settlements virtual event, said that “I do think its time to taper.” Furthermore, Powell added: “I don’t think it is time to raise rates,” pushing back the expectations of a hike rate.

In the outcome of a hawkish Federal Reserve, an upward move in the USD/CAD pair would be capped because the Bank of Canada (BoC) is one step ahead of the Fed, as the BoC ended its QE program, as it gets ready for hiking rates.

USD/CAD Price Forecast: Technical outlook

Daily chart

The USD/CAD depicts the pair is under some buying pressure, as witnessed by the loonie testing the top of a bearish flag pattern around 1.2406, which would invalidate the pattern in case of being upward broken. Furthermore, the daily moving averages (DMA’s) are above the spot price, with the longer time frame 200-DMA, beneath the short time-frame ones.

For USD bulls, a break above the channel’s top would immediately expose the 200-DMA at 1.2483. The next resistance level would be the 100-DMA at 1.2528.

On the flip side, USD/CAD bull’s failure at 1.2400 leave sellers in control. To accelerate the downward trend, they need a break below 1.2300. Once that is achieved, the next stop on the way south would be the June 23 low at 1.2252.

-

21:47

New Zealand Unemployment beats forecasts, NZD firms

New Zealand Unemployment beat forecasts which are supporting the NZD/USD rate that trades 0.15% on the day so far.

The New Zealand Unemployment rate for the third quarter (Q3) arrived at 3.4% vs the estimated 3.9% and previous 4.0%.

The New Zealand Employment Change (Q/Q) Q3 came in at 2.0% vs the estimated 0.4% and the prior 1.0%; with the previous revised to 1.1%).

Meanwhile, the New Zealand Average Hourly Earnings (Q/Q) Q3 came in at 1.2% vs the estimated 1.5% and the previous 0.7%.

The Kiwi started the day off lower as the currency tracked a lower Aussie following the Reserve Bank of Australia saying that it was prepared to be patient.

''That looks to have caught a market looking for a more upbeat tone off guard, and the AUD slipped. From here on in, it’s up to the data, and the outlook could change quickly, as it did here,'' analysts at ANZ Bank said.

However, this labour market data is likely going to help stop the rot in NZD for the session ahead, especially with the Participation Rate jumping to 71.2% from 70.5% prior.

About the Unemployment Rate

The Unemployment Rate released by the Statistics New Zealand is the number of unemployed workers divided by the total civilian labor force. If the rate is up, it indicates a lack of expansion within the New Zealand labor market. As a result, a rise leads to weaken the New Zealand economy. A decrease of the figure is seen as positive (or bullish) for the NZD, while an increase is seen as negative (or bearish).

-

21:46

New Zealand Employment Change came in at 2%, above expectations (0.4%) in 3Q

-

21:46

New Zealand Labour Cost Index (QoQ) came in at 0.7% below forecasts (0.8%) in 3Q

-

21:46

New Zealand Labour Cost Index (YoY) below expectations (2.6%) in 3Q: Actual (2.5%)

-

21:46

New Zealand Participation Rate above expectations (70.6%) in 3Q: Actual (71.2%)

-

21:45

New Zealand Unemployment Rate below expectations (3.9%) in 3Q: Actual (3.4%)

-

21:45

New Zealand: Unemployment Rate, Quarter III 3.4% (forecast 3.9%)

-

21:45

New Zealand: Employment Change, q/q, Quarter III 2% (forecast 0.4%)

-

21:35

GBP/USD Price Analysis: Bears bracing for a bumpy road to 1.3570

- GBP/USD grinds lower around mid-October lows after three-day downtrend.

- Bearish MACD, sustained trading below 50-DMA favor sellers.

- Horizontal supports from August and July test immediate downside.

GBP/USD licks its wounds around 1.3620, the lowest level in three weeks as traders brace for the key Wednesday morning in Asia.

Although a clear downside break of 50-DMA and bearish MACD signals back the GBP/USD sellers, nearness to the key support zones and the RSI line’s proximity to the oversold area can put a floor under the prices.

That being said, a horizontal area comprising multiple lows marked since August 20, around 1.3600-3610 acts as an immediate challenge for the pair bears before targeting another support region surrounding 1.3575-70, stretched from July.

Should the quote refrain from bouncing off 1.3570, the 1.3500 threshold may offer an intermediate halt before dragging the quote to the yearly bottom close to 1.3410.

On the contrary, an upside clearance of 50-DMA level of 1.3710 isn’t a green pass to the GBP/USD buyers as the late September’s swing high close to 1.3750 and October’s peak of 1.3833 could challenge the bulls before giving them controls.

To sum up, GBP/USD remains weak but has strong supports on the downside to limit the short-term declines.

GBP/USD: Daily chart

Trend: Further weakness expected

-

21:30

Australia: AiG Performance of Construction Index, October 57.6

-

21:27

When is the New Zealand Q3 employment data and how could it affect NZD/USD?

New Zealand quarterly employment report overview

Early Wednesday in Asia, at 21:45 GMT Tuesday the world over, the global market sees the second-quarter (Q3) 2021 employment data from Statistics New Zealand.

Although the Reserve Bank of New Zealand (RBNZ) has already announced the much-awaited interest rate hike, the anticipated strength in the jobs report may propel the Kiwi central bank towards some more, which in turn makes today’s decision the key.

Market consensus suggests a reduction in the headline Unemployment Rate to 3.9% from 4.0% and a softer Employment Change figure of 0.4% versus 1.0% previous readouts. Further, the Participation Rate may also inch up from 70.5% to 70.6%, per forecasts.

Ahead of the data, ANZ said,

New Zealand wage growth is expected to be impacted by inflation and contribute to inflation. The ‘great resignation’ in NZ details how the churn in our labor market slowed last year, but is expected to take off again this year. The tight labor market is providing workers with plenty of options and these are readily being taken up, following limited movement of workers last year. Today’s labor market data will provide a steer on wage inflation, the participation rate and unemployment.

How could it affect the NZD/USD?

NZD/USD edges lower around 0.7100 ahead of the key NZ data during Wednesday’s Asian session. In doing so, the Kiwi pair bears the burden of the Reserve Bank of Australia’s (RBA) firm commitment to wait for a rate hike until 2024, coupled with the pre-Fed caution.

The RBNZ has already hinted towards a firmer employment scenario and is ready to act as and when needed. This joins the job market's previous weakness to keep NZD/USD bulls hopeful of firmer data and the pair’s rebound. However, expectations surrounding the Fed’s tapering and a speech by the RBNZ Governor Adrian Orr following the data will keep the Kiwi traders guessing.

Technically, a clear downside break of a two-week-old trading range directs NZD/USD towards the 61.8% Fibonacci retracement of the May-August downside and the 200-DMA, respectively around 0.7120 and 0.7100 but further weakness will be challenged by the RSI conditions.

Key Notes

NZD/USD slips below key support, consolidates at 200DMA ahead of key NZ jobs report

RBNZ: Higher global interest rates could prove to be a headwind to asset prices

About New Zealand unemployment rate and employment change

The quarterly report on New Zealand's unemployment rate and employment change is being released by Statistics New Zealand.

The unemployment rate is the number of unemployed workers divided by the total civilian labor force. If the rate is up, it indicates a lack of expansion within the New Zealand labor market. As a result, a rise leads to weaken the New Zealand economy. A decrease of the figure is seen as positive (or bullish) for the NZD, while an increase is seen as negative (or bearish).

On the other hand, employment change is a measure of the change in the number of employed people in New Zealand. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. A high reading is seen as positive (or bullish) for the NZ dollar, while a low reading is seen as negative (or bearish).

-

21:01

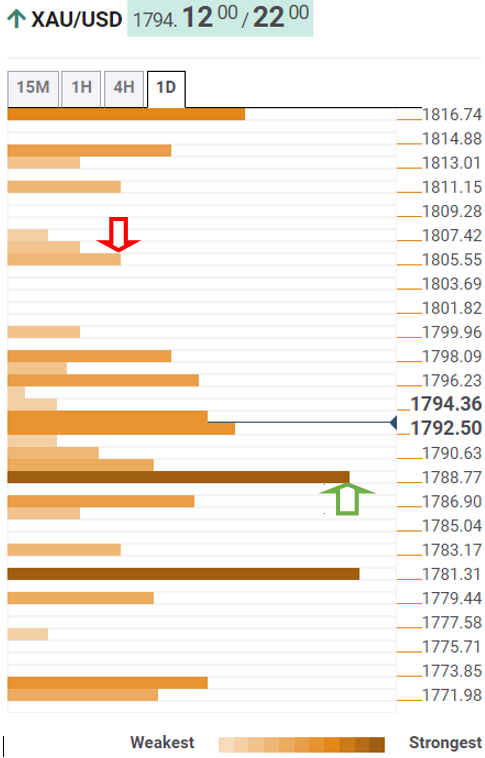

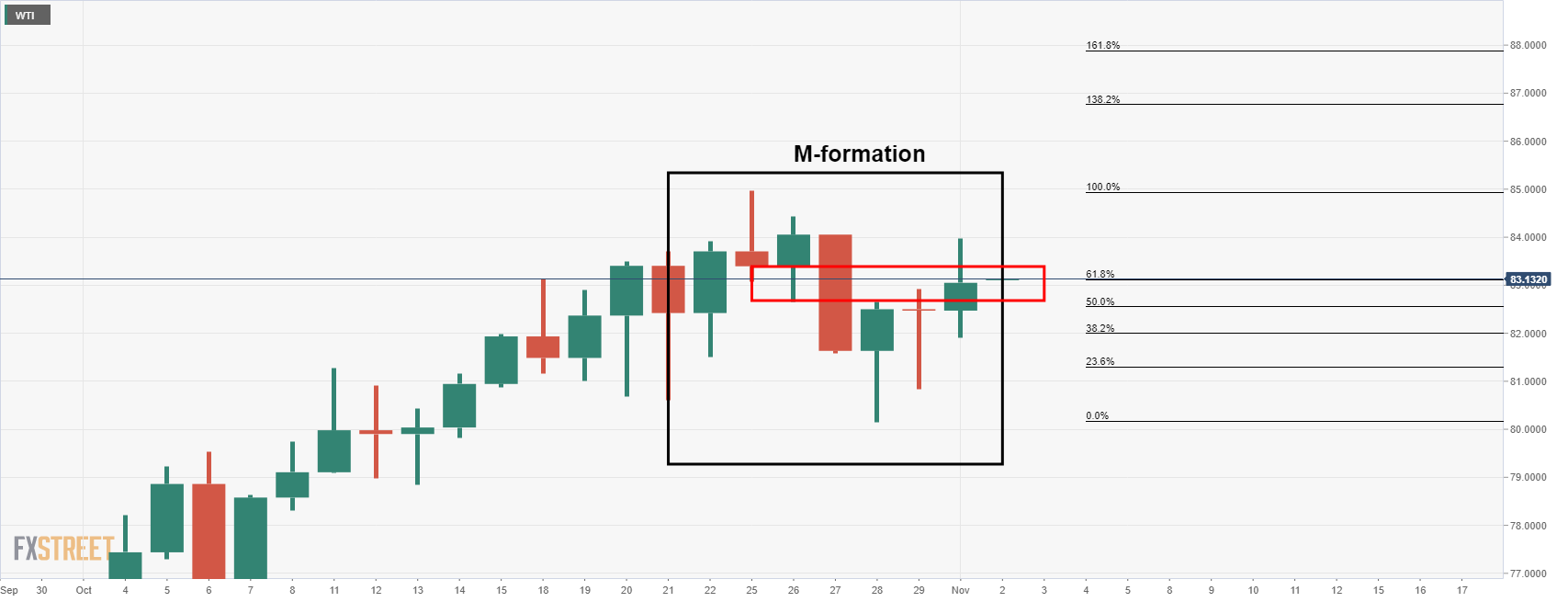

Gold Price Analysis: Bulls run into a wall of resistance at the 61.8% golden ratio

- Gold is meeting a critical level of resistance ahead of the FOMC outcome on Wednesday.

- Technicians will be looking for a downside continuation from a daily perspective.

The price of gold fell some 0.3% to $1,786.45/oz overnight from a high of $1,796.43 while market participants stayed focused on the Federal Open Market Committee meeting which is now underway. The US dollar is firmly holding the 94 figure as per the DXY, an index that measure's the greenback vs a number of rival and major currencies.

FOMC in focus

In the interim, the US markets were buoyed by positive earnings data while awaiting the Federal Reserve Governor Jerome Powell’s post FOMC presser that will focus on a more evenly balanced assessment of inflation risks. The market has fully priced in the Fed's expected tapering announcement and will be looking for any clues as to when the central bank will begin raising rates, similar to last week's European Central Bank meeting.

'Most officials seem to agree that it’s better to get tapering over as quickly as possible in order to leave the Fed maximum flexibility to hike rates when needed,'' analysts at Brown Brothers Harriman explained. ''We believe that the most likely path for tapering has already been flagged by the Fed, which would reduce asset purchases by $15 bln per month ($10 bln UST and $5 bln MBS).''

The Fed will start tapering this month so that QE effectively ends by mid-2022, according to the analysts at BBH. The market has taken that process a step further and is pricing in around 50% odds for liftoff in Q2. ''Q3 liftoff is already fully priced in,'' they explained, ''followed by another hike fully priced in for Q4. This is much more aggressive than what the Fed itself anticipates, at least in the current Dot Plots. We suspect the Fed will try to push back a bit against such aggressive tightening expectations, but we are not sure that the market will listen.''

US jobs market a key event

Meanwhile, US data will be a key focus this week also. Yesterday, October ISM Manufacturing PMI came in strongly at 60.8 vs. 60.5 expected and 61.1 in September. Readings above 60 are rare and yet here we are above 60 for 8 of the past 11 months. Looking at the components, employment came in at 52.0 vs. 50.2 in September, which could be symbolic of a healthy Nonfarm Payrolls report at the end of the week where forex volatility could be highest, depending on the outcome.

''Employment component of 52.0 is the highest since July, when 57k manufacturing jobs were added out of 1.09 mln total NFP gain. All in all, this was a very solid report,'' analysts at Brown Brothers Harriman said. ISM services PMI will be reported Wednesday and so too will the ADP jobs report. The current consensus is 450k and we suspect it will creep higher.

Analysts at TD Securities argued that the US Nonfarm Payrolls likely reaccelerated in October, consistent with a fading of Delta's drag as well as a smaller education-related drop in government jobs than in September. ''We reiterate that pricing for Fed hikes remains far too hawkish, but the outlook for hikes will become increasingly dependent on the Fed's jobs mandate, setting up this week's nonfarm payroll number as a show-stealer.''

''With that said'', the analysts added, ''despite the keen focus on pricing the Fed's exit, recent pressure on gold has abated, prompting CTAs to begin to cover some of their short positions. Furthermore, a potential break higher would bring the $1830/oz level into sight, which represents a key level to shift momentum toward a notable uptrend.

Gold technical analysis

The price of the yellow metal has found the resistance of the M-formation's neckline that meets the dynamic trendline resistance also. This reinforces the prospects of a downward continuation having hit the 61.8% golden Fibonacci retracement level.

-

21:00

South Korea FX Reserves registered at 469.21B, below expectations (471.08B) in October

-

20:56

EUR/JPY holds above key short-term support at 131.50 ahead of Lagarde speech

- EUR/JPY held above last week’s lows around 131.50 after bouncing from its 21DMA on Tuesday.

- ECB President Lagarde delivers a speech on Wednesday that could be market moving.

Ahead of the close of Tuesday FX market trade, EUR/JPY has been able to remain supported above last week’s lows in the 131.50 region. Early on during Tuesday’s European session, the pair was probing the recent lows, but after briefly touching its 21DMA (at 131.47 at the time, now at 131.53), buyers came in to push the pair back towards the 132.00 level, where is has spent most of the rest of the session trading.

There isn't much by way of important European or Japanese economic or central bank events for the remainder of the week, aside from a speech at 1015GMT on Wednesday from ECB President Christine Lagarde. In wake of last week’s ECB meeting, EUR rate markets saw further hawkish repricing (futures markets point to roughly 60bps worth of tightening by the end of 2022), after markets deemed Lagarde’s pushback against the idea of rate hikes in 2022 as insufficiently dovish. She may want to use the speech to rectify that mistake and send a more clear cut message that, in light of the ECB’s recently adopted strategy review which saw the bank raise its inflation target to a 2.0% symmetric one from “close to but just below 2.0%”, the ECB will not be hiking interest rates in 2022.

Otherwise, EUR/JPY is likely to be left to trade off of global dynamics; Wednesday’s Fed meeting, Thursday’s BoE meeting and Friday’s US October labour market report will be the main events to watch. Any signs that these events are giving a boost to long-term US and European bond yields could broadly weigh on JPY and could thus help propel EUR/JPY back towards last week’s highs close to 133.00. Conversely, if support at 131.50 does go, that could open the door to a move lower the next area of support at 130.70 (the 3 September high) and the 50DMA at 130.40. However, if US (and global) equities remain as well supported as they currently are, it seems unlikely that the safe-haven JPY will be able to muster sufficient strength for such a move.

-

20:46

United States API Weekly Crude Oil Stock: 3.594M (October 29) vs 2.318M

-

20:39

S&P 500 posts fourth consecutive record close, Dow clinches 36K level

- All three major US indices posted record closes on Tuesday, the fourth in a row to the S&P 500.

- Strong earnings are being cited the major factor underpinning the ongoing rally.

It was another day of cheer for US equity markets, with all three major bourses clinching fresh record closing levels; the S&P 500 gained 0.4% to close above 4630, the Dow rose by the same amount to close above the 36K level for the first time ever, while the Nasdaq 100 overcame pre-market losses to also post 0.4% on the day gain, though the index did fall ever so slightly short of conquering the 16K level. For the S&P 500, Tuesday’s close was a fourth consecutive all-time high close in a row. Equity analysts continue to attribute the ongoing rally (the S&P 500 is up more than 8.0% from the early October lows) to the strong Q3 earnings season.

Earnings

Shares of US pharmaceutical giant Pfizer rose over 4.0% on Tuesday after the company revealed in its Q3 earnings report that 2021 vaccine sales were expected to exceed $36B. More than 60% of the 320 S&P 500 companies to report Q3 earnings thus far have beaten analyst forecasts and, according to Reuters, aggregate S&P 500 company earnings are now expected to have risen more than 40% when compared to Q3 2020.

There was a particular focus on the Dow Jones Transportation Average index, which surged to fresh record highs (and is up 25% from September lows) amid a 180% spike in rental/car sharing company Avis Budget Groups share price after a strong earnings report. Avis shares (ticker CAR) seems to have joined the “meme stock” category for the day, and was one of the top trending shares on stocktwits.com, reported Reuters.

Stocks rise despite hawkish central bank shift, inflation risks

Strong earnings have underpinned US equity markets in recent weeks despite a distinct hawkish repricing of expectations for interest rate hikes in 2022 (or sooner) from most of the major G10 central banks, which has in large part been driven by a sharp rise in upside inflation risks due to higher energy prices and further evidence that it might take some time for inflationary supply chain disruptions and shortages to clear. The fact that major G10 central banks like the Fed and BoE are expected to keep long-term interest rates at historic lows (i.e. they are expected to hike a percent or two, but not back up to pre-crisis levels of 4-5% or above) seems to be one factor helping keep equity investors calm at the start of a synchronised global hiking cycle, whilst the notion that companies are largely able to pass on higher input costs to price-insensitive consumers (a theme alluded to in recent business surveys and earnings), thus maintaining high margins is another.

Equity investors may have their tolerance for the ongoing hawkish shift in global central bank policy put to the test this week as the Fed announces policy on Wednesday (they will probably announce plans to reduce QE purchases by $15B per month) and the BoE announces policy on Thursday (if they want to avoid a hit to their credibility, they ought to implement a 15bps rate hike). Otherwise, US data in the form of the October ISM Services PMI survey and the October labour market report should show that US economic growth remains robust in the first month of Q4, if not hampered somewhat by supply chain issues and labour shortages.

-

20:25

RBNZ: Higher global interest rates could prove to be a headwind to asset prices

Reuters acknowledged that New Zealand's financial system remains resilient despite the challenges presented by COVID-19, the central bank governor Adrian Orr said on Wednesday.

''But the more recent Delta outbreak was creating stresses for some industries and regions - particularly in Auckland, Orr said in the Reserve Bank of New Zealand's financial stability report.

The bank said it we will soon consult on implementing debt servicing restrictions to address housing risks and also intends to increase the minimum core funding ratio (CFR) requirement for banks to its previous level of 75% from January.''

Key notes

The financial system is well-placed to support economic recovery despite uncertainty and risks.

A more recent delta outbreak is creating stress for some industries and regions - particularly in Auckland.

With the risk of global inflation heightened, already stretched asset prices are facing headwinds from rising global interest rates.

Supply chain bottlenecks and inflation are adding to stresses in some sectors.

The transition towards living with covid-19 in the community as a managed, endemic disease is changing consumer behaviour.

Strong demand for housing has pushed house prices above their sustainable level, increasing the chance of a correction.

Recent buyers are borrowing more relative to their income, and maybe vulnerable to higher mortgage rates or a fall in house prices.

Will soon consult on the merits of implementing debt servicing restrictions to lean against these housing risks

Intend to increase the minimum core funding ratio (CFR) requirement to its previous level of 75 per cent on 1 January 2022.

Intend to increase minimum CFR requirement to its previous level of 75% on 1 Jan 2022, subject to no significant worsening in econ condition.

Intend to increase min core funding ratio requirement to the previous level of 75% on 1 Jan 2022, subject to no significant worsening in economic conditions.

Capital requirements for banks to progressively increase from 1 July 2022; is encouraging to see them increasing ahead of these requirements.

Higher global interest rates could prove to be a headwind to asset prices.

We expect banks to be more cautious about high debt-to-income loans given the risks of rising interest rates and the economic outlook.

Activity uncertain, given novel nature of the shock, and risk of further variants developing/return to tighter restrictions.

Impacts of climate change becoming common, meaning increasing claims for insurers; greater risk to properties that banks use to secure lending.

Building consents data suggest a pipeline of new houses becoming available by next year, which should suppress rent and house price inflation.

-

19:49

S&P 500 Price Analysis: Reaches a new all-time high around 4,635.30 ahead of the Fed meeting

- The S&P 500 advances 0.34% during the New York session amid risk-on market sentiment.

- S&P 500 Sectorwise: Lifted by real-estate, health, and technology, while energy is the laggard.

- S&P 500: In case of a correction lower, 4,550 is the first support, followed by 4,400.

The S&P 500 extends its rally during the New York session, up some 0.34%, sitting at 4,631.60 at the time of writing. Market sentiment throughout the North American session has improved, portrayed by US stock indices rising. The heavy-tech Nasdaq Composite and the Dow Jones Industrial climb 0.19% and 0.39%, respectively.

Sectorwise in the S&P 500, the winners are real-estate up 1.04%, health rising 0.85%, and technology gaining 0.77%. Contrarily, the main loser is energy, falling 1.05%.

In the meantime, the US Dollar Index, which measures the buck’s performance against a basket of six currencies, advances 0.23%, sits at 94.08, while the US T-bond 10-year benchmark note falls three basis points, down to 1.544%, ahead of the FOMC meeting.

S&P 500 Price Forecast: Technical outlook

The S&P 500 daily chart shows the index has a strong upward bias, approaching the top of an ascending channel that has capped any upside moves, keeping a steady trend in the index. The daily moving averages (DMA’s) are located below the price action, with a rising slope, confirming the uptrend.

However, the Relative Strength Index (RSI), a momentum indicator, is at 71 in overbought levels, indicating the S&P 500 could be headed towards a correction.

In the case of that outcome, the first support level would be 4,550. However, if the index corrects 5%, as the dip from mid-September to mid-October of 2021, the 4,400 area would be the next support. -

19:40

Forex Today: All eyes on the looming Fed’s decision

What you need to know on Wednesday, November 3:

The greenbacks strengthened against most of its major rivals, only stable against those considered safe-havens. The AUD and the GBP were the worst performers, the first hit by a dovish Reserve Bank of Australia, the second hit by Brexit jitters and uncertainty related to the Bank of England, scheduled to meet this week. AUD/USD trades around 0.7420 while GBP/USD hovers near 1.3600.

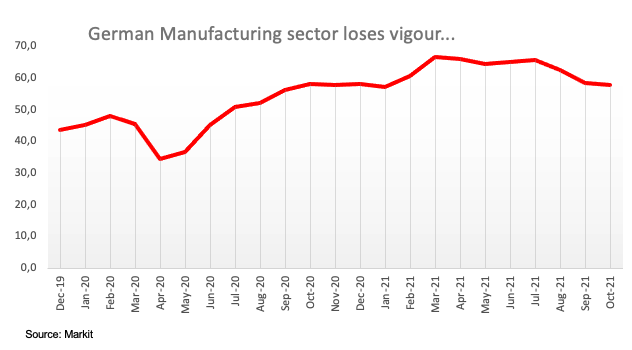

The EUR/USD pair is trading around 1.1580, with demand for the shared currency undermined by Markit´s final readings of its October Manufacturing PMIs. The German index was downwardly revised to 57.8 from 58.2, while that for the Union was confirmed at 58.3, below the preliminary estimate of 58.5. According to the official report, “supply bottlenecks remained a major hindrance to Germany's manufacturers at the start of the fourth quarter.”

Commodities shed some ground but held within familiar levels. Spot gold settled at $1,787 a troy ounce while WTI trades around $83.60 a barrel.

Japanese markets will be closed amid a local holiday on Wednesday, most likely exacerbating range trading ahead of the US Federal Reserve monetary policy announcement. Market participants anticipate US policymakers will decide to reduce the monthly purchases of Treasuries and mortgage-backed securities by $15 billion per month, to finalize it mid-2022. If the Fed announces a larger monthly reduction of facilities, the dollar may reach fresh 2021 highs vs the common currency.

Wall Street advanced, with the DJIA and the S&P closing at record levels. The Nasdaq also edged higher, while government bond yields ticked lower.

Market participants are taking off some of their bets on soon-to-come rate hikes within major economies.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: The next crypto bullish expansion phase has begun

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:35

NZD/USD slips below key support, consolidates at 200DMA ahead of key NZ jobs report

- NZD/USD has dropped sharply on Tuesday from the upper 0.7100s to the 200DMA at 0.7100.

- If New Zealand Q3 jobs data, set for release shortly, is strong, the pair could retest prior support at 0.7130.

The New Zealand dollar has seen significant selling pressure on Tuesday, with the currency seemingly being dragged lower in tandem with its cross Tasman sea peer the Aussie; AUD has been selling off in wake of Tuesday’s Asia Pacific session RBA meeting, at which RBA Governor Philip Lowe delivered a stronger than an expected dose of pushback against hawkish money market pricing than markets had likely been expecting (he criticised the notion of rates being hike as soon as 2022), though the RBA did admittedly open the door to a potential first rate hike in 2023. Either way, AUDUSD is down about 1.2% on the day and, subsequently, NZDUSD is down about 1.0%.

Whilst it is normal to expect AUD underperformance to exert some drag on the highly correlated NZD, the extent of the sell-off in NZD on Tuesday has been somewhat perplexing. Technical selling, once the pair dropped below key resistance in the 0.7130 area, will have exacerbated things (perhaps a few stops were blown through). The pair now trades around the 0.7100 level, which also coincides with its 200-day moving average, marking a roughly 100 pip turnaround from last week’s highs above 0.7200.

Key NZ jobs data set for release at 2145GMT

Perhaps some pre-positioning ahead of the release of very important New Zealand economic data has also been at play; at 2145GMT, Q3 labour market data is released. In Q2, the Household Labour Force Survey unemployment rate stood at 4.0%, a level the RBNZ deems as consistent with full employment and a key justification (alongside above-target inflation for the same quarter) for starting off their rate hiking cycle in October. Some local banks are calling for the unemployment rate to drop under 4.0% in Q3, which would take it to its lowest level since 2008 (prior to the global financial crisis). Such an outturn would strengthen the case for the RBNZ to lift rates swiftly in order to mitigate upside inflation risks and would support NZD/USD, perhaps allowing it to recover and retest prior support (now resistance) around 0.7130. NZD traders will also keep an eye on alternative labour market indicators such as the Participation Rate (expected to fall a little due to the lockdowns in New Zealand in Q3) and the Labour Cost Index.

Note that the RBNZ will also be releasing its Financial Stability Report at 2000BST, where high housing costs and the associated implications will be a key theme. With the RBNZ already on the path towards acting decisively to lift rates, this report will likely not garner too much attention now more kiwi dollar markets too much.

-

19:23

EUR/USD Price Analysis: Bears seeking a break below 1.15 the figure

- EUR/USD is under pressure on a fractal basis and eyes are on a break below 1.15 the figure.

- Day traders will be looking for an optimal entry to scalp the larger move from lower time frames.

EUR/USD is a compelling bearish scenario and the following technical analysis illustrate the various time frames, from the weekly to the H1 charts.

EUR/USD weekly chart

The weekly chart is bearish as the price has already corrected some of the imbalance of price following the weekly bearish impulse. A test into the weekly fractal highs of the spring and summer below 1.15 the figure is in focus.

EUR/USD daily bearish engulfing candle

We have seen a strong momentum candle in the last few days which is yet to lead to a lower low. The price has instead corrected 50% of the imbalance in a phase of mitigation and a retest of liquidity. The price has since been rejected which would now be expected to lead to further downside.

EUR/USD H1 chart

meanwhile, from an intraday trading perspective, the price has corrected a significant portion of the drop and the focus is now back on the downside:

There is now room to go and test the Oct lows in the 1.1520s.

Meanwhile, however, there could be some more correction to go into the 38.2% Fibonacci of the breakout below the trendline that would be expected to act as a counter-trendline on a restest beyond the 38.2%. This would offer a reasonable area for placement of a stop loss to protect short entries in order to target the 1.1560s and beyond.

-

19:10

GBP/JPY consolidates in low 155.00s after technical selling, BoE meeting looms

- GBP/JPY is consolidating between 155.00 and its 21DMA.

- The pair broke to the downside of a descending triangle formation recently.

- The Bank of England meeting could spark volatility on Thursday.

GBP/JPY has spent the majority of Tuesday’s session consolidating close to the 155.00 level and its 21-day moving average at 155.35. Since slipping below support at the 156.00 level on Monday, the pair has been trading with a negative bias, although the downside seen on Tuesday has more to do with broad yen strength rather than on Monday, which had more to do with broad GBP weakness at the time as a result of Brexit tensions and uncertainty regarding this week’s Bank of England rate decision.

As to why the yen is performing well on Tuesday (it is the best performing G10 currency on the day), it it probably because long-term bond yields across developed markets (particularly in Europe) have been on the back foot, thus putting downwards pressure on rate differentials with Japanese bonds. For reference, US 10-year yields are consolidating close to recent lows around 1.55%, while 10-year German yields have dropped back sharply from above -0.10% on Monday to current levels around -0.17%.

For the GBP/JPY pair, some technical selling might also be at play; the pair formed a descending triangle in recent weeks, with support coming in at 156.00 and a downtrend linking the 20, 26 and 29 October highs. Such patterns are often indicative that a downside break is in the offing.

Bank of England in the spotlight

Looking ahead to the rest of the week, the fundamentals will once again take precedent; the main event for GBP this week is the Thursday Bank of England meeting. While UK money markets pricing suggests a rate hike of at least 15bps is almost a certainty, economists are more divided, as seemingly is the BoE’s rate-setting committee (called the Monetary Policy Committee or MPC).

To sum up the differences in opinion; hawkish BoE members (including Governor Andrew Bailey and Chief Economist Huw Pill) have expressed concern that if the BoE does start taking its foot of the “accelerator” (i.e. start unwinding ultra-accommodative policy) with YoY rates of Consumer Price Inflation hitting multi-year highs (and likely to go above 5.0% in 2022) and the output gap now closed (i.e. the economy having recovered to its pre-pandemic size), medium-term inflation expectations risk becoming de-anchored. Conversely, the dovish members have argued the bank should until December so the bank can properly observe the impact that the end of the government furlough scheme had on the labour market.

A few analysts have pointed out that, given recent hawkish rhetoric from the BoE Governor and others that has pumped market expectations for rate hikes as soon as November, the bank might face credibility issues if it fails to live up to these expectations. The vote on interest rates is likely to be split with the four known hawks voting for an immediate 15bps rise, while the three known doves might vote to hold rates at 0.1%. That leaves two MPC members who can decide the outcome, with only one needing to vote for the hike to set it in stone. Note that the bank will vote on whether or not to continue its bond-buying programme until the year’s end.

The BoE will release its quarterly Monetary Policy Report, which contains its latest economic forecasts. Some have suggested that there is a risk that the new long-term inflation forecasts might suggest a less aggressive hiking cycle from the BoE than money markets are currently pricing; short sterling futures suggest more than 100bps of rate hikes in 2022. Some have suggested the bank might try to play down the aggressiveness with which it plans on hiking interest rates over the coming years verbally as a way to bring the more dovish MPC members on side.

Either way, the higher than usual uncertainty surrounding the meetings suggests that the reaction in GBP pairs like GBP/JPY could be very choppy. Note that Thursday also sees UK Brexit Minister David Frost and the French Secretary of State for European Affairs getting together to talk fish, as both sides try to avoid tensions escalating into a full-blown trade/legal battle.

-

18:42

USD/JPY retreats below 114.00 amid mild risk-on market sentiment

- USD/JPY pares some of its Monday losses, approaches 114.00 on dismal market sentiment.

- Falling US T-bond yields drag the USD/JPY pair with it, despite broad greenback strength across the board.

- USD/JPY: An upside break above a downward slope trendline around 114.20 could propel the pair towards 116.00.

The USD/JPY trims some of Monday’s losses, edges lower 0.07%, trading at 113.92 during the New York session at the time of writing. The market sentiment is mild risk-on, portrayed by US equity indices rising between 0.26% and 0.39%. Nevertheless, the Japanese yen appreciated as traders got ready for the Federal Reserve November meeting.

On Monday, the USD/JPY pair fell 0.44% due to a risk-off market mood spurred by three central banks reviewing their monetary policy conditions. Furthermore, as US third-quarter corporate earnings wane, market participants' focus turns on central banks, macroeconomic developments, and higher inflation.

In the meantime, the US 10-year Treasury yield is falling four basis points, sitting at 1.533%, following the USD/JPY footsteps. Meanwhile, the US Dollar Index, which tracks the greenback’s performance versus a basket of its peers, advances 0.25%, currently at 94.09, clinging to the 94 handle, for the second consecutive day.

In the Asian session, the Bank of Japan Governor Haruhiki Kuroda and Japanese Finance Minister Shunichi Suzuki, and Economic Minister Yamagiwa held a meeting. They discussed the economy and the financial situation of the country.

Before the reunion, some market speculation was that the newly formed Japanese government and the BoJ might review the joint statement and the 2% goal, per Reuters.

On the US economic docket, the IBD/TIPP Economic Optimism for November fell for the fifth consecutive month to 43.9, lower than the 46.8 October figure.

USD/JPY Price Forecast: Technical outlook

Daily chart

The USD/JPY daily chart shows the pair found strong support at the October 28 low at 113.25. The daily moving averages remain below the spot price, confirming the upward bias. Furthermore, Tuesday’s price action portrays some mild USD buying pressure around 113.50, depicted by a large bottom wick of the candlestick.

For USD bulls to resume the upward bias, they will need an upside break above the downslope trendline that travels from October 20 to November 1 high. In the case of that outcome, the USD/JPY pair could rally towards 116.00.

Therefore, as the USD/JPY lacks catalyst at press time, investors might refrain to open fresh bets, as the Federal Reserve meeting, lies ahead. Instead would be prudent to wait for further forward guidance, that could give direction to the pair.

-

18:05

United States 52-Week Bill Auction rose from previous 0.09% to 0.16%

-

18:00

AUD/USD Price Analaysis: A countertrend trader's setup in the making?

- AUD/USD bears have taken over, but there are bullish prospects from here.

- The price would now be expected to correct a significant portion of the drop in the sessions ahead.

The price has run into what would be expected to be a strong area of support and given the imbalance, a correction is the most probable next scenario. Looking back at the price action, it would appear that there is a huge imbalance all the way back to the 0.7450s. This also coincides with a 61.8% Fibonacci as well as a smoothed 200 hourly moving average.

That is not to say that the price can necessarily reach that far immediately, but bulls will be aware of that area of liquidity and will potentially want to target there in due course.

From a 15-min perspective, the 0.7440s is a more probable level that could be more easily achieved in the short term:

As illustrated, the 21-EMA meets with this area of potential interest and the drop from there was sudden, so there is some mitigation that needs to happen which most probably would lead to a restest of the 21-EMA in the coming sessions.

With that being said, a break of daily support opens risk to the 0.7380s:

-

17:15

USD/CHF rallies back to 200DMA at 0.9150, despite strong Swiss data

- USD/CHF is sharply higher on Tuesday and has returned to its 200DMA at 0.9150.

- Strong Swiss Retail Sales and inflation numbers have not prevented the Swiss franc from selling off.

- USD/CHF traders are focused on key risk events in the US as the next key driver.

USD/CHF is up sharply on Tuesday, with the Swiss franc having depreciated 0.6% on the session versus the buck. That translates to a roughly 0.6% rebound for USD/CHF on the day from Asia Pacific session lows nuder 0.9100 to current levels around 0.9150, where, incidentally, the 200-day moving average resides. Indeed, the key long-term moving average may well halt USD/CHF’s rebound in its tracks, though the currency pair hasn’t paid too much attention to the level in recent days.

Tuesday’s upside marks a sharp reversal of the trend towards gradual depreciation seen over the last few weeks; since the start of October, USD/CHF has dropped from above 0.9300 to before printing lows under 0.9100 on Monday. The rebound to 0.9150 doesn’t yet mark a trend reversal, however, as the key downtrend that has been suppressing the price action in recent weeks remains intact.

Strong Swiss data

CHF weakness on Tuesday flies in the face of strong Swiss economic data released during Tuesday’s European morning; firstly, the October Consumer Price Inflation report was much hotter than expected with the MoM rate of CPI coming in at 0.3% versus forecasts for 0.1% and the YoY rate rising to 1.2% from 0.9% in September, more than the expected rise to 1.1%. The September Retail Sales report also showed an acceleration in consumer spending, with the YoY rate of sales growth rising to 2.5% from an upwardly revised 0.8% in August.

Rest of the week

Looking ahead to the rest of the week; state-side events will likely be the dominant driver of price action, with the most notable events the release of the ISM Services PMI at 1400GMT, the release of the Fed’s latest monetary policy decision at 1800GMT and then the post-meeting press conference with Fed Chair Jerome Powell at 1830GMT on Wednesday, followed by the release of the October Labour Market report at 1230GMT on Friday. FX strategists have argued in recent weeks that if the Fed does continue to signal more hawkish policy guidance/tone, then the currencies most at risk of depreciating versus the US dollar are those where the central banks are substantially behind the Fed in terms of monetary normalisation.

That means the Swiss franc, given that, at present, there is no end in sight to the SNB’s ultra-accommodative stance which is at this point now mainly geared around trying to fight long-term CHF strength. Should the Fed deliver hawkish undertones and US jobs data come in strong, this may trigger a break above the recent downtrend and send USD/CHF back towards 0.9200.

-

16:36

GBP/USD threatens a break below 1.3600

- GBP/USD is under pressure ahead of both the Fed and Boe this week.

- Markets could be readjusting their GBP length ahead of an uncertain outcome.

GBP/USD is being pressured at the start of the week, down some 0.3% at the time of writing after sliding from a high of 1.3669 to a low of 1.3608 so far and staying close to a three-week low. Central banks are the focus for the week with uncertainty as to whether the Bank of England will raise interest rates and if the US Federal Reserve will start tapering this month.

FOMC meeting underway

Firstly, the two-day Federal Open Market Committee meeting kicked off today. The market has positioned for a tapering announcement following guidance from the central bank which has managed expectations perfectly in terms of preparing the markets for what is likely to be speed tapering.

''Most officials seems to agree that it’s better to get tapering over as quickly as possible in order to leave the Fed maximum flexibility to hike rates when needed,'' analysts at Brown Brothers Harriman explained. ''We believe that the most likely path for tapering has already been flagged by the Fed, which would reduce asset purchases by $15 bln per month ($10 bln UST and $5 bln MBS).''

The analysts also believe that the Fed will start tapering this month so that QE effectively ends by mid-2022. The market has taken that process a step further and is pricing in around 50% odds for liftoff in Q2. ''Q3 liftoff is already fully priced in,'' they explained, ''followed by another hike fully priced in for Q4. This is much more aggressive than what the Fed itself anticipates, at least in the current Dot Plots. We suspect the Fed will try to push back a bit against such aggressive tightening expectations, but we are not sure that the market will listen.''

Meanwhile, US data will be a key focus this week also. Yesterday, October ISM Manufacturing PMI came in strongly at 60.8 vs. 60.5 expected and 61.1 in September. Readings above 60 are rare and yet here we are above 60 for 8 of the past 11 months. Looking at the components, employment came in at 52.0 vs. 50.2 in September, which could be symbolic of a healthy Nonfarm Payrolls report at the end of the week where forex volatility could be highest, depending on the outcome.

''Employment component of 52.0 is the highest since July, when 57k manufacturing jobs were added out of 1.09 mln total NFP gain. All in all, this was a very solid report,'' analysts at Brown Brothers Harriman said. ISM services PMI will be reported Wednesday and so too will the ADP jobs report. The current consensus is 450k and we suspect it will creep higher.

BoE in focus

Casting minds back, sterling rose to a 20-month high versus the euro in late October and added around 3% for the same month vs the greenback for the same month amid expectations for a BoE interest rate hike. Inflation risks have surged, but there are growing doubts around what the central bank will actually do at its policy meeting on Thursday. Three of the nine Monetary Policy Committee members, including the BoE Governor Andrew Bailey, have been voicing concerns around inflation and the need to act.

It is a close call whether the Bank of England (BoE) hikes on Thursday or not, so should there be a hike, it could well be a dovish one with the BoE saying that the hiking cycle will be "gradual and limited". Market pricing is pretty aggressive as it is pricing in a total of 125bp rate hikes until year-end 2022 and hence traders could be rethinking and adjusting some of its lengths into the meeting this week.

-

16:32

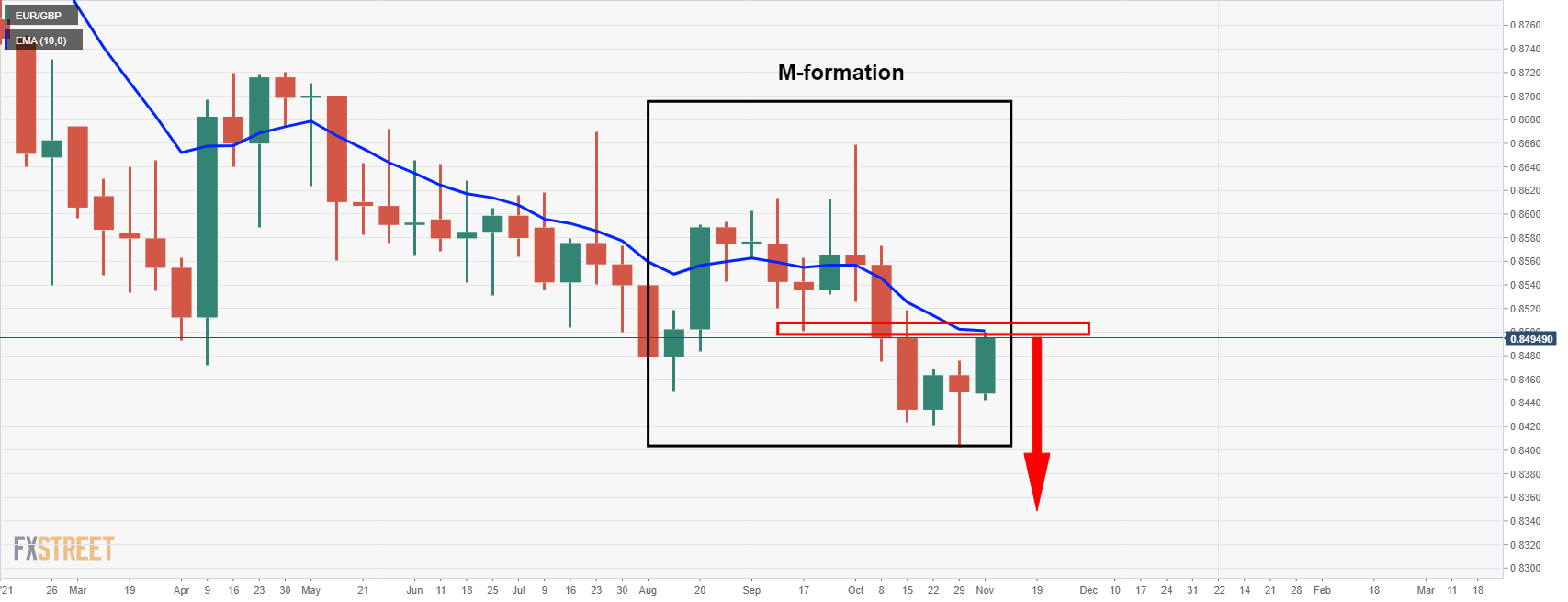

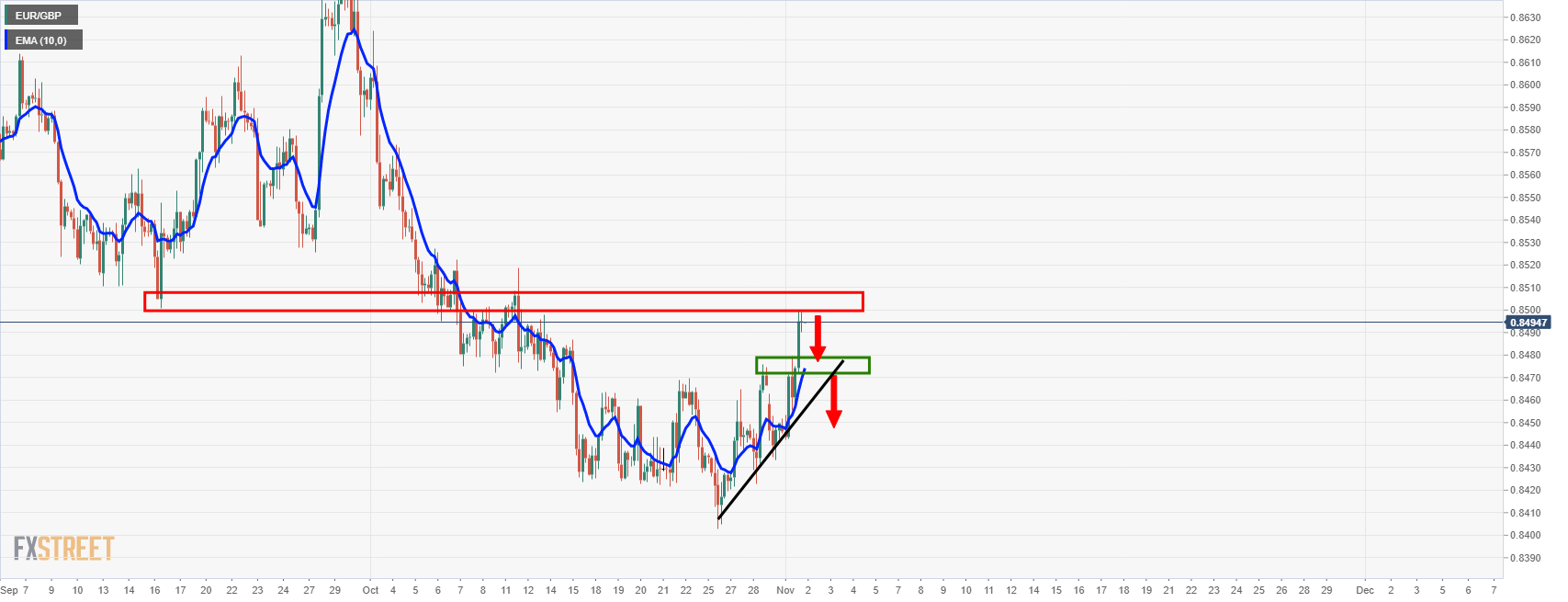

EUR/GBP reclaims 0.8500 amid mild risk-off market sentiment

- EUR/GBP edges higher on the back of a weaker Sterling across the board.

- EUR/GBP: As long as the EUR/GBP pair remains below 0.8530, the cross-currency has a downward bias.

The EUR/GBP reclaims the 0.8500 level, climbing to fresh two-week highs up 0.12% during the New York session, trading at 0.8506 at the time of writing. The market sentiment remains subdued as three central banks will review their current monetary policy conditions. That, in part, spurred a sell-off of risk-sensitive currencies, like the British pound, which at press time, the GBP/USD pair threatens to break below the 1.3600 figure.

Last Thursday, the European Central Bank (ECB) reviewed its monetary policy stance. The ECB decided to keep rates unchanged. Further, despite high inflation readings, with the Eurozone CPI expanding by 4.1%, it maintained its dovish stance, pushing backward investors’ intentions of a rate hike until late 2023.

Meanwhile, the Bank of England (BoE) is heading into their monetary policy meeting this week, where investors already priced in a 15-basis point hike rate on November 4. A rate rise in the UK would be the first one since the pandemic. Furthermore, it responds to surging inflation readings, as BoE members Michael Saunders and Governor Andrew Bailey expressed.

On the macroeconomic front, Eurozone PMI’s for October hit the wires. The German Markit Manufacturing PMI came at 57.8 lower than the 58.2 estimated. Furthermore, the Eurozone Markit Manufacturing PMI increased to 58.3, worse than the 58.5 foreseen by analysts.

Despite being lower than expected readings, production remained strong but was affected by supply chain bottlenecks and logistical problems. Alongside those abovementioned, the shortage of truck drivers continued to hurt the manufacturing sector.

EUR/GBP Price Forecast: Technical outlook

Daily chart

The EUR/GBP cross-currency pair has a downward bias, as shown by the directionless daily moving averages (DMA’s) located above the spot price. At press time, the pair is approaching the confluence of the 50 and the 100-DMA around the 0.8520-40 area, which would oppose strong resistance for EUR buyers. However, the Relative Strength Index (RSI) at 54 aims higher, a bullish signal that diverges with price action.

To extend the downward trend, EUR/GBP sellers will need to hold the price below the September 16 low at 0.8500. In that outcome, EUR sellers could push the pair towards a renewed re-test of 0.8402, which is 2021 low.

For EUR/GBP buyers to confirm its upward bias, they will need a daily close above 0.8530. In that outcome, the following resistance would be the 200-DMA at 0.8588.

-

16:15

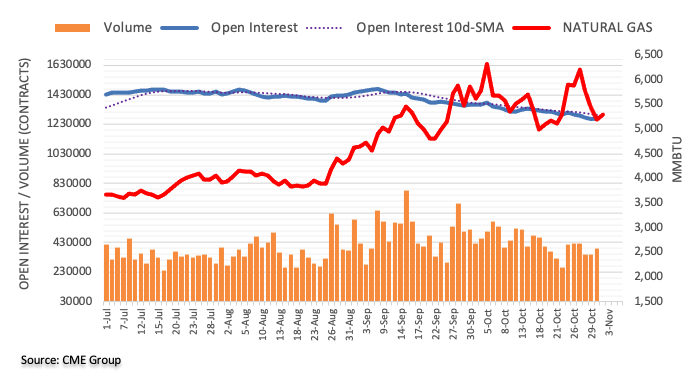

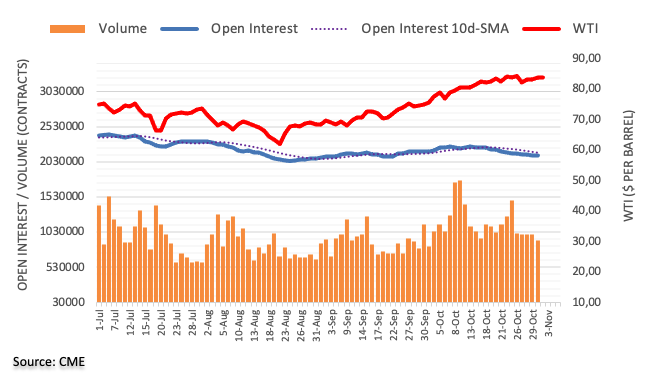

WTI ebbing lower but within recent ranges ahead of key OPEC+ get-together

- WTI has slipped back to $83.00 in recent trade but remains well within the rough $81.00-$85.00 range of recent weeks.

- OPEC+ are widely expected not to deviate from plans to hike output at a rate of 400K bdp/ month.

- Most analysts remain bullish on oil’s near-term prospects with the global supply/demand imbalance set to persist.

The price of front-month future contracts for the delivery of the American benchmark of sweet light crude oil, West Texas Intermediary (often referred to as WTI), has been ebbing lower in recent trade as traders refrain from placing big bets ahead of this week’s OPEC+ meeting. Ahead of the Thursday gathering, where the group is widely expected not to deviate from its current plan to increase output at a rate of 400K barrels per day each month, most traders are likely to keep their powder dry, meaning WTI may well continue to undulate within recent ranges, as has been the case since the start of the week. At present, front-month futures are trading in the mid-$83.00s per barrel, about $1.50 below Monday’s high at just under $84.00. But that leaves prices well within the $81.00-$85.00ish range of the past few weeks.

In terms of oil-relevant macro updates; there haven't been many notable developments as of late. There has been some chatter about the struggles that some OPEC+ members (mainly in Africa) have been having in lifting output as the cartel’s output curbs have eased in recent months, which has resulted in aggregate over-compliance of the cartel to its own self-imposed output restrictions OPEC+. This adds to the idea that OPEC+ is not increasing output quickly enough to match the rebound in global oil demand, which according to some big US and European oil companies who reported earnings this week has now returned to pre-pandemic levels, has been a key factor underpinning the more than 20% surge in oil prices since the start of September. The return of global oil demand to pre-pandemic levels has happened faster than many analysts anticipated back then because the surge in global natural gas prices has encouraged energy companies to switch to using relatively cheaper derivatives of crude oil as a power source.

Given the above, most analysts remain bullish on WTI’s near-term prospects. If OPEC+ does deliver on expectations and some post-event profit-taking is seen, look out for support in the $81.00 area, where resides a few recent lows and the 21-day moving average. Dip-buyers may see a pullback here may be an attractive opportunity for dip-buyers, which could potentially set the stage for a push back towards annual highs around $85.00 or even beyond.

-

16:05

Silver Price Analysis: XAG/USD drops more than 2.5%, to the $23.35 area

- Silver having the worst day since late September amid a stronger USD ahead of FOMC.

- XAG/USD is back below the 20-day moving average.

Silver (XAG/USD) is falling significantly on Tuesdays, even as gold prices drop only marginally. Recently it bottomed at $23.38, the lowest level since October 19.

The metal remains near the lows, under pressure and falling 2.61% during the day, the worst day since September. The sharp decline pushed the price under the 20-day moving average and is testing the 55-day.

The extension of the reversal from levels near $25.00 that reached two weeks ago deteriorated the technical outlook. Below $23.40, the next support is seen at $23.15 and then $22.80.

On the upside, $23.75 is the immediate resistance, followed by $23.95 and $24.10. A recovery above $24.00 should alleviate the bearish momentum and could even be a sign of more gains ahead.

Despite current technical factors, Wednesday’s FOMC meeting could be a market mover triggering sharp moves in metals, particularly gold. The yellow metal is under $1,790/oz, down just 0.26%.

XAG/USD daily chart

-637714658716724905.png)

-

16:00

Denmark Currency Reserves: 491.9B (October) vs previous 501.7B

-

15:51

USD/MXN Price Analysis: Upside eases after six-day of gains, finds resistance near 21.00

- USD/MXN peaks at 20.91, the highest level since March.

- Mexican peso recovers from some losses, amid a holiday in Mexico.

- US dollar mixed ahead of the FOMC meeting.

The USD/MXN is falling for the first time in more than a week on Tuesday after the pair found resistance at 20.90. A holiday in Mexico and some profit-taking weighed on the pair that retreated to the 20.70 area.

The bias in USD/MXN still points to the upside. In order to clear the way to more gains, the dollar needs to consolidate above 20.90. The next area to watch is 21.00 with the next resistance at 21.05 followed by 21.45.

The correction of USD/MXN could extend to 20.60/65 without negating the current bullish bias. Below around 20.45 is the next critical area, horizontal support and the 20-day moving average. A slide below would alleviate the pressure, leaving the Mexican peso stronger.

USD/MXN daily chart

-637714650255969017.png)

-

15:23

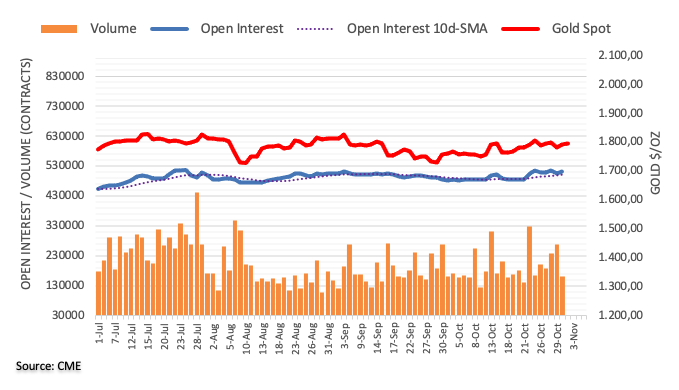

Gold Price Analysis: XAU/USD sticks close to 200DMA ahead of key Fed announcement

- The 200DMA just above $1790 has been acting like a magnet for spot gold prices on a quiet trading day.

- The main focus for gold traders is Wednesday’s Fed meeting, which carries hawkish risks.

Spot gold (XAU/USD) prices trade marginally lower on Tuesday, having gradually ebbed in recent hours from Asia Pacific session highs in the mid-$1790s to current levels around $1790. That means spot prices have been undulating either side of the 200-day moving average (currently at $1792.40). A lack of notable economic data points or scheduled events for the remainder of the European and US trading sessions suggests that lackluster trading conditions may persist and that the 200DMA may continue to act as a magnet for XAU/USD.

Fed meeting looms

Currency, bond and (by virtue) precious metal markets are in wait and see mode ahead of tomorrow’s Fed policy meeting and Friday’s US labour market report; at present, the DXY is around the 94.00 level and well within recent ranges and the same can be said for US bond yields, with the nominal 10-year close to 1.55% and the 10-year TIPS close to -1.0%. With regards to the Fed meeting, there are a few key focal points of interest to market participants; 1) the timing/pace of the bank’s QE taper plans (Fed officials have said they plan to announce taper plans at this meeting) – markets currently expect the Fed to reduce the monthly pace of purchases at a rate of $15B per month, taking eight months to taper net monthly purchases to zero from the current $120B, 2) any new guidance on when the bank might potentially start lifting interest rates, given that markets are now pricing a strong likelihood of lift-off in early H2 2022 and 3) any further recognition that upside inflation risks have grown.

Some analysts have suggested that there are upside risks to market expectations for a monthly QE taper pace of $15B. Danske Bank said in a recent note that they see a strong risk that the Fed opts to taper at a rate of $20B per month, meaning that (assuming the taper begun in November) QE purchases would be reduced to zero by April. This might be taken as a hawkish signal by markets; the Fed has previously said it does not want to lift interest rates before its QE taper has concluded, so a move to end the QE taper more quickly might be seen as the Fed giving itself more optionality to lift rates earlier if required. This may reflect a growing fear within the FOMC that their (up until only very recently) strongly held conviction that the current spike in inflation is “transitory” is under threat. Indeed, the recent spike in gas prices, combined with continued pro-inflationary supply bottlenecks are hitting consumer pockets, and rising inflation expectations and an already very tight US labour market risk embedding expectations for a more prolonged period of high inflation, all risks that recent rhetoric from Fed members has suggested they are growing increasingly worried about.

A hawkish Fed meeting could send real yields higher and would likely give the DXY the impetus that it needs to break above recent highs in the mid-94.00s, which would not be a good combo for gold. In this case, XAU/USD could well slip back below its 21 and 50DMAs around $1780 and to a retest of recent lows in the $1770s, ahead of a more protracted move back towards support in the $1750 area.

-

15:21

EUR/NOK: Limited downside potential as Norway's December rate hike is priced in – ING

In the view of economists at ING, Norges Bank will this week reiterate its intention to hike rates in December – they expect that to be followed by a further three rate rises next year. The krone has already seen the benefits of the hawkish re-pricing, so EUR/NOK has limited further downside potential in 4Q.

NOK already embedding hawkish expectations

“We expect a December rate hike and most likely three further increases through 2022.”

“We expect this week’s Norges Bank meeting to generate a quite contained market impact, as we should merely see a confirmation that interest rates will be raised again in December, a prospect that is already very much priced in by markets.”

“We think that more benefits for NOK stemming from the Norges Bank's tightening cycle should come through a carry advantage (which should play out in the longer run) rather than from the central bank surprising on the hawkish side.”

“We see only limited downside room for EUR/NOK in 4Q, and we expect 9.70 as a year-end value.”

-

15:18

EUR/USD breaks below 1.1600 amid subdued market sentiment

- The shared currency fell below 1.1600 on mild US dollar strength.

- Central banks: The RBA disappoints investors, despite dropping the YCC, dampening the market optimism.

- Eurozone PMI’s in expansion territory, though lower than expected due to supply bottlenecks and transportation problems.

The EUR/USD retreats from daily tops around 1.1600, down 0.10%, trading at 1.1593 during the New York session at the time of writing. Due to three central banks reviewing their monetary policy stances, the market sentiment is subdued, not risk-on or off, as market participants prepare for the Federal Reserve monetary policy meeting.

On Tuesday in the Asian session, the first one of the three central banks, the Reserve Bank of Australia, maintained rates on hold, dropped the Yield Curve Control and expressed the possibility of a hike rate in 2023. The market sentiment dampened once the decision crossed the wires, as witnessed by the rising Japanese yen and US Dollar, with market participants flying to safe-haven assets.

Meanwhile, the US Dollar Index reclaims the 94.00 threshold, up 0.19% at 94.04 amid lower US bond yields, with the 10-year Treasury yield falling one basis point, sitting at 1.556%

On the macroeconomic front, Eurozone PMI’s for October hit the wires. The German Markit Manufacturing PMI came at 57.8 lower than the 58.2 estimated. Furthermore, the Eurozone Markit Manufacturing PMI increased to 58.3, worse than the 58.5 foreseen by analysts.

Despite being lower than expected readings, production remained strong but was affected by supply chain bottlenecks and logistical problems. Alongside those abovementioned, the shortage of truck drivers continued to hurt the manufacturing sector.

Across the pond, the IBD/TIPP Economic Optimism for November fell for the fifth consecutive month to 43.9, lower than the 46.8 October figure.

EUR/USD Price Forecast: Technical outlook

1-hour chart

The EUR/USD chart shows the pair bounced off 1.1534, towards the 50% Fibonacci retracement at 1.1611, which confluences with Monday’s high and the 100-simple moving average. That area would oppose strong resistance to the pair, and if EUR bulls would like to regain near-term control, they will need to reclaim the 200-SMA at 1.1614.

In the case of that outcome, it would expose the confluence of the 78.6% Fibonacci retracement and the R2 pivot level around 1.1650. On the flip side, failure at 1.1600 would expose the 2021 low at 1.1524.

Therefore, the pair would be trading at narrow ranges ahead of the Federal Reserve. Significant upward or downward moves would be capped around the 1.1543-1.1610 range.

-

15:10

NZD/USD falls to two-week lows to test 0.7100

- Kiwi under pressure during the American session, among worst performers

- NZD/USD breaks the two-week range to the downside; the 20-day moving average awaits at 0.7080.

- Wednesday: NZ employment report, FOMC announcement.

The NZD/USD is falling sharply on Tuesday amid a stronger dollar and ahead of the FOMC meeting and the New Zealand employment report. The pair broke a range and tumbled to 0.7106, reaching the lowest level since October 19.

NZD losses strength on US hours

The kiwi dropped against its G10 rivals during the American session, probably weakened by the rebound in AUD/NZD. The US dollar rose across the board, pushing NZD/USD further to the downside. The greenback gained momentum even as US yields dropped modestly and the fact that stocks were higher on Wall Street. The AUD/NZD bottomed hours ago following the Reserve Bank of Australia at 1.0403, the lowest in a month and as of writing, is at 1.0470.

Early on Wednesday, the employment report is due in New Zealand. “We are more hawkish on the Q3 NZ labour market report and expect it to show that the labour market has turned even tighter despite most parts of NZ being in lockdown in Q3. We expect the Q3 unemployment rate to fall to 3.5% from 4.0% in Q2 (cons: 3.9%),” wrote TD Securities analysts. They point out employment growth is likely to be strong again, “up 1.0% q/q (cons: 0.4%, Q2:1.1%) with Stats NZ's monthly employment indicator showing filled jobs rising 1.3% q/q at the end of Q3.”

Then, during the second half of the American session, the Federal Reserve will announce its monetary policy decision. No change in rates is seen; an announcement regarding the purchase program is expected. Volatility in the bond and currency markets will likely rise around the event. Previously, price action could remain sideways.

Technical levels

-

15:02

USD/TRY extends the range bound theme near 9.6000

- USD/TRY resumes the upside after Monday’s retracement.

- The upbeat tone in the greenback weighs on the EM FX space.

- Turkey’s key inflation figures will be published on Wednesday.