Notícias do Mercado

-

19:22

American focus : the euro fell sharply against the U.S. dollar

The dollar rose sharply against the euro, despite the strong performance of European PMI, which surprised investors. Most likely, this strengthening of the American currency was due to the fact that this week will be a meeting of the ECB, which will attract the attention of investors , whose views on the next steps of the Bank diverge. Note that there are serious arguments against what the Central Bank to launch new measures , at least this week , given the internal debate on the recent rate cut . All of this suggests that the ECB would not be surprised markets for the second time in a row.

Regarding the current data , there is also worth highlight strengths American reports that partially helped strengthen the U.S. dollar. As it became known , the index of business activity in the U.S. manufacturing sector rose to a ten-month high , signaling for Strong improvement in business conditions . Final data from Markit showed that the manufacturing purchasing managers index (PMI) rose to 54.7 in November , showed a strong improvement since January. The index was 51.8 in October ( annual minimum). The initial assessment in November stood at 54.3 . The three-month moving average PMI, indicating the main trend was 53.1 and is broadly in line with the corresponding average for 2013 to date. Meanwhile, a report published by the Institute for Supply Management (ISM), showed that in November the activity in the U.S. manufacturing sector has grown, despite the expectations of economists to decline. PMI index for the U.S. manufacturing rose this month to 57.3 vs. 56.4 in October. Note that the latter growth was a surprise to economists , as they forecast a decline to 55.2 . Index increase was primarily due to robust growth components production, new orders and employment. At the same time , a decline compared with the previous month , it was noted by the component stocks and prices .

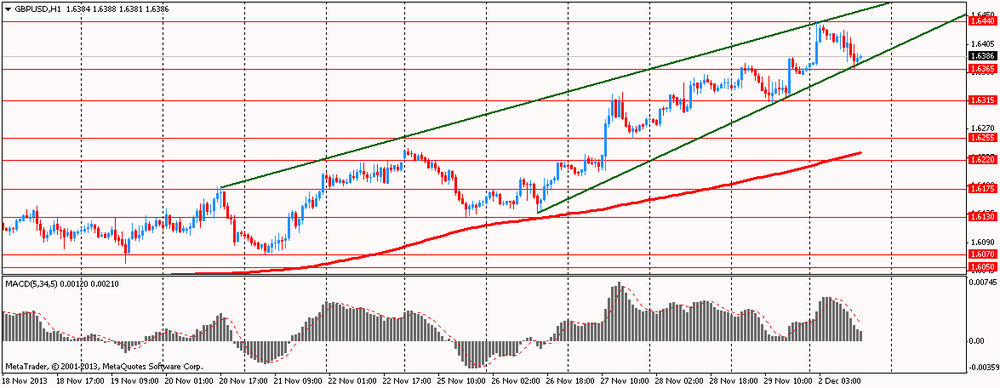

Pound declined significantly against the dollar , having lost all positions earned in the first hours after the opening of trading today. Note that the first pair is reduced over the last five sessions , but retains a bullish tone. Strong British PMI failed to prevent today's sell the pair before the meeting of the Bank of England and the publication of the autumn forecasts , scheduled for Thursday. Recall that today's report showed that manufacturing activity in the UK expanded at the fastest pace since February 2011 , as the sector gained momentum from production and new orders. PMI from Markit / Chartered Institute of Purchasing & Supply rose to 58.4 in November from a revised 56.5 in October. November result was well above the consensus forecast of 56.5 . In addition, the PMI index indicates an increase in activity for eight consecutive months. Recovery occurred in all sub-sectors covered by the survey , amid rising production and new business. Production prospects remain positive in November, while stocks continued to decline . The continuing rise of the producers led to further job creation in November.

-

15:00

U.S.: Construction Spending, m/m, September -0.3% (forecast +0.5%)

-

15:00

U.S.: Construction Spending, m/m, October +0.8% (forecast +0.4%)

-

15:00

U.S.: ISM Manufacturing, November 57.3 (forecast 55.2)

-

14:15

French manufacturing activity deteriorates further

Operating conditions across French manufacturing sector deteriorated further in November, survey results published by Markit Economics revealed Monday.

The headline seasonally adjusted purchasing managers' index fell to 48.4 in November from 49.1 in October. A reading below 50 indicates contraction of the sector. The latest reading was the slowest since June.

Production also fell at the sharpest rate since June, extending the current period of contraction to four months. New orders declined at the steepest rate in six months.

Staff levels at French manufacturers declined again in November with the pace of job shedding the sharpest since June, Markit said.

-

13:58

U.S.: Manufacturing PMI, November 54.7 (forecast 54.3)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y100.00, Y101.00, Y101.80, Y102.00, Y102.50

EUR/USD $1.3400, $1.3410, $1.3470, $1.3515, $1.3520, $1.3590, $1.3625, $1.3650

GBP/USD $1.6400

AUD/USD $0.9000, $0.9100, $0.9150, $0.9300

USD/CAD Cad1.0525

-

13:15

European session: the euro fell

08:30 Switzerland Manufacturing PMI November 54.2 55.1 56.5

08:48 France Manufacturing PMI (Finally) November 47.8 47.8 48.4

08:53 Germany Manufacturing PMI (Finally) November 52.5 52.5 52.7

08:58 Eurozone Manufacturing PMI (Finally) November 51.5 51.5 51.6

09:15 Eurozone ECB’s Vitor Constancio Speaks

09:30 United Kingdom Purchasing Manager Index Manufacturing November 56.5 Revised From 56.0 56.5 58.4

Euro fell against the dollar amid mixed data on manufacturing activity in the euro area .

According to the company Markit Purchasing Managers Index (PMI), calculated on the basis of 3000 survey of managers of manufacturing companies in eight countries in the euro zone rose to 51.6 from 51.3 in October.

Increased activity of November was achieved despite an unexpected decline in activity in the manufacturing sector in Spain , which suggests that a return to moderate economic growth in the fourth the size of the eurozone economy may have stalled.

Overall improvement is mainly due to the manufacturing sector in Germany : PMI largest eurozone economy grew in November to 52.7 from 51.7 in October. However, Italian producers have a surprisingly large contribution : PMI -thirds the size of the eurozone economy rose to 51.4 from 50.7 , reaching its highest level in two and a half years.

France PMI indicates that in November its activity in the manufacturing sector was the weakest in the eurozone. In addition, only here and in Greece decreased exports . This reinforces concerns about the ability of the second-largest eurozone economy after the recession contribute to the restoration of economic activity in the 3rd quarter.

Pound rebounded from the lows after the publication of the British PMI, which exceeded forecasts in November. PMI from Markit / Chartered Institute of Purchasing & Supply rose to 58.4 in November from a revised 56.5 in October. November result was well above the consensus forecast of 56.5 .

In addition, the PMI index indicates an increase in activity for eight consecutive months. Recovery occurred in all sub-sectors covered by the survey , amid rising production and new business.

Production prospects remain positive in November, while stocks continued to decline . The continuing rise of the producers led to further job creation in November.

" Manufacturing PMI touched a new high in two and a half years , when production and new orders rose to near 19 - year high - said Rob Dobson, senior economist at Markit. - Sustaining the recovery remains crucial ."

EUR / USD: during the European session, the pair fell to $ 1.3525

GBP / USD: during the European session, the pair rose to $ 1.6427 , and then retreated to $ 1.6367

USD / JPY: during the European session, the pair rose to Y102.90

At 13:30 GMT a speech Fed chairman Ben Bernanke . At 14:30 GMT , Canada will release PMI index for the production sector ( seasonally adjusted ) from RBC in November. At 15:00 GMT the U.S. ISM manufacturing index will be released in November. End the day at 23:50 GMT Japan data on the volume change of the monetary base in November.

-

13:00

Orders

EUR/USD

Offers $1.3690/710, $1.3660/65, $1.3650, $1.3625/30, $1.3575/80

Bids $1.3525/15, $1.3500, $1.3450

GBP/USD

Offers $1.6520, $1.6500, $1.6480, $1.6450

Bids $1.6380, $1.6350, $1.6300, $1.6280/75

AUD/USD

Offers $0.9300, $0.9240/50, $0.9200, $0.9180

Bids $0.9120, $0.9100, $0.9050

EUR/GBP

Offers stg0.8350

Bids stg0.8250, stg0.8220, stg0.8200, stg0.8150, stg0.8120

USD/JPY

Offers Y103.50, Y103.25, Y103.00

Bids Y102.40/30, Y102.00, Y101.80

EUR/JPY

Offers Y140.50, Y140.00, Y139.55/60

Bids Y139.00, Y138.80, Y138.60/50, Y138.20

-

11:15

U.K. Manufacturing Strongest Since Feb 2011

U.K. manufacturing activity expanded at its fastest pace since February 2011 as the sector gained further momentum from production and new orders, data from Markit Economics showed Monday.

The Markit/Chartered Institute of Purchasing & Supply Purchasing Manager's Index rose to 58.4 in November, from an upwardly revised reading of 56.5 in October. The score was also above consensus of 56.4.

Moreover, the PMI has signaled expansion for eight months running. The upturn also remained broad-based, with all of the sub-sectors covered by the survey reporting increases in output and new business.

The outlook for manufacturing remained positive in November. They reported further stock depletion. The ongoing recovery at manufacturers encouraged further job creation in November.

"Manufacturing and the wider economy are therefore both on course to build on the third quarter's solid foundation," Rob Dobson, senior economist at survey compilers Markit said.

Input costs increased for the fifth month in a row and companies reported some success in passing on higher costs to clients.

-

11:00

Eurozone manufacturing sector continues to recover

Eurozone manufacturing activity continued to recover in November, supported by expansion in output and new orders, a survey by Markit Economics revealed Monday.

The headline purchasing managers' index, a gauge of the manufacturing performance, rose to 51.6 in November from 51.3 in October. The latest reading was slightly up from the flash estimate of 51.5.

The headline PMI is currently at its highest level since June 2011, Markit said. Levels of manufacturing production, new orders and new export business all rose for the fifth consecutive month, the survey report said.

The PMIs for Germany, Italy, the Netherlands, Austria and Ireland all signaled expansion in November, with the rates of increase accelerating in all except Ireland. Operating conditions deteriorated in France and Spain, while the pace of decline in activity eased in Greece.

-

10:40

German manufacturing PMI rises more than initial estimate

Germany's overall manufacturing sector expanded for the fifth straight month in November, and the rate of growth exceeded initial estimate, final data from Markit Economics showed Monday.

The Markit/BME Purchasing Managers' Index came in at 52.7 in November, up from 51.7 in October. The reading signaled the strongest improvement since June 2011 and was above the initial estimate of 52.5.

The expansion was driven by a solid upturn in production and new business. A further drop in employment numbers was the main negative influence on the PMI figure during the latest survey period.

Increased production led to a rise in input purchasing during November. However, input price pressures remained muted in the latest survey period, with the rate of cost inflation dropping further below the long-run survey average.

Prices charged by manufactures increased for the second month in a row, and at the most marked pace since August 2011.

-

10:19

Option expiries for today's 1400GMT cut

USD/JPY Y100.00, Y101.00, Y101.80, Y102.00

EUR/USD $1.3400, $1.3410, $1.3470, $1.3515, $1.3520, $1.3590, $1.3625, $1.3650

GBP/USD $1.6400

AUD/USD $0.9000, $0.9100, $0.9150, $0.9300

USD/CAD Cad1.0525

-

08:58

Eurozone: Manufacturing PMI, November 51.6 (forecast 51.5)

-

08:53

Germany: Manufacturing PMI, November 52.7 (forecast 52.5)

-

08:48

France: Manufacturing PMI, November 48.4 (forecast 47.8)

-

08:30

Switzerland: Manufacturing PMI, November 56.5 (forecast 55.1)

-

07:01

Asian session: The greenback fell versus most of its 16 major peers

00:30 Australia Building Permits, m/m October +14.4% -4.3% -1.8%

00:30 Australia Building Permits, y/y October +18.6% +17.0% +23.1%

00:30 Australia Company Operating Profits Quarter III -0.8% +1.0% -0.5%

01:45 China HSBC Manufacturing PMI (Finally) November 50.4 50.5 50.8

02:30 Japan BOJ Governor Haruhiko Kuroda Speaks

The greenback fell versus most of its 16 major peers after figures today and yesterday showed manufacturing in China continued to grow last month. The manufacturing PMI for China, the world’s second-biggest economy, held at 51.4 last month, beating analyst estimates, according to government data yesterday. Figures released today by HSBC Holdings Plc and Markit Economics also indicated a reading above the 50 level dividing expansion from contraction.

The euro strengthened before a report that may confirm a fifth-straight period of manufacturing growth in the 17-nation region, while the pound climbed before a factory output reading that may indicate an eighth month of expansion. Data on a similar gauge for the euro region today may confirm manufacturing expanded in November at the fastest pace in more than two years, the median estimate in Bloomberg News survey showed. A U.K. factory index may indicate output growth continued last month, maintaining an uninterrupted streak that began in April, according to a separate poll.

Japan’s capital spending rose 1.5 percent in the third quarter from a year earlier, a finance ministry report showed. Bank of Japan Governor Haruhiko Kuroda said today in Nagoya that he expects a gradual increase in spending and will monitor the impact of the yen’s correction on small companies.

EUR / USD: during the Asian session, the pair rose to $ 1.3615

GBP / USD: during the Asian session, the pair rose to $ 1.6440

USD / JPY: during the Asian session, the pair fell to Y102.20

There is a full calendar on both sides of the Atlantic Monday, with the European final manufacturing PMI data for November likely to be the early highlight. Key Eurozone data gets underway from 0800GMT, with the release of the French car registrations data for November. The first of the main euro area PMI numbers comes at 0813GMT, when the Spanish numbers cross the wires. Italian data follows at 0843GMT, with France at 0848GMT, German at 0853GMT and the amalgamated euro data at 0858GMT. PMI numbers are seen in line with the flash data, showing a region just about holding on to a recovery. German data is seen at 52.5. At 0900GMT, German October machine orders will be released at 0900GMT. At 0915GMT, ECB Vice-President Vitor Constancio will deliver a keynote speech at a banking conference in Dublin. The UK November CIPS/Markit Manufacturing PMI numbers will cross the wires at 0928GMT and is seen edging higher to 56.1 from 56.0. Further UK data is expected at 0930GMt, when the BOE's third quarter FLS Usage and Lending Data are set to be published. Across the Atlantic, at 1330GMT, Federal Reserve Chairman Ben Bernanke will deliver the welcoming remarks to the Fed's College Challenge Finals, in Washington. The US data calendar kicks off at 1358GMT, with the release of the final November Markit PMI data. At 1500GMT, the Construction Spending data for both September and October are due for release. Construction spending is expected to rise 0.5% in October. The September data will be released for the first time with the October data. The lack of housing starts data makes the residential construction data harder to forecast, but declines in the NAHB index in both September and October suggest some weakness. October building permits, however, were sharply higher and could suggest a turnaround in the near future. In October, public construction should have been cut due to the government shutdown. Also at 1500GMT, the November ISM Index will cross the wires. The index is expected to fall to a reading of 55.8 in November after rising slightly to 56.4 in October. Regional conditions were somewhat softer in the month based on the declines in a number of surveys, including the MNI Chicago report. -

05:58

Schedule for today, Monday, Dec 2’2013:

00:30 Australia Building Permits, m/m October +14.4% -4.3%

00:30 Australia Building Permits, y/y October +18.6% +17.0%

00:30 Australia Company Operating Profits Quarter III -0.8% +1.0%

01:45 China HSBC Manufacturing PMI (Finally) November 50.4 50.5

02:30 Japan BOJ Governor Haruhiko Kuroda Speaks

05:30 Australia RBA Commodity prices, y/y November -1.0%

08:30 Switzerland Manufacturing PMI November 54.2 55.1

08:48 France Manufacturing PMI (Finally) November 47.8 47.8

08:53 Germany Manufacturing PMI (Finally) November 52.5 52.5

08:58 Eurozone Manufacturing PMI (Finally) November 51.5 51.5

09:15 Eurozone ECB’s Vitor Constancio Speaks

09:30 United Kingdom Purchasing Manager Index Manufacturing November 56.0 56.5

13:30 U.S. Fed Chairman Bernanke Speaks

13:58 U.S. Manufacturing PMI (Finally) November 54.3 54.3

15:00 U.S. Construction Spending, m/m September +0.6% +0.5%

15:00 U.S. Construction Spending, m/m October +0.4%

15:00 U.S. ISM Manufacturing November 56.4 55.2

23:50 Japan Monetary Base, y/y November +45.8% +47.2%

-