Notícias do Mercado

-

23:51

Japan Monetary Base (YoY) above forecasts (-8.4%) in December: Actual (-6.1%)

-

23:46

NZD/USD Price Analysis: Kiwi needs to trespass 0.6350 for a bullish trend

- Weakness in the US Dollar Index is supporting a recovery in the kiwi asset.

- The Kiwi asset is holding above the 200-EMA, which indicates that the long-term upside bias is still solid.

- An oscillation in the 40.00-60.00 range by the RSI (14) indicates a consolidation ahead.

The NZD/USD pair is displaying back-and-forth moves around 0.6300 in the early Tokyo session. Earlier, the Kiwi asset attracted offers after failing to reclaim the critical hurdle of 0.6350. The New Zealand Dollar is expected to regain strength as the market mood has turned cheerful. Investors dumped the risk-aversion theme amid expectations of a further slowdown in the inflationary pressures in the United States.

The US Dollar Index (DXY) has shifted into a sideways profile and reacted less to the release of downbeat United States Manufacturing PMI and the Federal Open Market Committee (FOMC) minutes.

On a four-hour scale, the Kiwi asset witnessed a responsive buying action after dropping below December 22 low around 0.6230. The incident formed a Double Bottom chart pattern and a follow-up recovery underpinned the New Zealand Dollar. The major is focusing on holding itself above the 20-period Exponential Moving Average (EMA) at around 0.6300.

With solid efforts, the Kiwi asset has managed to sustain itself above the 200-period EMA at 0.6268, which indicates that the long-term trend is still bullish.

Meanwhile, the Relative Strength Index (RSI) (14) has also defended a drop into the bearish range of 20.00-40.00 and is continuously oscillating in the 40.00-60.00 range, which indicates a consolidation ahead.

Going forward, a further recovery above December 30 high at 0.6373 will drive the kiwi asst towards December 19 high at 0.6409. In case, the New Zealand Dollar pushes the asset above the latter, the major will march towards December 15 high at 0.6500.

Alternatively, with a break below the round-level support of 0.6200, the US Dollar will get stronger and will drag the major below November 28 low at 0.6155 followed by November 28 low at 0.6087.

NZD/USD four-hour chart

-638084726839822709.png)

-

23:14

USD/CAD declines towards 1.3450 amid upbeat market mood, US/Canada Employment eyed

- USD/CAD has exposed to drop to near 1.3450 amid weak US Treasury yields.

- Investors will keep an eye on US/Canada Employment data for fresh cues.

- Oil prices drop below $74.00 amid short-term pain in China’s prospects due to rising Covid cases.

The USD/CAD pair has surrendered the crucial support of 1.3486 in the Asian session after a vertical sell-off from above 1.3650 on Wednesday. The downside pressure in the Loonie asset is bolstering the expression of extension in the south-side journey towards 1.3450 ahead. The US Dollar witnessed a steep fall following the footprints of weaker US Treasury yields.

Investors’ risk appetite has improved dramatically after the release of the downbeat United States ISM Manufacturing PMI. S&P500 witnessed demand from the market participants as various factors are now signaling for further inflation softening ahead.

The US Dollar Index (DXY) reacted less to the release of the Federal Open Market Committee (FOMC) minutes as it seems it was already discounted. None of the Federal Reserve (Fed) policymakers voted against the decision of easing the pace of interest rate hike to 50 basis points (bps) amid evidence of a slowdown in the Consumer Price Index (CPI).

Going forward, investors will focus on the release of the US Nonfarm Payrolls (NFP) data, which will release on Friday. As per the consensus, the United States economy added 200K fresh jobs in December vs. the former release of 263K. The Unemployment Rate is likely to remain steady at 3.7%. Apart from that, the Average Hourly Earnings could drop to 5.0% from 5.1% released earlier.

Meanwhile, the Canadian Dollar will also dance to the tunes of Employment data. According to the estimates, net addition in payrolls for December stands at 8K against 10.1K released earlier. The jobless rate will escalate marginally to 5.2%.

On the oil front, oil prices have dropped further below $74.00 as short-term pain in China’s economic prospects led by accelerating Covid infections is hurting oil demand prospects. It is worth noting that Canada is a leading exporter of oil to the United States and lower oil prices could weaken the Canadian Dollar.

-

22:55

AUD/JPY Price Analysis: Double bottom emerged, eyeing a rise towards 95.00

- The AUD/JPY rallied more than 2.90% on Wednesday on an upbeat sentiment.

- Double bottom in the AUD/JPY daily chart could pave the way for further upside.

- AUD/JPY Price Analysis: The double bottom targeted is the 95.00 figure.

The Australian Dollar (AUD) registered staggering gains against the Japanese Yen (JPY) on Wednesday, rallied 250 pips, further cementing the case for a double bottom in the daily chart. As the Asian session begins, the AUD/JPY is trading with minuscule losses of 0.05%, at 90.47.

AUD/JPY Price Analysis: Technical outlook

Wednesday’s price action presented the AUD/JPY rising above the 20-day Exponential Moving Average (EMA) at 90.33, and on the rally, it approached December’s monthly high of 91.05. Now that the AUD/JPY pair confirmed the double bottom, a clear break of the latter would pave the path towards the double bottom measured target of 95.00. Oscillators like the Relative Strength Index (RSI) is about to cross over the 50 mid-line, a bullish signal, while the Rate of Change (RoC) suggests that buying pressure is building.

Therefore, the AUD/JPY first resistance would be the confluence of the 50 and 200-day EMA around 91.66. Once cleared, that would expose the 92.00 figure, followed by the 100-day EMA at 92.42.

As an alternate scenario, the AUD/JPY first support would be the 90.00 mark, which, once cleared, could open the door for a fall to January’s three daily high-turned-support once broken, at 89.32. Break below would send the AUD/JPY sliding to 89.00.

AUD/JPY Key Technical Levels

-

22:34

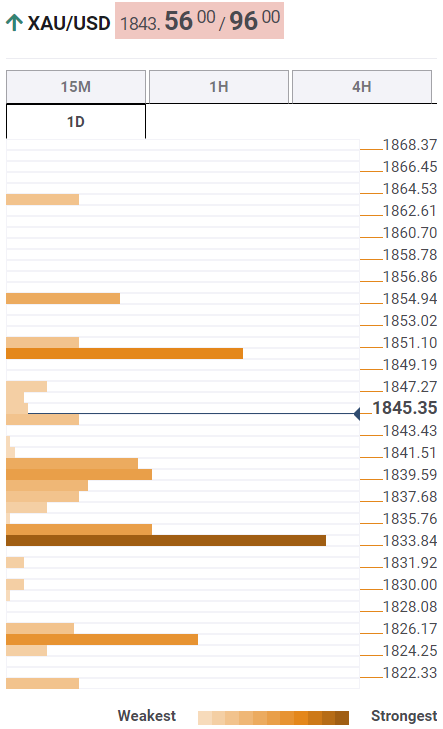

Gold Price Forecast: XAU/USD shifts auction above $1,850 as yields drop post FOMC minutes

- Gold price has comfortably shifted its business above $1,850.00 on weaker US Manufacturing PMI.

- The risk profile has turned positive as S&P500 sensed buying interest and US yields dropped further.

- A drop in inflation expectations has sensed pressure on the US Dollar Index.

Gold price (XAU/USD) has picked buying interest after a corrective move to near the crucial support of $1,850.00 in the late New York session. The precious metal dropped after failing to sustain above $1,860.00, however, the corrective move is mild and is not showing any significant sign of reversal.

Risk-perceived assets like S&P500 witnessed a decent demand from the market participants after a decline in the United States Manufacturing PMI bolstered signs of further cool-off in the US Consumer Price Index (CPI). A decline in demand for goods might force firms to trim prices at factory goods to compensate for the former.

The US Dollar Index (DXY) dropped below the 104.00 support after 10-year US Treasury yields witnessed immense pressure and scaled down to near 3.69%. Safe-haven assets are facing pressure on expectations of further decline in the inflationary pressures. Federal Reserve (Fed) chair Jerome Powell shifted to a slowdown context in the extent of an interest rate hike in December after remaining aggressive for the entire year. No doubt, the inflation rate is still extremely far from the 2% target, however, the presence of catalysts that advocates further slowdown in the price index is weighing on safe-haven assets.

Gold technical analysis

Gold price is attempting to deliver a breakout of the Rising Channel chart pattern on a four-hour scale. The precious metal has delivered a perpendicular rally after picking demand near the round-level support of $1,800.00. The 20-period Exponential Moving Average (EMA) at $1,839.11 is accelerating, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, which indicates that the upside momentum has been triggered.

Gold four-hour chart

-

22:14

Australia S&P Global Composite PMI: 47.5 (December) vs 47.3

-

22:14

Australia S&P Global Services PMI above expectations (46.9) in December: Actual (47.3)

-

22:13

AUD/USD rallies above the 200-DMA at around 0.6830 post-hawkish Fed minutes

- The Australian economic calendar eyes the release of the Services PMI.

- US Federal Reserve policymakers are not projecting any rate cuts in 2023.

- Chinese authorities lifting a ban on Australian coal could underpin the AUD/USD.

The AUD/USD erased Tuesday’s losses and climbed above the 200-day Exponential Moving Average (EMA), bolstered by China’s news lifting an import ban on Australia’s coal. Also, a tranche of US economic data and the release of the Federal Reserve’s last meeting minutes failed to propel the US Dollar (USD). At the time of writing, the AUD/USD is trading at 0.6840 after diving to a daily low of 0.6716.

AUD/USD climbed above the 200-day EMA

The US stock market closed Wednesday with solid gains. According to the last monetary policy meeting minutes of the Federal Reserve, policymakers do not expect to cut rates in 2023. Fed officials added that slowing the pace of rate hikes is “weakening commitment to achieving price stability on that inflation is already on a persistent downward path.” They said that inflation could be more persistent.

Aside from this, earlier, the December US ISM Manufacturing PMI came below estimates for the second consecutive month at 48.4 vs. estimates of 48.5. At the same time, the Bureau of Labor Statistics (BLS) revealed JOLTs Opening for November jumped more than estimates of 10M, came at 10.458M, while October figures were upward revised.

In the Fedspeak front, Minnesota’s Fed President Neil Kashkari said that it would be appropriate to continue to hike rates “at least at the next few meetings” until inflation has peaked and foresees the Federal Funds rate (FFR) at 5.4%. He added that the Fed must avoid cutting the policy rate prematurely and would consider cutting only when it’s convinced inflation is on its way back down to 2%.

Aside from this, Chinese authorities are planning to resume imports from Australian coal following a two-year ban as relations between both parties improved. Therefore, the commodity-linked Australian Dollar (AUD) got bolstered, and the AUD/USD rallied sharply toward fresh three-week highs of 0.6835.

Ahead of Thursday’s Asian session, the Australia economic docket will feature Australian Services PMI alongside Caixin Services PMI for China. On the US front, the calendar will reveal the Trade Balance alongside the Initial Jobless Claims for the week ending on December 31.

AUD/USD Key Technical Levels

-

22:06

United States API Weekly Crude Oil Stock increased to 3.298M in December 30 from previous -1.3M

-

22:01

GBP/USD remains inside the woods around 1.2050 as investors await FOMC minutes

- GBP/USD is awaiting the release of the Fed minutes for a decisive move.

- Rising demand for US government bonds is weighing on the US Dollar Index.

- A consecutive shrink in US Manufacturing PMI is showing signs of a further slowdown in the price index.

The GBP/USD pair has continued its sideways performance around 1.2050 as investors are awaiting the release of the Federal Open Market Committee (FOMC) minutes for fresh cues. The Cable asset displayed a wild gyration after the United States Institute of Supply Management (ISM) reported a shrink in the volume of manufacturing activities consecutively for the second time and then continued to auction sideways.

A decent recovery move in S&P500 on Wednesday after a two-day sell-off signifies that the risk appetite of the market participants has increased significantly. The US Dollar Index (DXY) dropped below the crucial support of 104.00 as the return on 10-year US Treasury bonds faced immense pressure. The 10-year US Treasury yields slipped to near 3.69% as a decline in Manufacturing PMI has been added to filters that call for a slowdown in the pace of policy tightening by the Federal Reserve (Fed).

On Wednesday, the US ISM Manufacturing PMI declined to 48.4 vs. the consensus of 48.5 and the former release of 49.0. A consecutive shrink in the extent of manufacturing activities is the outcome of higher interest rates by the Fed, which has forced firms to avoid debts due to higher interest obligations. Apart from that, New Order Index that indicates forward demand has dropped dramatically to 45.2. While the street was expecting a jump in the economic data to 48.1 from the prior release of 47.2.

For a decisive move, investors are awaiting the release of the Fed’s minutes for the December meeting, which will provide a detailed explanation of the policy outlook for CY2023. Fed chair Jerome Powell in a December policy meeting announced that interest rates will top above 5% and higher interest rates will be continued for a longer period to tame stubborn inflation.

On the United Kingdom front, A monthly survey conducted by Citi and YouGov revealed on Wednesday that the British public's inflation expectations for 12 months ahead declined to 5.7% in December from 6.1% in the previous survey, as reported by Reuters. This is going to provide support to the Bank of England (BOE) which is worried about roaring inflation.

-

19:56

Forex Today: New year, old Fed

What you need to take care of on Thursday, January 5:

The US Dollar changed course on Wednesday and edged sharply lower across the FX board. However, losses were uneven, with the AUD among the best performers and the EUR at the bottom of the list.

In fact, news coming from China and affecting Australia were the initial catalyst for the US Dollar sell-off. News indicated that the Chinese National Development and Reform Commission discussed plans to partially lift the ban on Australian coal imports after two years of conflict. Imports were interrupted in mid-2020 after Australia joined other nations in launching an investigation into the origins of COVID-19, triggering China's rage, which imposed bans on multiple Australian products. According to market talks, coal imports could resume as soon as April 1.

Another factor weighing on the US Dollar came from Japan, as the Bank of Japan attempted to lower government bond yields. Governor Haruhiko Kuroda noted that policymakers would continue to ease monetary policy to achieve their inflation goal.

Global yields were down, adding pressure on the American currency, as Australian and Japanese news affected local yields while dragging lower overseas counterparts.

The International Monetary Fund (IMF) managing director said a third of the world's economies could slide into a recession in 2023.

Sentiment continues to revolve around China's economic progress. On the one hand, market players are optimistic the country will resume growth after dropping the zero-covid policy. But, on the other, many expect such recovery to be a long and bumpy road.

Mid-US afternoon, the FOMC released the Minutes of its latest meeting. The document showed that policymakers remain concerned about inflation risks, and while they welcomed easing price pressures in October and November, they are still taking monetary policy decisions on the base of price pressures.

Most participants noted the upside risks to inflation remain a key factor in shaping the monetary policy outlook. Some officials believe inflation risks could be more persistent, while a couple of officials think the risks are more balanced. Finally, there are no hints on how much Fed officials intend to raise interest rates at their next meeting.

The news pushed stocks off their intraday highs and fueled speculation that US officials will remain on the aggressive tightening path.

EUR/USD struggles to retain the 1.0600 threshold at the end of the day, as the shared currency remains among the weakest USD rivals.

The GBP/USD pair returned to its comfort zone at around 1.2050, little changed on a weekly basis. Concerns about a UK recession undermined demand for the British Pound amid negative real GDP.

Commodity-linked currencies led the way against the greenback, with the AUD rallying over 150 pips. AUD/USD now trades at around 0.6830, weighed by easing Wall Street. The USD/CAD, on the other hand, trades at around 1.3500, not far from an intraday low of 1.3476.

The USD/JPY pair advanced roughly 200 pips during US trading hours to end the day at around 132.60. The pair soared after a poor US ISM Manufacturing PMI and as US government bond yields jumped north.

Crude oil prices kept falling on Wednesday amid concerns about Chinese demand. WTI tumbled at trades at $72.90 a barrel. On the one hand, the commodity was affected by fears of reduced Chinese demand, later declining on the back of easing US indexes.

Gold trades at around $1,851 after hitting a fresh six-month high of $1,865.12

US Treasury yields eased, with the 10-year note currently hovering at around 3.70%, down 8 bps on the day, and the 2-year note offering 4.38%, down 2 bps.

UK National Crime Agency prepares to tackle fraud with new crypto unit

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:49

EUR/USD rises back above 1.0600 as Fed officials eye no rate cuts in 2023

- EUR/USD dived to 1.0580s on the release of the US Federal Reserve minutes.

- FOMC: Officials do not expect to cut rates in 2023.

- FOMC: Policymakers did not express the size for further rate hikes.

EUR/USD holds to the 1.0600 figure after the Federal Reserve (Fed) unveiled December’s monetary policy minutes which showed that policymakers remain resolute in tackling inflation and do not expect rate cuts during 2023. Therefore, the EUR/USD dived to 1.0585 before rebounding to current exchange rates. At the time of typing, the EUR/USD is trading at around 1.0600.

Summary of the December FOMC minutes

The Federal Reserve’s December minutes showed that officials agreed to slow the pace of interest rate hikes but added that a slowdown is not a “weakening commitment to achieving price stability on that inflation is already on a persistent downward path.” They also added that the US central bank had made significant progress in moving to restrictive policies in 2022 and that “no one predicted that rate cuts would be necessary for 2023.”

The minutes flashed that inflation risks could be more persistent. Even though the Fed welcomed October and November drop in inflation, they do not indicate that inflation is on a “persistent downward path.”

EUR/USD Reaction to the headline

The EUR/USD 1-hour chart showed that the shared currency edged towards the daily pivot at around 1.0580 but quickly retraced the downward move and climbed towards the 20-hour Exponential Moving Average (EMA) at around 1.0598, surpassing it towards 1.0600. Oscillators like the Relative Strength Index (RSI) persisted in bullish territory, while the Rate of Change (RoC) showed that sellers were gathering momentum. Therefore, the EUR/USD might remain range-bound within the 1.0580/1.0620 range ahead of the Wall Street close.

-

19:23

Gold Price Forecast: XAU/USD seesaws around $1,850 after hawkish FOMC minutes

- Gold reacted downwards towards the low $1,840s on the release.

- FOMC: Officials do not expect to cut rates in 2023.

- FOMC: Policymakers did not express the size for further rate hikes.

Gold price clings to gains around $1850 following the release of the Federal Reserve’s Open Market Committee (FOMC) minutes for the last meeting, which emphasized the need for the central bank to tighten conditions amid stubbornly high inflation levels. At the time of writing, the XAG/USD is trading at around $1,850.

Summary of the FOMC minutes

The December minutes showed that policymakers agreed to slow the pace of interest rate hikes but added that a slowdown is not a “weakening commitment to achieving price stability on that inflation is already on a persistent downward path.” Fed officials added that the US central bank had made significant progress in moving to restrictive policies and added that no rate cuts would be necessary for 2023.

Additionally, policymakers added that inflation risks could be more persistent and that further increases to the Federal Funds rate (FFR) would be appropriate.

US Dollar and Gold’s reaction

The US Dollar Index (DXY) headed towards 104.409 but retraced some of its gains. The XAU/USD slumped below $1,850, extending its drop towards $1,843, though, at the time of typing, it seesaws around the $1,850 figure.

Regarding US Treasury bond yields, which play a big part in XAU/USD’s direction, the 10-year benchmark note rate sits at 3.709%, falling three and a half bps during the day. Therefore, if XAU/USD holds to gains above $1,850, that could pave the way for a test of $1,900.

Gold Hourly Chart

-

19:09

FOMC Minutes: Hawkish Fed officials uncomfortable with inflation levels

The Federal Open Market Committee released the Minutes of the December 14-15 Meeting, spurring little action across the FX board. The US Dollar was little changed with the news, although US short-term interest-rate futures dropped.

Key notes

Most participants welcomed inflation easing in October and November but agreed it would take "substantially more evidence" of progress, to confirm the downward path.

Participants agreed that the central bank had made significant progress in moving to a sufficiently restrictive monetary policy stance in the previous year.

Most participants noted the upside risks to inflation remain a key factor in shaping the monetary policy outlook.

Some officials believe inflation risks could be more persistent, while a couple of officials think the risks are more balanced.

Any of the FOMC voting members predicted that rate cuts would be necessary for 2023.

Full Statement

-

18:54

NZD/USD erases some of Tuesday’s losses and hovers around 0.6300

- The NZD/USD rises courtesy of an improvement in market sentiment.

- US economic data was mixed with prices easing, while the labor market remains tight, supporting further Fed tightening.

- Minnesota Fed’s Kashkari foresees rates peaking at around 5.4%.

The New Zealand Dollar (NZD) snapped two days of losses against the US Dollar (USD), as economic data released in the United States (US), showed the labor market remains tight while manufacturing activity continues to contract. All this in an upbeat mood spurred on China’s news. At the time of writing, the NZD/USD is trading at 0.6299..

US manufacturing activity slides while inflationary pressures ease

Traders’ mood remains optimistic as high beta currencies rose. The NZD/USD slipped from daily highs around 0.6352 at the release of mixed US economic data. The Institute for Supply Management (ISM) revealed that Manufacturing PMI for December dropped to 48.4, exceeding estimates for a fall to 48.5, extending its downtrend for the second consecutive month. The report highlighted that prices and demand are slowing, a welcomed development for the Federal Reserve (Fed), while the employment subcomponent expanded, implying the tightness of the labor market.

At the same time, the November US JOLTs reported that vacancies rose to 10.458M, higher than the 10.0M estimated by analysts. October figures were upward revised to 10.512M, almost 200K more than the reported data, further cementing the case for additional Fed action.

Meanwhile, Minnesota’s Fed President Neil Kashkari (voter in 2023) said that it would be appropriate to continue to hike rates “at least at the next few meetings” until inflation has peaked and foresees the Federal Funds rate (FFR) at 5.4%. He added that the Fed must avoid cutting the policy rate prematurely and would consider cutting only when it’s convinced inflation is on its way back down to 2%.

Aside from this, the NZD/USD resumed its upward trajectory, though it is seesawing around the 20-day Exponential Moving Average (EMA) at 0.6301. if the NZD/USD achieves a daily close above the latter, further upside is expected. Contrarily, the NZD/USD might retest the 50-day EMA at 0.6209.

What to watch

An absent New Zealand (NZ) economic docket would leave traders adrift to US dynamics. The US economic calendar would feature the US Federal Reserve’s (Fed) last meeting minutes, followed by the Balance of Trade and the Initial Jobless Claims report on Thursday, ahead of the US Nonfarm Payrolls report on Friday.

NZD/USD Key Technical Levels

-

17:49

USD/CHF Price Analysis: Drops below 0.9300 ahead of FOMC minutes

- USD/CHF failed to crack above 0.9400, exacerbating a fall beneath 0.9300.

- US Dollar weakness and the confluence of technical levels around 0.9370s stalled the USD/CHF rally.

- A daily close above 0.9250 could lift the USD/CHF back again, towards 0.9300.

The USD/CHF struggles to clear the 0.9370 barrier, dives below the 20-day Exponential Moving Average (EMA), and the 0.9300 figure as the US Dollar (USD) weakens. The USD/CHF is trading at 0.9279, below its opening price by 0.80%.

USD/CHF Price Analysis: Technical outlook

After reaching a weekly high at around 0.9398 on Wednesday, the USD/CHF shifted gears and snapped three days of gains. The USD/CHF dived below the 20-day EMA, which sits at 0.9317, extending its fall toward its daily lows of 0.9253, but solid support around the latter spurred a slight jump to the current exchange rates.

The Relative Strength Index (RSI) failed to crack its midline and remained at bearish territory, exacerbating today’s fall. The Rate of Change (RoC) flashes sellers gathering some momentum. However, the top trendline of a falling wedge, a bullish chart pattern that emerged in the USD/CHF daily chart, stalled the drop. Therefore, the USD/CHF might remain range-bound.

The USD/CHF key support levels would be the 0.9250 figure, followed by the 0.9200 mark. As an alternate scenario, the USD/CHF first resistance would be 0.9300, followed by the weekly high of 0.9398, ahead of the 0.9400 mark.

USD/CHF Key Technical Levels

-

16:51

EUR/USD climbs above 1.0600 after mixed US data, as Fed’s minutes loom

- November’s US JOLTs report exceeded estimates, and upward revisions to October’s report suggest the labor market remains tight.

- US ISM Manufacturing PMI for December contracted for the second consecutive month.

- EUR/USD Price Analysis: Seesawing at around the 20-day EMA and the 1.0600 mark.

The Euro (EUR) retraces against the US Dollar (USD) after hitting daily highs of 1.0635 and is dropping after the release of mixed US economic data, slightly boosted the US Dollar and shifting sentiment sour. At the time of writing, the EUR/USD is trading at 1.0616, above its opening price by 0.66%.

The EUR/USD fell below 1.0600 after the release of US economic data. November’s JOLTs report showed that the labor market remains tight, coming at 10.458M vs. 10.0M estimates, while October’s upward revision to 10.512M vs. 10.334M cemented the Federal Reserve’s (Fed) case for a 50 bps rate hike on February 1.

At the same time, the Institute for Supply Management (ISM) revealed the Manufacturing PMI index for December, which fell to 48.4, more than the 48.5 estimated by street analysts. Timothy R. Fiore, Chair of the ISM, noted, “The US manufacturing sector again contracted, with the Manufacturing PMI® at its lowest level since the coronavirus pandemic recovery began. With Business Survey Committee panelists reporting softening new order rates over the previous seven months, the December composite index reading reflects companies’ slowing their output.”

Delving into the sub-components of the report, the Employment Index rose by 51.4, returning into expansion, showing an improvement in the labor market, though pressuring the Federal Reserve for further action. The Production and Prices indices continued to ease, flashing the consumer’s shift toward services rather than goods.

Meanwhile, the US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, falls 0.41%, down to 104.258.

EUR/USD Price Analysis: Technical outlook

From a daily chart perspective, the EUR/USD remains neutral biased, seesawing around the 20-day Exponential Moving Average (EMA) at around 1.0583. Since today’s price action has failed to crack Tuesday’s high of 1.0683, the EUR/USD pair remains exposed to selling pressure. However, it should be said that the Relative Strength Index (RSI) bounced nearby the 50 mid-line, while the Rate of Change (RoC) is almost flat.

The EUR/USD key resistance levels are 1.0683, followed by the 1.0700 mark. On the flip side, the EUR/USD first support would be the 1.0600 mark, followed by the 20-day EMA at 1.0584 and the January 3 swing low of 1.0519.

-

16:21

USD/IDR: Indonesian Rupiah to rebound modestly in 2023 – MUFG

Analysts at MUFG Bank consider that the Indonesian Rupiah (IDR) is set to rebound modestly during 2023. They forecast the USD/IDR to reach levels around 15.200 by the end of the year.

Potential IDR weakness mitigated by fundamentals and policy

“The IDR has weakened in 2022 against the USD, with an 8.8% move (until 16 Dec). From 2021’s close of 14,253, USD/IDR reached a YTD high of 15,750 on 4 November, before slight moderation thereafter. We expect a modest rebound for the IDR in 2023 and forecast USD/IDR at 15,200 at the end of 2023, from end-2022 of around 15,700.”

“Indonesia’s fundamentals have been broadly supported by external and domestic factors in 2022, despite some currency weaknesses from a stronger dollar. We anticipate a shift to domestic support in 2023, as external conditions turn more volatile. Our view of the slightly lower USD/IDR is premised on a weaker dollar alongside a balanced current account outlook in 2023. Risks

-

16:18

US: Manufacturing is slowing, price pressure is abating – Wells Fargo

The ISM Manufacturing report for December showed activity continues to slow. Analysts at Wells Fargo point out that the report showed price pressure is abating, and argued that while the labor market is slowing, it's doing so only gradually.

Falling prices at the expense of contraction in activity

“The ISM manufacturing index slipped further into contraction territory in December dipping to 48.4, the lowest number for this factory bellwether since the early days of the pandemic in May 2020. New orders and production were both lower and both were also in contraction territory. Both imports and exports fell deeper into contraction amid abounding signs of slowing global growth.”

“The largest decline was not in orders or in production, but rather in the prices component which slid 3.6 points to 39.4, approaching lows hit amid the height of the pandemic lockdowns in March and April of 2020. Not only that, the prices paid measure has posted declines for 9 straight months, suggesting that the fastest Fed tightening since the 1980s is being met with the intended drop in price pressures.”

“On Friday, we'll get the latest data for total payrolls in the U.S. economy in which we still expect to see payrolls rose by 205K in December. While this will mark a step down from the 272K workers added on average per month over the prior three months, it's still above pre-pandemic averages and consistent with a solid pace of hiring.”

-

16:06

EUR/GBP seen rising to 0.90 on a six to nine-month view – Rabobank

The discussion about the Bank of England’s rate outlook could create volatility for GBP crosses during 2023, warn analysts at Rabobank. They continue to see the EUR/GBP cross moving to the upside, reaching 0.90 in six to nine months.

BoE could turn dovish before either the ECB or the Fed

“One of the big themes for the year ahead will be the debate related to the likely timing of rate cuts from the large central banks. With the exception perhaps of the BoJ, there is a reasonable consensus about the likely timing of peak rates for most G10 central banks. By contrast, there is a big spread in opinions about when the first rate cuts could come, with economists apparently more likely than money market participants to judge that rates could remain higher for longer.

“There is speculation in the UK press that grim UK economic fundamentals could mean that the BoE could blink and cut rates before year end. While we do not subscribe to this outlook, the discussion regarding the BoE rate outlook could certainly create volatility for the GBP crosses this year.”

“The fact that the UK is already in a recession which, according to the BoE, could last all year suggests that GBP is likely to be sensitive to expectations that the BoE could turn dovish before either the ECB or the Fed. Even if the BoE has good reason to step up a hawkish tone, there were various instances last year when this failed to boost GBP, given the backdrop of weak investment growth, low productivity and overhanging uncertainties about the UK’s post Brexit relationship with the EU.”

“We retain the view that EUR/GBP will creep to 0.90 on a 6 to 9 month view.”

-

15:49

USD/INR forecast at 79.8 by the end of 2023 – MUFG

The Indian Rupee led declines among most emerging Asia currencies in 2022, slumping 10.9% year-to-date against the US dollar (as of December 15), point out analysts at MUFG. They expect the USD/INR pair to reach 79.8 by the end of 2023. Currently it is trading at 82.75.

Rupee boosted by India’s growth relative outperformance

“INR was the worst performing currency among its Asian peers this year due to resuming net portfolio outflows of foreign investments in India’s equity markets amid a strong dollar, even as India’s Nifty50 and Sensex were outliers in most stock market indices around the world sitting in red. Like other Asian currencies, US dollar remains in the driver seat for a higher USD/INR in next quarter. Having said that, the relative outperformance of India’s growth in 2023 compared with most of Asia economies, as well as that for US and Europe, alongside a sustained weaker dollar after 1Q23, funneling capital into Indian markets by foreigner should return, offering support to the INR.”

“The central bank likely delivers a final hike of 25bps at its next meeting in February 2023, lifting its repo rate to a terminal level of 6.50%. Notably, the real policy rate has turned positive, posing downside risks to economic growth. This also suggests that that peak of policy rate in this cycle is close to support the economy.”

“We see USD/INR rise to 82.3 in 1Q23 before getting back on the declining trek thereafter to reach 79.8 at end of 2023.”

-

15:41

USD/KRW likely to continue to rise during Q1 – MUFG

The Korean Won is expected to appreciate by around 5% during 2023 according to analysts at MUFG Bank. They see the USD/KRK at 1340 by the end of the first quarter and at 1240 by the end of 2023.

Won to turn positive during the second half of 2023

“Given the possibility of recovery in US dollar value till late 1Q or early Q2, 2023, we see some increase of USD/KRW during the period. However, when Fed eventually pivots, improving interest rate spread with US, a weakening US dollar, and Won’s undervaluation, these factors likely push Won to strengthen against the USD till the end of 2023.”

“Overall, we expect a roughly 5% appreciation for Won in 2023, which is still not enough to retrace its depreciation in 2022, due to the considerations that as an export-reliant economy and a net importer of energy, the country’s trade deficit likely continues to run large, as external demand weakens due to recessions in Europe and the US, energy prices stay high due to supply constraints, and tech sector probably still remains weak.”

“We expect USD/KRW to rise to 1340 at 1Q 2023 then fall to 1240 by the end of 2023.”

-

15:30

USD/JPY jumps toward 132.00 following US data, ahead of FOMC minutes

- US Dollar recovers strength after US data.

- US ISM Manufacturing Index drops to 48.4 versus 48.5 of market consensus.

- USD/JPY jumps after the report; attention turns to FOMC minutes.

The USD/JPY jumped from below 131.00 to 131.90 hitting the highest level since December 30 following the release of the US ISM Manufacturing Index and ahead of the FOMC minutes. A sharp rebound in US yields weighed on the Japanese Yen.

Dollar trims losses

The DXY is falling by just 0.35% and trades at 104.30 after being under 104.00 hours ago. The rebound accelerated after the latest round of US economic data. On the contrary, the Yen weakened amid surging US bond yields. The US 10-year yield rose from six-day lows at 3.67% to 3.71%.

The ISM Manufacturing report showed that business activity in the manufacturing sector contracted for the second straight month in December. The main index declined to 48.4 from 49 in November and below the market consensus of 48.5. The employment index rose to 51.4 surpassing expectations. The Price Paid index declined from 43 to 39.4, another sign of a slowdown in inflation.

The Federal Reserve will release at 19:00 GMT the minutes of the latest FOMC meeting. The document will be scrutinized for signs about the future path of monetary policy. On Thursday the ADP employment report is due and on Friday, NFP.

USD/JPY looking at 132.00

The USD/JPY is breaking and holding above 131.30/50, a positive development for the bulls. The pair is now looking at 132.00. Above the next relevant barrier is seen at the 132.30 zone. A decline back under 131.00 should suggest that the bearish pressure is still intact suggesting the bullish correction is over. A consolidation below 130.00 is needed to clear the way to more losses.

Technical levels

-

15:12

US: JOLTS Job Openings little changed at 10.45 million in November

- Job openings in the US declined margianlly in November.

- US Dollar Index continues to rise toward 104.50.

The data published by the US Bureau of Labor Statistics (BLS) revealed on Wednesday that the number of job openings on the last business day of November was 10.45 million, compared to 10.51 million in October and the market expectation of 10 million.

"Over the month, the number of hires and total separations changed little at 6.1 million and 5.9 million, respectively," the BLS further noted in its publication. "Within separations, quits (4.2 million) and layoffs and discharges (1.4 million) changed little."

Market reaction

The US Dollar Index stages a rebound in the American session and was last at 104.35, where it was still down 0.3% on the day.

-

15:06

US: ISM Manufacturing PMI declines to 48.4 in December vs. 48.5 expected

- US ISM Manufacturing PMI declined modestly in December.

- US Dollar Index recovers from daily lows, holds above 104.00.

Business activity in the US manufacturing sector contracted for the second straight month in December with ISM's Manufacturing PMI declining to 48.4 from 49 in November. This reading came in slightly below the market expectation of 48.5.

Further details of the publication revealed that the Prices Paid Index slumped to 39.4 from 43 and the Employment Index improved to 51.4 from 48.4.

Commenting on the survey's findings, "manufacturing contracted again in December after expanding for 29 straight months," noted Timothy R. Fiore, Chair of the Institute for Supply Management.

"Panelists' companies continue to judiciously manage hiring. The month-over-month performance of supplier deliveries was the best since March 2009," Fiore added. Managing head counts and total supply chain inventories remain primary goals as the sector closes the year. More attention will be paid to demand as we enter the first quarter to shore up order books for the next six to 12 months."

Market reaction

The US Dollar Index edged higher with the initial reaction and was last seen losing 0.45% on the day at 104.22.

-

15:05

Gold Price Forecast: XAU/USD climbs above $1,850 on improved mood, ahead of FOMC minutes

- Gold prices are bolstered by an upbeat market sentiment keeping the US Dollar offered.

- Investors cheered China’s planning to support the property market and the relaxation of its Covid zero-tolerance policy.

- A busy US economic docket keeps traders wary of propelling the US Dollar.

- Minnesota Fed Kashkari: The Fed must avoid cutting rates prematurely.

Gold price rallied to eight-month highs around $1,865.15, though slightly retraced some of its gains amidst an upbeat market sentiment, spurred by China’s support to its housing market, alongside its border reopening, as it relaxes Covid-19 zero-tolerance measures. Investors get ready for a busy economic calendar in the United States (US), while Federal Reserve’s (Fed) officials began to cross newswires. At the time of writing, the XAU/USD is trading at $1,856.01, above its opening price by 1%.

Upbeat market mood spurred by China’s news underpinned Gold

Wall Street is poised to open higher, as shown by equity futures rising, while the US Dollar (USD) weakens. Factors like Chinese authorities planning to deliver additional support to property developers, aimed to relax liquidity stress in some “too-big-to-fail” developers, sparked a rally in Asian stocks. Meanwhile, China’s reopening was cheered by investors, even though the country reported 5 Covid deaths on January 3, vs. three from the previous day.

US Dollar weakens as traders brace for US data

Aside from this, investors waiting for US economic data has bolstered Gold prices, as Tuesday’s US Dollar longs exited ahead of market-moving data. Following the S&P Global Manufacturing PMI release on Tuesday, the Institute for Supply Management (ISM) for December is expected to drop from 49.0 to 48.5. Also, the JOLTs report is estimated to hit 10 M, vs. 10.334M in the previous month, while the main spotlight would be the release of the Federal Open Market Committee (FOMC) December meeting minutes.

Minnesota Fed Kashkari sees rates around 5.4%

In the meantime, Minnesota’s Fed President Neil Kashkari (voter in 2023) said that it would be appropriate to continue to hike rates “at least at the next few meetings” until inflation has peaked and foresees the Federal Funds rate (FFR) at 5.4%. He added that the Fed must avoid cutting the policy rate prematurely and would consider cutting only when it’s convinced inflation is on its way back down to 2%.

Gold Daily Chart

Gold Key Technical Levels

-

15:04

USD Index bounces off lows and regains 104.00 ahead of FOMC

- The index meets some initial contention near 103.80.

- The key ISM Manufacturing surprised to the downside in December.

- Investors’ attention remains on the FOMC Minutes due later on Wednesday.

Following an earlier drop to daily lows near 103.80, the USD Index (DXY) manages to pick up some pace and retake the 104.00 neighbourhood on Wednesday.

USD Index looks offered ahead of FOMC Minutes

Despite the bounce off daily lows, the dollar remains well on the defensive midweek against the backdrop of the broad-based better tone in the risk-associated complex.

The downbeat mood in the buck is also underpinned by another negative session of US yields across the curve, leaving the pessimism in the first week of the new trading year unchanged so far.

Furthermore, the dollar remains cautious ahead of the publication of the FOMC Minutes of the December 14 gathering later in the NA session, where market participants will closely follow members’ opinions of the recent loss of momentum in the domestic inflation vs. the resilience in the labour market and the impact on the future decisions on interest rate hikes.

In the US calendar, MBA Mortgage Applications contracted 10.3% in the week to December 30 and the key ISM Manufacturing receded to 48.4 for the month of December. Additionally, JOLTs Job Openings eased to 10.458M during November.

What to look for around USD

The dollar loses some traction after a strong start of the new year on Tuesday, when it climbed to the proximity of the 105.00 hurdle, or 2-week highs.

Meanwhile, the Fed’s pivot narrative remains in the freezer for the time being, although upcoming key results in US fundamentals would likely play a key role in determining the chances of a slower pace of the Fed’s normalization process in the next months.

Key events in the US this week: MBA Mortgage Applications, ISM Manufacturing PMI, FOMC Minutes (Wednesday) – ADP Employment Change, Initial Jobless Claims, Balance of Trade, Final S&P Global Services PMI (Thursday) – Nonfarm Payrolls, Unemployment Rate, ISM Non-Manufacturing PMI, Factory Orders (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is retreating 0.65% at 104.01 and the breakdown of 103.39 (monthly low December 30) would open the door to 101.29 (monthly low May 30) and finally 100.00 (psychological level). On the upside, the next hurdle comes at 104.85 (weekly high January 3) seconded by 105.82 (weekly high December 7) and then 106.25 (200-day SMA).

-

15:01

United States JOLTS Job Openings registered at 10.458M above expectations (10M) in November

-

15:01

United States ISM Manufacturing PMI registered at 48.4, below expectations (48.5) in December

-

15:00

United States ISM Manufacturing Prices Paid came in at 39.4, below expectations (42.6) in December

-

15:00

United States ISM Manufacturing Employment Index came in at 51.4, above forecasts (48.3) in December

-

15:00

United States ISM Manufacturing New Orders Index below forecasts (48.1) in December: Actual (45.2)

-

14:18

Fed's Kashkari: Fed must avoid cutting rates prematurely

Minneapolis Federal Reserve (Fed) President Neel Kashkari said on Wednesday that the Fed must avoid cutting the policy rate prematurely and having inflation flare up again, as reported by Reuters.

Key takeaways

"Appropriate to continue interest rate hikes at least at the next few meetings until confident inflation has peaked."

"Increasing evidence that inflation may have peaked."

"Fed should then hold target interest rate and says his forecast is that would be at 5.4%."

"Won't know if that is high enough until Fed pauses for a reasonable period of time."

"Once Fed allows for policy lag effects, can then assess if rates need to go higher or remain at peak for longer."

"In this phase, any sign of slow progress on lowering inflation will require taking policy rate potentially much higher."

"Fed can consider cutting rates only when convinced inflation well on its way back down to 2% target."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen losing 0.6% on the day at 104.05.

-

13:55

United States Redbook Index (YoY) rose from previous 9.6% to 10.2% in December 30

-

13:54

GBP/USD retreats modestly, clings to strong gains near 1.2050

- GBP/USD consolidates its daily gains following earlier rally.

- Wall Street's main indexes remain on track to open in positive territory.

- Latest YouGov survey points to a decline in UK inflation expectations.

GBP/USD edged modestly lower after having reached a daily high of 1.2088 during the European trading hours. As of writing, the pair was still up 0.75% on the day at 1.2057.

The positive shift witnessed in risk sentiment earlier in the day caused the US Dollar to come under renewed selling pressure. Additionally, falling US Treasury bond yields put additional weight on the currency. The benchmark 10-year US Treasury bond yield, which fell more than 2% on Tuesday, stays in negative territory below 3.7%.

Currently, US stock index futures are up between 0.4% and 0.8% on a daily basis, pointing to a positive opening in Wall Street's main indexes.

Later in the session, the ISM's will release the December Manufacturing PMI report. The headline PMI is forecast to decline to 48.5 from 49 in December. Market participants will also pay close attention to the Prices Paid component of the survey, which will offer fresh insight into input inflation in the manufacturing sector.

Finally, the Federal Reserve will publish the minutes of the December policy meeting at 1900 GMT. At the time of press, the CME Group's FedWatch Tool shows that markets are pricing in a 72.3% probability of a 25 basis points Fed rate hike in February.

In the meantime, the latest monthly survey conducted by Citi and YouGov revealed that the British public's inflation expectations for 12 months ahead declined to 5.7% in December from 6.1% in the November's survey.

Technical levels to watch for

-

13:51

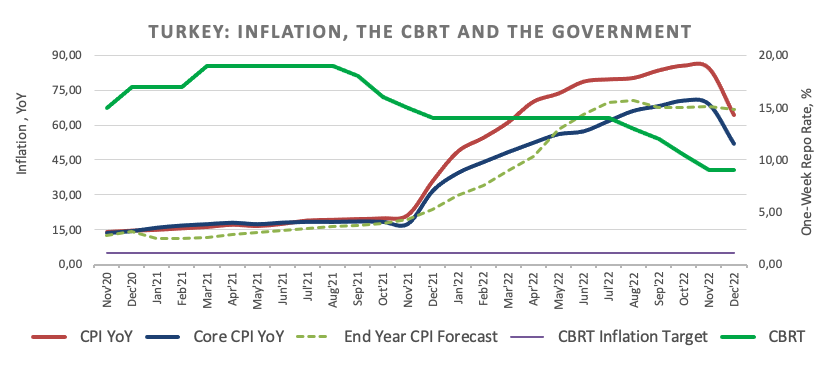

USD/TRY stays bid and climbs to fresh all-time highs near 18.73

- USD/TRY flirts with the 18.73 level, new record high.

- Inflation in Türkiye surprised to the downside in December.

- The CBRT could extend the impasse further in the next meetings.

The Türkiye lira gives away part of Tuesday’s gains and motivates USD/TRY to climb further and clinch new all-time peaks near 18.73 on Wednesday.

USD/TRY remains broadly consolidative

Price action in USD/TRY keeps the multi-month erratic performance well in place for the time being.

Indeed, the pair remained largely apathetic to the latest release of the inflation figures in the country, where the CPI extended further the drop from 24-year highs recorded back in October 2022, always on the back of strong base effects.

On the latter, the headline CPI rose at an annualized 64.27% in December, while the Core CPI gained 51.93% YoY and Producer Prices climbed 97.72% YoY.

Moving forward, the current disinflation seems to fall in line with President Erdogan’s views that inflation should see a pronounced decline during the first half of the new year amidst the absence of strong headwinds and relatively stable macro environment.

Against this, the Türkiye’s central bank (CBRT) could refrain from acting on the interest rates after a 500 bps cut during the past year.

What to look for around TRY

USD/TRY remains within the multi-month consolidative theme near all-time highs in the 18.70 region.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and dollar dynamics.

In the meantime, the lira is expected to remain under the microscope in response to Ankara’s plans to prioritize growth via transforming the current account deficit into surplus and always following a lower-interest-rate recipe.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Tuesday).

Eminent issues on the back boiler: Threats of FX intervention by the CBRT. Persistent government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 2023.

USD/TRY key levels

So far, the pair is gaining 0.25% at 18.7041 and faces the next hurdle at 18.7287 (all-time high January 4) followed by 19.00 (round level). On the downside, a break below 18.5992 (55-day SMA) would expose 18.5565 (weekly low December 26) and finally 18.4827 (monthly low December 13).

-

12:00

United States MBA Mortgage Applications down to -10.3% in December 23 from previous 0.9%

-

11:47

UK: Public inflation expectations for 12 months ahead fall to 5.7% in December from 6.1%

A monthly survey conducted by Citi and YouGov revealed on Wednesday that the British public's inflation expectations for 12 months ahead declined to 5.7% in December from 6.1% in the previous survey, as reported by Reuters.

Public inflation expectations for 5-10 years ahead fell to 3.6% from 3.9% previously, the survey further showed.

Finally, Citi said that the latest findings point to a moderating risk of a more embedded inflation through 2023.

Market reaction

GBP/USD edged lower from the daily high it set at 1.2087 and was last seen trading near 1.2050, where it was still up 0.7% on a daily basis.

-

11:43

USD/CAD drops below 1.3550 ahead of US data

- USD/CAD is already down more than 100 pips on Wednesday.

- The US Dollar Index stays deep in negative territory ahead of key US data.

- Falling crude oil prices don't seem to be impacting CAD's performance for the time being.

USD/CAD came under heavy bearish pressure on Wednesday and dropped to a fresh daily low of 1.3542 during the European trading hours. As of writing, the pair was down 0.85% on the day at 1.3555.

The broad-based US Dollar weakness on Wednesday forces USD/CAD to stay on the back foot. Following Tuesday's rally, the US Dollar Index is down more than 0.5% on a daily basis near 104.00. Improving risk mood, as reflected by the 0.5% gain in the S&P Futures, seems to be hurting the safe-haven US Dollar as investors await key macroeconomic data releases.

The ISM will publish the December Manufacturing PMI report. In addition to the headline PMI reading, investors will also pay close attention to the inflation component, the Prices Paid Index. Later in the day, the FOMC will release the minutes of the December policy meeting.

US Dec ISM Manufacturing PMI Preview: Encouraging sub-indices could temporarily boost US Dollar.

Meanwhile, crude oil prices are down sharply for the second straight day on Wednesday. After having lost nearly 4% on Tuesday, the barrel of West Texas Intermediate is already down nearly 3% on the day, trading slightly below $75. For the time being, however, the US Dollar's market valuation continues to drive the pair's action as the commodity-related Canadian Dollar doesn't seem to be paying attention to oil prices.

Technical levels to watch for

-

11:06

EUR/USD Price Analysis: Next on the upside comes 1.0713

- EUR/USD partially reverses Tuesday’s strong decline to the 1.0520 zone.

- Further upside is expected to meet the next barrier at 1.0713.

EUR/USD reverses part of the weekly leg lower and advances past 1.0600 the figure on Wednesday.

Further upside in the pair could now see the weekly high at 1.0713 (December 30) revisited in the near term ahead of the December 2022 peak at 1.0736 (December 15).

The constructive outlook for EUR/USD should remain unchanged while above the key 200-day SMA, today at 1.0316.

EUR/USD daily chart

-

10:45

USD Index Price Analysis: Extra losses likely below 103.39

- The index starts the new year in an erratic fashion.

- The multi-month low at 103.39 emerges as the next support.

DXY gives away most of Tuesday’s strong advance to the boundaries of the 105.00 hurdle and returns to the sub-104.00 region on Wednesday.

The index appears to have moved into a consolidative phase, although the outlook remains tilted to the downside while it remains below the key 200-day SMA at 106.25.

A deeper pullback could revisit the multi-month low at 103.39 (December 30). The loss of this region could leave the dollar vulnerable to further losses in the short-term horizon.

DXY daily chart

-

10:25

China still trying to cope with surge in Covid infections – Rabobank

Analysts at Rabobank note that China is still trying to cope with the surge in Covid infections after restrictions were eased.

EU will discuss a joint-policy today

"Some news outlets are reporting a potential peak in new infections, whereas reports of over-full hospitals and morgues paint a much bleaker picture. Some countries have already imposed inbound travel restrictions for passengers from China, and the EU will discuss a joint-policy today."

"The recent surge in Covid infections is not only straining the Chinese health care system. Bloomberg reports that it may now also stifle Beijing’s plans to kick-start a domestic semiconductor industry to compete with US-controlled supply chains. According to Bloomberg, the virus’ impact on the government’s budget forces government officials to reconsider its subsidies for the sector, which have been expensive and have yielded relatively few results."

"It’s yet unclear what alternative policies the government may unveil but new strategies could include lowering the costs of materials, according to the news agency’s sources. This may slow the country’s path towards self-sufficiency in the chip sector, as it seeks to untangle itself from the US – which has increasingly been limiting its strategic rival’s access to key chip resources."

-

10:21

Calendar picks up pace with US Manufacturing ISM and FOMC Minutes – Societe Generale

Analysts at Societe Generale note that the US Dollar stages a broad retreat early Wednesday ahead of key data releases.

Macro calendar picks up pace today

"The brace of below forecast inflation data from France and Germany may not reshape policy tactics at the ECB but the speedier drop in prices will fuel hopes that perhaps inflation trends could improve more quickly in 2023. It is early days of course and reports over surging food prices and faster wage growth could keep core inflation rates elevated. The reduction in energy gas bills in Germany will not be repeated next month and means that inflation will probably return to double digits in January."

"The macro calendar picks up pace today with the US manufacturing ISM, JOLTS job openings and FOMC minutes. A flurry of client enquiries followed the intra-day 1.5% swoon from high to low yesterday in EUR/USD but buyers emerged on the dip overnight."

"The dollar stages a broader retreat on higher stocks in HK and China. Besides the correlation with risk assets, a reopening of the Chinese economy and boost to European trade can galvanise gains for the single currency. The US macro releases today and NFP on Friday should provide a clearer view of whether the tactic of selling dollar rallies remains pertinent or is losing its appeal. The price action this morning suggests it is the former. The FOMC raised the dot plot for 2023 through 2025 last month, with interest rates staying restrictive for the next three years."

-

10:13

Market-implied expectations of ECB’s next few rate hikes shifted marginally lower – Rabobank

Assessing the latest inflation figures from Germany, Rabobank analsysts noted that German HICP inflation slowed from 11.3% y/y to 9.6%; the lowest reading since August.

Not surprising ECB’s hawks have not been muted

"That’s a softer than expected headline number, with markets anticipating a drop to 10.2%. Yet, as welcome as this stronger retreat to single-digit headline numbers is, the reading is affected by some unusual factors. Most importantly, the German government provided one-off compensation for energy bills last month. Meanwhile, prices of e.g. services have re-accelerated to 3.9%, in a sign that any retreat back to the ECB’s 2%-target may be a long process."

"Market-implied expectations of the ECB’s next few rate hikes have shifted marginally lower since the release of the data, with a cumulative 120bp of hikes priced by May, down from 126bp before the turn of the year."

"That said, adding to the ECB’s concerns that it could take significant time before inflation returns to the central banks’ target, labour markets remain tight in various countries. Specifically, German unemployment unexpectedly fell in December. According to the Federal Labour Agency, there were 13,000 fewer unemployed after adjusting for seasonal factors and the inflow of Ukrainian refugees. With employment at a new high (latest data is for November), staff shortages continue to support employees’ bargaining power as they try to recoup some of the real incomes lost to high inflation."

"Given the upside risks, it’s not surprising that the ECB’s hawks have not been muted by these recent inflation data. Kazaks repeated that he sees “significant” rate increases at the February and March meetings, after which “of course the steps may become smaller as necessary as we find the level appropriate to bring the inflation down to 2%.”

-

09:45

EUR/JPY Price Analysis: Weakness expected to persist below the 200-day SMA

- EUR/JPY picks up some upside traction and regains 138.00.

- The immediate target appears at the 200-day SMA (140.45).

EUR/JPY manages to leave behind four consecutive daily drops and reclaims the area beyond 138.00 the figure on Wednesday.

Despite the daily bounce, the cross still trades under pressure and the door remains open to another probable visit to recent lows in the 137.40/35 band (January 3).

The outlook for EUR/JPY is expected to remain negative while below the 200-day SMA, today at 140.45.

EUR/JPY daily chart

-

09:32

United Kingdom M4 Money Supply (YoY) declined to 2.5% in November from previous 4.8%

-

09:31

United Kingdom M4 Money Supply (MoM) below forecasts (0.4%) in November: Actual (-1.6%)

-

09:31

United Kingdom Net Lending to Individuals (MoM) climbed from previous £4.7B to £5.9B in November

-

09:30

United Kingdom Consumer Credit came in at £1.507B, above forecasts (£0.9B) in November

-

09:30

United Kingdom Mortgage Approvals below forecasts (55K) in November: Actual (46.075K)

-

09:08

AUD/USD soars over 2% on Sino-Australian news, 0.6900 and US data eyed

- AUD/USD is rallying hard, eyeing 0.6900 amid USD sell-off, upbeat mood.

- China is considering a partial end to the Australian coal ban.

- US ISM PMI and Fed Minutes to offer fresh cues to the Aussie.

AUD/USD is riding the risk-on wave higher so far this Wednesday, extending the rebound by over 2% amid a broad sell-off in the US Dollar and the renewed China-Australia trade optimism.

The Aussie caught this relentless bid only after several media reported that China is considering a partial end to its ban on imports of Australian coal. The positive sentiment in the European markets only added to the upsurge in the higher-yielding Aussie Dollar at the expense of the safe-haven US Dollar.

Traders also take advantage of encouraging Reserve Bank of Australia (RBA) thinking, cited by MNI. The report said, “the Reserve Bank of Australia (RBA) believes that “accumulated savings, a tight jobs market and spending cuts will make higher interest rates manageable for most homeowners.”

Next of relevance for the AUD/USD pair remains the US ISM Manufacturing PMI release and the Fed December meeting, which could have a significant impact on US Dollar valuations, eventually influencing the currency pair.

AUD/USD: Technical levels to consider

-

09:00

European Monetary Union S&P Global Services PMI above forecasts (49.1) in December: Actual (49.8)

-

09:00

European Monetary Union S&P Global Composite PMI above forecasts (48.8) in December: Actual (49.3)

-

08:55

Germany S&P Global/BME Services PMI came in at 49.2, above expectations (49) in December

-

08:55

Germany S&P Global/BME Composite PMI above forecasts (48.9) in December: Actual (49)

-

08:51

Gold Price Forecast: XAU/USD refreshes seven-month highs above $1,860 amid falling yields

- Gold price hits fresh seven-month highs above $1,860 in European trading.

- The US Treasury yields decline, risk-on mood smash the US Dollar.

- Sell-off in the US Treasury yields cap the downside in the Gold price.

Gold price is holding close to the highest level in seven months above $1,860 in the Europen session, accelerating the upbeat momentum, as the US Dollar tumbled across the board following a hot start to 2023.

The US Dollar remains under heavy selling pressure, as the European equities opened higher. Further, the sell-off in the US Treasury bond yields gathered steam and exacerbated the pain in the greenback, allowing the non-yielding Gold price to extend its uptrend into the fourth straight session.

Markets continue to adjust their positions in the first week of this year, gearing up for the first top-tier US economic events release due later this Wednesday. The US ISM Manufacturing PMI and the US Federal Reserve (Fed) Minutes will be closely scrutinized for the Fed’s future policy path, which will significantly influence the US Dollar and the USD-sensitive yellow metal.

The fresh upsurge in the Gold price could be also attributed to the big technical breakout on the daily chart. Gold price confirmed an upside from the ascending triangle on Tuesday. The price closed Tuesday above the horizontal trendline (triangle) resistance at $1,825.

Gold price: Daily chart

Gold price: Technical level to watch

-

08:50

France S&P Global Composite PMI came in at 49.1, above expectations (48) in December

-

08:50

France S&P Global Services PMI came in at 49.5, above forecasts (48.1) in December

-

08:45

Italy S&P Global Services PMI above expectations (49.5) in December: Actual (49.9)

-

08:31

Hong Kong SAR Retail Sales came in at -4.2% below forecasts (2%) in November

-

08:15

Spain S&P Global Services PMI came in at 51.6, above forecasts (50.8) in December

-

07:46

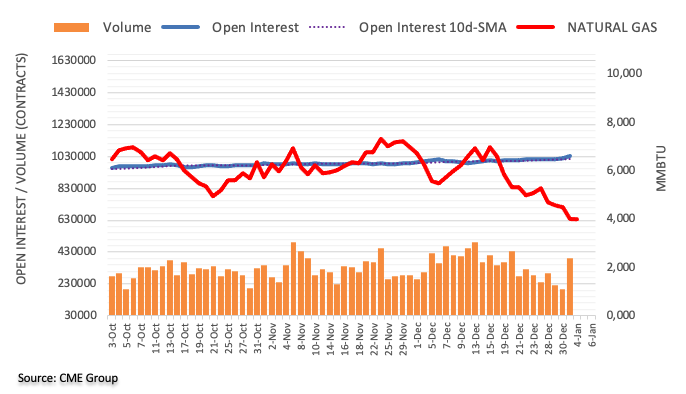

Natural Gas Futures: Door open to further decline

Considering advanced results from CME Group for natural gas futures markets, open interest climbed for the fourth session in a row on Tuesday, now by around 15.1K contracts. Volume, in the same direction, reversed two straight daily drops and increased by around 191.3K contracts.

Natural Gas: Further losses target the $3.50 region

Tuesday’s retracement in prices of the natural gas was accompanied by rising open interest and volume and is supportive of a deeper pullback in the very near term at least. Against that, the commodity could revisit the December 2021 low at $3.53 per MMBtu (December 30)

-

07:45

France Consumer Price Index (EU norm) (MoM) came in at -0.1%, below expectations (0.3%) in December

-

07:45

France Consumer Price Index (EU norm) (YoY) registered at 6.7%, below expectations (7.2%) in December

-

07:45

France Consumer Confidence registered at 82, below expectations (84) in December

-

07:34

EUR/USD accelerates gains and re-targets 1.0600

- EUR/USD partially reverses Tuesday’s drop and approaches 1.0600.

- Final Services PMIs in the euro area are due next in the docket.

- Investors’ attention remains on the release of the FOMC Minutes.

The European currency regains some balance and leaves behind part of the Tuesday’s strong drop to the 1.0520/15 band vs. the dollar on Wednesday.

EUR/USD looks at data, US calendar

EUR/USD starts the first week of the new year on the defensive after three consecutive weekly advances, although Wednesday’s rebound shifts the focus to a potential test/breakout of the 1.0600 hurdle.

The so far improved mood around the pair comes in response to the knee-jerk in the dollar following the strong bounce seen earlier in the week.

In the German money markets, the 10-year Bund yields appear to be regaining some upside traction following two consecutive daily retracements.

Later in the euro area, the final December Services PMI readings will take centre stage prior to the US ISM Manufacturing and the publication of the FOMC Minutes of the December gathering.

What to look for around EUR

EUR/USD seems to have met some decent contention around 1.0520 so far this week.

In the meantime, the European currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: France Flash Inflation Rate, France Consumer Confidence, Germany Final S&P Global Services PMI, EMU Final S&P Global Services PMI (Wednesday) – Germany Balance of Trade, Germany S&P Global Construction PMI, Italy Flash Inflation Rate (Thursday) – Germany Retail Sales, EMU Flash Inflation Rate, EMU Retail Sales.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.37% at 1.0586 and is expected to meet the next up barrier at 1.0713 (weekly high December 30) ahead of 1.0736 (monthly high December 15) and finally 1.0773 (monthly high June 27). On the other hand, the breach of 1.0519 (weekly low January 3) would target 1.0443 (weekly low December 7) en route to 1.0316 (200-day SMA).

-

07:30

Switzerland Consumer Price Index (YoY) below expectations (2.9%) in December: Actual (2.8%)

-

07:30

Hungary Gross Wages (YoY) climbed from previous 17.5% to 18.1% in October

-

07:30

Switzerland Consumer Price Index (MoM) in line with expectations (-0.2%) in December

-

07:19

Forex Today: US Dollar rally pauses as focus shifts to PMI data, FOMC Minutes

Here is what you need to know on Wednesday, January 4:

Following Tuesday's impressive rally, the US Dollar Index seems to have gone into a consolidation phase at around 104.50 early Wednesday. S&P Global will release the December Services PMIs (final) for Germany and the Eurozone in the European session. The US economic docket will be packed with high-tier data releases. The ISM will publish the Manufacturing PMI for December, the US Bureau of Labor Statistics will announce the JOLTS Job Openings data for November. Finally, the FOMC will release the minutes of the December policy meeting.

US Dec ISM Manufacturing PMI Preview: Encouraging sub-indices could temporarily boost US Dollar.

Following the three-day weekend, Wall Street's main indexes struggled to gain traction on Tuesday. With investors remaining cautious, the US Dollar found demand as a safe haven and managed to outperform its rivals. In the meantime, the benchmark 10-year US Treasury bond yield lost more than 2% on a daily basis. In the early European session, the 10-year US T-bond yield is already down nearly 1% and US stock index futures trade modestly higher on the day.

EUR/USD lost more than 100 pips on Tuesday and touched its lowest level since December 13 at 1.519 before closing at 1.0550. The pair clings to modest recovery gains near 1.0570 early Wednesday.

AUD/USD rose sharply during the Asian trading hours and was last seen rising more than 1% on the day above 0.6800. Earlier in the day, reports suggesting that China was considering a partial end to its ban on imports of Australian coal seem to have provided a boost to the Australian Dollar. On a negaive note, China's Finance Minister Lie Kun noted that China's economic recovery was still not solid. He added that a possible contraction in demand and renewed disruptions to supply were downside risks. Nevertheless Shanghai Composite Index remains on track to close modestly higher while Hong Kong's Hang Seng Index is up more than 2% following Tuesday's rally.

GBP/USD closed the first two trading days of the week in negative territory. With the US Dollar losing some strength in the European morning, the pair clings modest recovery gains a few pips above 1.2000.

USD/JPY came under renewed bearish pressure in the Asian session and declined below 130.50. Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Wednesday that the Japanese central bank will continue monetary easing to achieve the price target in tandem with wage growth. This comment, however, doesn't seem to be weighing on the Japanese Yen for the time being. On a hawkish note, the Nikkei Asian Review reported that Prime Minister Fumio Kishida said that they will discuss whether they need to rework the inflation target with the new BoJ governor.

Despite the broad-based US Dollar strength, Gold price surged higher on Tuesday with the 10-year US T-bond yield declining sharply. XAU/USD preserves its bullish momentum and trades at its highest level since mid-June slightly above $1,850.

Bitcoin gained traction mid-week and was last seen gaining more than 1% on the day at $16,860. Ethereum closed flat on Tuesday but gathered bullish momentum on Wednesday. ETH/USD was last seen trading at its highest level in nearly three weeks at $1,250, rising 3% on a daily basis.

-

07:15

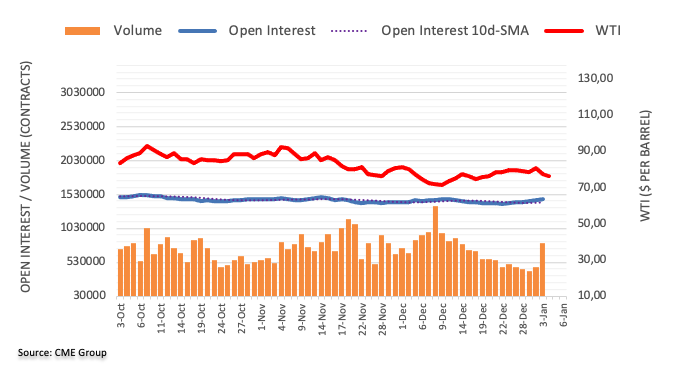

Crude Oil Futures: Extra losses favoured near term

CME Group’s flash data for crude oil futures markets showed traders extended the uptrend for yet another session on Tuesday, this time by more than 20K contracts. Volume followed suit and went up by around 351.6K contracts.

WTI: Sellers target the 2022 low near $70.00

Tuesday’s strong pullback in prices of the West Texas Intermediate came in tandem with increasing open interest and volume, opening the door to the continuation of the current decline in the short-term horizon and with the potential test at the 2022 low at $70.10 (December 9).

-

07:01

Germany Import Price Index (MoM) registered at -4.5%, below expectations (-1.6%) in November

-

07:01

Germany Import Price Index (YoY) below forecasts (18%) in November: Actual (14.5%)

-

07:01

FX option expiries for Jan 4 NY cut

FX option expiries for Jan 4 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- USD/JPY: USD amounts

- 130.00 420m

- NZD/USD: NZD amounts

- 0.6000 670m

-

06:41

China: Broad-based weakening seen in December – Standard Chartered

Economists at Standard Chartered provide a grim outlook of China’s economy amid weak business activity in December.

Key quotes

“Official manufacturing and non-manufacturing PMIs fell to their lowest levels since February 2020.”

“Supply-chain disruptions and worker absenteeism likely dragged production, trade activity significantly.”

“Decline in real estate investment may have stabilised; medical-related demand likely jumped.”

“We lower our Q4-2022 and 2022 growth forecasts to 2.0% y/y (2.9% prev.) and 2.7% (3%), respectively.”

-

06:34

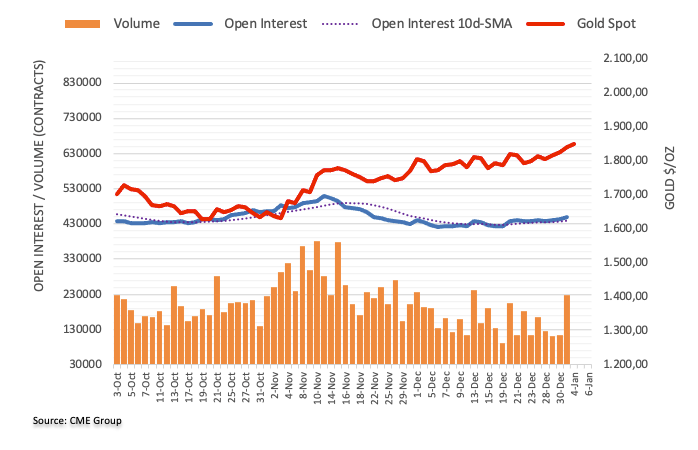

Gold Futures: Further upside on the cards

According to preliminary readings from CME Group, open interest in gold futures markets rose for the third day in a row on Tuesday, this time by nearly 8K contracts. In the same line, volume added to the previous advance and climbed by around 113.6K contracts.

Gold: Extra gains likely above $1850

Gold prices extended the uptrend to the $1850 region for the first time since mid-June on Tuesday. The move was amidst rising open interest and volume and exposes the continuation of this move in the very near term. The surpass of the $1850 zone should put bullion en route to the June 2022 high at $1879 (June 13).

-

06:20

RBA sees savings, jobs cushioning mortgage stress – MNI

According to MNI, the Reserve Bank of Australia (RBA) believes that “accumulated savings, a tight jobs market and spending cuts will make higher interest rates manageable for most homeowners.”

This comes as AUD400 billion of fixed-rate mortgages mature in 2023 and home prices are set to add to eight straight months of declines.

Citing sources familiar with the RBA thinking, MNI noted: “The full impact of the cumulative 300bps of tightening since May will become evident over coming months as higher cash rates are passed through to variable-rate mortgages, but a particular focus is on borrowers who fixed rates at historic lows and will confront a significant increase in repayments as the bulk of pandemic-era fixed rate deals mature this year. Fixed-rate mortgages peaked at around 40% of all home loans in early 2022.”

Related reads

- China considering a partial end to Australia coal ban

- AUD/USD firms up toward 0.6800 as risk flows return

-

06:12

USD Index retreats from recent peaks near 105.00, looks to data, FOMC Minutes

- The index sheds some ground after recent multi-day highs.

- The risk complex manages to regain some poise on Wednesday.

- Mortgage Applications, ISM Manufacturing, FOMC Minutes next on tap.

The greenback, when tracked by the USD Index (DXY), navigates the end of the Asian session slightly in the negative territory near 104.50 on Wednesday.

USD Index stays focused on the FOMC Minutes

The index gives away part of Tuesday’s strong advance to multi-session tops near the 105.00 hurdle on the back of the so far small improvement in the risk-associated universe on Wednesday.

The cautious note around the buck comes in line with investors’ prudence ahead of the release of the FOMC Minutes of the December 14 event later in the NA session. In the meantime, market participants continue to assess the potential next steps of the Federal Reserve amidst some loss of momentum in the domestic inflation and the upcoming publication of the December’s Nonfarm Payrolls (Friday).

In the meantime, US yields add to the weekly retracement across the curve and so far reverse two consecutive weeks with gains.