Notícias do Mercado

-

23:21

Currencies. Daily history for Sep 4'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2935 -1,65%

GBP/USD $1,6315 -0,88%

USD/CHF Chf0,9323 +1,58%

USD/JPY Y105,30 +0,44%

EUR/JPY Y136,21 -1,20%

GBP/JPY Y171,79 -0,44%

AUD/USD $0,9341 0,00%

NZD/USD $0,8302 -0,26%

USD/CAD C$1,0876 -0,09%

-

23:00

Schedule for today, Friday, Sep 5’2014:

(time / country / index / period / previous value / forecast)

00:15 U.S. FOMC Member Richard Fisher Speaks

01:00 U.S. FOMC Member Narayana Kocherlakota

05:00 Japan Leading Economic Index July 105.5 107.2

05:00 Japan Coincident Index July 109.7

05:00 Japan BoJ monthly economic report

06:00 Germany Industrial Production s.a. (MoM) July +0.3% +0.5%

06:00 Germany Industrial Production (YoY) July -0.5%

07:00 United Kingdom Halifax house price index August +1.4% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y August +10.2%

07:00 Switzerland Foreign Currency Reserves August 453.4

08:30 United Kingdom Consumer Inflation Expectations Quarter III +2.6%

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7%

12:30 Canada Employment August 41.7 10.3

12:30 Canada Unemployment rate August 7.0% 7.0%

12:30 U.S. Average workweek August 34.5

12:30 U.S. Average hourly earnings August 0.0% +0.2%

12:30 U.S. Unemployment Rate August 6.2% 6.1%

12:30 U.S. Nonfarm Payrolls August 209 222

14:00 Canada Ivey Purchasing Managers Index August 54.1 55.7

-

16:43

Foreign exchange market. American session: the euro plunged to 14-month low against the U.S. dollar after the European Central Bank’s interest rate cut

The U.S. dollar traded mixed to higher against due to the solid U.S. economic data and as the European Central Bank cut its interest rate. According to the ADP employment report, the U.S. economy added 204,000 jobs in August, missing expectations for a rise of 216,000, after 218,000 jobs in July.

The ISM services index climbed to 59.6 in August from 58.7 in July, beating forecasts for a drop to 57.5.

The number of initial jobless claims in the U.S. last week climbed by 4,000 to 302,000 from 298,000 in the previous week. Analysts had expected initial jobless claims to remain at 298,000.

The U.S. trade deficit declined to $40.5 billion in July from $40.8 billion in June. That was the smallest gap since January 2014. June's trade deficit was revised from $41.5 billion. Analysts had expected the deficit to widen to $42.5 billion.

Final nonfarm productivity in the U.S. rose 2.3% in the second quarter, missing expectations for a 2.5% gain, after a 2.5% increase in the first quarter.

The euro plunged to 14-month low against the U.S. dollar as the European Central Bank (ECB) lowered its interest rate to 0.05% from 0.15%. The central bank also cut its deposit facility rate to -0.20% from -0.10% and its marginal lending rate to 0.30% from 0.40%.

The ECB President Mario Draghi said the central bank will start buying asset-backed securities, including covered bonds. Details of the asset-backed securities (ABS) program will be announced later.

German factory orders rose 4.6% in July, exceeding expectations for a 1.6% increase, after a 2.7% decline in June. June's figure was revised up from a 3.2% fall.

The British pound declined against the U.S. dollar after the Bank of England's interest rate decision. The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

The Canadian dollar rose against the U.S. dollar after the better-than-expected Canadian trade data. Canadian trade surplus increased to C$2.58 billion in July from C$1.83 billion in June, beating expectations for a decline to C$0.9 billion. June's figure was revised down from a surplus of C$1.86 billion.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. Retail sales in Australia increased 0.4% in July, in line with expectations, after a 0.6% gain in June.

On a yearly basis, retail sales in Australia rose 5.9% in July, after a 5.5% gain in June.

Australia's trade deficit fell to A$1.36 billion in July from a deficit of A$1.56 billion in June, beating expectations for a deficit of A$1.77 billion. June's figure was revised down from a deficit of A$1.68 billion.

The Japanese yen traded lower against the U.S. dollar. The Bank of Japan (BoJ) kept its monetary policy unchanged. The BoJ said it will expand the monetary base at an annual pace of about ¥60 to ¥70 trillion. Japan's central bank added that it will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

-

16:00

U.S.: Crude Oil Inventories, August -0.9

-

15:44

Bank of Japan Governor Haruhiko Kuroda played down almost every concern at the press conference after the BoJ kept its monetary policy unchanged

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the press conference after the BoJ kept its monetary policy unchanged. He played down almost every concern. Mr. Kuroda said that he does not believe that the weaker yen would be negative for the economy in Japan.

The government and parliament to decide whether Japan should proceed with a sales tax hike to 10% next year, so the BoJ governor. But he added that "it's very important for Japan's fiscal state and for its economy".

Mr. Kuroda pointed out that Japan's inflation has largely moved in line with BoJ's forecasts. The recently released weak economic data was driven by temporary factors, so Kuroda.

-

15:10

European Central Bank lowered its interest to 0.05%

The European Central Bank (ECB) released its interest rate decision. The ECB lowered its interest to 0.05% from 0.15%. Analysts had not expected this decision.

The central bank also cut its deposit facility rate to -0.20% from -0.10% and its marginal lending rate to 0.30% from 0.40%.

The ECB President Mario Draghi said the central bank will start buying asset-backed securities, including covered bonds. Details of the asset-backed securities (ABS) program will be announced later.

The central bank lowered its growth forecast for 2014 to 0.9% down from 1.0%, while the forecast for 2015 was lowered to 1.6% from 1.7%.

The ECB cut its inflation forecast for this year to 0.6% from 0.7%. The 2015 inflation forecast remained unchanged at 1.1%.

-

15:00

U.S.: ISM Non-Manufacturing, August 59.6 (forecast 57.3)

-

14:45

U.S.: Services PMI, August 59.5 (forecast 58.5)

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD $1.3000, $1.2900

EUR/GBP stg0.7945, stg0.7975, stg0.8000

USD/JPY Y103.75, Y104.00, Y105.00, Y105.15, Y105.45, Y105.55

USD/CAD C$1.0850, C$1.0870, C$1.0875, C$1.0890, C$1.0910, C$1.0915, C$1.0920, C$1.0925

AUD/USD $0.9230, $0.9250, $0.9280, $0.9295, $0.9300, $0.9305, $0.9350

NZD/USD $0.8400

-

13:55

Bank of Japan kept its monetary policy unchanged

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged. The BoJ said it will expand the monetary base at an annual pace of about ¥60 to ¥70 trillion. Japan's central bank added that it will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

The BoJ also said that the economy in Japan "has continued to recover moderately as a trend".

"Financial conditions are accommodative", so Japan's central bank.

-

13:31

Canada: Trade balance, billions, July 2.6 (forecast 0.9)

-

13:30

U.S.: Initial Jobless Claims, August 302 (forecast 298)

-

13:30

U.S.: Nonfarm Productivity, q/q, Quarter II +2.3% (forecast +2.5%)

-

13:30

U.S.: International Trade, bln, July -40.5 (forecast -42.5)

-

13:15

U.S.: ADP Employment Report, August 204 (forecast 216)

-

13:15

Bank of England kept its interest rate unchanged at 0.50%

The Bank of England released its interest decision today. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

Investors are awaiting the release of the minutes of the meeting.

Two external members of the nine-strong Monetary Policy Committee (MPC), Martin Weale and Ian McCafferty, voted last month to hike interest rate from 0.5% to 0.75%. That was the first split vote since Mark Carney became a Bank of England governor.

-

13:02

Foreign exchange market. European session: the euro dropped against the U.S. dollar as the European Central Bank (ECB) lowered its interest rate to 0.05% from 0.15%

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail sales (MoM) July +0.6% +0.4% +0.4%

01:30 Australia Retail Sales Y/Y July +5.5% +5.9%

01:30 Australia Trade Balance July -1.68 -1.77 -1.36

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 270

03:00 Japan BoJ Monetary Policy Statement

06:00 Germany Factory Orders s.a. (MoM) July -2.7% Revised From -3.2% +1.6% +4.6%

06:00 Germany Factory Orders n.s.a. (YoY) July -2.0% Revised From -4.3% +4.9%

07:30 Japan BOJ Press Conference

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15% 0.05%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. The U.S. economy is expected to add 216,000 jobs in August according to the ADP employment report.

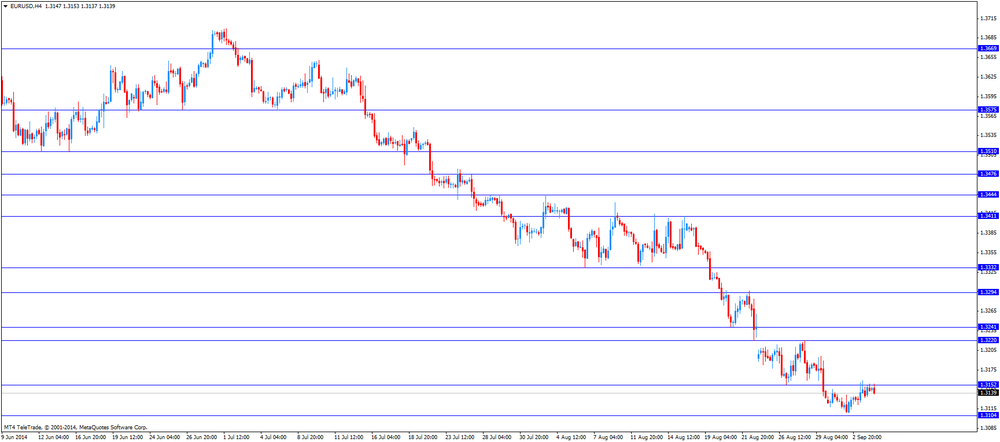

The euro dropped against the U.S. dollar as the European Central Bank (ECB) lowered its interest rate to 0.05% from 0.15%.

German factory orders rose 4.6% in July, exceeding expectations for a 1.6% increase, after a 2.7% decline in June. June's figure was revised up from a 3.2% fall.

The British pound declined against the U.S. dollar after the Bank of England's interest rate decision. The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

The Canadian dollar rose against the U.S. dollar ahead of Canadian trade data. Canadian trade surplus is expected to decline to C$0.9 billion in July from C$1.86 billion in June.

EUR/USD: the currency pair decreased to $1.3036

GBP/USD: the currency pair fell to $1.6421

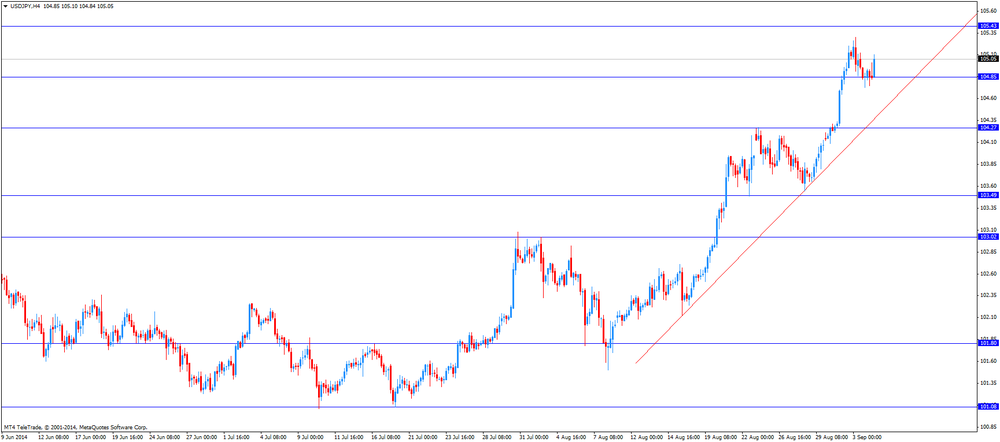

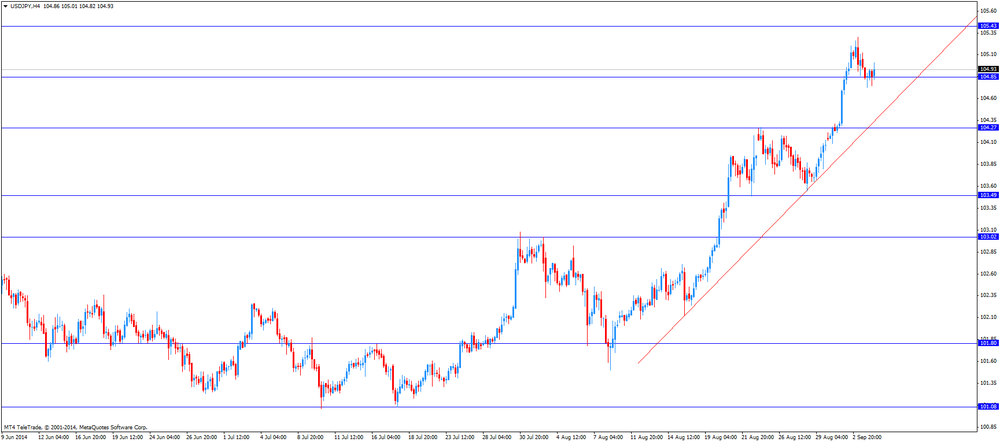

USD/JPY: the currency pair rose to Y105.10

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report August 218 216

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions July 1.9 0.9

12:30 U.S. International Trade, bln July -41.5 -42.5

12:30 U.S. Initial Jobless Claims August 298 298

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter II +2.5% +2.5%

14:00 U.S. ISM Non-Manufacturing August 58.7 57.3

16:30 U.S. FOMC Member Mester Speaks

23:30 U.S. FOMC Member Jerome Powell Speaks

-

12:56

Orders

EUR/USD

Offers $1.322-40, $1.3200, $1.3175

Bids $1.3020, $1.3000

GBP/USD

Offers $1.6720, $1.6700, $1.6650, $1.6600, $1.6555

Bids $1.6420, $1.6400, 1.6380

AUD/USD

Offers $0.9415/20, $0.9400, $0.9370/80

Bids $0.9260, $0.9250, $0.9235

EUR/JPY

Offers Y139.00, Y138.40, Y138.25

Bids Y137.25, Y137.00, Y136.50, Y136.20

USD/JPY

Offers Y106.00, Y105.50

Bids Y104.30, Y104.00, Y103.80, Y103.50, Y103.20

EUR/GBP

Offers stg0.8035, stg0.8015

Bids stg0.7960, stg0.7890, stg0.7850, stg0.7820, stg0.7800

-

12:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.15%)

-

12:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.50% (forecast 0.50%)

-

10:27

Option expiries for today's 1400GMT cut

EUR/USD $1.3100 (E595mn), $1.3120(E381mn), $1.3170(E750mn), $1.3200(E322mn)

EUR/GBP stg0.7945(E175mn), stg0.7975(E120mn), stg0.8000(E170mn)

USD/JPY Y103.75($970mn), Y104.00($1.4bn), Y105.00($960mn), Y105.15($570mn), Y105.45($1.75bn), Y105.55($1.75bn)

USD/CAD C$1.0850($160mn), C$1.0870($142mn), C$1.0875($230mn), C$1.0890($405mn), C$1.0910($105mn), C$1.0915($150mn), C$1.0920($655mn), C$1.0925($135mn)

AUD/USD $0.9230(A$119mn), $0.9250(A$735mn), $0.9280(A$102mn), $0.9295(A$412mn), $0.9300(A$273mn), $0.9305(A$128mn), $0.9350(A$186mn)

NZD/USD $0.8400(NZ$280mn)

-

09:47

Foreign exchange market. Asian session: the yen traded mixed against the U.S. dollar after the Bank of Japan’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail sales (MoM) July +0.6% +0.4% +0.4%

01:30 Australia Retail Sales Y/Y July +5.5% +5.9%

01:30 Australia Trade Balance July -1.68 -1.77 -1.36

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 270

03:00 Japan BoJ Monetary Policy Statement

06:00 Germany Factory Orders s.a. (MoM) July -2.7% Revised From -3.2% +1.6% +4.6%

06:00 Germany Factory Orders n.s.a. (YoY) July -2.0% Revised From -4.3% +4.9%

07:30 Japan BOJ Press Conference

The U.S. dollar traded mixed against the most major currencies. The greenback was supported by earlier released strong economic data from the U.S. that showed the U.S. economic recovery deepening. Investors speculate that the Fed will hike its interest rate sooner than expected.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar after the solid economic data in Australia. Retail sales in Australia increased 0.4% in July, in line with expectations, after a 0.6% gain in June.

On a yearly basis, retail sales in Australia rose 5.9% in July, after a 5.5% gain in June.

Australia's trade deficit fell to A$1.36 billion in July from a deficit of A$1.56 billion in June, beating expectations for a deficit of A$1.77 billion. June's figure was revised down from a deficit of A$1.68 billion.

The Japanese yen traded mixed against the U.S. dollar after the Bank of Japan's interest rate decision. The Bank of Japan (BoJ) kept its monetary policy unchanged. The BoJ said it will expand the monetary base at an annual pace of about ¥60 to ¥70 trillion. Japan's central bank added that it will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:15 U.S. ADP Employment Report August 218 216

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions July 1.9 0.9

12:30 U.S. International Trade, bln July -41.5 -42.5

12:30 U.S. Initial Jobless Claims August 298 298

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter II +2.5% +2.5%

14:00 U.S. ISM Non-Manufacturing August 58.7 57.3

16:30 U.S. FOMC Member Mester Speaks

23:30 U.S. FOMC Member Jerome Powell Speaks

-

07:00

Germany: Factory Orders s.a. (MoM), July +4.6% (forecast +1.6%)

-

06:26

Options levels on thursday, September 4, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3267 (5686)

$1.3231 (10782)

$1.3179 (975)

Price at time of writing this review: $ 1.3145

Support levels (open interest**, contracts):

$1.3115 (5876)

$1.3095 (5027)

$1.3067 (6066)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 83571 contracts, with the maximum number of contracts with strike price $1,3200 (10782);

- Overall open interest on the PUT options with the expiration date September, 5 is 62633 contracts, with the maximum number of contracts with strike price $1,3100 (6066);

- The ratio of PUT/CALL was 0.75 versus 0.94 from the previous trading day according to data from September, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.6700 (1184)

$1.6600 (834)

$1.6502 (727)

Price at time of writing this review: $1.6456

Support levels (open interest**, contracts):

$1.6398 (1227)

$1.6300 (672)

$1.6200 (413)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 32083 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 34262 contracts, with the maximum number of contracts with strike price $1,6450 (4267);

- The ratio of PUT/CALL was 1.07 versus 1.03 from the previous trading day according to data from September, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:10

Japan: BoJ Interest Rate Decision, 0.10% (forecast 0.10%)

-

04:10

Japan: Bank of Japan Monetary Base Target, 270 (forecast 270)

-

02:30

Australia: Retail sales (MoM), July +0.4% (forecast +0.4%)

-

02:30

Australia: Trade Balance , July -1,36 (forecast -1.77)

-