Notícias do Mercado

-

16:31

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar after mixed Canadian economic data

The U.S. dollar traded lower against the most major currencies. The U.S. currency remained supported by Thursday's strong U.S. labour market data. U.S. companies added 288,000 jobs in June.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

The euro traded higher against the U.S. dollar after mixed economic data from the Eurozone. German industrial production dropped 1.8% in May, missing expectations for a 0.3%, after a 0.3% decline in April. April's figure was revised down from a 0.2% increase.

Sentix investor confidence index for the Eurozone increased to 10.1 in July from 8.5 in June, beating expectations for a drop to 7.5.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports in the U.K.

The Swiss franc traded higher against the U.S. dollar after the economic data from Switzerland. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in June, in line with expectations.

The Swiss National Bank's foreign exchange reserves increased to 449.553 billion Swiss francs in June, from 444.351 billion Swiss francs in May. May's figure was revised down from 444.354 billion Swiss francs.

The Canadian dollar traded lower against the U.S. dollar after mixed Canadian economic data. Building permits in Canada increased 13.8% in May, exceeding expectations for a 3.1% rise, after a 2.2% gain in April. . That was the fastest pace in 10 months.

April's figure was revised up from a 1.1% increase.

Ivey purchasing managers' index for Canada dropped to 46.9 in June from 48.2 in May, missing expectations for a rise to 51.3.

The New Zealand dollar increased against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar climbed against the U.S. dollar after the economic data from Australia. The AI Group/HIA released its housing construction index for June. The index increased to 51.8 in June from 46.7 in May.

The ANZ job advertisements rose 4.3% in June from a decline of 5.7% in May. May's figure was revised down from a drop of 5.6%.

The Japanese yen traded higher against the U.S. dollar. Japan's leading economic index declined to 105.7 in May from 106.5 in April, missing expectations for a decrease to 106.0. April's figure was revised down from 106.6.

Japan's coincident index remained unchanged at 111.1 in May, beating expectations for a decline to 111.0.

The Bank of Japan Governor Haruhiko Kuroda said on Monday the BoJ will maintain its stimulus programme for as long as necessary to achieve its 2% inflation target. He added that "the BOJ will examine upside and downside risks to the economy and prices, and adjust monetary policy as needed".

-

15:45

Bank of Canada: Canadian companies expect low inflation

The Bank of Canada released its business outlook survey for the second quarter on Monday:

- There are "some encouraging signs for the economic outlook, although lingering uncertainty amid intense competition still hinders the pace of growth";

- 64 % of executives expect the inflation to be at 1% to 2% over the next two years;

- Canadian companies saw a "more modest improvement" in sales over the past 12 months, "expectations for future sales growth remain positive, and there are indications that business sentiment regarding exports is gradually firming";

- Competitive conditions remain challenging;

- Canadian companies operating on the domestic market hope that sales growth will improve;

- Canadian companies operating on the international markets saw an improvement compared with a year ago due to a strengthening of the U.S. economy and the depreciation of the Canadian dollar.

- There are "some encouraging signs for the economic outlook, although lingering uncertainty amid intense competition still hinders the pace of growth";

-

15:00

Canada: Ivey Purchasing Managers Index, June 46.9 (forecast 51.3)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3525, $1.3545, $1.3600, $1.3610, $1.3615, $1.3650-55

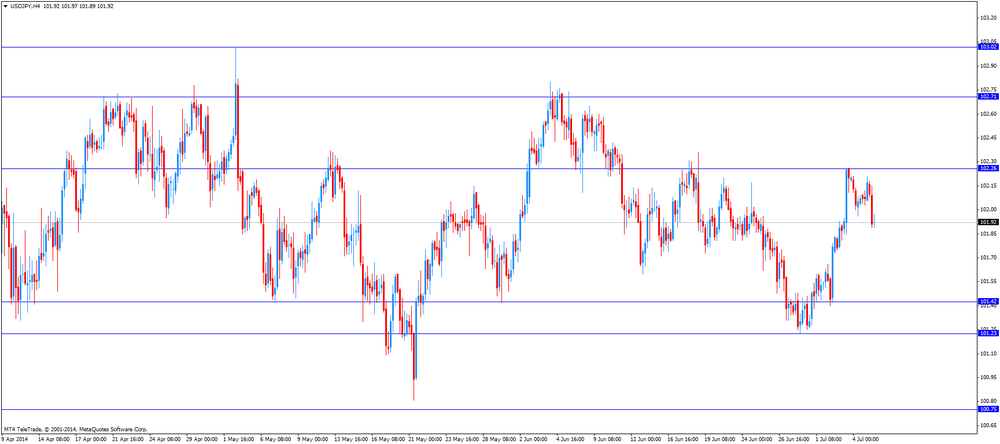

USD/JPY Y101.00, Y101.50, Y102.00, Y102.20, Y102.50-55

EUR/JPY Y138.50, Y139.75

USD/CHF Chf0.9000

AUD/USD $0.9360, $0.9495

NZD/USD $0.8800

USD/CAD C$1.0700, C$1.0725, C$1.0735

-

13:30

Canada: Building Permits (MoM) , May +13.8% (forecast +3.1%)

-

13:03

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia AiG Performance of Construction Index June 46.7 51.8

03:30 Australia ANZ Job Advertisements (MoM) June -5.7% Revised From -5.6% +4.3%

07:00 Japan Leading Economic Index May 106.5 106.0 105.7

07:00 Japan Coincident Index May 111.1 111.0 111.1

07:45 Switzerland Unemployment Rate June 3.2% 3.2% 3.2%

08:00 Germany Industrial Production s.a. (MoM) May -0.3% Revised From +0.2% +0.3% -1.8%

08:00 Germany Industrial Production (YoY) May +1.8% +1.3%

09:00 Switzerland Foreign Currency Reserves June 444.4 449.6

10:30 Eurozone Sentix Investor Confidence July 8.5 7.5 10.1

11:00 Eurozone Eurogroup Meetings

11:00 Eurozone ECB President Mario Draghi Speaks

The U.S. dollar traded lower against the most major currencies. The U.S. currency remained supported by Thursday's strong U.S. labour market data. U.S. companies added 288,000 jobs in June.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

The euro traded higher against the U.S. dollar after mixed economic data from the Eurozone. German industrial production dropped 1.8% in May, missing expectations for a 0.3%, after a 0.3% decline in April. April's figure was revised down from a 0.2% increase.

Sentix investor confidence index for the Eurozone increased to 10.1 in July from 8.5 in June, beating expectations for a drop to 7.5.

The British pound fell against the U.S. dollar in the absence of any major economic reports in the U.K.

The Swiss franc traded higher against the U.S. dollar after the economic data from Switzerland. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in June, in line with expectations.

The Swiss National Bank's foreign exchange reserves increased to 449.553 billion Swiss francs in June, from 444.351 billion Swiss francs in May. May's figure was revised down from 444.354 billion Swiss francs.

The Canadian dollar rose against the U.S. dollar ahead of the Canadian economic data. Building permits in Canada should increase 3.1% in May, after a 1.1% gain in April.

Ivey purchasing managers' index for Canada should climb to 51.3 in June from 48.2 in May.

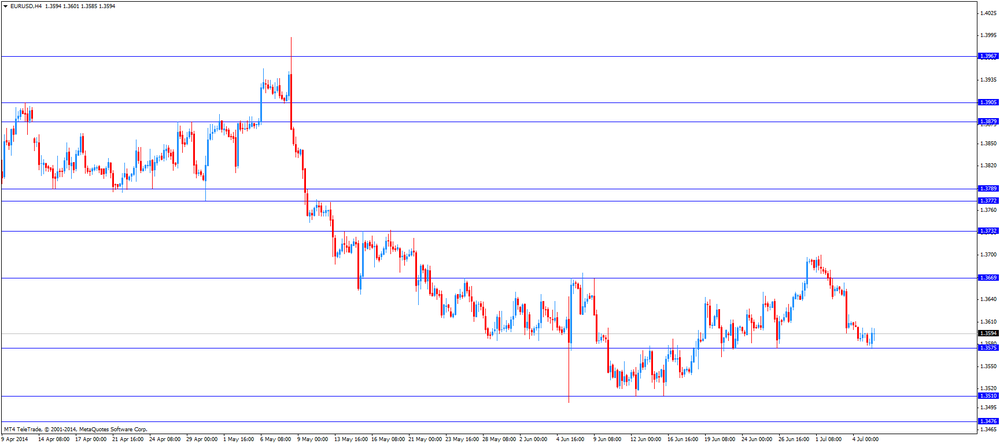

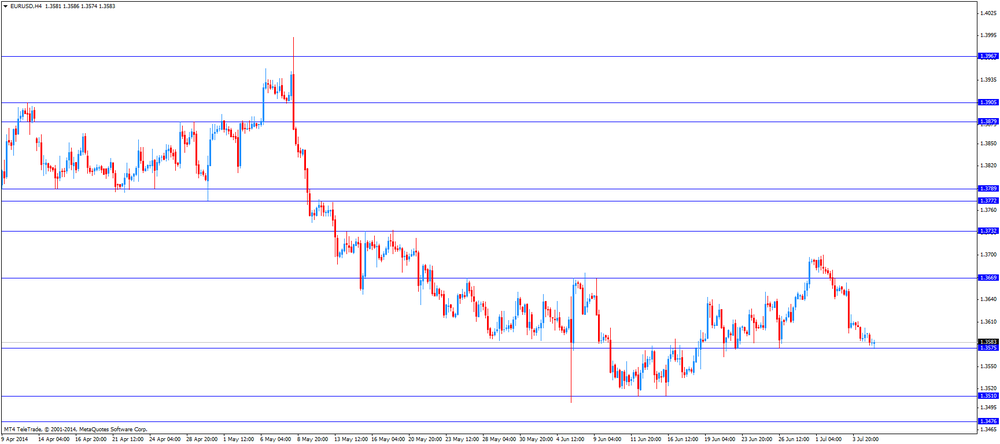

EUR/USD: the currency pair climbed to $1.3601

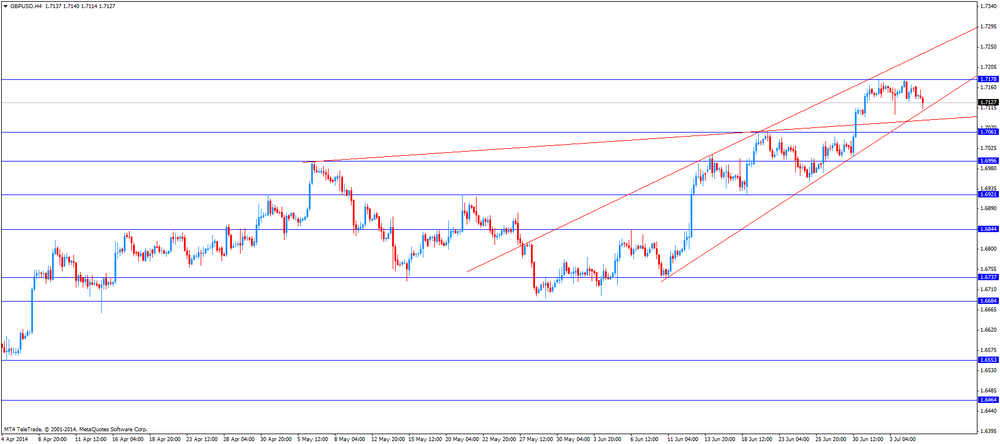

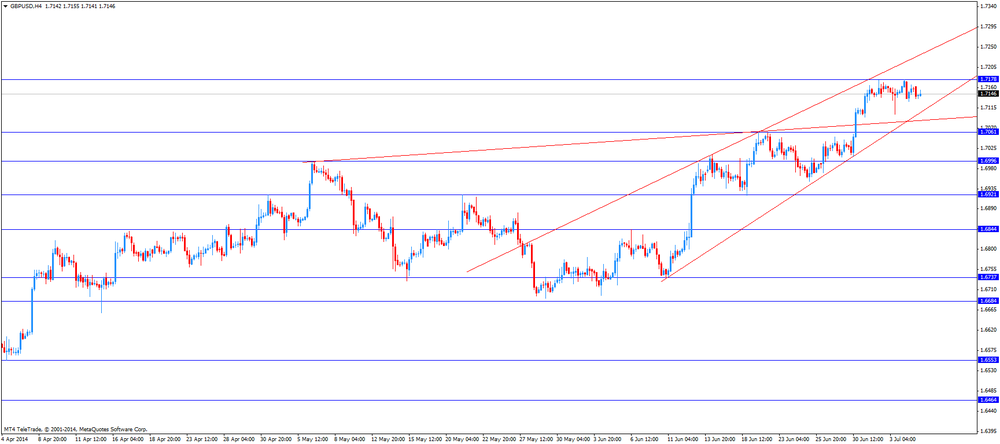

GBP/USD: the currency pair decreased to $1.7114

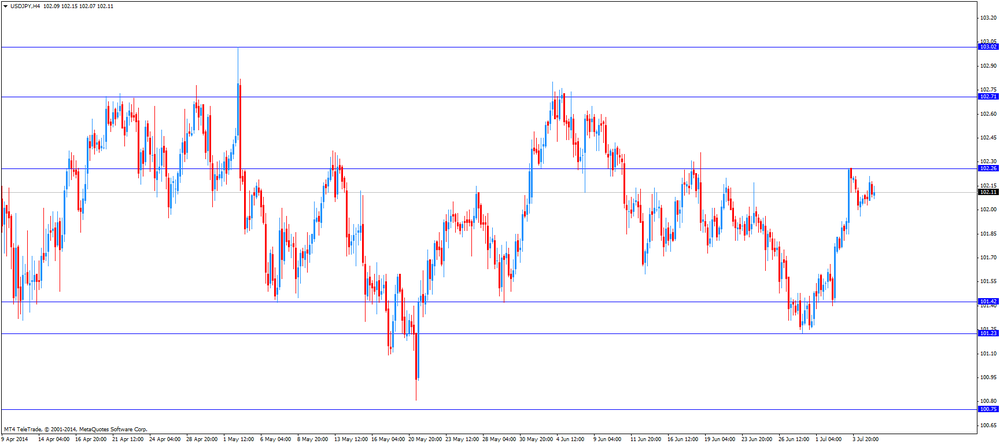

USD/JPY: the currency pair declined to Y101.89

The most important news that are expected (GMT0):

14:30 Canada Building Permits (MoM) May +1.1% +3.1%

16:00 Canada Ivey Purchasing Managers Index June 48.2 51.3

16:30 Canada Bank of Canada Business Outlook Survey Quarter II

-

13:00

Orders

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660, $1.3635

Bids $1.3565, $1.3550/40, $1.3500

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7095/90, $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420, $0.9400

Bids $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y140.50, Y140.00, Y139.50, Y139.30, Y139.00

Bids Y138.50, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.50, Y102.30

Bids Y101.70, Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970, stg0.7950

Bids stg0.7905-890, stg0.7800

-

11:08

Bank of Japan Governor Haruhiko Kuroda: Japan’s central bank will maintain its stimulus programme

The Bank of Japan Governor Haruhiko Kuroda said at BoJ's quarterly meeting of regional branch managers (32 domestic branches and general managers based in the U.S. and Europe):

- The BoJ's stimulus programme is producing the intended effects;

- The BoJ will maintain its stimulus programme for as long as necessary to achieve its 2% inflation target;

- "The BOJ will examine upside and downside risks to the economy and prices, and adjust monetary policy as needed";

- Japan's has continued to recover moderately, despite a domestic sales tax hike in April;

- Japan's financial system has remained stable.

- The BoJ's stimulus programme is producing the intended effects;

-

10:29

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3525, $1.3545, $1.3600, $1.3610, $1.3615, $1.3650-55

USD/JPY Y101.00, Y101.50, Y102.00, Y102.20, Y102.50-55

EUR/JPY Y138.50, Y139.75

USD/CHF Chf0.9000

AUD/USD $0.9360, $0.9495

NZD/USD $0.8800

USD/CAD C$1.0700, C$1.0725, C$1.0735

-

10:11

Foreign exchange market. Asian session: the Australian dollar traded slightly higher against the U.S. dollar after the economic data from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia AiG Performance of Construction Index June 46.7 51.8

03:30 Australia ANZ Job Advertisements (MoM) June -5.7% Revised From -5.6% +4.3%

07:00 Japan Leading Economic Index May 106.5 106.0 105.7

07:00 Japan Coincident Index May 111.1 111.0 111.1

07:45 Switzerland Unemployment Rate June 3.2% 3.2% 3.2%

08:00 Germany Industrial Production s.a. (MoM) May -0.3% Revised From +0.2% +0.3% -1.8%

08:00 Germany Industrial Production (YoY) May +1.8% +1.3%

09:00 Switzerland Foreign Currency Reserves June 444.4 449.6

10:30 Eurozone Sentix Investor Confidence July 8.5 7.5 10.1

11:00 Eurozone Eurogroup Meetings

11:00 Eurozone ECB President Mario Draghi Speaks

The U.S. dollar traded higher against the most major currencies. The U.S. currency was still supported by Thursday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Market participants speculate the Fed may hike its interest rate sooner than expected.

The New Zealand dollar decreased against the U.S dollar in the absence of any major economic reports in New Zealand. The U.S. dollar was still supported by Thursday's U.S. jobs report.

The Australian dollar traded slightly higher against the U.S. dollar after the economic data from Australia. The AI Group/HIA released its housing construction index for June. The index increased to 51.8 in June from 46.7 in May.

The ANZ job advertisements rose 4.3% in June from a decline of 5.7% in May. May's figure was revised down from a drop of 5.6%.

The Japanese yen traded higher against the U.S. dollar. Japan's leading economic index declined to 105.7 in May from 106.5 in April, missing expectations for a decrease to 106.0. April's figure was revised down from 106.6.

Japan's coincident index remained unchanged at 111.1 in May, beating expectations for a decline to 111.0.

The Bank of Japan Governor Haruhiko Kuroda said on Monday the BoJ will maintain its stimulus programme for as long as necessary to achieve its 2% inflation target. He added that "the BOJ will examine upside and downside risks to the economy and prices, and adjust monetary policy as needed".

EUR/USD: the currency pair declined to $1.3580

GBP/USD: the currency pair decreased to $1.7135

USD/JPY: the currency pair declined to Y102.09

The most important news that are expected (GMT0):

14:30 Canada Building Permits (MoM) May +1.1% +3.1%

16:00 Canada Ivey Purchasing Managers Index June 48.2 51.3

16:30 Canada Bank of Canada Business Outlook Survey Quarter II

-

09:30

Eurozone: Sentix Investor Confidence, July 10.1 (forecast 7.5)

-

08:01

Switzerland: Foreign Currency Reserves, June 449.6

-

07:00

Germany: Industrial Production s.a. (MoM), May -1.8% (forecast +0.3%)

-

06:45

Switzerland: Unemployment Rate, June 3.2% (forecast 3.2%)

-

06:18

Options levels on monday, July 7, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3705 (2149)

$1.3679 (1595)

$1.3644 (275)

Price at time of writing this review: $ 1.3583

Support levels (open interest**, contracts):

$1.3570 (311)

$1.3551 (1747)

$1.3527 (1594)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 19043 contracts, with the maximum number of contracts with strike price $1,3800 (3163);

- Overall open interest on the PUT options with the expiration date August, 8 is 26370 contracts, with the maximum number of contracts with strike price $1,3500 (6253);

- The ratio of PUT/CALL was 1.38 versus 1.29 from the previous trading day according to data from July, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (975)

$1.7304 (1371)

$1.7207 (1360)

Price at time of writing this review: $1.7138

Support levels (open interest**, contracts):

$1.7092 (700)

$1.6996 (1288)

$1.6898 (1539)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 13361 contracts, with the maximum number of contracts with strike price $1,7100 (1584);

- Overall open interest on the PUT options with the expiration date August, 8 is 16701 contracts, with the maximum number of contracts with strike price $1,6900 (1539);

- The ratio of PUT/CALL was 1.25 versus 0.94 from the previous trading day according to data from Jule, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:01

Japan: Leading Economic Index , May 105.7 (forecast 106.0)

-

06:01

Japan: Coincident Index, May 111.1 (forecast 111.0)

-

05:06

Schedule for today, Monday, July 7’2014:

(time / country / index / period / previous value / forecast)

23:30 Australia AiG Performance of Construction Index June 46.7

01:30 Australia ANZ Job Advertisements (MoM) June -5.6%

05:00 Japan Leading Economic Index May 106.5 106.0

05:00 Japan Coincident Index May 111.1 111.0

05:45 Switzerland Unemployment Rate June 3.2% 3.2%

06:00 Germany Industrial Production s.a. (MoM) May +0.2% +0.3%

06:00 Germany Industrial Production (YoY) May +1.8%

07:00 United Kingdom Halifax house price index June +3.9% -0.3%

07:00 United Kingdom Halifax house price index June +8.7%

07:00 Switzerland Foreign Currency Reserves June 444.4

08:30 Eurozone Sentix Investor Confidence July 8.5 7.5

12:30 Canada Building Permits (MoM) May +1.1% +3.1%

14:00 Canada Ivey Purchasing Managers Index June 48.2 51.3

14:30 Canada Bank of Canada Business Outlook Survey Quarter II

22:00 New Zealand NZIER Business Confidence Quarter II 52

23:50 Japan Current Account (adjusted), bln May 130.5 170.0

-