Notícias do Mercado

-

23:22

Currencies. Daily history for Oct 7'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2664 +0,09%

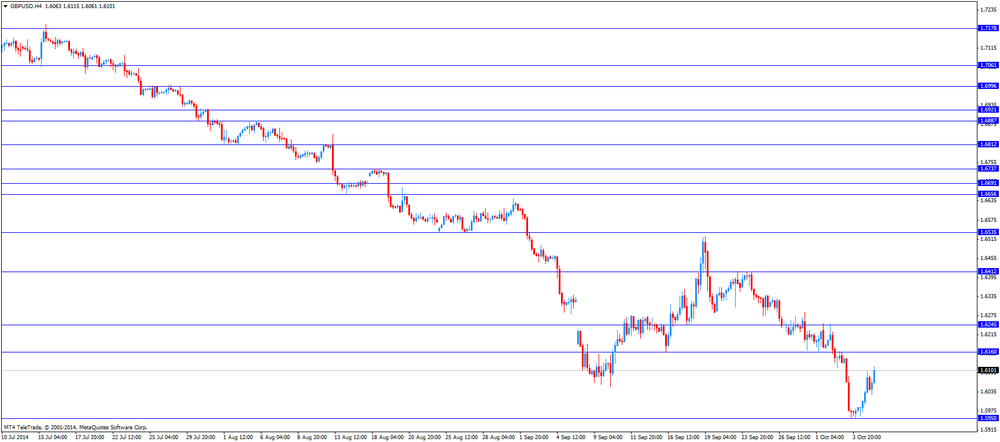

GBP/USD $1,6095 +0,09%

USD/CHF Chf0,9567 -0,16%

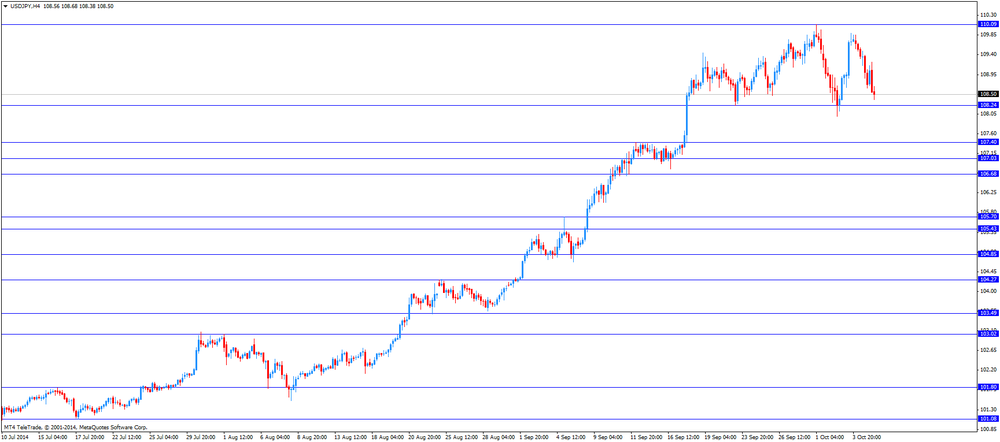

USD/JPY Y108,14 -0,54%

EUR/JPY Y136,94 -0,45%

GBP/JPY Y174,03 -0,46%

AUD/USD $0,8804 +0,52%

NZD/USD $0,7822 -0,14%

USD/CAD C$1,1161 +0,22%

-

23:00

Schedule for today, Wednesday, Oct 8’2014:

(time / country / index / period / previous value / forecast)

01:45 China HSBC Services PMI September 54.1

05:00 Japan BoJ monthly economic report

05:00 Japan Eco Watchers Survey: Current September 47.4 48.2

05:00 Japan Eco Watchers Survey: Outlook September 50.4

05:45 Switzerland Unemployment Rate September 3.2% 3.2%

07:00 United Kingdom Halifax house price index September +0.1% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y September +9,7%

12:15 Canada Housing Starts September 192 195

14:30 U.S. Crude Oil Inventories September -1.4

18:00 U.S. FOMC meeting minutes

23:01 United Kingdom RICS House Price Balance September 40% 38%

23:50 Japan Core Machinery Orders September +3.5% +1.1%

23:50 Japan Core Machinery Orders, y/y September +1.1% -5.1%

-

20:00

U.S.: Consumer Credit , August 13.5 (forecast 20.3)

-

16:32

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the International Monetary Fund (IMF) lowered its forecast for global growth for 2014 and 2015

The U.S. dollar traded mixed against the most major currencies after the International Monetary Fund (IMF) lowered its forecast for global growth for 2014 and 2015. The IMF cut its forecast for global economic growth to 3.3% in 2014, down from a previous forecast of 3.4%. 2015 forecast was lowered to 3.8%, down from a previous forecast of 4.0%.

Job openings rose to 4.835 million in August from 4.6 million in July, exceeding expectations for an increase to 4.710 million.

The greenback remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

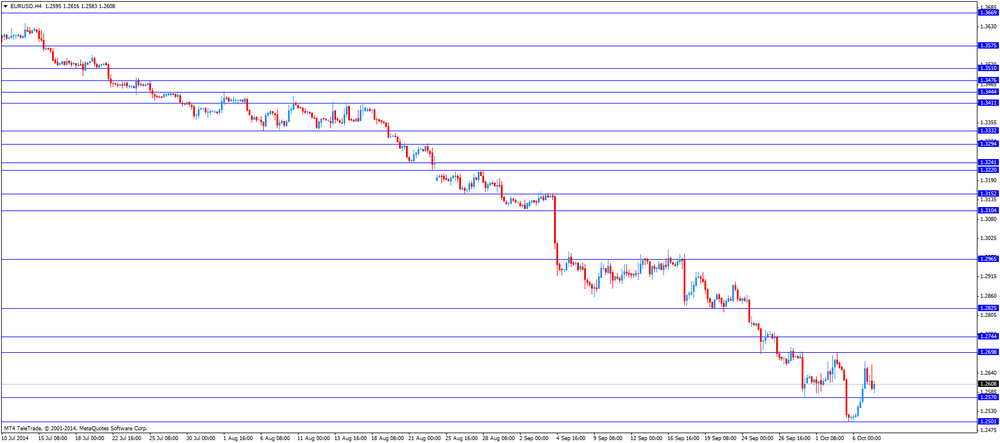

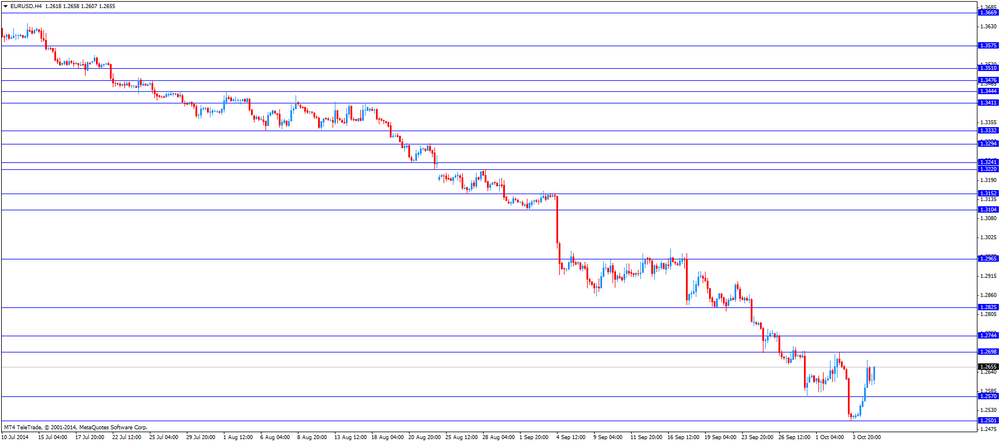

The euro traded higher against the U.S. dollar. In the morning trading session, the euro declined against the greenback due to disappointing German industrial production. German industrial production declined 4.0% in August, missing expectations for a 1.4% decrease, after a 1.6% rise in July. That was the largest drop since 2009.

July's figure was revised down from a 1.9% gain.

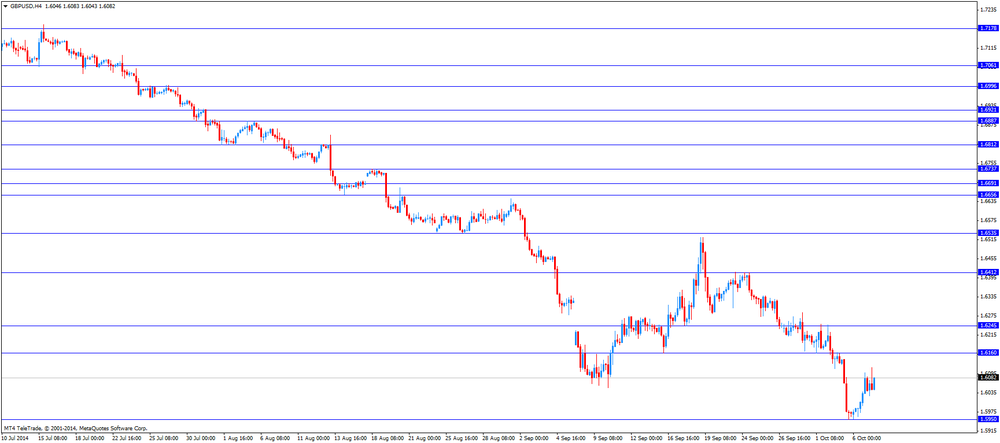

The British pound traded mixed against the U.S. dollar after the release of mixed economic data from the U.K. Manufacturing production in the U.K. increased 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% gain in July.

On a yearly basis, U.K. manufacturing production jumped 3.9% in August, beating expectations for a 3.4% increase, after a 3.5% rise in July. July's figure was revised up from a 2.2% increase.

Industrial production in the U.K. was flat in August, in line with expectations, after a 0.4% increase in July. July' figure was revised down from a 0.5% rise.

On a yearly basis, U.K. industrial production rose 2.5% in August, missing expectations for a 2.6% gain, after a 2.2% increase in July. July's figure was revised up from a 1.7% rise.

The National Institute of Economic and Social Research (NIESR) released its gross domestic product (GDP) estimate for the U.K. today. NIESR estimated that GDP increased 0.7% in the third quarter.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's consumer price index increased 0.1% in September, missing expectations for a 0.2% gain, after a flat reading in August.

Retail sales in Switzerland rose 1.9% in August, exceeding expectations for a 0.8% increase, after a 0.3% decline in July. July's figure was revised up from a 0.6% decrease.

The Swiss National Bank's foreign exchange reserves increased to 462.194 billion Swiss francs in September from 453.875 billion francs in August.

The Canadian dollar traded lower after the release of the disappointing Canadian building permits. Building permits in Canada dropped 27.3% in August, after a 11.6% rise in July. July's figure was revised down from a 11.8% gain.

The New Zealand dollar traded higher against the U.S. dollar. The New Zealand Institute of Economic Research released its business confidence index. The index dropped to 19 in the third quarter from 32 in the second quarter.

The Australian dollar traded higher against the U.S. dollar. The Reserve Bank of Australia (RBA) released its interest rate decision today. The RBA kept its interest rate unchanged at 2.50%. Analysts had expected this decision.

The RBA Governor Glenn Stevens said that the Aussie remained "high by historical standards" despite the recent decrease. He also said that Australia's economy grew moderately and "labour market data have been unusually volatile".

The AIG performance of construction index climbed to 59.1 in September from 55.0 in August.

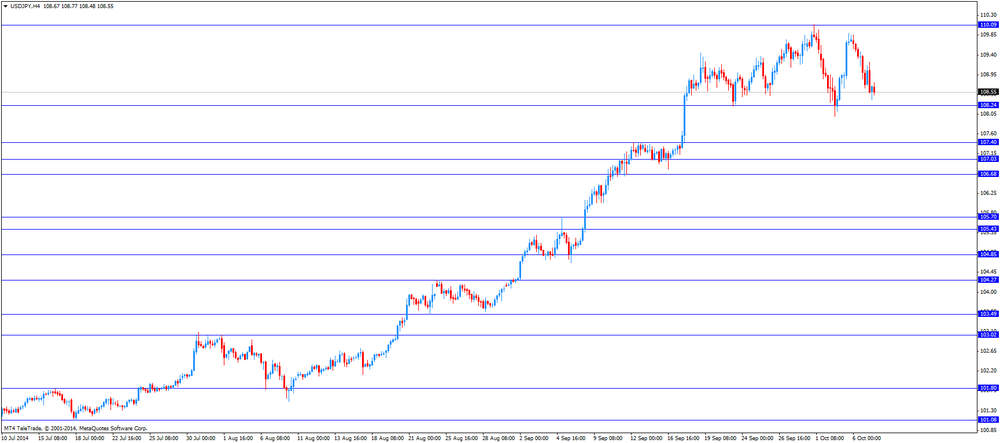

The Japanese yen rose against the U.S. dollar. Comments by Japanese Prime Minister Shinzo Abe supported the yen. Abe expressed concern about a weaker yen.

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at a press conference today that the BoJ will closely monitor the exchange rate. He added that the central bank will maintain its quantitative and qualitative monetary easing program until the inflation target of 2% is achieved. Kuroda noted the BoJ will adjust its quantitative and qualitative monetary easing program if necessary.

Japan's preliminary leading index declined to 104 in August from 105.4 in July, missing expectations for a decrease to 104.2. That was the lowest level since January 2013.

Japan's coincident index fell to 108.5 in August from 109.9 in July.

-

15:37

Bank of Japan kept its monetary policy unchanged

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged.

Japan's central bank said that the economy recovered moderately as a trend. The BoJ added that production has showed some weakness due to a sales tax hike in April.

The BoJ Governor Haruhiko Kuroda said at a press conference today that the BoJ will closely monitor the exchange rate. He added that the central bank will maintain its quantitative and qualitative monetary easing program until the inflation target of 2% is achieved. Kuroda noted the BoJ will adjust its quantitative and qualitative monetary easing program if necessary.

Current fall in crude oil prices is good for Japan's economy, Kuroda said.

The BoJ governor pointed out that job and income conditions are improving.

-

15:01

U.S.: JOLTs Job Openings, August 4835 (forecast 4710)

-

15:00

United Kingdom: NIESR GDP Estimate, September +0.7%

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2525-30(E333mn), $1.2600(E881bn), $1.2650(E734mn), $1.2685-90(E600mn), $1.2700(E3.0bn)

USD/JPY: Y109.00($2.95bn), Y110.50($603mn)

EURYEN: Y137.30(1.8bn)

EUR/GBP: Stg0.7800(E290mn)

USD/CHF: Chf0.9400($570mn)

AUD/USD: $0.8700(A$378mn), $0.8775(A$757mn)

NZD/USD: $0.7950(NZ$440mn)

USD/CAD: C$1.1180($230mn), C$1.1200($400mn), C$1.1250($290mn)

-

13:30

Canada: Building Permits (MoM) , August -27.3%

-

13:12

Foreign exchange market. European session: the euro fell against the U.S. dollar due to disappointing German industrial production

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

03:00 Japan BoJ Monetary Policy Statement

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

04:54 Japan Bank of Japan Monetary Base Target 270 270 270

04:54 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

05:00 Japan Leading Economic Index August 105.4 104.2 104.0

05:00 Japan Coincident Index August 109.9 108.5

06:00 Germany Industrial Production s.a. (MoM) August +1.6% Revised From +1.9% -1.4% -4.0%

06:00 Germany Industrial Production (YoY) August +2.5% -2.8%

07:00 Switzerland Foreign Currency Reserves September 453.8 462.2

07:15 Switzerland Retail Sales Y/Y August -0.6% +0.8% +1.9%

07:15 Switzerland Consumer Price Index (MoM) September 0.0% +0.2% +0.1%

07:15 Switzerland Consumer Price Index (YoY) September +0.1% 0.0% -0.1%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Industrial Production (MoM) August +0.5% 0.0% 0.0%

08:30 United Kingdom Industrial Production (YoY) August +1.7% +2.6% +2.5%

08:30 United Kingdom Manufacturing Production (MoM) August +0.3% +0.2% +0.1%

08:30 United Kingdom Manufacturing Production (YoY) August +2.2% +3.4% +3.9%

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar traded mixed to higher against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

The euro fell against the U.S. dollar due to disappointing German industrial production. German industrial production declined 4.0% in August, missing expectations for a 1.4% decrease, after a 1.6% rise in July. That was the largest drop since 2009.

July's figure was revised down from a 1.9% gain.

The British pound traded lower against the U.S. dollar after the release of mixed economic data from the U.K. Manufacturing production in the U.K. increased 0.1% in August, missing expectations for a 0.2% rise, after a 0.3% gain in July.

On a yearly basis, U.K. manufacturing production jumped 3.9% in August, beating expectations for a 3.4% increase, after a 3.5% rise in July. July's figure was revised up from a 2.2% increase.

Industrial production in the U.K. was flat in August, in line with expectations, after a 0.4% increase in July. July' figure was revised down from a 0.5% rise.

On a yearly basis, U.K. industrial production rose 2.5% in August, missing expectations for a 2.6% gain, after a 2.2% increase in July. July's figure was revised up from a 1.7% rise.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's consumer price index increased 0.1% in September, missing expectations for a 0.2% gain, after a flat reading in August.

Retail sales in Switzerland rose 1.9% in August, exceeding expectations for a 0.8% increase, after a 0.3% decline in July. July's figure was revised up from a 0.6% decrease.

The Swiss National Bank's foreign exchange reserves increased to 462.194 billion Swiss francs in September from 453.875 billion francs in August.

The Canadian dollar traded mixed ahead of the Canadian building permits.

EUR/USD: the currency pair decreased to $1.2583

GBP/USD: the currency pair fell to $1.6043

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) August +11.8%

14:00 United Kingdom NIESR GDP Estimate September +0.6%

14:00 U.S. JOLTs Job Openings August 4673 4710

17:20 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. FOMC Member Dudley Speak

23:50 Japan Current Account (adjusted), bln August 99.3 190

-

12:50

Orders

EUR/USD

Offers $1.2750, $1.2700/02

Bids $1.2500

GBP/USD

Offers $1.6120/25

Bids $1.6060-50, $1.6020, $1.6000, $1.5980

AUD/USD

Offers $0.8950, $0.8900, $0.8850

Bids $0.8755/50, $0.8700, $0.8680/60, $0.8650, $0.8640/20

EUR/JPY

Offers Y138.00, Y137.75/80, Y137.50

Bids Y136.50, Y136.00, Y135.50

USD/JPY

Offers Y110.10, Y110.00, Y109.50, Y108.90/00

Bids Y108.20, Y108.00, Y107.50, Y107.00

EUR/GBP

Offers stg0.7900

Bids stg0.7835/30

-

12:17

Reserve Bank of Australia kept its interest rate unchanged at 2.50%

The Reserve Bank of Australia (RBA) released its interest rate decision today. The RBA kept its interest rate unchanged at 2.50%. Analysts had expected this decision.

The RBA Governor Glenn Stevens said that the Aussie remained "high by historical standards" despite the recent decrease. He also said that Australia's economy grew moderately and "labour market data have been unusually volatile".

Australia's central bank expects the economic growth to be below trend, so the RBA governor.

Stevens noted that wages growth fell "noticeably".

The central bank's monetary policy will remain accommodative, so Stevens.

-

10:14

Foreign exchange market. Asian session: the Australian dollar traded mixed against the U.S. dollar after the release of the Reserve Bank of Australia’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

03:00 Japan BoJ Monetary Policy Statement

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

04:54 Japan Bank of Japan Monetary Base Target 270 270 270

04:54 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

05:00 Japan Leading Economic Index August 105.4 104.2 104.0

05:00 Japan Coincident Index August 109.9 108.5

06:00 Germany Industrial Production s.a. (MoM) August +1.6% Revised From +1.9% -1.4% -4.0%

06:00 Germany Industrial Production (YoY) August +2.5% -2.8%

07:00 Switzerland Foreign Currency Reserves September 453.8 462.2

07:15 Switzerland Retail Sales Y/Y August -0.6% +0.8% +1.9%

07:15 Switzerland Consumer Price Index (MoM) September 0.0% +0.2% +0.1%

07:15 Switzerland Consumer Price Index (YoY) September +0.1% 0.0% -0.1%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Industrial Production (MoM) August +0.5% 0.0% 0.0%

08:30 United Kingdom Industrial Production (YoY) August +1.7% +2.6% +2.5%

08:30 United Kingdom Manufacturing Production (MoM) August +0.3% +0.2% +0.1%

08:30 United Kingdom Manufacturing Production (YoY) August +2.2% +3.4% +3.9%

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar mixed to higher against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

The New Zealand dollar traded mixed against the U.S. dollar after the disappointing NZIER business confidence data from New Zealand. The New Zealand Institute of Economic Research released its business confidence index. The index dropped to 19 in the third quarter from 32 in the second quarter.

The Australian dollar traded mixed against the U.S. dollar after the release of the Reserve Bank of Australia's interest rate decision. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.50%. Analysts had expected this decision.

The RBA Governor Glenn Stevens said that the Aussie remained "high by historical standards" despite the recent decrease. He also said that Australia's economy grew moderately and "labour market data have been unusually volatile".

The AIG performance of construction index climbed to 59.1 in September from 55.0 in August.

The Japanese yen rose against the U.S. dollar after comments by Japanese Prime Minister Shinzo Abe. He expressed concern about a weaker yen.

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at a press conference today that the BoJ will closely monitor the exchange rate. He added that the central bank will maintain its quantitative and qualitative monetary easing program until the inflation target of 2% is achieved. Kuroda noted the BoJ will adjust its quantitative and qualitative monetary easing program if necessary.

Japan's preliminary leading index declined to 104 in August from 105.4 in July, missing expectations for a decrease to 104.2. That was the lowest level since January 2013.

Japan's coincident index fell to 108.5 in August from 109.9 in July.

EUR/USD: the currency pair fell to $1.2604

GBP/USD: the currency pair decreased to $1.6025

USD/JPY: the currency pair fell to Y108.53

AUD/USD: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) August +11.8%

14:00 United Kingdom NIESR GDP Estimate September +0.6%

14:00 U.S. JOLTs Job Openings August 4673 4710

17:20 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. FOMC Member Dudley Speak

23:50 Japan Current Account (adjusted), bln August 99.3 190

-

09:30

United Kingdom: Manufacturing Production (MoM) , August +0.1% (forecast +0.2%)

-

09:30

United Kingdom: Manufacturing Production (YoY), August +3.9% (forecast +3.4%)

-

09:30

United Kingdom: Industrial Production (MoM), August 0.0% (forecast 0.0%)

-

09:30

United Kingdom: Industrial Production (YoY), August +2.5% (forecast +2.6%)

-

08:15

Switzerland: Retail Sales Y/Y, August +1.9% (forecast +0.8%)

-

08:15

Switzerland: Consumer Price Index (MoM) , September +1.9% (forecast +0.2%)

-

08:00

Switzerland: Foreign Currency Reserves, September 462.2

-

07:01

Germany: Industrial Production (YoY), August -2.8%

-

07:00

Germany: Industrial Production s.a. (MoM), August -4.0% (forecast -1.4%)

-

06:27

Options levels on tuesday, October 7, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2811 (2362)

$1.2753 (1570)

$1.2711 (1664)

Price at time of writing this review: $ 1.2626

Support levels (open interest**, contracts):

$1.2572 (1897)

$1.2530 (1759)

$1.2472 (2999)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 47355 contracts, with the maximum number of contracts with strike price $1,2900 (4876);

- Overall open interest on the PUT options with the expiration date November, 7 is 45666 contracts, with the maximum number of contracts with strike price $1,2500 (4394);

- The ratio of PUT/CALL was 0.96 versus 1.05 from the previous trading day according to data from October, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.6304 (880)

$1.6206 (644)

$1.6110 (586)

Price at time of writing this review: $1.6064

Support levels (open interest**, contracts):

$1.5990 (1885)

$1.5593 (1068)

$1.5795 (1234)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 20397 contracts, with the maximum number of contracts with strike price $1,6750 (1897);

- Overall open interest on the PUT options with the expiration date November, 7 is 27098 contracts, with the maximum number of contracts with strike price $1,5400 (1936);

- The ratio of PUT/CALL was 1.33 versus 1.44 from the previous trading day according to data from October, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:02

Japan: Leading Economic Index , August 104.0 (forecast 104.2)

-

06:02

Japan: Coincident Index, August 108.5

-

05:56

Japan: BoJ Interest Rate Decision, 0.10% (forecast 0.10%)

-

04:30

Australia: Announcement of the RBA decision on the discount rate, 2.50% (forecast 2.50%)

-