Notícias do Mercado

-

23:59

USD/CHF rebound from 0.9200 amid caution in market mood, Fed Powell’s speech eyed

- USD/CHF has picked demand after a marginal correction to near 0.9200.

- The risk-on profile is easing further, weighed down by rising US Treasury yields.

- Fed Bostic sees no recession in CY2023 but has trimmed the GDP forecast dramatically to 1%.

The USD/CHF pair has sensed buying interest after dropping to near the round-level support of 0.9200 in the early Asian session. Earlier, the Swiss franc asset extended its recovery above the immediate resistance of 0.9200 despite a cheerful market mood.

S&P500 futures are displaying a subdued performance after a corrective move on Monday as equities failed to extend a rally. Stretched upside in stocks triggered long liquidation. The US Dollar Index (DXY) has refreshed its seven-month low at around 102.50 led by soaring recession fears after a meaningful contraction in economic activities and less-hawkish monetary policy projections after a sheer drop in wage inflation.

The demand for US government bonds is losing traction further as investors’ risk appetite is declining again. This has led to an increase in 10-year US Treasury yields above 3.53%.

On Tuesday, the show-stopper event will be the speech from Federal Reserve (Fed) chair Jerome Powell, which will trim ambiguity over February’s monetary policy action. Meanwhile, the commentary from Atlanta Fed bank president Raphael Bostic is full of information that will guide investors for further action. Fed policymaker sees no recession in CY2023 but has trimmed Gross Domestic Product (GDP) forecast dramatically to 1%. He believes that interest rates will have to stay high for a long time well into 2024".

On the Swiss franc front, a decline in the Real Retail Sales (Nov) data on an annual basis is going to compel the Swiss National Bank (SNB) to keep monetary policy moderate. The economic data contracted by 1.3% while the street was expecting an expansion of 3.0%.

-

23:38

USD/JPY slides below 132.00 despite mixed Tokyo Inflation data, focus on Fed Chair Powell

- USD/JPY extends two-day downtrend even after mixed Tokyo inflation figures.

- Tokyo Consumer Price Index eased below market forecasts, CPI ex Food, Energy matched upbeat expectations.

- Downbeat yields, hawkish hopes from BOJ challenge recovery moves.

- Upbeat Fedspeak, long weekend in Japan allowed Yen bears to take a breather ahead of Fed Chair Powell’s speech.

USD/JPY takes offers to refresh the intraday low near 131.60 as it prints a three-day downtrend even as the Tokyo inflation data fails to bolster hawkish expectations from the Bank of Japan (BOJ). The reason could be linked to the long weekend in Japan, as well as the wait for Fed Chair Jerome Powell’s speech and the US inflation data.

As per the latest Tokyo inflation data, the headline Consumer Price Index (CPI) rose by 4.0% versus 4.5% market forecasts and 3.8% previous readings. Further, the Tokyo CPI ex-Food, Energy matched 2.7% YoY forecasts versus 2.5% prior.

However, hawkish Fedspeak and waiting for full markets, as well as a speech from Fed Chair Jerome Powell, seemed to have put a floor under the Yen prices.

Given the escalating price pressure in Japan, the odds of the Bank of Japan’s (BOJ) exit from the easy money policy gains momentum and weighs on the USD/JPY. That said, Japanese Prime Minister Fumio Kishida said on Sunday his government and the central bank must discuss their relationship in guiding economic policy after he names a new Bank of Japan (BOJ) governor in April, reported Reuters. The recent chatters over the BOJ’s readiness to edit the Yield Curve Control (YCC) policy seemed to have weighed on the USD/JPY prices of late.

It’s worth noting that the hawkish comments from the Fed policymakers join the firmer prints of the US inflation expectations to challenge the USD/JPY bears.

On Monday, Atlanta Federal Reserve bank president Raphael Bostic said that it is ''fair to say that the Fed is willing to overshoot.'' On the same line, San Francisco Federal Reserve Bank President Mary Daly stated that they are determined, united, resolute to bring inflation down. Additionally, the Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation declined to 5% in December from 5.2% prior. Alternatively, the three-year ahead expected inflation remained unchanged at 3% and the five-year ahead expected inflation edged higher to 2.4% from 2.3%.

Against this backdrop, the US 10-year Treasury yields dropped five basis points to 3.51% while printing the three-day downtrend whereas Wall Street closed mixed.

Looking forward, USD/JPY traders will pay attention to Fed Chairman Jerome Powell’s speech, as well as Thursday’s US inflation data, for near-term directions amid receding hawkish bias for the Fed.

Technical analysis

A daily closing beyond the 21-DMA hurdle surrounding 133.35 becomes necessary for the USD/JPY buyers to retake control, even for the short-term.

-

23:31

Japan Tokyo CPI ex Fresh Food (YoY) came in at 4%, above expectations (3.8%) in December

-

23:31

Japan Tokyo CPI ex Food, Energy (YoY) meets forecasts (2.7%) in December

-

23:30

Japan Tokyo Consumer Price Index (YoY) came in at 4% below forecasts (4.5%) in December

-

23:30

Japan Overall Household Spending (YoY) registered at -1.2%, below expectations (0.5%) in November

-

23:20

WTI Price Analysis: Keeps pullback from weekly resistance near $75.00

- WTI seesaws above the key moving average convergence after reversing from eight-day-old horizontal resistance.

- Bearish MACD signals, failure to cross short-term hurdle favor sellers.

- Ascending trend line from Thursday adds to the downside filters.

WTI crude oil seesaws around the $75.00 round figure after taking a U-turn from the one-week-long horizontal resistance the previous day. In doing so, the black gold stays defensive above the convergence of the 100 and 50 Hour Moving Averages (HMAs).

That said, the previous day’s failure to cross the $76.75-95 horizontal hurdle joins the bearish MACD signals to keep the WTI sellers hopeful.

However, the aforementioned HMA confluence near $74.80 puts a floor under the energy benchmark’s prices.

Also acting as short-term support is an upward-sloping support line from Thursday, close to $74.25 by the press time.

In a case where the quote remains weak past $74.25, the $74.00 threshold may act as the last defense of the oil buyers before directing the commodity prices towards the recent trough surrounding $72.60.

On the flip side, a successful break of $77.00 becomes necessary for the WTI bull’s conviction. Following that, a run-up toward the $80.00 round figure can’t be ruled out

Even so, the WTI buyers should remain cautious unless crossing the monthly top surrounding $81.55.

Overall, WTI remains bearish despite the latest inaction surrounding the key HMAs and a short-term support line.

WTI: Hourly chart

Trend: Further weakness expected

-

23:07

EUR/USD aims to recapture 1.0760, investors await Fed Powell’s speech for fresh cues

- EUR/USD is looking to recapture 1.0760 as the overall risk profile is still positive.

- Only the stronger-than-projected US CPI report could avoid certain fresh lows for USD Index.

- The speech from Fed Powell will provide cues about the likely monetary policy action for the February meeting.

The EUR/USD pair has displayed a corrective move after failing to extend the upside range above the crucial resistance of 1.0760. The major currency pair has not shown any meaningful sign of bearish reversal, therefore, it would not be ideal to place bearish bids on EUR/USD for now. Investors are required to keep caution in the overall bullish environment as risk-sensitive assets have already displayed a strong run-up, which could force investors to ease their longs ahead.

S&P500 ended on a marginal weak note as Goldman Sachs announced the biggest lay-offs since the subprime crisis as Wall Street banks have suffered a major slowdown in corporate deal-making activity as a result of volatile global financial markets, as reported by Bloomberg. Meanwhile, a decline in 10-year US Treasury yields to 3.53% also weighed pressure on the US Dollar Index (DXY) pushing it to near 102.20, a fresh seven-month low figure.

The US Dollar Index (DXY) is subjected to continue making fresh lows as a meaningful drop in economic activities in the United States economy and a one-time significant drop in wage inflation has accelerated expectations of a deceleration in the pace of interest rate hike by the Federal Reserve (Fed). According to the economists at MUFG Bank, only a stronger-than-expected US Consumer Price Index (CPI) on Thursday would avoid a slide to fresh lows for the USD Index.

But before the release of the US CPI report, the speech from Fed chair Jerome Powell will provide more clarity on monetary policy action for the December meeting.

On the Eurozone front, Economic Bulletin published by the European Central Bank (ECB) clears that wage growth is going to be extremely solid ahead led by robust labor markets that so far have not been substantially affected by the economic slowdown, increases in national minimum wages and some catch-up between wages and high rates of inflation.

-

23:02

AUD/JPY Price Analysis: Stalls at the 200-DMA, eyeing a re-test on its way to 92.00

- AUD/JPY tested but failed to clear solid resistance around the 100 and 200-day EMAs.

- AUD/JPY Price Analysis: A break above 91.70 could open the door for additional gains.

The AUD/JPY edged up during Monday’s session, though it faltered to clear the 200-day Exponential Moving Average (EMA) around 91.66, retracing from the daily highs, and aimed toward January 4 highs around 90.88. As Tuesday’s Asian Pacific session begins, the AUD/JPY is trading with minuscule gains of 0.01%, at around 91.11.

AUD/JPY Price Analysis: Technical outlook

AUD/JPY Monday’s price action witnessed the formation of an inverted hammer preceded by a slight uptrend after the AUD/JPY bottomed at around 87.40s, forming a double bottom. Albeit AUD sellers pushed exchange rates toward’s 91.05, they failed to achieve a daily close beneath that price level, which would have opened the door for further losses and invalidated the chart pattern.

However, the AUD/JPY might consolidate in the near term and depend on market sentiment and Aussie (AUD) upbeat news. So if the AUD/JPY is to resume its uptrend, it would need to decisively reclaim the 100 and 200-day EMAs at around 91.57 and 91.66, respectively, which, once cleared, could open the door for further gains.

If that scenario plays out, the AUD/JPY first resistance would be 92.00. A breach of the latter will send the cross rallying toward December’s 13 daily high of 93.35, followed by the 94.00 figure and the 95.00 mark.

AUD/JPY Key Technical Levels

-

23:00

South Korea Current Account Balance registered at -0.62B, below expectations (-0.17B) in November

-

22:57

NZD/USD retreats towards 0.6350 with eyes on Fed Chair Powell

- NZD/USD eases from three-week high, snaps two-day uptrend.

- Hawkish Fedspeak, lack of fresh positives from China probe Kiwi bulls.

- Powell’s speech will be crucial ahead of Thursday’s US inflation as NZD/USD is susceptible to Fed wagers.

NZD/USD fades upside momentum after two-day advances as it drops to 0.6370 during early Tuesday’s Asian session. The Kiwi pair previously rose to the highest level in three weeks as headlines surrounding China and the US data helped the NZD/USD bulls. However, recent comments from the Fed officials and the cautious mood ahead of this week’s key data and events seem to challenge the pair buyers.

That said, softer US data concerning the wage growth and ISM Services PMI for December, raised speculations that the Federal Reserve (Fed) finally has an upper hand in taming inflation, suggesting a pause to aggressive rate hikes, which in turn propelled NZD/USD prices.

However, hawkish comments from the Fed policymakers seemed to have challenged the NZD/USD traders. On Monday, Atlanta Federal Reserve bank president Raphael Bostic said that it is ''fair to say that the Fed is willing to overshoot.'' On the same line, San Francisco Federal Reserve Bank President Mary Daly stated that they are determined, united, resolute to bring inflation down.

Additionally, the Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation declined to 5% in December from 5.2% prior. Alternatively, the three-year ahead expected inflation remained unchanged at 3% and the five-year ahead expected inflation edged higher to 2.4% from 2.3%.

Amid these plays, the US 10-year Treasury yields dropped five basis points to 3.51% while printing the three-day downtrend whereas Wall Street closed mixed.

Moving on, the economic calendar appears light ahead of Thursday’s US Consumer Price Index (CPI) for December. However, today’s Fed Chairman Jerome Powell’s speech will be crucial for the NZD/USD traders to watch for clear directions amid receding hawkish bias for the Fed. Should Powell refrains from conveying hawkish bias, the NZD/USD could refresh the multi-day high.

Technical analysis

Despite the recent pullback, the NZD/USD pair’s capacity to stay beyond the 21-DMA support of 0.6330 keeps buyers hopeful.

-

22:35

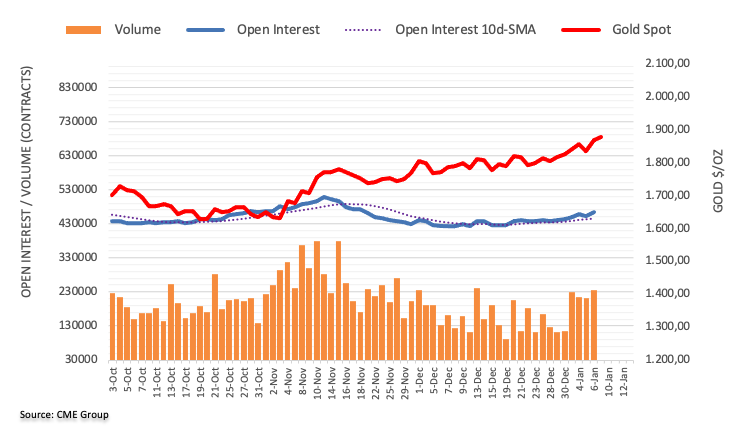

Gold Price Forecast: XAU/USD struggles below $1,900 on mixed Federal Reserve talks

- Gold price retreats after refreshing eight-month high, lacks follow through.

- Federal Reserve officials tried to defend US Dollar and probed XAU/USD bulls.

- China-linked optimism, previous United Stated data allowed Gold price to stay firmer.

- Light calendar ahead of US, China Inflation can probe XAU/USD traders, Fed Chair Powell eyed for intraday moves.

Gold price (XAU/USD) seems running out of upside momentum as it retreats to $1,871, after renewing the multi-day high amid the mostly quiet week-start trading. That said, the United States economics and China’s reopening appeared to have previously helped the XAU/USD to rise to the highest level since May 2022. However, comments from the Federal Reserve (Fed) officials appear to challenge the Gold bulls afterward.

Federal Reserve talks probe Gold buyers

Last week’s United States economics, mainly concerning the wage growth and ISM Services PMI for December, raised speculations that the Federal Reserve (Fed) finally has an upper hand in taming inflation, suggesting a pause to aggressive rate hikes. The same weighed on the US Treasury bond yields and the US Dollar even as the latest comments from the Fed officials restrict the Greenback’s latest downside.

That said, Atlanta Federal Reserve bank president Raphael Bostic said on Monday that it is ''fair to say that the Fed is willing to overshoot.'' On the same line, San Francisco Federal Reserve Bank President Mary Daly stated that they are determined, united, resolute to bring inflation down. Additionally, the Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation declined to 5% in December from 5.2% prior. Alternatively, the three-year ahead expected inflation remained unchanged at 3% and the five-year ahead expected inflation edged higher to 2.4% from 2.3%.

Hence, the Federal Reserve officials’ defense of the hawkish monetary policy actions weighs on the Gold prices.

China favors XAU/USD bulls amid a light calendar

China’s reopening of the international borders after a three-year halt joined the People’s Bank of China’s (PBOC) quest for more Gold reserves to underpin the XAU/USD upside the previous day. The reason could be linked to the dragon nation’s status as one of the world’s biggest gold consumers. That said, Beijing’s readiness for stimulus and early signals of shopping spree ahead of the Chinese New Year holiday season also seemed to have favored the Gold’s upside. It’s worth noting that a lack of major data and events from elsewhere also allowed Chinese catalysts to gain major attention.

Fed talks, United States inflation in focus

Moving on, Gold traders are likely to witness further hardships amid a lack of major catalysts ahead of Thursday’s United States Consumer Price Index (CPI) for December. However, comments from the various Federal Reserve (Fed) officials may offer intermediate moves. It’s worth observing that Tuesday’s speech from Fed Chair Jerome Powell will be crucial for XAU/USD traders considering the latest shift in the United States data and the market’s bias for the US central bank’s next move.

Gold price technical analysis

Gold buyers managed to poke June 2022 high surrounding $1,880 while extending the bounce off one-month-old horizontal support the previous day. However, nearly overbought conditions of the Relative Strength Index (RSI) line, placed at 14, joined an upward-sloping trend line from December 27 to restrict the metal’s further upside.

Also challenging the XAU/USD buyers was the receding bullish bias of the Moving Average Convergence and Divergence (MACD) indicator.

As a result, Gold’s pullback towards the previous weekly top surrounding $1,865 appears imminent.

However, a fortnight-long ascending support line, close to $1,838 by the press time, could challenge the XAU/USD sellers afterward.

In a case where the Gold price fails to rebound from $1,838, the aforementioned horizontal support near $1,823 and the 100-Simple Moving Average (SMA) level surrounding $1,818 will gain the market’s attention.

Alternatively, the $1,880 level and ascending trend line from early December 2022, around $1,883 restricts the short-term upside of the Gold price.

Following that, highs marked during May 2022 and late April, close to $1,910 and $1,920 in that order, could challenge the Gold buyers.

Gold price: Four-hour chart

Trend: Pullback expected

-

22:33

USD/CAD Price Analysis: Downside looks solid to near 1.3400 ahead of Powell/Macklem’s speech

- USD/CAD has gauged an intermediate cushion of around 1.3350.

- Volatility is likely to contract ahead of Powell/Macklem’s speech.

- Downward-sloping 20-and 50-EMAs add to the downside filters.

The USD/CAD pair has shifted its auction profile below the critical resistance of 1.3400 in the early Asian session. The Lonnie asset is displaying a sideways profile after finding an immediate cushion below 1.3400 post carnage led by risk-on market mood. A continuation of rangebound structure is highly expected ahead of the speech from Federal Reserve (Fed) chair Jerome Powell and Bank of Canada (BoC) Governor Tiff Macklem.

The US Dollar Index (DXY) is displaying a subdued performance after a massive sell-off. An absence of follow-up recovery despite gauging an immediate cushion indicates more downside ahead. Meanwhile, a failure in the extension of S&P’s rally resulted in a corrective move, portraying a caution in the risk appetite theme.

After a breakdown of stretched consolidation formed in a range of 1.3482-1.3702 on a four-hour, USD/CAD has dropped dramatically to near 1.3350. The range expansion on the south side is expected to continue further as the overall market sentiment is still positive.

Declining 20-and 50-period Exponential Moving Averages (EMAs) at 1.3482 and 1.3518 respectively, add to the downside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bearish range of the 20.00-40.00 range, which indicates that a bearish momentum has been activated.

For further downside, the Canadian Dollar needs to push the Loonie asset below Monday’s low of around 1.3350, which will drag the major towards November 18 low at 1.3300 followed by November 15 low at 1.3226.

On the contrary, a break above December 27 low of around 1.3484 will strengthen the US Dollar and will drive the major towards December 8 low at 1.3561. A breach of the latter will expose the asset for further upside towards January 6 high at 1.3664.

USD/CAD four-hour chart

-638089003590056618.png)

-

22:21

USD/JPY Price Analysis: Seesawed around 131.90s on mixed mood

- USD/JPY falters to extend its downtrend after forming a bearish engulfing candle pattern.

- The RSI and the RoC suggest that the USD/JPY might resume downwards, though it needs the USD/JPY to fall below 131.30.

The USD/JPY is almost flat as Monday’s New York session wanes, printing a doji preceded by a bearish engulfing candle pattern that failed to trigger downward action. The USD/JPY dived as low as 131.30, still almost unchanged, down by 0.17%. At the time of typing, the USD/JPY is trading at 131.88.

USD/JPY Price Analysis: Technical outlook

After testing the 200-day Exponential Moving Average (EMA) at around 134.70s on Friday, the USD/JPY remained almost unchanged as risk appetite improved and safe-haven peers weakened. Therefore, the USD/JPY seesawed between the high/low of 132.65-131.30 before stabilizing around 131.80s, without buyers/sellers having the upper hand. Should be said that the Relative Strength Index (RSI) portrays the pair as bearish biased, though the Rate of Change (RoC) shows momentum heading downwards.

Hence, the USD/JPY might resume its downtrend, but it would need to hurdle some support levels on its way down. The USD/JPY first support would be the January 9 daily low of 131.30. Break below will expose the 131.00 figure, followed by the January 4 swing low of 129.92 and the YTD low of 129.50.

USD/JPY Key Technical Levels

-

22:06

AUD/USD drops to near 0.6900 as risk-on eases, focus shifts to Fed Powell’s speech

- AUD/USD has corrected to near 0.6900 as investors have turned cautious ahead of Fed Powell’s speech.

- The USD Index is expected to continue its downside momentum as the overall sentiment is still solid.

- Australia’s monthly CPI and Retail Sales data will be keenly watched.

The AUD/USD pair has sensed solid barricades while attempting to extend a rally above the critical resistance of 0.6950 in the New York session. The Aussie asset has corrected to near 0.6900 as a firmer rally is generally followed by a healthy correction, therefore, it would be ideal not to consider the correction a bearish reversal.

Optimism in the global market eased vigorously as investors are shifting their focus toward the release of the United States Consumer Price Index (CPI) data, which is scheduled for Thursday. S&P500 witnessed a corrective move on late Monday after a stretch of Friday’s solid rally, portraying a caution in the overall upbeat market mood.

The US Dollar Index (DXY) has gauged immediate support above 102.50, however, an absence of follow-up recovery indicates that more steam is still left in USD Index bears. Meanwhile, the demand for US government bonds remained solid, which led to a further drop in the 10-year US Treasury yields to 3.53%.

Investors are shifting their focus toward the speech from Federal Reserve (Fed) chair Jerome Powell, which is scheduled for Tuesday. The speech from Fed Powell will provide cues about the likely monetary policy to be taken in February’s monetary policy meeting. Apart from that, fresh projections on the terminal rate after a slowdown in economic activities in the United States economy and a drop in wage inflation will be of utmost importance.

On the Aussie front, the Australian Dollar will remain in action ahead of the release of the monthly CPI data, which is scheduled for Wednesday. As per the consensus, the annual CPI (Nov) will escalate to 7.3% vs. the prior release of 6.9%. Also, the Australian Retail Sales data will hog the limelight, which is seen higher at 0.7% against the former figure of -0.2%.

-

21:46

GBP/USD Price Analysis: Bullish impulse is decelerating, eyes on 1.2150

- GBP/USD bears are lurking in a key area of potential resistance.

- 1.1900 is eyed on the downside extreme on a break below 1.2150/00.

The outlook is bearish for GBP/USD while below 1.2400 and 1.2220 nearer-term highs. The following illustrates GBP/USD's W-formation and test of mid-December highs where a failure to break higher would eventuate in a bearish thesis for the days ahead.

GBP/USD daily charts

As seen, the market is on the back side of the recent supportive trendline and the price broke 1.1900 structure leaving a bearish bias on the charts.

Zoomed in...

The W-formation is supportive of the bearish thesis given that it is a reversion pattern.GBP/USD would be expected to revert towards the neckline and day's lows of near 1.2080. This level guards a run to the prior broken lows of 1.1900 and 1.1778 below there. A break of that opens risk for a run to 1.1350.

GBP/USD H1 chart

At this juncture, the lower time frames can be monitored for a deceleration of the bullish run and signs of distribution as follows:

1.2170, 1.2150 and 1.2113 areas are meanwhile key structure target levels. These guard against a full-on capitulation of the bulls and bears taking over towards the 1.1900 target area.

-

21:18

Silver Price Forecast: XAG/USD struggled at $24.00, retraces gains despite a soft USD

- Silver price failed to gain traction, even though the US Dollar and US Treasury bond yields dropped.

- Latest US jobs data flashing that wages are aiming lower keeps traders hopeful for a Fed pivot.

- Silver Price Analysis: Bears mounted around $24.00, dragging prices towards the 20-DMA.

Silver price stumbles as Wall Street entered its last hour of trading on Monday after hitting a daily high of $24.09 but retraced those gains, albeit market sentiment remains positive as shown by US equities trading with solid gains. Therefore, the US Dollar (USD) weakened, bolstering dollar-denominated commodities. At the time of writing, XAG/USD is trading at $23.64, below its opening price by 0.64%.

Silver failed to capitalize on a soft US Dollar

Optimism surrounds worldwide investors as most global equity indices edged higher. China’s reopening and last week’s mixed economic data from the United States (US) were some of the reasons that weighed on the greenback, alongside growing speculations that the US Federal Reserve (Fed) might pivot.

Last week’s employment data showed the US labor market resilient, adding more jobs than estimated. Still, the data spotlight was Average Hourly Earnings, which dropped to 4.6% YoY, below the previous month’s 5%. That eased some of the Federal Reserve’s (Fed) pressures to curb inflation and even opened the door for a 25 bp rate increase for February 1, as shown by the swaps market.

Therefore, traders are repricing a less hawkish Fed, as shown by the US bond market. The US 10-year Treasury bond rate yields 3.53%, losing three and a half bps, undermining the greenback. The US Dollar Index, which measures the buck’s value against a basket of six currencies, edges lower by 0.71%, down at 103.171.

Silver Price Analysis: Technical outlook

From a daily chart perspective, XAG/USD remains upward biased, with prices trending above the 20 and 50-day Exponential Moving Averages (EMAs), which remain as a support level. Last Friday’s price action formed a bullish engulfing candle pattern, which is usually a bullish pattern. However, XAG/USD failure to hold to its gains above Friday’s $23.90 daily high, and oscillators aimed lower capped silver rally.

Therefore, the XAG/USD first support would be the 20- day EMA at 23.48. Break below will expose the last week’s low of $23.12, followed by the $23.00 figure.

-

20:36

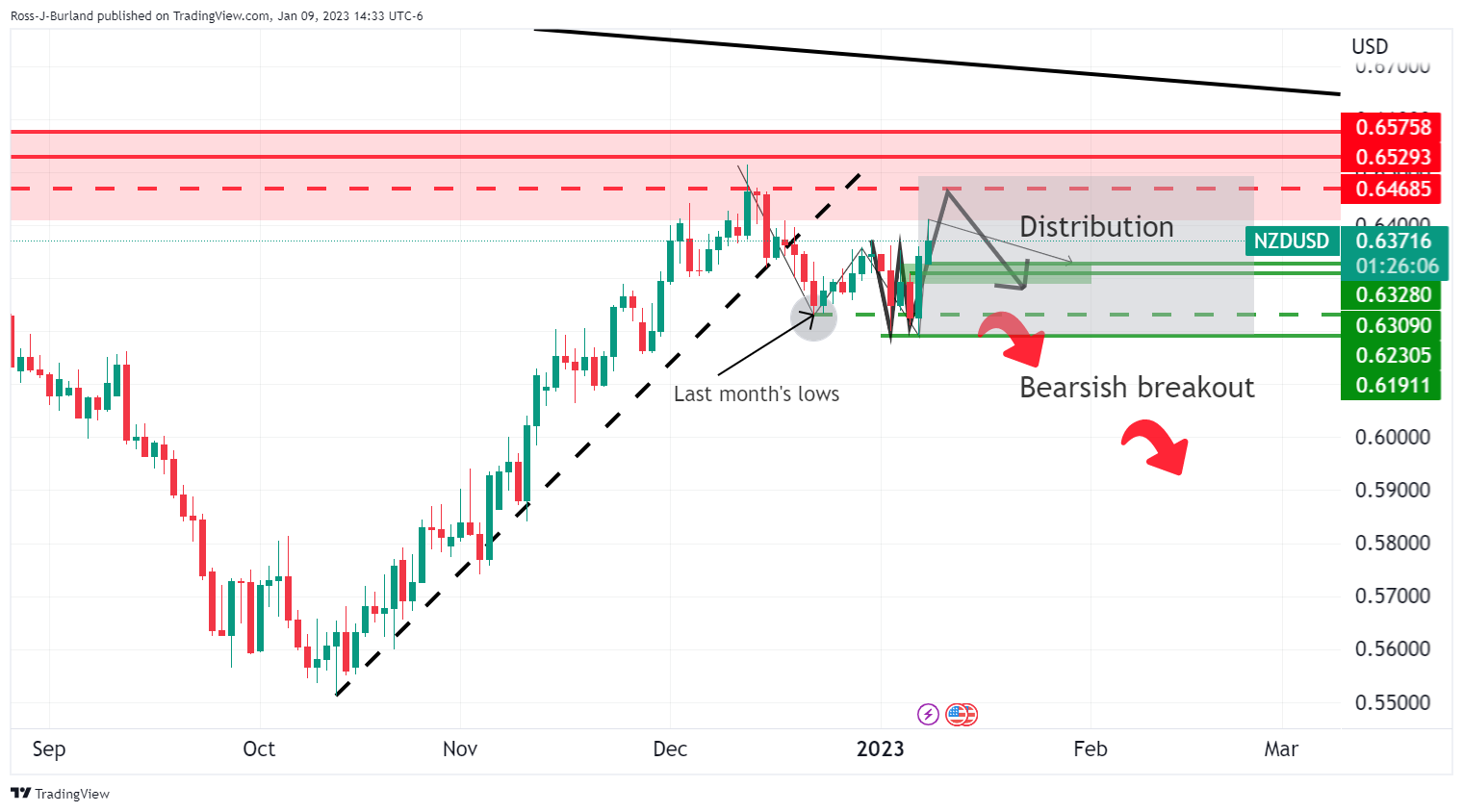

NZD/USD Price Analysis: Bears are lurking in critical resistance area

- NZD/USD bulls coming up for ain ahead of the keyUS event.

- The price is on the backside of a daily trend, and the front side of the weekly/monthly bear trend.

NZD/USD is higher by some 0.5% on the day so far and headed for a bullish close to starting the week. However, breakout traders chasing the move could find themselves in trouble as per the following technical analysis.

NZD/USD weekly chart

The price took out last month's low last week which is a bearish development looking forward while Kiwi remains on the front side of the dominant bearish trendline and below the following resistance:

The W-formation that is forming is also a bearish feature that could see the price struggle and hamstrung on bullish attempts. The W-formation is clearer on the line chart as follows:

NZD/USD daily chart

We also have a daily W-formation forming into the close on Monday and this reinforces the bearish prospects for days ahead as the countdown to the US Consumer Price Index gets underway.

That is not to say, however, that a test of resistance cannot happen before Thursday's main event. This leaves the 0.6470s exposed. In any case, traders will be looking to the lower timeframes for signs for deceleration from the bulls that could lead to a break of 0.6200 and the 90.6191 recent lows in time to come:

-

20:02

United States Consumer Credit Change above forecasts ($25B) in November: Actual ($27.96B)

-

19:55

Forex Today: Optimism hits the US Dollar

What you need to take care of on Tuesday, January 10:

The US Dollar started the week on the back foot as optimism weighed on the safe-haven currency. On the one hand, market players assessed US macroeconomic data published last Friday, which suggests the Federal Reserve could slow the pace of tightening.

Federal Reserve officials backed such speculation, as San Francisco Fed President Mary Daly said that 50 bps or 25 bps are on the table for the next meeting. Atlanta Federal Reserve bank president Raphael Bostic added rates should rise to 5% or 5.25%. Both pledged more hikes to tame inflation before they could finally pause and hold for some time.

On the other, China announced the re-opening of sea and land crossings with Hong Kong, which were closed three years ago. Asian stocks posted substantial gains, leading the way higher for their overseas counterparts. It is worth noting that Wall Street trimmed a good bunch of its intraday gains ahead of the close.

EUR/USD reached 1.0760, holding on to gains despite tepid Euro Zone data. GBP/USD trades at 1.2200, benefiting from the broad US Dollar weakness.

Commodity-linked currencies advanced at the beginning of the day, spending the last two sessions consolidating near their daily peaks vs the dollar. AUD/USD trades around 0.6930, while USD/CAD is down to 1.3370.

The Japanese Yen appreciated against the US Dollar, with the pair down to 131.50.

Gold holds on to gains and trades around $1,875 a troy ounce. However, crude oil prices ended the day little changed, with WTI currently changing hands at $74.70 a barrel.

Here’s what to expect from Shiba Inu price with spike in trade volume and the burn rate

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:24

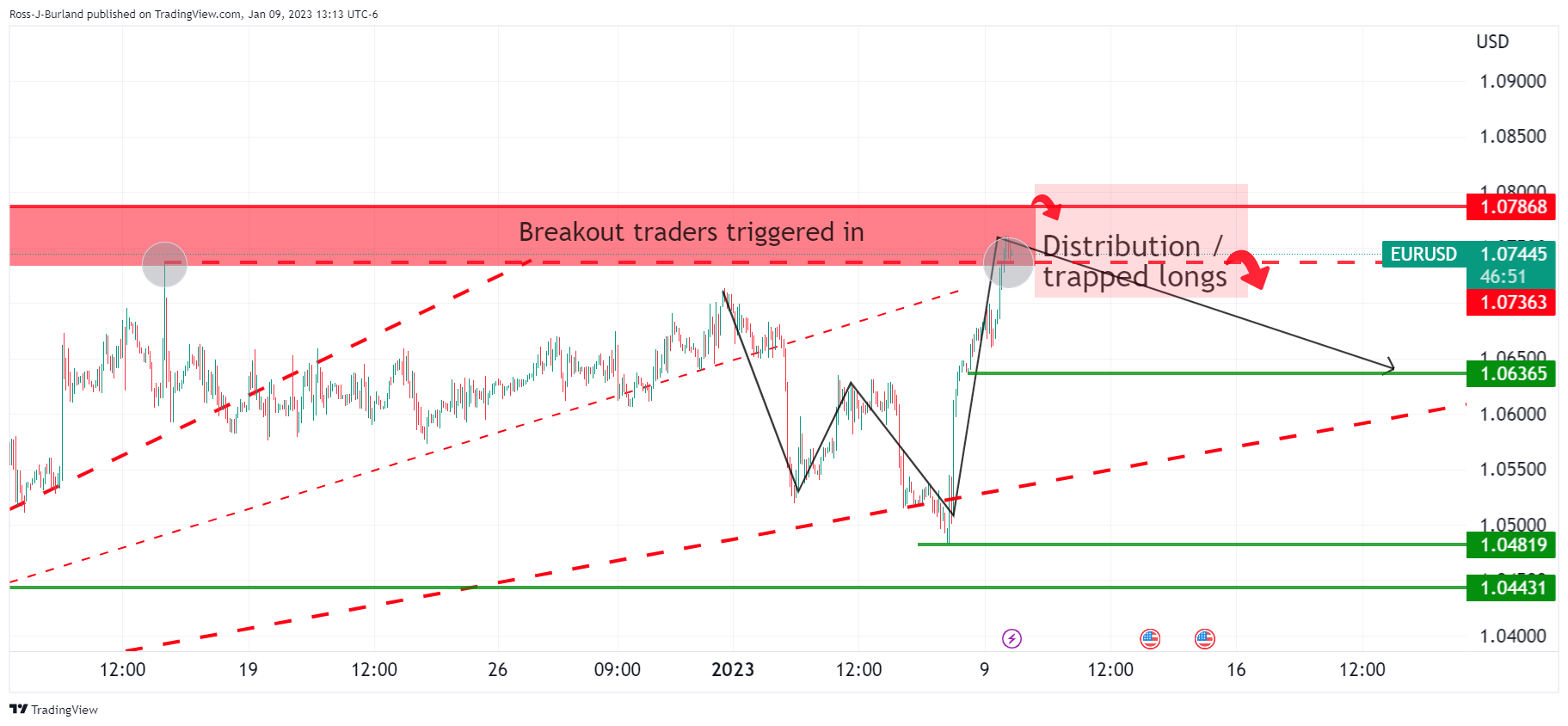

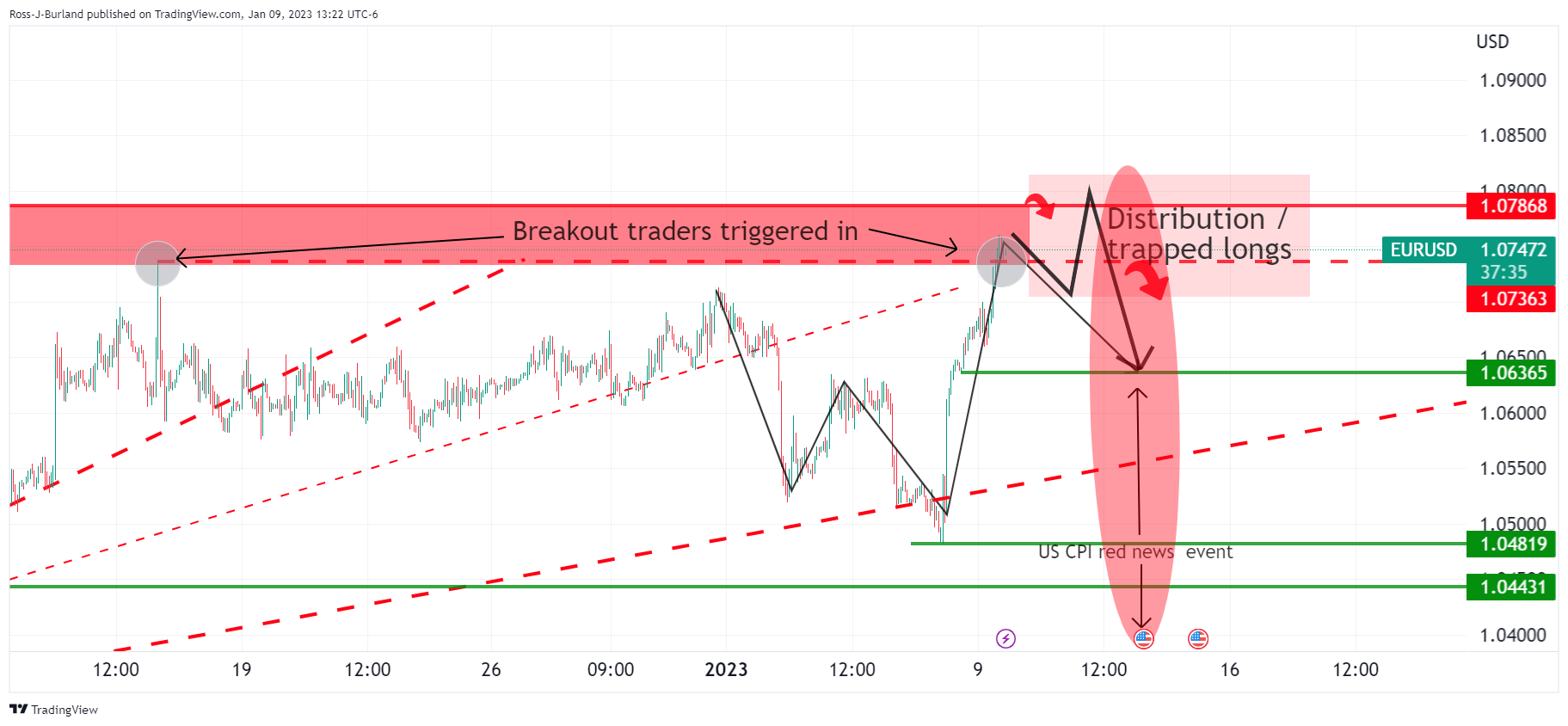

EUR/USD Price Analysis: Breakout traders triggered long, bears looking to pounce

- EUR/USD bearish W-formation is in focus.

- Bulls could find themselves trapped in trying to break out through recent highs.

- US CPI red news event could be the catalyst for a sizeable downside move.

EUR/USD broke to the backside of the bearish trend at the end of last year. It has since rallied towards a key resistance area but has started to slow in its ascent which leaves the focus on signs of distribution for the days ahead. The following illustrates this on a daily chart and highlights a key reversion pattern that has emerged at the start of the year:

EUR/USD daily chart

EUR/USD has reached up to test prior highs of 1.0736 and has moved into a critical resistance area as a potential last stop before the bears move back in.

Zoomed in...

Should the bears emerge below 1.0790, then the focus will be on signs of distribution again that will ultimately trap the breakout long positions.

The W-formation is supportive of such a thesis given that it is a reversion pattern. EUR/USD would be expected to revert towards the neckline and day's lows of near 1.0637. This could put the trendline support back under pressure and open the risk of a move below 1.0500 and on to test 1.0480, 0.0440 and then 1.0300 that guards 1.0290 and 1.0225 lower down.

EUR/USD H1 chart

In the meantime, the lower time frames can be monitored for signs of buying exhaustion love the coming sessions:

A long squeeze below 1.0750/36 could be in order for the sessions and days ahead with US Consumer Price Index eyed as a potential catalyst on Thursday for a three-day set-up and bearish opportunity.

With that being said, a test of 1.0800 is on the table beforehand:

-

18:46

USD/CHF Price Analysis: Drops and invalidates falling wedge, seesaw around 0.9200

- Overall, US Dollar weakness and improvement in risk appetite weighed on the USD/CHF pair.

- A USD/CHF daily close below 0.9200 could exacerbate a fall toward 2022 yearly lows.

- Otherwise, the USD/CHF could bounce at around YTD lows and climb above 0.9300.

The USD/CHF drops back beneath a falling wedge top-trendline and extends its losses for two consecutive trading days, down by 0.73% as the US Dollar (USD) falls. At the time of writing, the USD/CHF is trading at 0.9202.

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart portrays the resumption of the major’s downtrend. Failure to cling to gains around 0.9280s exacerbated a downfall toward its daily low of 0.9167, though buyers stepped around the daily lows, lifting the USD/CHF to current exchange rates. The USD/CHF stepped inside the falling wedge, a signal of bearishness. However, it would be needed a USD/CHF daily close below 0.9200 to pave the way for further downside. Otherwise, buyers could step in and lift the USD/CHF pair.

USD/CHF key support levels would be 0.9167. A breach of the latter would expose the February 21 daily low of 0.9150, followed by the 0.9100 mark, ahead of the 2022 year low of 0.9091. On the flip side, the USD/CHF first resistance would be 0.9200, which, once cleared, could pave the way towards today’s high of 0.9292, ahead of 0.9300.

USD/CHF Key Technical Levels

-

18:29

Fed's Bostic: Fair to say that the Fed is willing to overshoot

Atlanta Federal Reserve bank president Raphael Bostic said on Monday that it is ''fair to say that the Fed is willing to overshoot.''

Key notes

A likelihood that services inflation will prove sticker than the Fed would want.

Not seeing that wages are driving final goods prices.

Economy still has a "fair amount" of momentum, remains robust.

Right now economy can absorb Fed policy tightening.

Base case for 2023 is GDP growth of 1%, no recession.

Think inflation can fall to about 3% this year, though it will take time for the Fed's policy change to play out.

If there is a contraction it is going to be shallow and short.

Repeats see rates rising to between 5 and 5.25%.

Broad consensus that the Fed policy is in a restrictive place, appropriate to be much more cautious in terms of calibrating more. movements

Getting back to a more normal cadence of policy movements will be "appropriate and important".

Rates will have to stay high for "a long time...well into 2024".

Fair to say that the Fed is willing to overshoot.US Dollar update

The US Dollar was at a 7-month low, last down 0.83% at 103.05. The index, which measures the greenback against six major currencies, tumbled 1.15% on Friday as investors moved into riskier assets following a mixed labour market report and dismal US PMIs.

-

18:15

USD/CAD bears take out last month's low, but bulls could emerge

- USD/CAD bears remain in charge but a correction could be imminent.

- US CPI will be the key event for the week and US Dollar.

- Oil surges on China reopening, supportive of CAD.

USD/CAD has been pressured to a key area on the charts as the price of oil rallies while risky currencies benefited from China reopening borders. At the time of writing, USD/CAD is trading at 1.3370 and is down over 0.5% as we head towards the close of the first day of the week.

While there is good news being priced into the markets as China reopens, traders are looking ahead to this week's United States inflation data following a slew of market-impacting economic data last week from the US economy to start the year off. Markets are still digesting Friday’s Nonfarm Payrolls giving credence to a pivot from the Federal Reserve.

''The jobs report was strong overall as Unemployment dropped back to the cycle low of 3.5%, supporting the view that the labour market remains red hot,'' analysts at Brown Brothers Harriman explained. ''However, markets focused on the bigger than expected drop in average hourly earnings to 4.6% year over year.'' However, the analysts argued that ''if the labour market remains as tight as it seems, wages are unlikely to fall much further in the coming months.''

US CPI in focus

Meanwhile, US Services came in dismally poor and the combined jobs report has painted a picture of an economy that is growing and adding jobs, but where overall activity is tilting into recession territory. This prompted traders to sell the dollar against a range of currencies ahead of the US consumer inflation data due later this week.

Price pressures are still front and centre for investors and analysts at TD Securities explained that ''Core prices likely edged higher in December, with the index rising 0.3% month over month after printing 0.2% in November.

''Shelter inflation likely remained the key wildcard, though we look for goods deflation to act again as a major offset. Importantly, gas prices likely provided new relief to the CPI, as they fell sharply in December. All told, our month-over-month forecasts imply 6.5%/5.7% year over year for total/core prices.''

If the data were to surprise to the upside, this would be expected to shift investors' belief that the most likely outcome for the Fed's February meeting is for a 25-basis- point increase.

Oil rises as China reopens borders

Elsewhere, China continued to dismantle much of its strict zero-COVID rules around movement as it reopened its borders to international visitors for the first time since it imposed travel restrictions in March 2020. The BBC reported that ''incoming travellers will no longer need to quarantine, marking a significant change in the country's Covid policy as it battles a surge in cases. They will still require proof of a negative PCR test taken within 48 hours of travelling.''

As a consequence, supportive of the oil-exporting nation's currency, CAD, oil prices surged early on Monday as hopes demand from China will improve as the country issued new import quotas and offered economic support for its flagging economy. Spot West Texas Intermediate crude was last seen up 1.7% to $ 74.91 bbls.

USD/CAD positioning data

When looking at the positioning data, it is worth noting that speculators’ net long USD index positions remain close to their recent lows.

''Despite the hawkish tone of the Fed, net longs are around half the size they were in August, reflecting talk of ‘peak’ Fed rates in recent months. Hopes that the Fed may slacken the pace of rate hikes following the December payrolls report suggest scope for another fall in net longs in the next set of data,'' analysts at Rabobank argued.

The analysts also explained that Canada’s strong December jobs report could have an impact in the next set of CAD's positioning data. ''Speculators’ net short CAD positions dropped lower. The previous week they reached their highest levels since August 2020,'' the analysts said.

USD/CAD technical analysis

After meeting the weekly M-formation's neckline, USD/CAD is now testing last month's low this week and is penetrating a weekly bullish trendline with another more dominant one in sight below:

USD/CAD weekly chart

USD/CAD eyes 1.3316 and 1.3225 that come in and around the trendline as illustrated.

USD/CAD daily chart

From a daily perspective, given USD/CAD has pulled in higher time frame sellers on a break of last month's low, the initial balance of the week is being set and this could be the low for the week:

If so, trapped shorts will be under pressure. A retest of last week's low near 1.3430 opens the risk of a move beyond and into the Fibonacci scale to target a 38.2% ratio that meets late December and early January lows as the structure around the 1.3470s. Should the bears commit at this juncture, then they will be encouraged to stay the course for a re-run of the recent lows to target a -272% ratio of the corrective range that meets prior lows of 1.3316 that guard the 1.3220s.

USD/CAD H4 chart

From a 4-hour perspective, the M-formation supports the meanwhile bullish thesis as this is a reversion pattern that would be expected to draw in the price towards the anticipated resistance near 1.3470s. A bullish 4-hour close would be encouraging in this regard:

Zoomed in...

-

18:02

WTI climbs on China’s reopening, steadily around $74.80s

- Oil prices trim some of the last week’s 8% losses, up by 1.70%.

- The reopening of China and a softer US Dollar keep WTI advancing, though trading off the $76.69 highs of the day.

- WTI Price Analysis: Break above $75.00 could pave the way toward the 20-day EMA.

Western Texas Intermediate (WTI), the US crude oil benchmark, rose about 2% on Monday following China’s border reopening, which bolstered fuel’s demand outlook amidst recessionary fears looming. At the time of writing, WTI is trading at $74.83 per barrel.

A boost in sentiment spurred by China’s news and a less hawkish US Federal Reserve (Fed) was cheered by oil traders. Consequently, the greenback weakened, as shown by the US Dollar Index dropping 0.81%, down to 103.069.

Although today’s price action suggests WTI prices could resume upward, traders should be aware of last week’s losses of more than 8%, which were the most significant weekly declines since 2016.

Even though China’s opening its borders after three years of being closed was cheered by investors, woes that it could trigger an uptick in Covid-19 cases keep investors refraining from committing to riskier assets.

Meanwhile, US economic inflation expectations unveiled by a New York Fed survey flashed that consumers for one-year-ahead inflation slowed to 5% in December, on its lowest reading since July 2021. However, estimates for the three years were unchanged at 3%, while for a longer term, they edged 0.1% up to 2.4%.

WTI Price Analysis: Technical outlook

From a technical perspective, WTI peaked at around $76.69 per barrel on Monday, failing to crack the 20-day Exponential Moving Average (EMA) at $76.67. Suppose WTI achieves a daily close above January’s 6-daily high of $75.44. In that case, that will keep oil bulls for a resumption of a challenge of the 50-day EMA at $79.35, ahead of testing a three-month-old downslope trendline drawn from November highs of $93.73, which passes around $79.85, ahead of WTI reaching $80.00 a barrel.

-

17:48

Fed's Daly: December wage data was one month of data, can't declare victory

San Francisco Federal Reserve Bank President Mary Daly is dropping important comments in a live questions and answers with the Wall Street Journal.

Key notes

Expect US economy to continue slowing.

In Q1 expect labor market to continue to slow, inflation to come down.

Fed is data-dependent.

Have not seen core services inflation come down as we would like.

Core services inflation excluding shelter has shown no sense it is coming down.

There's agreement among fed policymakers that inflation is more persistent than thought.

Biggest risk is that inflation expectations would drift up.

We are determined, united, resolute to bring inflation down.

Wage growth coming down is completely consistent with labor market slowing.

Still out of balance in labor market.December wage data was one month of data, can't declare victory.

It's too soon to declare victory and stop rate hikes.We don't need to see inflation get to 2%, or even down to a stone's throw before we would stop raising rates. This phase of tightening is extremely challenging.

More to come...

US Dollar update

The US Dollar was at a 7-month low, last down 0.77% at 103.11. The index, which measures the greenback against six major currencies, tumbled 1.15% on Friday as investors moved into riskier assets following a mixed labour market report and earlier dismal US PMIs.

-

16:56

AUD/USD prints a new five-month high above 0.6900 as the USD remains offered

- AUD/USD climbs due to traders’ speculations that the US Federal Reserve would shift dovish.

- US 10-year Treasury bond yield continues to edge lower, eyeing the 3.50% threshold and weighing on the USD.

- AUD/USD Price Analysis: A daily close above 0.6900 can exacerbate a rally to 0.7000.

The AUD/USD soars sharply above the 0.6900 figure on speculations that the US Federal Reserve (Fed) would pivot from tightening monetary conditions, so the US Dollar weakened. US Treasury yields are dropping toward the 3.50% region while global equities continue to rise. At the time of writing, the AUD/USD is trading at 0.6948, above its opening price by 1.11%.

Sentiment and traders pricing a less hawkish Fed bolstered the AUD/USD

Wall Street extends its gains on Monday, ahead of the first release of US earnings. Inflation expectations in the United States (US) revealed by a New York Fed survey showed that consumers for one-year-ahead inflation decelerated to 5% in December, on its lowest reading since July 2021. However, estimates for the three-year period were unchanged at 3%, while for a longer term, they edged 0.1% up to 2.4%.

Aside from this, the US Dollar is edging down by 0.84%, as the US Dollar Index (DXY) shows, at 103.036, weakened by investors assessing a possible Fed pivot, as shown by US Treasury bond yields pushing lower, down at 3.523%.

Earlier in the Asian session, the Australian docket featured Building Permits for November, flashing a weaker housing as permits plummeted -9.0% below estimates for a -1.0% contraction, though AUD/USD traders mainly ignored data.

Reports from China added to an upbeat sentiment, suggesting that the country will boost the issuance of special local government bonds to a record high of CNY 3.8 trillion. Senior PBOC official Guo said growth would soon return to “normal” as policymakers support households and private companies more. Guo added that “The key to the economic recovery is to convert current total income to consumption and investment to the largest possible extent.”

AUD/USD Price Analysis: Technical outlook

Following a daily close above 0.6886 and piercing the 200-day Exponential Moving Average (EMA) at around 0.6821 exacerbated the AUD/USD rally to the current exchange rate. After seesawing around the 0.6600-0.6800 area during the last ten days, the major broke upwards, eyeing the 0.7000 mark. Oscillators like the Relative Strength Index (RSI) at 63 paint a bullish picture of the AUD/USD, while the Rate of Change (RoC) shows an increase in volatility, as the AUD/USD reclaimed 0.6900.

Therefore, the AUD/USD path of least resistance is upwards, and the key resistance levels would be the 0.7000 mark, followed by the August 26 daily high of 0.7008 and the August 12 swing high of 0.7128.

-

16:48

Brazil: Protests unlikely to hit the Real – Wells Fargo

On Sunday, just a week after Luiz Ignacio Lula da Silva was sworn in as president, supporters of former President Jair Bolsonaro stormed Brazil's Congress and other buildings against the outcome of the 2022 presidential election and the new administration. Analysts at Wells Fargo point out that despite political risk being typically elevated in Brazil, they believe Brazil's “January 6 moment” will not have a long-lasting impact on local financial markets or the economy. They still see USD/BRL around 5.30 by the end of the first quarter.

Past weekend’s event unlikely to weigh on BRL

“Despite more elevated political risk, we maintain our view that the USD/BRL exchange rate can hover around BRL5.30 by the end of Q1-2023 and that the real can strengthen toward BRL5.00 by the end of this year. We also believe this past weekend's events do not alter the course of Brazilian Central Bank (BCB) monetary policy, and we continue to believe BCB policymakers will initiate an easing cycle in Q3 of this year. And as far as the economy, our base case scenario is intact, and we believe Brazil's economy will enter a mild and modest recession by the middle of this year.”

“In the near-term, we will be focused on the Lula administration's reaction to the riots, especially since federal intervention is in place through the end of the month.”

“Over the medium-to-longer term, Lula's fiscal policy will likely be the driving force of the currency. Should future fiscal policies result in a further erosion of fiscal responsibility, we would turn outright negative on the currency for all of 2023, and our BRL5.00 target would be adjusted to reflect an outlook for Brazilian real weakness through the end of this year.”

-

16:23

Gold Price Forecast: XAU/USD bullish near eight-months highs as US Dollar keeps falling

- Gold price holds onto recent gains as the rally in Wall Street continues.

- A weaker US Dollar offers support to XAU/USD that continues to look at $1,880.

- Strong demand for Treasury bonds as market participants await a less hawkish Fed.

Gold prices are holding up and near the $1,880 area on Monday, supported by another slide of the US Dollar across the board, amid risk appetite and lower US Treasury bond yields. Technical bias points to further gains for the yellow metal.

US Dollar drops to lowest in months

The US Dollar, measured by the DXY is trading at the lowest level since June 2022, approaching 103.00, down 0.75% for the day, falling for the second day in a row. The greenback weakened on Friday following US economic data that included a mixed NFP report and an concerning ISM Service Sector PMI report.

Even USD/JPY is trading in negative territory on Monday after being unable to hold onto daily gain, and is back under 132.00. EUR/USD is at the highest level in six months while AUD/USD is at 0.6950, the highest since late August.

US Treasury bonds on demand

Last week’s economic data boosted speculations about a slowdown in the Fed rate hike cycle, favoring an increase of 25 basis points instead of a 50 bps. US Treasury yields tumbled on Friday and remains near the lows on Monday, with the US 10-year Treasury yield at 3.55%, the lowest since December 19 and the 2-year at 4.22%.

European yields are modestly higher but still near weekly lows. The rise in sovereign bond yields is a positive development for gold prices. As long as the market environment favors less hawkish monetary policy in Europe and the US, XAU/USD will likely remain strong.

Risk appetite: other positive for gold

After rising more than 2% on Friday, US equity prices are having another great day. The S&P 500 is up by 1.25% and the Nasdaq gains almost 2%. The improvement in market sentiment is also boosting commodity prices. The WTI barrel is at 75.85$, off highs but by 2.75%. Even cryptocurrencies are up with Bictoin at $17,260 and Ethereum up by 5.35% at $1,337.

Gold: Cleary bullish above $1,825

Last week, XAU/USD broke above $1,830, and it consolidated above strengthening the outlook for the yellow metal. The price peaked on Monday at $1,881.53, the highest level since June. It then pulled back finding support above $1,870.

The RSI is about to hit overbought readings suggesting that a correction or a consolidation might take place before the next leg higher. The next target is seen at $1,890, the last line of defence for a test of $1,900.

The bullish outlook for gold prices will remain strong while it holds above $1,825/30. The mentioned zone is a strong horizontal support and also currently an uptrend line is seen. A break lower would favor more losses.

Gold daily chart

-638088779264729573.png)

.

-

16:06

NY Fed: One-year consumer inflation expectation declines to 5% in December

The Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation declined to 5% in December from 5.2% in October.

Further details of the publication showed that the three-year ahead expected inflation remained unchanged at 3% and the five-year ahead expected inflation edged higher to 2.4% from 2.3%.

"The median expected growth in household income rose by 0.1 percentage point to 4.6% in December, a new series high," the NY Fed noted in its publication. "Median household spending growth expectations fell sharply to 5.9% from 6.9% in November. The decline was broad based across age and income groups."

Market reaction

The US Dollar Index stays under bearish pressure and was last seen losing 0.8% on the day at 103.05.

-

16:00

Gold Price Forecast: XAU/USD supported by negative real yields – Erste Group

XAU/USD increased by +9.9% in the fourth quarter. Negative real yields favour a rising Gold price, economists at Erste Group Research report.

Gold to inch higher to around $1,890 in 1Q 2023

“Real yields remain in negative territory in 1Q 2023 despite Fed rate hikes. This is a factor that favours a rising Gold price. However, real yields will rise due to the continuation of the Fed's rate hike cycle and the expected decline in the US inflation rate during 1Q but will remain in negative territory. As long as that is the case, Gold has very strong support.”

“The expected slowdown in global economic growth and declining corporate earnings growth rates will boost safe-haven flows in gold.”

“We expect a slight price increase to around $1,890 in 1Q 2023.”

-

15:49

GBP/USD rallies above 1.2200 on soft US Dollar, BoE’s comments

- The GBP/USD pierces the 200-day EMA and distance from it, rallying above the 1.2200 figure.

- Investors are eyeing the United States inflation report on Thursday.

- GBP/USD Price Analysis: A daily close above 1.2200 to pave the way toward 1.2300.

The Pound Sterling (GBP) advances against the US Dollar (USD) early in the North American session due to an upbeat market mood on speculations that the US Federal Reserve (Fed) would slowdown rate hikes in a week that an inflation report in the United States is the spotlight. At the time of writing, the GBP/USD is trading at 1.2205.

UK politics and hawkish BoE commentary lift the GBP/USD

Wall Street opens with solid gains. An absent US economic docket on Monday keeps traders adrift to UK news. As reported by Reuters, UK Prime Minister Rishi Sunak said that inflation is not guaranteed to decline in 2022 and that the government would need to be disciplined to curb inflation. Regarding strikes and other themes, UK’s PM Sunak added that he was willing to discuss pay increases for nurses in an effort to finish strikes.

In the meantime, Bank of England (BoE) policymakers led by Catherine Mann said that energy price caps could bring inflation up in other sectors as it could boost consumer spending. She added that what would happen to inflation is unclear when lids are removed.

At the time of typing, the BoE Chief Economist Huw Pill said that the BoE would continue to act to reach the inflation target, saying that the Monetary Policy Committee (MPC) “will respond forcefully” if needed. Pill stated that domestic prices and wages are key to the MPC outlook.

GBP/USD Price Analysis: Technical outlook

After breaching the 200-day Exponential Moving Average (EMA), the GBP/USD closes toward the 1.2200 mark, printing a three-week new high. The twelve-day consolidation period appears to end, and if the GBP/USD clears the 1.2200 figure, that could pave the way for December’s 19 daily high of 1.2242, which, once cleared, could open the door for a rally to 1.2300.

Oscillators like the Relative Strength Index (RSI) show buyers gathering momentum, while the Rate of Change (RoC) woke up and aimed higher after showing lower levels of volatility.

-

15:48

GBP/USD reasserts the uptrend toward the 1.2668/1.2758 area – Credit Suisse

GBP/USD’s weakness was aggressively reversed on Friday. Analysts at Credit Suisse look for strength back to 1.2447 and eventually 1.2668/1.2758.

Support is seen at 1.1936/30

“We look for strength back to 1.2242 initially, then the potential downtrend from February last year at 1.2346/55. Whilst we would look for a fresh pause here, we look for a break in due course for strength back to the 1.2445/47 December highs and eventually our core objective at 1.2668/1.2758 – the May 2022 high and 61.8% retracement of the 2021/2022 fall.”

“Support is seen at 1.2075 initially, then 1.2035, with the aforementioned 55DMA and ‘neckline’ support at 1.1936/30 ideally holding further weakness.”

-

15:45

BoE's Pill: Supply disruptions appear to have eased in recent months

Bank of England (BoE) Chief Economist Huw Pill said on Monday that the rise in the policy rates to current levels can be seen as significant progress in the normalization of the monetary policy, as reported by Reuters.

Key takeaways

"Supply disruptions appear to have eased in recent months."

"There have been some, albeit still tentative, signs of a normalisation in the patterns of consumer demand."

"We are starting to see labour market indicators turn.

"The extent to which an easing in the labour market induced by monetary tightening will weigh against inflationary pressures will depend on the wider context."

"To the extent that the level of imported gas prices remains significantly higher than in the past, then the threat of second round may well remain."

"Important question for BoE is how pragmatic and realistic UK firms and households are in accepting the macroeconomic implications of the higher imported energy and goods prices."

"The longer that firms try to maintain real profit margins and employees try to maintain real wages at pre-energy price shock levels, the more likely it is that domestically-generated inflation will achieve its own self-sustaining momentum."

"BoE must ensure that any self-sustaining momentum in inflation at rates above the 2% target is squeezed out of the system by constraining demand."

Market reaction

GBP/USD preserves its bullish momentum following these comments and was last seen rising nearly 1% on a daily basis at 1.2205.

-

15:28

USD Index to plunge towards 100 on failure to defend 103 – SocGen

The US Dollar Index is close to potential support of 103. A break below here would open up significant losses to the 100 level, analysts at Société Générale report.

Death cross points towards deeper correction

“Daily MACD has started posting positive divergence however signals of a meaning rebound are not yet visible. The 50DMA is about to cross below the 200DMA forming a death cross; this points towards persistent downtrend.”

“Test of 103 could result in an initial bounce however a break above the confluence of the MAs at 105.80/106.50 is essential to affirm a meaningful up-move.”

“Failure to defend 103 could mean continuation in decline towards last June low of 102/101.30 and 100.”

-

15:08

USD/JPY: Support is seen at 129.62/52 and eventually 127.53/27 – Credit Suisse

USD/JPY has fallen sharply post US payrolls. In the view of analysts at Credit Suisse, the recent strength has been corrective only and stay bearish for 127.53/27.

Resistance at 134.78/89 set to cap

“The recovery in USD/JPY last week was unable to hold above the 134.50 recent high. This adds weight to the core view recent strength has been corrective only.”

“Below support at 131.30 should see the immediate risk stay lower for a retest of the 129.62/52 recent low. An eventual break below here should clear the way for a move to our 127.53/27 core objective – the ‘neckline’ to the multi-year base and 50% retracement of the 2020/2022 uptrend.”

“Resistance is seen at 132.96 initially, then 133.24, with 134.78/89 expected to remain a major cap.”

-

15:03

EUR/USD climbs to 4-week highs past 1.0730, dollar remains offered

- EUR/USD picks up extra pace and trespasses the 1.0700 barrier.

- The greenback remains on the defensive and drops to 7-month lows.

- EMU Unemployment Rate held steady at 6.5% in November.

Bulls push harder at the beginning of the week and lift EUR/USD to the 1.0730 region for the first time since mid-December.

EUR/USD bolstered by risk-on sentiment, weaker dollar

EUR/USD leaves behind the 1.0700 barrier to clinch fresh multi-week peaks always on the back of the persevering sell-off in the greenback, which comes pari passu with investors’ re-assessment of the potential next steps by the Federal Reserve when it comes to future interest rate hikes.

This change of perspective from market participants have been reignited soon after the publication of the December’s Nonfarm Payrolls last Friday. Indeed, while the mixed tone from the monthly US labour market showed a still healthy job creation, the wage growth seems to have lost some momentum and that is what is leading traders to start pricing in some probable pause in the Fed’s hiking cycle.

On another page, and in the euro docket, the Unemployment Rate in the broader Euroland remained at 6.5% in November, while the Investor Confidence gauged by the Sentix Index improved a tad to -17.5 for the current month.

Across the pond, the Consumer Credit Change will be the sole release as well as 3-month/6-month bill auctions.

What to look for around EUR

EUR/USD has embarked on a strong recovery and has already surpassed the 1.0700 barrier. The extent and duration of the breakout, however, should hinge on the risk trends and dollar dynamics.

In addition, the next steps regarding monetary policy – and particularly the ongoing tightening cycles - from both the ECB and the Fed will be crucial in determining the direction of the pair’s price action in the next months.

Looking at the euro area, speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: Germany Industrial Production, Italy Unemployment Rate, EMU Unemployment Rate/Sentix Index (Monday) – France Industrial Production (Tuesday) – France final Inflation Rate, Germany Full Year GDP Growth, MEU Balance of Trade/Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.84% at 1.0729 and faces the next resistance level at 1.0736 (monthly high December 15 2022) seconded by 1.0773 (monthly high June 27 2022) and finally 1.0786 (monthly high May 30 2022) On the downside, the breach of 1.0496 (monthly low January 6) would target 1.0443 (weekly low December 7) en route to 1.0383 (55-day SMA).

-

14:43

GBP/USD to rise up towards the 1.3000 level – MUFG

The Pound has outperformed since the end of last week. Economists at MUFG Bank expect the GBP/USD pair to advance nicely towards 1.30 this year.

A better year ahead for the Pound after weak performance in 2022?

“While it is already well anticipated that the UK economy is in recession, the recent favourable energy price developments increase the likelihood that the downturn could be shallower and shorter than expected. In the BoE’s latest projections, they expected that the recession could last until the middle of 2024. The downbeat assessment leaves more room for upside surprises in the year ahead.”

“We are now forecasting a more bullish outlook for the pound later this year and expect Cable to rise up towards the 1.3000 level.”

“We believe that we have moved past peak pessimism towards the Pound, although remain wary that strike action alongside elevated wage growth continue to pose downside risks by potentially contributing to a more persistent period of higher inflation in the UK.”

-

14:20

EUR/USD: Break above 1.0737/88 to clear the way for a test of 1.0900/44 – Credit Suisse

EUR/USD’s corrective setback is already over. Economists at Crdit Suissenow look for a retest and then eventual break above 1.0736/88 for a move to 1.0900/44.

Support at 1.0630 set to hold

“The corrective setback is most likely already over and we look for a retest of key resistance at 1.0736/88 – the recent high, May and June 2022 highs, and 61.8% retracement of the 2022 decline. Whilst a fresh setback from here should be allowed for, we continue to look for an eventual clear break for a test of 1.0900/44 – the 50% retracement of the entire 2021/2022 fall.”

“Support at 1.0636/30 ideally holds to keep the immediate risk higher. A break can see a deeper setback to 1.0580, potentially 1.0546.”

-

14:13

Indonesia: FX Reserves shrank in 2022 – UOB

Economist at UOB Group Enrico Tanuwidjaja reviews the latest report of FX Reserves in Indonesia.

Key Takeaways

“Indonesia’s foreign exchange reserves increased by USD3.2bn to USD137.2bn in Dec 2022 but declined a total of USD7.7bn throughout last year.”

“The latest reserve level was equivalent to finance 6 months of import or 5.9 months of imports and servicing the government’s external debt, well above the international adequacy standard of 3 months of imports.”

“Services and tax payment revenue and government external debt drawdown accounted for last month’s significant increase in the reserves. BI maintains the view that the official reserve assets will remain adequate to anchor stability and safeguard the Indonesian economy.”

-

13:58

Silver Price Analysis: XAG/USD retreats from multi-day top, technical setup favours bulls

- Silver struggles to capitalize on its modest intraday gains beyond the $24.00 mark.

- The technical set-up favours bullish traders and supports prospects for further gains.

- A convincing break below the $23.00 mark is needed to negate the positive outlook.

Silver builds on Friday's goodish rebound from the vicinity of the $23.00 mark and gains some follow-through traction on the first day of a new week. The white metal, however, struggles to find acceptance above the $24.00 round figure and retreats from a three-day high touched during the first half of the European session.

The XAG/USD, meanwhile, manages to defend the 100-period SMA on the 4-hour chart, around the $23.70 area, and the technical set-up still seems tilted in favour of bullish traders. The outlook is reinforced by positive oscillators on daily/hourly charts. That said, it will still be prudent to wait for a sustained strength beyond the $24.00 mark before positioning for any further appreciating move.

The XAG/USD might then aim to surpass an intermediate hurdle near the $24.25 region, which is followed by the multi-month high, around the $24.50-$24.55 region touched last week. Some follow-through buying beyond the latter will be seen as a fresh trigger for bullish traders and lift spot prices further towards reclaiming the $25.00 psychological mark for the first time since April 2022.

On the flip side, the $23.20-$23.10 area now seems to have emerged as immediate support ahead of the $23.00 round figure. A convincing break below could drag the XAG/USD towards the $22.60-$22.55 region en route to the next relevant support near the $22.10-$22.00 horizontal zone. Failure to defend the latter will mark a breakdown and set the stage for a further near-term depreciating move.

Silver 4-hour chart

Key levels to watch

-

13:30

Canada Building Permits (MoM) came in at 14.1%, above expectations (3.7%) in November

-

13:18

Gold Price Forecast: XAU/USD at risk of suffering a setback – Commerzbank

Gold price has chalked up gains at the start of the new year. Nonetheless, strategists at Commerzbank envisage a risk of setbacks in the yellow metal market.

Any lasting recovery will require a shift in sentiment among ETF investors

“Gold’s upswing is presumably due primarily to more optimism among speculative financial investors, who are generally more fickle.”

“However, any lasting recovery of prices on the Gold market will require above all a shift in sentiment among ETF investors, who are still exercising caution. They appear to be waiting for the US rate hike cycle to come to an end.”

“In the short term, we envisage if anything a risk of setbacks on the gold market.”

-

13:08

GBP/USD to enjoy further gains toward the mid/upper 1.22s – Scotiabank

GBP/USD retests mid-1.21s. Economists at Scotiabank expect the pair to extend its advance toward the mid/upper 1.22s.

Dip under 1.2080/75 to open up a retest of 1.1950/00

“A strong close on the session Friday (bullish outside range) and a close back above the 200-day MA (1.2014) are clearly GBP positive from a technical point of view.”

“Spot is struggling a little to extend through the mid-1.21s, which may be an early warning that gains may not stick but the basic set-up for the Pound is positive and favours near-term gains to the mid/upper 1.22s at least.”

“Support is 1.2075/80; weakness below here would signal a retest of 1.1950/00.”

-

13:04

USD/JPY clings to modest intraday gains above 132.00, upside potential seems limited

- USD/JPY rallies over 100 pips from the daily low, though the intraday uptick lacks follow-through.

- A generally positive risk tone undermines the safe-haven JPY and offers some support to the pair.

- The prevalent USD selling bias keeps a lid on any meaningful gains and warrants caution for bulls.

The USD/JPY pair attracts some dip-buying near the 131.30 area on Monday and hits a fresh daily high during the mid-European session, though lacks follow-through. The pair, however, sticks to a mildly positive tone heading into the North American session and is currently placed around the 132.30 region.

A generally positive tone around the equity markets undermines the safe-haven Japanese Yen and lends some support to the USD/JPY pair. The global risk sentiment gets a lift in the wake of China's biggest pivot away from its strict zero-COVID policy. In fact, China opened its borders over the weekend for the first time in three years, though worries about a deeper global economic downturn keep a lid on any further optimism.

Apart from this, the prevalent US Dollar selling bias, amid rising bets for a less aggressive policy tightening by the Fed, acts as a headwind for the USD/JPY pair. Friday's mixed US jobs report (NFP) and the disappointing release of the US ISM Services PMI fueled speculations that the US central bank will soften its hawkish stance. Moreover, the markets are now pricing in 25 bps at the next FOMC policy meeting in February.

Apart from this, the recent reports that the Bank of Japan (BoJ) plans to raise its inflation forecasts could lend support to the JPY and contribute to capping the USD/JPY pair. This, in turn, suggests that the path of least resistance for spot prices is to the downside. Hence, attempted recovery could be seen as a selling opportunity and remain capped, at least for the time being, in the absence of any relevant macro data from the US.

Technical levels to watch

-

12:43

EUR/USD to stretch higher toward 1.0750 – Scotiabank

EUR/USD’s rebound extends to the upper 1.06s. Economists at Scotiabank expect the world's most popular currency pair to test the 1.0750 mark.

Technicals are bullish

“A strong close on the session Friday (bullish outside range) following the spot’s rebound back above 1.0575/00 suggests additional upside risks from a technical point of view from here.”

“Resistance is seen at 1.0740/50.”

“Support is 1.0625/30 and 1.0600 on the day.”

“Additional gains will need to be driven by USD-negative developments.”

See: EUR/USD set to head up to 1.0735/85 – ING

-

12:21

AUD/USD to enjoy further upside towards August high at 0.7136 – Credit Suisse

AUD/USD is breaking into fresh highs. Economists at Credit Suisse look for further upside towards 0.7088/7136.

Support shifts to 0.6888/86

“Whilst a solid close above 0.6893/6916 is needed to serve as a final confirmation for the fresh upside, our bias shifts to bullish given the recent breaks, with resistance seen at 0.7000/09 initially and next at 0.7026/40, above which would look to test a much tougher resistance at a retracement resistance and the August high at 0.7088/7136.”

“Support shifts to 0.6888/86 initially and then to 0.6861, though only back below the 13-day exponential average at 0.6798/88 would put the market back within its recent range.”

-

12:16

USD/CAD drops to fresh multi-week low, further below 1.3400 amid weaker USD/rallying oil prices

- USD/CAD drops to a seven-week low on Monday and is pressured by a combination of factors.

- An intraday rally in crude oil prices underpins the Loonie and exerts pressure amid a weaker USD.

- Diminishing odds for more aggressive Fed rate hikes and the risk-on mood weigh on the buck.

The USD/CAD pair remains under heavy selling pressure for the second straight day and drops to its lowest level since late November heading into the North American session on Monday. The pair is currently placed around the 1.3380-1.3375 region, down nearly 0.50% for the day, and is pressured by a combination of factors.

The Canadian Dollar continues to draw support from Friday's upbeat domestic employment details, which raised expectations for additional rate hikes by the Bank of Canada. Adding to this, a strong intraday rally of over 3% in crude oil prices, bolstered by China’s biggest pivot away from its strict zero-COVID policy, underpins the commodity-linked Loonie. This, along with sustained US Dollar selling bias, contributes to the offered tone surrounding the USD/CAD pair and the ongoing downward trajectory.

The mixed US monthly jobs report (NFP) and the disappointing release of the US ISM Services PMI on Friday lifted bets for a less aggressive policy tightening by the Fed. In fact, the markets are now pricing in a 25 bps Fed rate hike move in February, which is reinforced by a further decline in the US Treasury bond yields. Furthermore, a generally positive tone around the equity markets is also seen denting the greenback's relative safe-haven status and exerting additional pressure on the USD/CAD pair.

That said, worries about a deeper global economic downturn keep a lid on the optimism in the markets, which could help limit losses for the USD. Nevertheless, the USD/CAD pair confirms a bearish breakdown below a technically significant 100-day SMA. Moreover, a subsequent slide below the 1.3400 mark could be seen as a fresh trigger for bearish traders. In the absence of any relevant market-moving macro data, either from the US or Canada, this supports prospects for a further depreciating move for the pair.

Technical levels to watch

-

12:14

USD/JPY: 200DMA at 136.50 could cap the bounce – SocGen

USD/JPY’s downward momentum has got arrested after forming a trough near 129.50. The 200-Day Moving Average (DMA) near 136.50 could provide resistance, economists at Société Générale report.

Short-term rebound not ruled out

“Holding above 129.50, a short-term up move is not ruled out towards the 200DMA at 136.50; this could cap the upside.”

“December high of 138/138.80 could be an important resistance zone. Failure to reclaim 138.50/139.00 would mean risk of continuation in downtrend.”

“Below 129.50, next potential supports are located at projections of 128 and peak of 2015 near 125.85/124.00.”

-

12:07

EUR/USD Price Analysis: The surpass of 1.0713 exposes 1.0736

- EUR/USD adds to the upside momentum near 1.0700.

- Extra gains initially target the weekly high at 1.0713.

EUR/USD picks up extra upside traction and flirts with the 1.0700 barrier at the beginning of the week.

If the recovery gathers extra steam, then the pair should challenge the weekly top at 1.0713 (December 30). Once cleared, the next hurdle of relevance is seen at the December 2022 peak at 1.0736 (December 15).

In the meantime, further gains remain in store for the pair while above the 200-day SMA at 1.0310.

EUR/USD daily chart

-

12:00

Mexico 12-Month Inflation above forecasts (7.62%) in December: Actual (7.82%)

-

12:00

Mexico Headline Inflation came in at 0.38%, below expectations (0.83%) in December

-

12:00

Mexico Core Inflation came in at 0.65% below forecasts (0.7%) in December

-

11:54

USD/IDR faces some consolidation near term – UOB

USD/IDR is expected to trade between 14,450 and 15,800 in the near term, comments Markets Strategist at UOB Group Quek Ser Leang.

Key Quotes

“USD/IDR bucked the USD weakness trend as it closed higher by 0.42% last Friday (NY close of 15,575).”

“The price actions appear to be part of a broad consolidation range and we expect USD/IDR to trade between 15,450 and 15,800 this week.”

-

11:52

USD/CNY to slip towards 6.70 by end-2023 – TDS