Notícias do Mercado

-

16:32

Foreign exchange market. American session: the Canadian dollar rose against the U.S. dollar due to the better-than-expected housing starts in Canada

The U.S. dollar traded lower against the most major currencies ahead Fed's monetary policy meeting. The U.S. currency remained under pressure after yesterday's comments by Minneapolis Fed President Narayana Kocherlakota. He said that inflation in the U.S. was more likely to be under Fed's 2% target until 2018. That may mean that interest rate in the U.S. will remain at the low level for a longer period.

Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

The euro increased against the U.S. dollar in the absence of any major economic reports in the Eurozone.

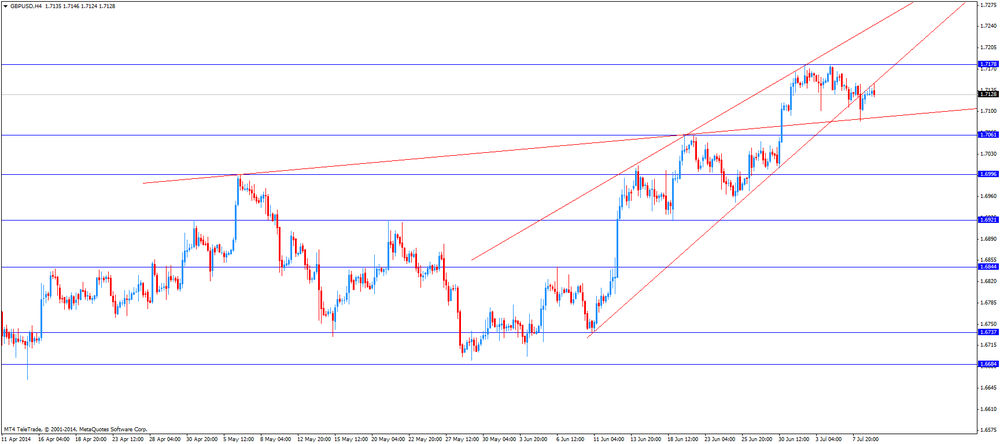

The British pound traded higher against the U.S. dollar. The Halifax house price index declined 0.6% in June, missing expectations for a 0.3% fall, after a 3.9% rise in May.

On a yearly basis, the Halifax house price index rose 8.8% in June, after a 8.7% gain in May.

The Canadian dollar rose against the U.S. dollar due to the better-than-expected housing starts in Canada. The number of housing starts in Canada increased to 198,200 units in June, beating expectations for a decline to 191,000 units, after 197,000 units in May. May's figure was revised down from 198,300 units.

The New Zealand dollar traded near 3-year highs against the U.S dollar due to decreasing demand for the U.S. currency ahead of Fed's meeting minutes. The kiwi was also supported by Fitch's decision. The ratings agency affirmed the New Zealand's AA rating yesterday and raised New Zealand's outlook to positive from stable.

The Australian dollar traded mixed against the U.S. dollar after the better-than-expected consumer confidence in Australia. The Westpac Banking Corporation released its consumer confidence index for Australia. The index increased 1.9% in July, after a 0.2% gain in June.

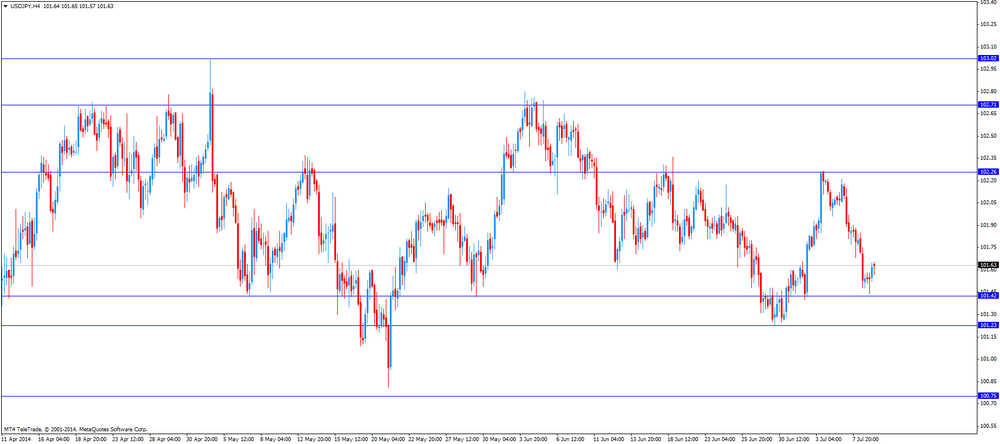

The Japanese yen traded lower against the U.S. dollar. The machine tool orders in Japan climbed 34.2% in June, after a 24.1% gain in May.

-

15:30

U.S.: Crude Oil Inventories, July -2.4

-

14:40

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3615, $1.3650

USD/JPY Y101.75, Y102.00, Y102.25

GBP/USD $1.7125

AUD/USD $0.9350, $0.9400, $0.9450

USD/CAD C$1.0625, C$1.0675, C$1.0700, C$1.0725, C$1.0730

EUR/GBP stg0.7925, stg0.8000, stg0.8050

-

13:15

Canada: Housing Starts, June 198 (forecast 191)

-

13:00

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies ahead Fed's monetary policy meeting

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence June 7 8

05:00 Japan Eco Watchers Survey: Current June 45.1 49.2 47.7

05:00 Japan Eco Watchers Survey: Outlook June 53.8 53.3

06:00 Germany Trade Balance May 17.7 15.7 18.8

06:45 France Trade Balance, bln June -4.1 Revised From -3.9 -4.1 -4.9

07:15 Switzerland Retail Sales Y/Y May +0.4% +1.5% -0.6%

07:15 Switzerland Consumer Price Index (MoM) June +0.3% +0.1% -0.1%

07:15 Switzerland Consumer Price Index (YoY) June +0.2% +0.2% 0.0%

08:30 United Kingdom Industrial Production (MoM) May +0.4% +0.3% -0.7%

08:30 United Kingdom Industrial Production (YoY) May +3.0% +3.1% +2.3%

08:30 United Kingdom Manufacturing Production (MoM) May +0.4% +0.5% -1.3%

08:30 United Kingdom Manufacturing Production (YoY) May +4.4% +5.6% +3.7%

09:00 Eurozone ECOFIN Meetings

09:00 Eurozone ECB's Vitor Constancio Speaks

The U.S. dollar traded higher against the most major currencies ahead Fed's monetary policy meeting. The U.S. currency remained under pressure after yesterday's comments by Minneapolis Fed President Narayana Kocherlakota. He said that inflation in the U.S. was more likely to be under Fed's 2% target until 2018. That may mean that interest rate in the U.S. will remain at the low level for a longer period.

Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

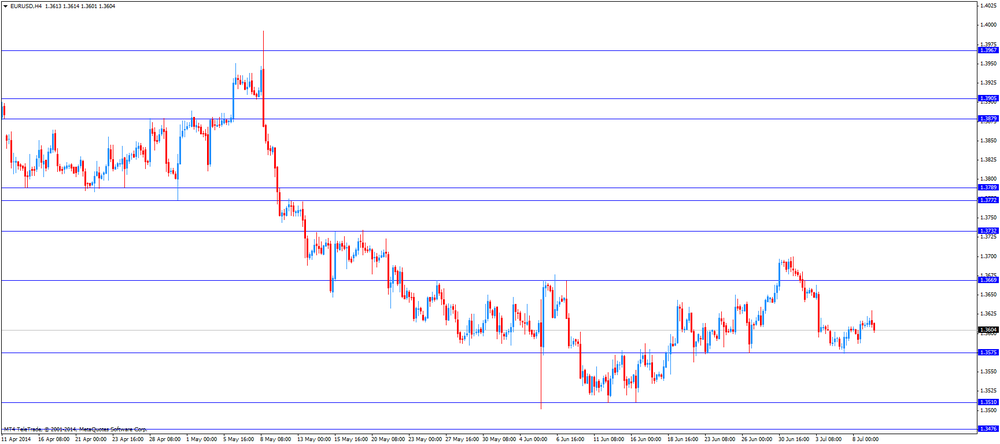

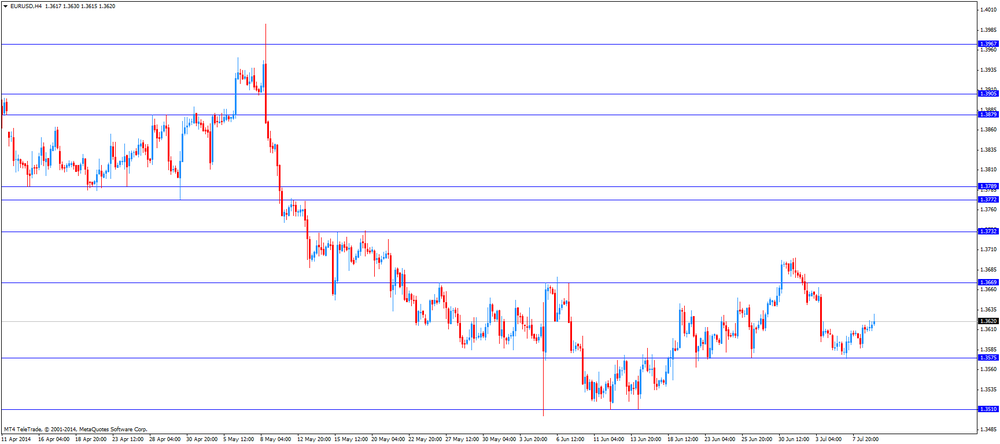

The euro traded lower against the U.S. dollar in the absence of any major economic reports in the Eurozone.

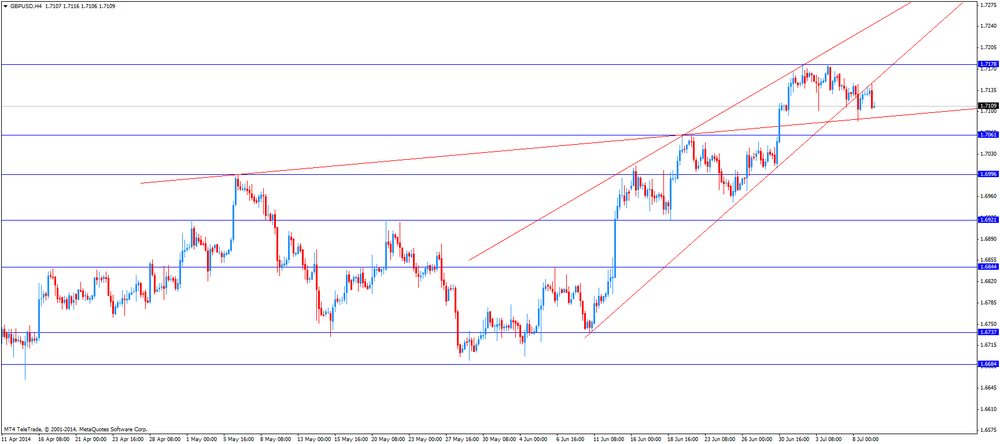

The British pound fell against the U.S. dollar after the Halifax house price index. The Halifax house price index declined 0.6% in June, missing expectations for a 0.3% fall, after a 3.9% rise in May.

On a yearly basis, the Halifax house price index rose 8.8% in June, after a 8.7% gain in May.

The Canadian dollar traded higher against the U.S. dollar ahead of the housing starts in Canada. The number of housing starts in Canada should be 191,000 units in June, after 198,000 units in May.

EUR/USD: the currency pair declined to $1.3601

GBP/USD: the currency pair decreased to $1.7104

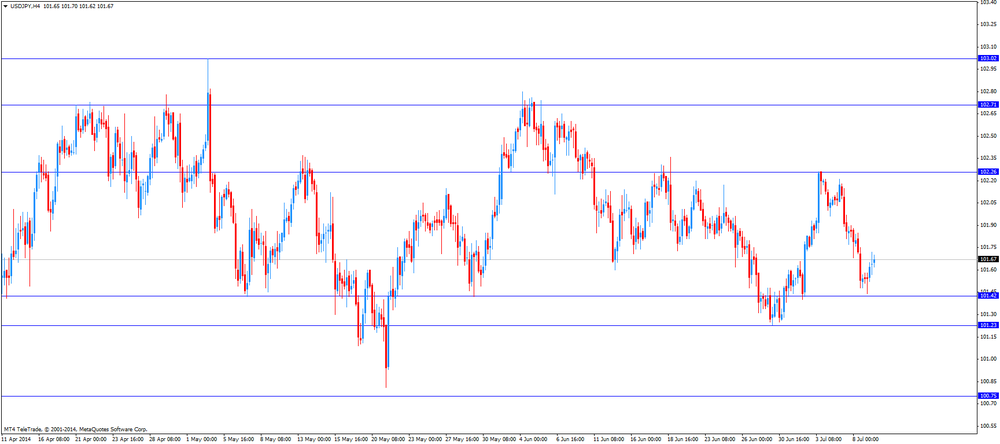

USD/JPY: the currency pair climbed to Y101.72

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate June +0.9%

14:00 U.S. JOLTs Job Openings May 4455 4530

17:45 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. Consumer Credit May 26.8 21.3

20:30 U.S. API Crude Oil Inventories July -0.9

-

12:45

Orders

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660

Bids $1.3585, $1.3565, $1.3550/40, $1.3500

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420

Bids $0.9360, $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y140.00, Y139.50, Y139.30, Y139.00, Y138.65

Bids Y138.00, Y137.90, Y137.70

USD/JPY

Offers Y102.80, Y102.65, Y102.50, Y102.30, Y102.00

Bids Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970

Bids stg0.7925, stg0.7905-890, stg0.7800

-

10:21

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3615, $1.3650

USD/JPY Y101.75, Y102.00, Y102.25

GBP/USD $1.7125

AUD/USD $0.9350, $0.9400, $0.9450

USD/CAD C$1.0625, C$1.0675, C$1.0700, C$1.0725, C$1.0730

EUR/GBP stg0.7925, stg0.8000, stg0.8050

-

09:51

Foreign exchange market. Asian session: the New Zealand dollar climbed toward 3-year highs against the U.S dollar

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence July +0.2% +1.9%

01:30 China PPI y/y June -1.4% -1.1% -1.1%

01:30 China CPI y/y June +2.5% +2.4% +2.3%

06:00 Japan Prelim Machine Tool Orders, y/y June +24.1% +34.2%

07:00 United Kingdom Halifax house price index June +3.9% -0.3% -0.6%

07:00 United Kingdom Halifax house price index 3m Y/Y June +8.7% +8.8%

The U.S. dollar traded lower against the most major currencies due to yesterday's comments by Minneapolis Fed President Narayana Kocherlakota. He said that inflation in the U.S. was more likely to be under Fed's 2% target until 2018. That may mean that interest rate in the U.S. will remain at the low level for a longer period.

Market participants are awaiting the release of the last Fed's monetary policy meeting today. They will be looking for any signs of the recovery of the world's largest economy. There are speculations that stronger employment data may lead to interest rate hike by the Fed.

The New Zealand dollar climbed toward 3-year highs against the U.S dollar due to decreasing demand for the U.S. currency ahead of Fed's meeting minutes. The kiwi was also supported by Fitch's decision. The ratings agency affirmed the New Zealand's AA rating yesterday and raised New Zealand's outlook to positive from stable.

The Australian dollar traded mixed against the U.S. dollar after the better-than-expected consumer confidence in Australia. The Westpac Banking Corporation released its consumer confidence index for Australia. The index increased 1.9% in July, after a 0.2% gain in June.

The Japanese yen traded lower against the U.S. dollar after the better-than- expected preliminary machine tool orders from Japan. The machine tool orders in Japan climbed 34.2% in June, after a 24.1% gain in May.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y101.65

The most important news that are expected (GMT0):

14:15 Canada Housing Starts June 198 191

20:00 U.S. FOMC meeting minutes

-

08:00

United Kingdom: Halifax house price index, June -0.6% (forecast -0.3%)

-

08:00

United Kingdom: Halifax house price index 3m Y/Y, June +8.8%

-

07:01

Japan: Prelim Machine Tool Orders, y/y , June +34.2%

-

06:24

Options levels on wednesday, July 9, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3705 (2816)

$1.3680 (2562)

$1.3646 (278)

Price at time of writing this review: $ 1.3617

Support levels (open interest**, contracts):

$1.3592 (151)

$1.3559 (1803)

$1.3534 (2152)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 22315 contracts, with the maximum number of contracts with strike price $1,3800 (3433);

- Overall open interest on the PUT options with the expiration date August, 8 is 29623 contracts, with the maximum number of contracts with strike price $1,3500 (6890);

- The ratio of PUT/CALL was 1.33 versus 1.34 from the previous trading day according to data from July, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (1004)

$1.7303 (1483)

$1.7206 (1389)

Price at time of writing this review: $1.7131

Support levels (open interest**, contracts):

$1.7092 (1870)

$1.6996 (1617)

$1.6898 (1823)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15152 contracts, with the maximum number of contracts with strike price $1,7250 (2035);

- Overall open interest on the PUT options with the expiration date August, 8 is 18938 contracts, with the maximum number of contracts with strike price $1,7100 (1870);

- The ratio of PUT/CALL was 1.25 versus 1.19 from the previous trading day according to data from Jule, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:25

Currencies. Daily history for Jule 8'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3611 +0,04%

GBP/USD $1,7130 -0,01%

USD/CHF Chf0,8928 -0,07%

USD/JPY Y101,54 -0,32%

EUR/JPY Y138,21 -0,29%

GBP/JPY Y173,92 -0,33%

AUD/USD $0,9397 +0,31%

NZD/USD $0,8785 +0,41%

USD/CAD C$1,0676 -0,05%

-

05:05

Schedule for today, Wednesday, July 9’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence July +0.2%

01:30 China PPI y/y June -1.4% -1.1%

01:30 China CPI y/y June +2.5% +2.4%

06:00 Japan Prelim Machine Tool Orders, y/y June +24.1%

07:00 United Kingdom Halifax house price index June +3.9% -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y June +8.7%

12:15 Canada Housing Starts June 198 191

14:30 U.S. Crude Oil Inventories July -3.2

18:00 U.S. FOMC meeting minutes

22:30 New Zealand Business NZ PMI June 52.7

23:01 United Kingdom RICS House Price Balance June 57% 55%

23:50 Japan Core Machinery Orders May -9.1% +0.9%

23:50 Japan Core Machinery Orders, y/y May +17.6% +9.5%

23:50 Japan Tertiary Industry Index May -5.4% +1.9%

-