Notícias do Mercado

-

23:28

Currencies. Daily history for Feb 10'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3644 +0,05%

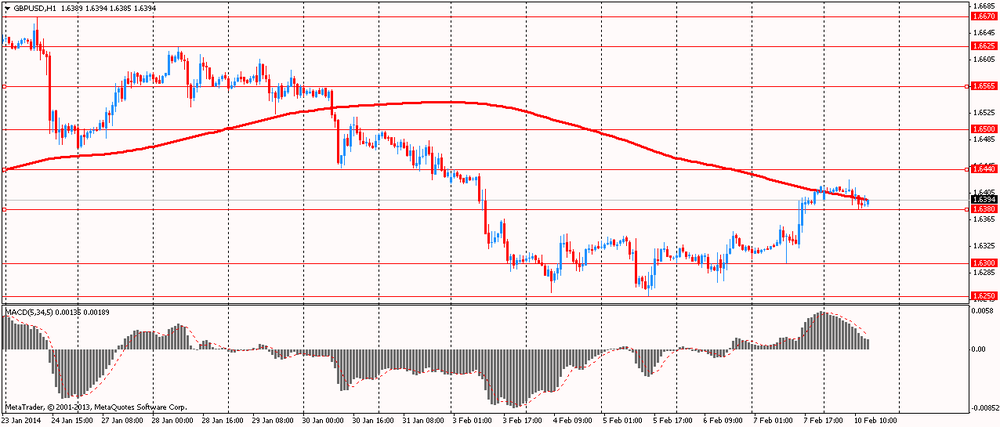

GBP/USD $1,6400 -0,09%

USD/CHF Chf0,8966 -0,07%

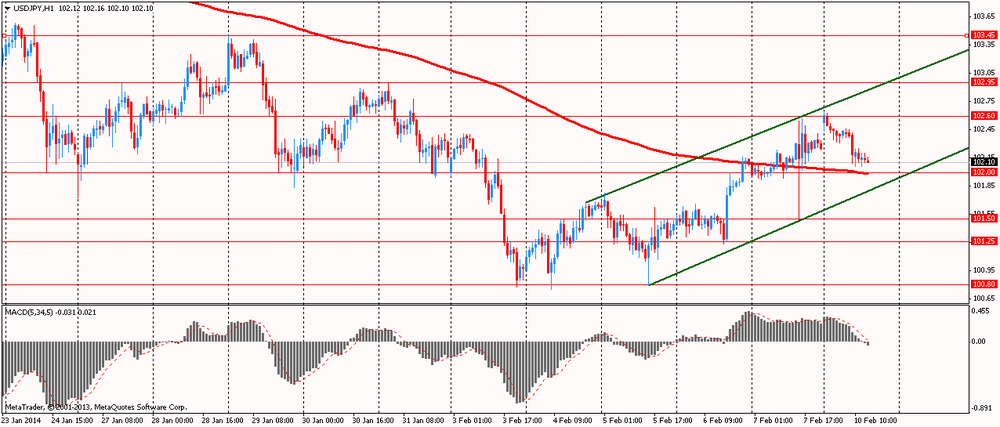

USD/JPY Y102,25 0,00%

EUR/JPY Y139,52 +0,06%

GBP/JPY Y167,68 -0,09%

AUD/USD $0,8948 -0,11%

NZD/USD $0,8265 -0,28%

USD/CAD C$1,1055 +0,16%

-

23:24

Schedule for today, Tuesday, Feb 11’2014:

02:00 Japan Bank holiday

02:01 United Kingdom BRC Retail Sales Monitor y/y January +0.4% +0.8%

02:30 Australia National Australia Bank's Business Confidence January 6

02:30 Australia House Price Index (QoQ) Quarter IV +1.9% +3.2%

02:30 Australia House Price Index (YoY) Quarter IV+7.6% +8.6%

02:30 Australia Home Loans December +1.1% +0.9%

04:00 China Trade Balance, bln January 25.6 24.2

04:00 China New Loans January 483 1100

12:00 United Kingdom BOE Deputy Governor Andrew Bailey Speaks

16:00 U.S. FOMC Member Charles Plosser Speaks

17:00 U.S. Wholesale Inventories December +0.5% +0.5%

17:00 U.S. JOLTs Job Openings December 4001

17:00 U.S. Federal Reserve Chair Janet Yellen Testifies

23:00 Canada Annual Budget 2014

23:30 U.S. API Crude Oil Inventories February +0.4

01:30 Australia Westpac Consumer Confidence February -1.7%

01:50 Japan Core Machinery Orders December +9.3% -3.7%

01:50 Japan Core Machinery Orders, y/y December +16.6% +17.4%

01:50 Japan Tertiary Industry Index December +0.6% -0.2%

-

19:20

American focus : the euro rose slightly against the U.S. currency

The euro exchange rate rose slightly against the U.S. dollar, which is likely due to the expectations of tomorrow's speech by Fed Yellen . According to analysts , it will not deviate from the course indicated by Bernanke in December, and will be a key promise of continuity rather than innovation .

As for today's events , a small influence on the bidding had data from the research center Sentix, which showed that investor confidence in the eurozone unexpectedly improved in February, the index of investor sentiment rose by 1.4 points to 13.3 points. The result was higher than the projected decline to 10.3 points. The improvement was mainly due to the increase in assessment of the current situation in February. Current situation index rose to 1.8 from 0.8 in January and was positive for the first time since August 2011 . At the same time , investors' expectations have risen only slightly in February to 25.5 from 25.3 in January.

The Canadian dollar was down against the U.S. dollar, which has been partly due to the Report on Canada. As it became known , in Canada the number of Housing Starts fell by 3.7 % m / m to an average of 180,248 units in January . January was the result of lower than forecast analysts expecting 184,000 bookmarks.

CMHC report showed that urban bookmarks new foundations fell by 2.7 % last month to 163,158 units. Bookmark urban apartment fell by 6% to 102,289 units, while single urban Bookmarks rose by 3.4% to 60,869 units.

CMHC said that the city grew on the prairies Bookmark and Ontario , and fell in Atlantic Canada , Quebec and British Columbia.

Rural Share of new foundations were estimated at a seasonally adjusted annual rate of up to 90 170 units.

" These past two months is actually quite healthy , given the harsh winter in some parts of the country , and are roughly in line with the demand associated with population growth ," said CIBC.

The Swiss franc rose against the U.S. dollar on the background of the earlier report , which showed that the unemployment rate remained stable at a seasonally adjusted at 3.2 percent in January . Similarly, the unadjusted unemployment rate remained unchanged at 3.5 percent .

In late January , there were about 153,260 people as unemployed , which is 3,823 more than compared to the previous month . Unemployment rose by 5102 , compared with the corresponding period last year.

Unemployment among young people aged 15 to 24 years increased by 52 persons to 20 533 people . Nevertheless, the unemployment rate fell by 674 people compared to last year.

-

18:20

American focus : the euro rose slightly against the U.S. currency

The euro exchange rate rose slightly against the U.S. dollar, which is likely due to the expectations of tomorrow's speech by Fed Yellen . According to analysts , it will not deviate from the course indicated by Bernanke in December, and will be a key promise of continuity rather than innovation .

As for today's events , a small influence on the bidding had data from the research center Sentix, which showed that investor confidence in the eurozone unexpectedly improved in February, the index of investor sentiment rose by 1.4 points to 13.3 points. The result was higher than the projected decline to 10.3 points. The improvement was mainly due to the increase in assessment of the current situation in February. Current situation index rose to 1.8 from 0.8 in January and was positive for the first time since August 2011 . At the same time , investors' expectations have risen only slightly in February to 25.5 from 25.3 in January.

The Canadian dollar was down against the U.S. dollar, which has been partly due to the Report on Canada. As it became known , in Canada the number of Housing Starts fell by 3.7 % m / m to an average of 180,248 units in January . January was the result of lower than forecast analysts expecting 184,000 bookmarks.

CMHC report showed that urban bookmarks new foundations fell by 2.7 % last month to 163,158 units. Bookmark urban apartment fell by 6% to 102,289 units, while single urban Bookmarks rose by 3.4% to 60,869 units.

CMHC said that the city grew on the prairies Bookmark and Ontario , and fell in Atlantic Canada , Quebec and British Columbia.

Rural Share of new foundations were estimated at a seasonally adjusted annual rate of up to 90 170 units.

" These past two months is actually quite healthy , given the harsh winter in some parts of the country , and are roughly in line with the demand associated with population growth ," said CIBC.

The Swiss franc rose against the U.S. dollar on the background of the earlier report , which showed that the unemployment rate remained stable at a seasonally adjusted at 3.2 percent in January . Similarly, the unadjusted unemployment rate remained unchanged at 3.5 percent .

In late January , there were about 153,260 people as unemployed , which is 3,823 more than compared to the previous month . Unemployment rose by 5102 , compared with the corresponding period last year.

Unemployment among young people aged 15 to 24 years increased by 52 persons to 20 533 people . Nevertheless, the unemployment rate fell by 674 people compared to last year.

-

13:15

Canada: Housing Starts, January 180 (forecast 184)

-

13:00

European session: the euro stabilized

06:45 Switzerland Unemployment Rate January 3.2% 3.2% 3.2%

07:45 France Industrial Production, m/m December +1.2% Revised From +1.3% -0.1% -0.3%

07:45 France Industrial Production, y/y December +1.5% +0.5%

09:30 Eurozone Sentix Investor Confidence February 11.9 10.3 13.3

The euro / dollar failed to gain a foothold on the heights reached and pulled back from 11 -day high , as the pair virtually ignored the study of confidence of European investors Sentix. As revealed on Monday monthly survey research center Sentix, investor confidence in the eurozone unexpectedly improved in February . Investor sentiment index rose by 1.4 points to 13.3 points. The result was higher than the projected decline to 10.3 points. The improvement was mainly due to the increase in assessment of the current situation in February. Current situation index rose to 1.8 from 0.8 in January and was positive for the first time since August 2011 . At the same time , investors' expectations have risen only slightly in February to 25.5 from 25.3 in January.

The euro kept data on industrial production in France. Industrial production in France increased at a slower pace in December , with growth rates gave way to the forecasts of economists showed on Monday, the latest data statistical office Insee. Industrial production grew by 0.5 percent in December compared with the same month last year. Economists had expected a more rapid increase of 1 per cent . In November, production recorded a growth of 1.7 percent.

Industrial production fell by 0.3 percent compared to November , when it was recorded an increase of 1.2 percent. Expectations were reducing by 0.1 percent . During the three months ended in December , production increased by 0.3 percent compared with the previous three-month period . Industrial production grew by 0.5 per cent in quarterly terms.

In Insee also noted that production in the French manufacturing sector expanded by 0.9 percent year on year in December. On a monthly measurement of industrial production remained unchanged after rising 0.2 percent in November.

The yen strengthened against the euro and the dollar in anticipation of tomorrow's presentation of the new Federal Reserve Chairman Janet Yellen . Chapter Fed on Tuesday will deliver to Congress for the first time after its official accession to the post of head of the Federal Reserve and is expected to confirm the Fed's intention to continue to decline in the quantitative easing program unabated.

The dollar index suspended its five-day decline, even after January in the U.S. was created only 113 thousand jobs , and the unemployment rate fell to 6.6 % compared to 6.7% in December , said Friday the Ministry of Labour . Economists had expected an increase of the number of non-agricultural jobs in the 185 thousand unemployment fell to its lowest level since October 2008 .

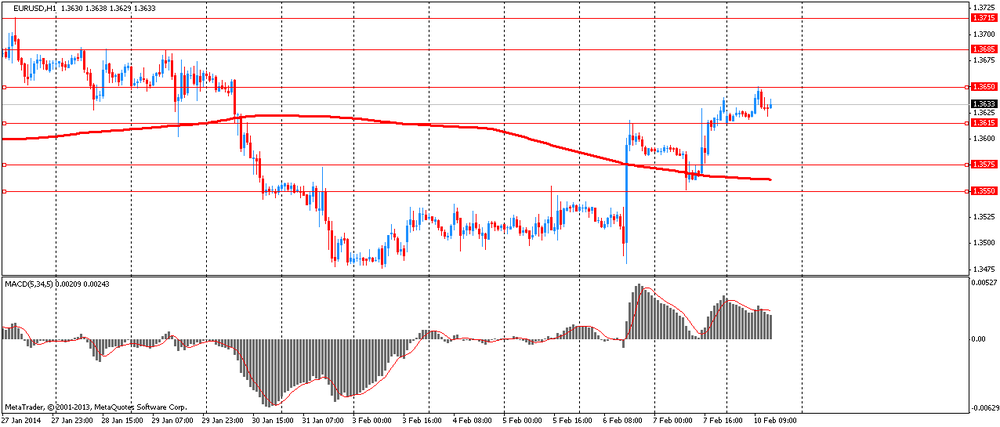

EUR / USD: during the European session, the pair rose to $ 1.3650 , then dropped to $ 1.3622

GBP / USD: during the European session, the pair fell to $ 1.6381

USD / JPY: during the European session, the pair dropped to Y102.06

At 13:15 GMT will be released in Canada by Housing Starts in January . At 15:00 GMT the U.S. will release the share of overdue mortgage payments for the 4th quarter . At 17:50 GMT to make a speech , Deputy Governor of the Bank of Canada John Murray .

-

12:45

Orders

EUR/USD

Offers $1.3700/10, $1.3680, $1.3650

Bids $1.3600, $1.3575/70, $1.3555/45, $1.3525/20, $1.3500

GBP/USD

Offers $1.6577, $1.6545/55, $1.6520

Bids $1.6380, $1.6365-50, $1.6330/20, $1.6300

AUD/USD

Offers $0.9050, $0.9000, $0.8980, $0.8935/40

Bids $0.8900, $0.8850, $0.8820, $0.8800

EUR/GBP

Offers stg0.8400/05, stg0.8370/80, stg0.8325/30

Bids stg0.8270/65, stg0.8250/40, stg0.8225/20

EUR/JPY

Offers Y140.50, Y139.95/00, Y139.55/60

Bids Y139.00, Y138.50, Y138.00

USD/JPY

Offers Y102.90/00, Y102.75/80, Y102.60/70, Y102.40/50

Bids Y102.00, Y101.55/50, Y101.00, Y100.80

-

10:22

Option expiries for today's 1400GMT cut

USD/JPY Y101.50, Y102.00, Y102.50, Y103.00, Y104.50

EUR/USD $1.3470, $1.3525, $1.3530, $1.3550, $1.3575, $1.3600, $1.3650

AUD/USD $0.8850, $0.8900, $0.8925, $0.9000

AUD/JPY Y90.10, Y90.50

USD/CAD Cad1.0875, Cad1.0995, Cad1.1040, Cad1.1100, Cad1.1150

-

09:30

Eurozone: Sentix Investor Confidence, February 13.3 (forecast 10.3)

-

07:45

France: Industrial Production, m/m, December -0.3% (forecast -0.1%)

-

07:01

Asian session: The dollar gained to the highest level

05:00 Japan Consumer Confidence January 41.3 43.9 40.5

05:00 Japan Eco Watchers Survey: Current January 55.7 55.5 54.7

05:00 Japan Eco Watchers Survey: Outlook January 54.7 54.0 49.0

The dollar gained to the highest level in more than a week against the yen as investors bet the Federal Reserve will press on with a reduction in stimulus before Chairman Janet Yellen speaks to U.S. lawmakers tomorrow.

The Bloomberg Dollar Spot Index halted a five-day slide, even after a Feb. 7 report indicated employment growth last month in the world’s biggest economy was less than analysts expected. The Labor Department said last week hiring in the U.S. rose by 113,000 in January, fewer than the 180,000 gain that was the median forecast of economists surveyed by Bloomberg News and following a 75,000 increase the prior month. Unemployment fell to 6.6 percent, the least since October 2008, from 6.7 percent in December.

The yen weakened against most major peers as Japan’s finance ministry said the nation’s current-account deficit widened to a record in December. The December deficit pushed Japan’s 2013 current-account surplus down to about 3.3 trillion yen, reducing the balance that allows Japan to be less reliant on foreign capital and makes the yen a haven from financial turmoil.

The euro snapped an advance from last week before data today that may show factory production in France declined. In France, industrial production probably fell 0.2 percent in December from the previous month, when it rose 1.3 percent, according to the median estimate by economists surveyed by Bloomberg before today’s report.

EUR / USD: during the Asian session, the pair traded in the range of $1.3615-30

GBP / USD: during the Asian session, the pair traded in the range of $1.6395-15

USD / JPY: during the Asian session, the pair rose to Y102.65

At 0645GMT, the Swiss January unemployment data is set for release and is seen unchanged at 3.5%. French data kicks off at 0730GMT, when the French December Bank of France business survey is set for publication, followed at 0745GMT by the release of the December industrial output data. Italian December industrial output data will be released at 0900GMT, seen flat on month and higher by 0.9% on year. At 0930GMT, the EMU February sentiment index will cross the wires. The last scheduled European release comes at 1100GMT, when the December leading indicator crosses the wires. -

06:45

Switzerland: Unemployment Rate, January 3.2% (forecast 3.2%)

-

05:01

Japan: Consumer Confidence, January 40.5 (forecast 43.9)

-