Notícias do Mercado

-

16:50

Foreign exchange market. American session: the euro slid to 4-month lows against the U.S. dollar

The U.S. dollar traded mixed against the most major currencies. The U.S. dollar was still supported by Friday’s nonfarm payrolls report. The U.S. economy added 217,000 in May, missing expectations for a 218,000 rise, after a 282,000 gain in April. April’s figure was revised down from a 288,000 increase.

The U.S. Labor Department released the Job Openings and Labor Turnover Survey or JOLTS today. Job openings in the U.S. climbed by 289,000 to 4.46 million in April. That was the highest figure since September 2007. Analysts had expected an increase to 4.04 million. The pace of firing also rose.

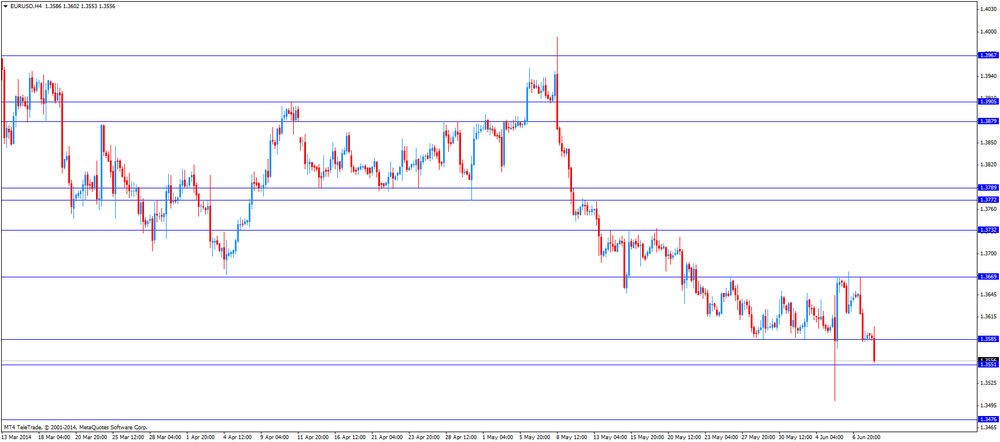

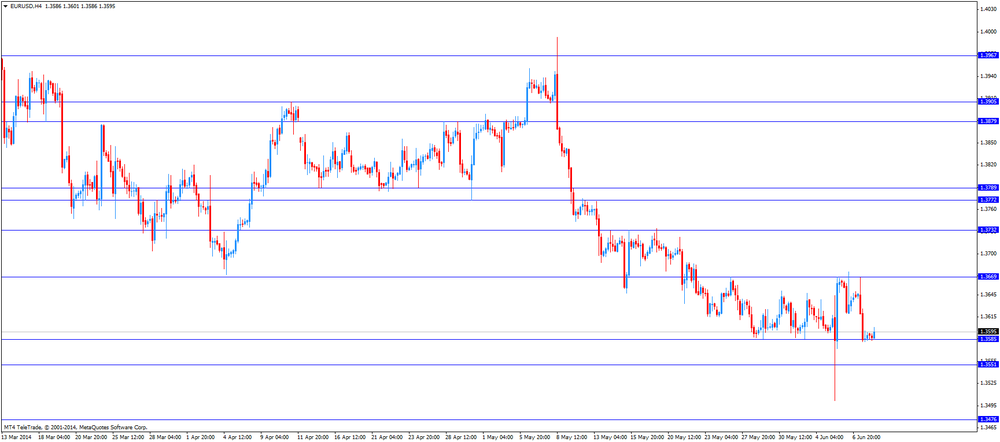

The euro slid to 4-month lows against the U.S. dollar despite the strong industrial production in France. Industrial production in France rose 0.3% in April, meeting expectations, after a 0.4% decline in March. March’s figure was revised up from a 0.7% decrease.

On a yearly basis, industrial production in France was flat in April, after a 0.8% fall in March.

The euro suffers due to bond yield gap between some euro area government bonds and U.S. Treasuries. While the currency in the Eurozone is to remain permanently cheap, the first interest rate hike by the Fed in the United States and by the Bank of England in the U.K. is more likely.

The European Central Bank cut its interest rate to 0.15% from 0.25% last Thursday. The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s first major central bank to use a negative rate. The deposit rate of -0.10% means that commercial bank will be charged for holding their reserves. This measure should spur commercial banks to ramp up lending.

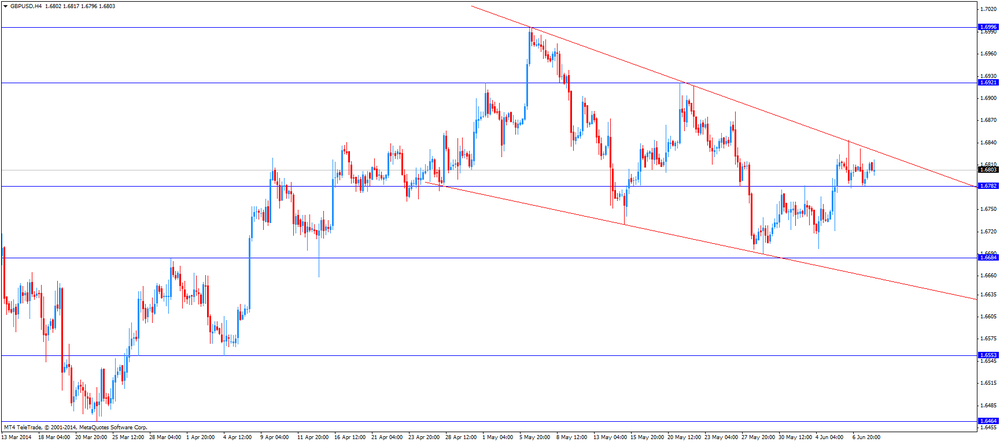

The British pound traded lower against the U.S. dollar. Manufacturing output in the U.K. increased 0.4% in April, meeting expectations, after 0.5% gain in March. On a yearly basis, manufacturing production in the U.K. rose 4.4% in April, exceeding expectations for a 4% increase, after a 3.3% increase in March.

Industrial production in the U.K. climbed 0.4% in April, in line with forecasts, after a 0.1% decline in March. On a year-over-year basis, industrial production in the U.K. rose 3.0% in April, after a 2.3% increase in March. That was the biggest annual increase since 2011. Economists had expected a 2.7% gain.

The National Institute of Economic and Social Research (NIESR) released their monthly U.K. GDP estimates. They forecasted that GDP increased by 0.9% in the three months ending in May after rise of 1.1% in the three months ending in April 2014.

The Swiss franc declined against the U.S. dollar. Switzerland’s unemployment rate remained unchanged at 3.2% in May, as expected.

Retail sales in Switzerland increased 0.4% in April, missing expectations for a 3.5% gain, after a 3.4% rise in March. March’s figure was revised up from a 3.0% increase.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major economic reports. The kiwi was supported by expectations the Reserve Bank of New Zealand will raise interest rates again this Wednesday.

The increasing consumer price inflation in China supported the New Zealand and Australian dollar. The Chinese consumer price index increased 2.5% in May, after a 1.8% gain in April. Analysts had expected a 2.4% rise.

The Chinese producer price index declined 1.4% in May, after a 2.0% decrease in April. Analysts had expected a 1.5% fall.

The Australian dollar traded higher against the U.S. dollar due to the better-than-expected Australian business confidence data and the Chinese consumer price inflation. The National Australia Bank released its business confidence index for Australia. The index climbed to 7 in May, from 6 in April.

Job advertisements in Australia fell 5.6% in May, after a 1.9% increase in April. April’s figure was revised down from a 2.2% gain.

Home loans in Australia were flat in April, after a 0.8% fall in March. March’s figure was revised up from a 0.9% decline. Analysts had expected a 0.3% gain.

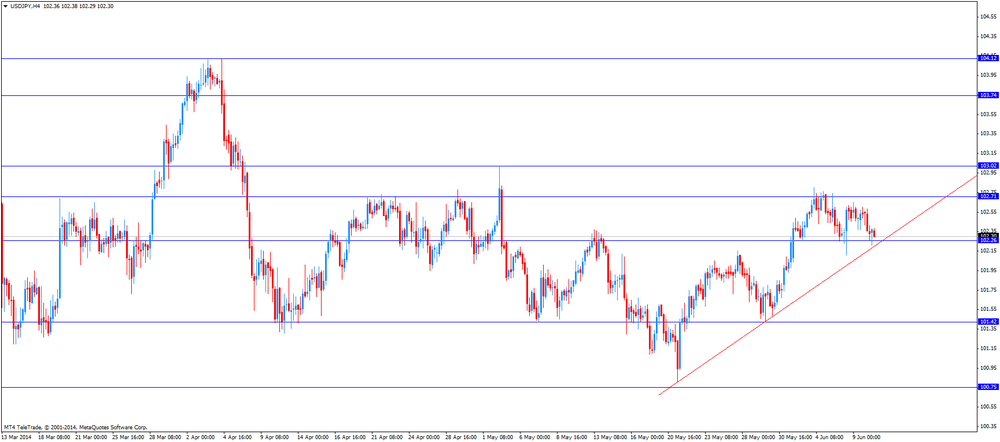

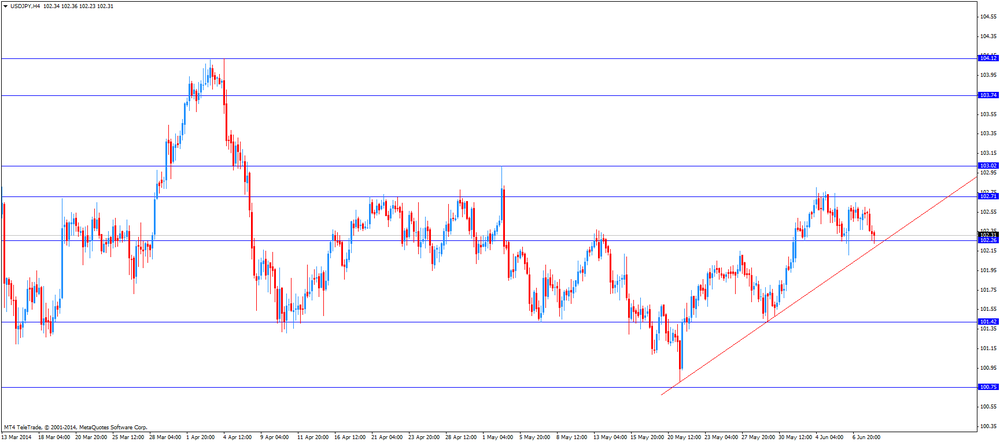

The Japanese yen traded higher against the U.S. dollar ahead of the Bank of Japan (BoJ) meeting this Friday. Investors speculate that the BoJ’s monetary policy will support the Japanese currency.

Japan’s preliminary machine tool orders decreased to 24.1% in May from 48.7% in April. April’s figure was revised down from 48.8%.

Japanese tertiary industry activity index dropped to -5.4% in April from 2.4% in March. Analysts had expected the index to fall -3.3%.

-

15:02

U.S.: JOLTs Job Openings, April 4460 (forecast 4040)

-

15:00

United Kingdom: NIESR GDP Estimate, May +0.9%

-

15:00

U.S.: Wholesale Inventories, April +1.1% (forecast +0.6%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3550, $1.3600, $1.3635, $1.3650, $1.3700

USD/JPY Y101.75, Y102.50, Y103.10

USD/CAD Cad1.0920, Cad1.0935

AUD/USD $0.9250, $0.9300, $0.9330

EUR/CHF Chf1.2185

EUR/GBP stg0.8125

-

13:11

Foreign exchange market. European session: the euro dropped against the U.S. dollar despite the strong industrial production in France

Economic calendar (GMT0):

01:30 Australia National Australia Bank's Business Confidence May 6 7

01:30 Australia ANZ Job Advertisements (MoM) May +2.2% -5.6%

01:30 Australia Home Loans April -0.8% +0.3% 0%

01:30 China PPI y/y May -2.0% -1.5% -1.4%

01:30 China CPI y/y May +1.8% +2.4% +2.5%

05:45 Switzerland Unemployment Rate May 3.2% 3.2% 3.2%

06:00 Japan Prelim Machine Tool Orders, y/y May 48.7% 24.1%

06:45 France Industrial Production, m/m April -0.4% +0.3% +0.3%

06:45 France Industrial Production, y/y April -0.8% 0.0%

07:15 Switzerland Retail Sales Y/Y April +3.4% +3.5% +0.4%

08:30 United Kingdom Industrial Production (MoM) April -0.1% +0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) April +2.3% +2.7% +3.0%

08:30 United Kingdom Manufacturing Production (MoM) April +0.5% +0.4% +0.4%

08:30 United Kingdom Manufacturing Production (YoY) April +3.3% +4.0% +4.4%

The U.S. dollar traded higher against the most major currencies. The U.S. dollar was still supported by Friday’s nonfarm payrolls report. The U.S. economy added 217,000 in May, missing expectations for a 218,000 rise, after a 282,000 gain in April. April’s figure was revised down from a 288,000 increase.

The euro dropped against the U.S. dollar despite the strong industrial production in France. Industrial production in France rose 0.3% in April, meeting expectations, after a 0.4% decline in March. March’s figure was revised up from a 0.7% decrease.

On a yearly basis, industrial production in France was flat in April, after a 0.8% fall in March.

The European Central Bank’s interest rate decision weighed on the euro. The European Central Bank cut its interest rate to 0.15% from 0.25% last Thursday. The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s first major central bank to use a negative rate. The deposit rate of -0.10% means that commercial bank will be charged for holding their reserves. This measure should spur commercial banks to ramp up lending.

The British pound traded lower against the U.S. dollar. Manufacturing output in the U.K. increased 0.4% in April, meeting expectations, after 0.5% gain in March. On a yearly basis, manufacturing production in the U.K. rose 4.4% in April, exceeding expectations for a 4% increase, after a 3.3% increase in March.

Industrial production in the U.K. climbed 0.4% in April, in line with forecasts, after a 0.1% decline in March. On a year-over-year basis, industrial production in the U.K. rose 3.0% in April, after a 2.3% increase in March. That was the biggest annual increase since 2011. Economists had expected a 2.7% gain.

The Swiss franc declined against the U.S. dollar. Switzerland’s unemployment rate remained unchanged at 3.2% in May, as expected.

Retail sales in Switzerland increased 0.4% in April, missing expectations for a 3.5% gain, after a 3.4% rise in March. March’s figure was revised up from a 3.0% increase.

EUR/USD: the currency pair declined to $1.3532

GBP/USD: the currency pair decreased to $1.6764

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate May +1.0%

14:00 U.S. JOLTs Job Openings April 4014 4040

23:50 Japan BSI Manufacturing Index Quarter II 12.5 14.1

-

13:00

Orders

EUR/USD

Offers $1.3775, $1.3735, $1.3695/700, $1.3675, $1.3620

Bids $1.3550, $1.3500, $1.3480

GBP/USD

Offers $1.6920, $1.6900, $1.6880, $1.6845

Bids $1.6760, $1.6700, $1.6690

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9335, $0.9300, $0.9255/50, $0.9235/30

EUR/JPY

Offers Y140.80, Y140.50, Y140.00, Y139.40

Bids Y138.65, Y138.00,

USD/JPY

Offers Y103.50, Y103.00, Y102.75/80

Bids Y102.00, Y101.60, Y101.50

EUR/GBP

Offers stg0.8160/65, stg0.8150, stg0.8100

Bids stg0.8050, stg0.8035/30, stg0.8005/000

-

10:39

The currency pair EUR/USD declines

The European Central Bank’s interest rate decision weighed on the euro. The European Central Bank cut its interest rate to 0.15% from 0.25% last Thursday. The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s first major central bank to use a negative rate. The deposit rate of -0.10% means that commercial bank will be charged for holding their reserves. This measure should spur commercial banks to ramp up lending.

-

10:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3550, $1.3600, $1.3635, $1.3650, $1.3700

USD/JPY Y101.75, Y102.50, Y103.10

USD/CAD Cad1.0920, Cad1.0935

AUD/USD $0.9250, $0.9300, $0.9330

EUR/CHF Chf1.2185

EUR/GBP stg0.8125

-

10:03

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar due to the better-than-expected Australian business confidence data and the Chinese consumer price inflation

Economic calendar (GMT0):

01:30 Australia National Australia Bank's Business Confidence May 6 7

01:30 Australia ANZ Job Advertisements (MoM) May +2.2% -5.6%

01:30 Australia Home Loans April -0.8% +0.3% 0%

01:30 China PPI y/y May -2.0% -1.5% -1.4%

01:30 China CPI y/y May +1.8% +2.4% +2.5%

05:45 Switzerland Unemployment Rate May 3.2% 3.2% 3.2%

06:00 Japan Prelim Machine Tool Orders, y/y May 48.7% 24.1%

06:45 France Industrial Production, m/m April -0.4% +0.3% +0.3%

06:45 France Industrial Production, y/y April -0.8% 0.0%

07:15 Switzerland Retail Sales Y/Y April +3.4% +3.5% +0.4%

08:30 United Kingdom Industrial Production (MoM) April -0.1% +0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) April +2.3% +2.7% +3.0%

08:30 United Kingdom Manufacturing Production (MoM) April +0.5% +0.4% +0.4%

08:30 United Kingdom Manufacturing Production (YoY) April +3.3% +4.0% +4.4%

The U.S. dollar traded mixed against the most major currencies. The U.S. dollar was still supported by Friday’s nonfarm payrolls report. The U.S. economy added 217,000 in May, missing expectations for a 218,000 rise, after a 282,000 gain in April. April’s figure was revised down from a 288,000 increase.

The New Zealand dollar rose against the U.S dollar in the absence of any major economic reports. The kiwi was supported by expectations the Reserve Bank of New Zealand will raise interest rates again this Wednesday.

The increasing consumer price inflation in China supported the New Zealand and Australian dollar. The Chinese consumer price index increased 2.5% in May, after a 1.8% gain in April. Analysts had expected a 2.4% rise.

The Chinese producer price index declined 1.4% in May, after a 2.0% decrease in April. Analysts had expected a 1.5% fall.

The Australian dollar traded higher against the U.S. dollar due to the better-than-expected Australian business confidence data and the Chinese consumer price inflation. The National Australia Bank released its business confidence index for Australia. The index climbed to 7 in May, from 6 in April.

Job advertisements in Australia fell 5.6% in May, after a 1.9% increase in April. April’s figure was revised down from a 2.2% gain.

Home loans in Australia were flat in April, after a 0.8% fall in March. March’s figure was revised up from a 0.9% decline. Analysts had expected a 0.3% gain.

The Japanese yen increased against the U.S. dollar ahead of the Bank of Japan (BoJ) meeting this Friday. Investors speculate that the BoJ’s monetary policy will support the Japanese currency.

Japan’s preliminary machine tool orders decreased to 24.1% in May from 48.7% in April. April’s figure was revised down from 48.8%.

Japanese tertiary industry activity index dropped to -5.4% in April from 2.4% in March. Analysts had expected the index to fall -3.3%.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair climbed to $1.6815

USD/JPY: the currency pair declined to Y102.35

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate May +1.0%

14:00 U.S. JOLTs Job Openings April 4014 4040

23:50 Japan BSI Manufacturing Index Quarter II 12.5 14.1

-

09:31

United Kingdom: Manufacturing Production (YoY), April +4.4% (forecast +4.0%)

-

09:30

United Kingdom: Industrial Production (MoM), April +0.4% (forecast +0.4%)

-

09:30

United Kingdom: Industrial Production (YoY), April +3.0% (forecast +2.7%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , April +0.4% (forecast +0.4%)

-

08:15

Switzerland: Retail Sales Y/Y, April +0.4% (forecast +3.5%)

-

07:45

France: Industrial Production, m/m, April +0.3% (forecast +0.3%)

-

07:02

Japan: Prelim Machine Tool Orders, y/y , May 24.1%

-

06:45

Switzerland: Unemployment Rate, May 3.2% (forecast 3.2%)

-

06:25

Options levels on tuesday, June 10, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3698 (1450)

$1.3670 (2727)

$1.3631 (152)

Price at time of writing this review: $ 1.3586

Support levels (open interest**, contracts):

$1.3558 (1642)

$1.3519 (3848)

$1.3491 (4215)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 24396 contracts, with the maximum number of contracts with strike price $1,3600 (2727);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 38921 contracts, with the maximum number of contractswith strike price $1,3500 (5302);

- The ratio of PUT/CALL was 1.60 versus 1.62 from the previous trading day according to data from June, 9.

GBP/USD

Resistance levels (open interest**, contracts)

$1.7101 (1281)

$1.7002 (899)

$1.6904 (1240)

Price at time of writing this review: $1.6806

Support levels (open interest**, contracts):

$1.6695 (842)

$1.6598 (1893)

$1.6499 (1584)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 13271 contracts, with the maximum number of contracts with strike price $1,7100 (1281);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 15259 contracts, with the maximum number of contracts with strike price $1,6600 (1893);

- The ratio of PUT/CALL was 1.15 versus 1.08 from the previous trading day according to data from June, 9.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:34

China: PPI y/y, May -1.4% (forecast -1.5%)

-

02:33

China: CPI y/y, May +1.4% (forecast +2.4%)

-

02:32

Australia: Home Loans , April 0% (forecast +0.3%)

-

02:31

Australia: ANZ Job Advertisements (MoM), May -5.6%

-

02:30

Australia: National Australia Bank's Business Confidence, May 7

-

00:52

Japan: Tertiary Industry Index , April -5.4% (forecast -3.3%)

-

00:20

Currencies. Daily history for June 09'2014:

(pare/closed(GMT +2)/change, %)EUR/USD $1,3590 -0,38%

GBP/USD $1,6801 +0,01%

USD/CHF Chf0,8969 +0,38%

USD/JPY Y102,54 +0,05%

EUR/JPY Y139,38 -0,29%

GBP/JPY Y172,28 +0,08%

AUD/USD $0,9349 +0,18%

NZD/USD $0,8492 -0,07%

USD/CAD C$1,0901 -0,27%

-

00:01

United Kingdom: BRC Retail Sales Monitor y/y, May +0.5%

-

00:00

Schedule for today, Tuesday, June 10’2014:

(time / country / index / period / previous value / forecast)01:30 Australia National Australia Bank's Business Confidence May 6

01:30 Australia ANZ Job Advertisements (MoM) May +2.2%

01:30 Australia Home Loans April -0.9% +0.3%

01:30 China PPI y/y May -2.0% -1.5%

01:30 China CPI y/y May +1.8% +2.4%

05:45 Switzerland Unemployment Rate May 3.2% 3.2%

06:00 Japan Prelim Machine Tool Orders, y/y May 48.7% [Revised From 48.8%]

06:45 France Industrial Production, m/m April -0.7% +0.3%

06:45 France Industrial Production, y/y April -0.8%

07:15 Switzerland Retail Sales Y/Y April +3.0% +3.5%

08:00 China New Loans May 775 750

08:30 United Kingdom Industrial Production (MoM) April -0.1% +0.4%

08:30 United Kingdom Industrial Production (YoY) April +2.3% +2.7%

08:30 United Kingdom Manufacturing Production (MoM) April +0.5% +0.4%

08:30 United Kingdom Manufacturing Production (YoY) April +3.3% +4.0%

14:00 United Kingdom NIESR GDP Estimate May +1.0%

14:00 U.S. Wholesale Inventories April +1.1% +0.6%

14:00 U.S. JOLTs Job Openings April 4014 4040

20:30 U.S. API Crude Oil Inventories June -1.4

23:50 Japan BSI Manufacturing Index Quarter II 12.5 14.1

-