Notícias do Mercado

-

23:56

Currencies. Daily history for Aug 10’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,1771 +0,11%

GBP/USD $1,2974 -0,24%

USD/CHF Chf0,9621 -0,14%

USD/JPY Y109,13 -0,71%

EUR/JPY Y128,47 -0,61%

GBP/JPY Y141,6 -0,95%

AUD/USD $0,7870 -0,20%

NZD/USD $0,7266 -1,18%

USD/CAD C$1,2738 +0,34%

-

23:52

New Zealand: Food Prices Index, m/m, July -0.2%

-

23:34

New Zealand: Business NZ PMI, July 55.4

-

23:02

Schedule for today, Friday, Aug 11’2017 (GMT0)

00:01 Japan Bank holiday

06:00 Germany CPI, y/y (Finally) July 1.6% 1.7%

06:00 Germany CPI, m/m (Finally) July 0.2% 0.4%

06:45 France CPI, y/y (Finally) July 0.7% 0.7%

06:45 France CPI, m/m (Finally) July 0.0% -0.3%

06:45 France Non-Farm Payrolls (Preliminary) Quarter II 0.4% 0.4%

09:00 U.S. IEA Monthly Report 12:30 U.S. CPI excluding food and energy, m/m July 0.1% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July 1.7% 1.7%

12:30 U.S. CPI, Y/Y July 1.6% 1.8%

12:30 U.S. CPI, m/m July 0% 0.2%

13:40 U.S. FOMC Member Kaplan Speak

15:30 U.S. FOMC Member Kashkari Speaks

17:00 U.S. Baker Hughes Oil Rig Count August 765

12:30 U.S. PPI, y/y July 2% 2.2%

12:30 U.S. PPI, m/m July 0.1% 0.1%

12:30 U.S. Initial Jobless Claims 240 240

14:00 U.S. FOMC Member Dudley Speak

18:00 U.S. Federal budget July -90 -73

22:30 New Zealand Business NZ PMI July 56.2

22:45 New Zealand Food Prices Index, y/y July 3.0%

-

19:00

U.S.: Federal budget , July -43 (forecast -73)

-

15:47

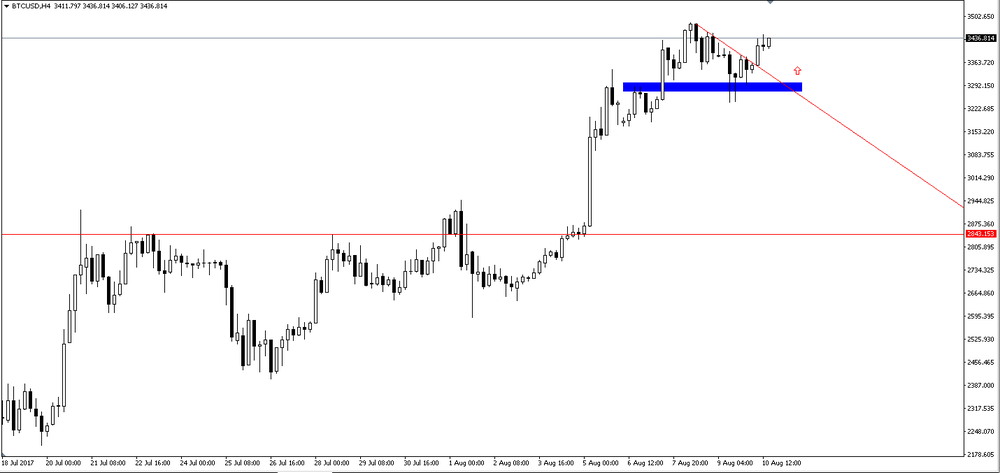

BITCOIN

Bitcoin fez esta semana novos máximos - 3400$!

A gráfico h4 podemos ver uma ligeira correção do preço após ter atingido novos máximos históricos. Porém, podemos observar que o preço já quebrou uma linha descendente que se foi formando ao longo do período de consolidação.

Para além do breakout da linha de tendência descendente, temos também, o preço aguentar bastante bem um suporte a H4 (rectângulo azul) pelo que poderá indicar o fim da correção e a formação de novos máximos.

-

13:31

Canada: New Housing Price Index, YoY, June 3.9%

-

13:30

Canada: New Housing Price Index, MoM, June 0.2%

-

13:30

U.S.: Continuing Jobless Claims, 1951 (forecast 1960)

-

13:30

U.S.: PPI excluding food and energy, m/m, July -0.1% (forecast 0.2%)

-

13:30

U.S.: PPI, m/m, July -0.1% (forecast 0.1%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, July 1.8% (forecast 2.1%)

-

13:30

U.S.: PPI, y/y, July 1.9% (forecast 2.2%)

-

13:30

U.S.: Initial Jobless Claims, 244 (forecast 240)

-

12:59

United Kingdom: NIESR GDP Estimate, July 0.2%

-

09:30

United Kingdom: Total Trade Balance, June -4.56

-

09:30

United Kingdom: Manufacturing Production (YoY), June 0.6% (forecast 0.7%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , June 0.0%

-

09:30

United Kingdom: Industrial Production (YoY), June 0.3% (forecast -0.2%)

-

09:30

United Kingdom: Industrial Production (MoM), June 0.5% (forecast 0.1%)

-

07:46

France: Industrial Production, m/m, June -1.1% (forecast -0.4%)

-

07:30

Options levels on thursday, August 10, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1902 (2722)

$1.1855 (2622)

$1.1823 (2345)

Price at time of writing this review: $1.1733

Support levels (open interest**, contracts):

$1.1675 (2334)

$1.1650 (3302)

$1.1621 (3260)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 8 is 122606 contracts (according to data from August, 9) with the maximum number of contracts with strike price $1,2000 (5351);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3170 (1785)

$1.3116 (3111)

$1.3054 (284)

Price at time of writing this review: $1.2980

Support levels (open interest**, contracts):

$1.2928 (1048)

$1.2903 (1249)

$1.2873 (1968)

Comments:

- Overall open interest on the CALL options with the expiration date September, 8 is 28674 contracts, with the maximum number of contracts with strike price $1,3000 (3111);

- Overall open interest on the PUT options with the expiration date September, 8 is 24832 contracts, with the maximum number of contracts with strike price $1,2850 (2558);

- The ratio of PUT/CALL was 0.87 versus 0.87 from the previous trading day according to data from August, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:31

Japan: Tertiary Industry Index , June 0.0%

-

02:02

Australia: Consumer Inflation Expectation, August 4.2%

-

00:50

Japan: Core Machinery Orders, y/y, June -5.2% (forecast -1%)

-

00:50

Japan: Core Machinery Orders, June -1.9% (forecast 3.7%)

-