Notícias do Mercado

-

23:53

US Dollar put to the guillotine, but plenty to live on for

- The US Dollar is under pressure on the back of the US CPI report.

- Markets are in two minds as to whether this is the end of the bull cycle.

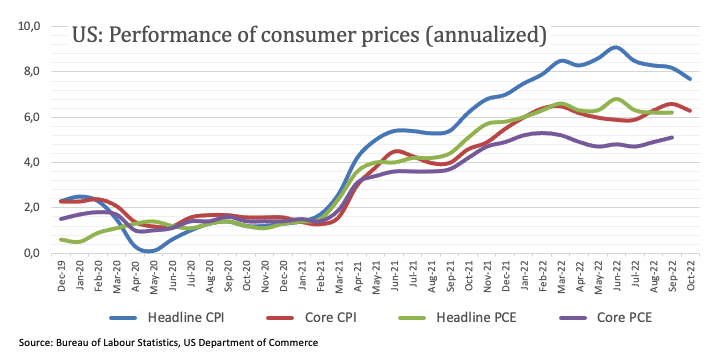

The US Dollar has been sent into a critical support level as the following charts will illustrate. The markets are in a phase of hysteria on the back of one inflation print that undershot expectations on Thursday. US Consumer Price Inflation rose 0.3% MoM in October as goods prices fell and service price inflation, ex-shelter, eased. Food price inflation also moderated, rising 0.6% MoM versus 0.8% in September.

With pent-up demand for risk, investors have run with the idea that the Federal Reserve will react to the report and pivot and as a result, they are stampeding away from the US Dollar. Indeed, the softer-than-expected US CPI has bolstered the case for risky assets as the data gave some investors confidence that consumer prices may have finally started trending lower. Consequently, the data sent US Treasury yields below key trendlines, with the benchmark 10-year hitting 3.8387%, its lowest in about a month - narrowing gaps between yields on US and foreign government debt that have burnished the greenback's appeal.

However, ''the Federal Reserve will not put too much weight on one month’s numbers,'' analysts at ANZ Bank said. ''It wants to see a sustained moderation in monthly inflation before being confident that inflation is on track to return to target.''

On Thursday, Fed's Cleveland President Loretta Mester spoke in recent trade and commented on the CPI data. She said, ''this morning’s October CPI report also suggests some easing in overall and core inflation,'' but added, “there continue to be some upside risks to the inflation forecast.” This type of rhetoric will guide the market to think that even when Fed policy rates peak, they are likely to remain higher for longer.

This could be significantly bullish for the greenback over the horizon of today's CPI data. Additionally, Fed's Daly spoke and said that there is no evidence of wage prices spiralling and that inflation is one of the most lagging variables, adding, the Fed needs ''policy to be sufficiently restrictive until see inflation is well on its way to 2%.''

The analysts at ANZ Bank said they expect that the Fed will raise rates by 50bp in December and 25bp in February and March anticipating some moderation in core inflation in the fourth quarter, Q4. ''We maintain that profile and see the fed funds rate peaking at 5.0% in Q1.''

Indeed, plenty of investors are cautious about betting on a lasting dollar reversal. Analysts at Rabainak said it is their view that even when Fed policy rates peak, they are likely to remain higher for longer, with no interest rate cut until 2024.

''This is a message already mooted by Fed speakers including Daly who spoke last month about the persistence of inflation. Even when price pressures fall from their peak, they could remain buoyed by wage rises which may be a function of factors such as an ageing demographic and the fall in the US labour force participation rate.''

In addition to the outlook for rate increases, the analysts said that in their view, the USD is set to remain supported by safe-haven flows. ''Like many other assets including equities and property, cryptocurrencies performed well in an era of cheap money. This year, higher US interest rates have been undermining the outlook for risky assets and promoted the attraction of the safe haven USD.''

US Dollar, DXY, weekly chart

Indeed, looking back over the charts, the dollar index has fallen by 3% or more three times over the last two years, only to resume its upward trend:

In summary, we will get one more jobs report and another set of inflation and Retail Sales data before the December 13-14 meeting. If there are signs that inflation is picking up again or an escalation of geopolitical and COVID risks to global growth, the greenback could be seen as the cleanest shirt in the laundry basket once again. ''Simultaneously USD strength is a constraint on global trade and world growth which feeds back into demand for USDs,'' the analysts at Rabobank said. The USD may be approaching the later stages of its rally, but we consider it far too soon to expect the USD to reverse course.''

US Dollar daily chart

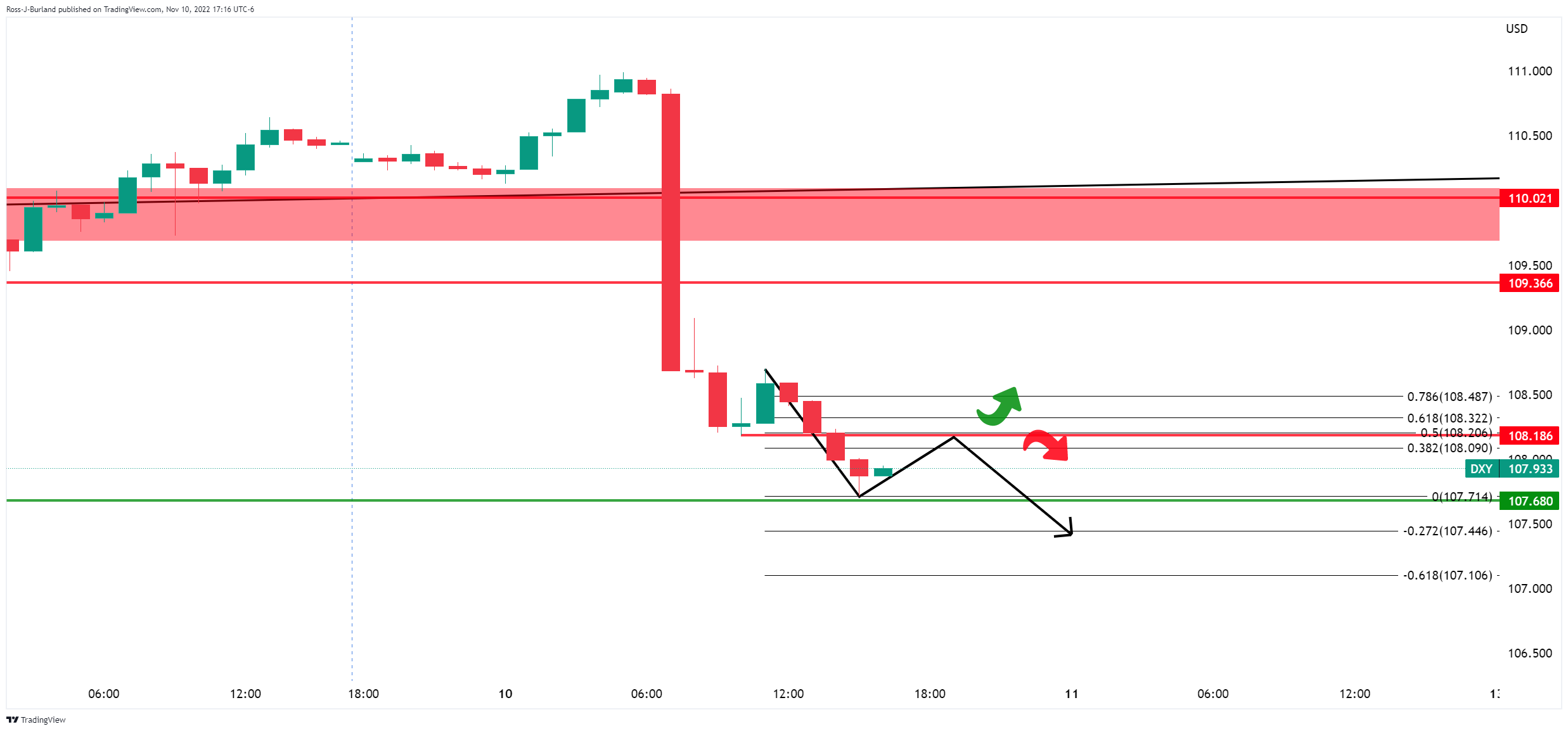

The DXY is now well below the counter trendline and has formed a sopping M-formation.

this is a reversion pattern, however, that could see the price move back into the Fibonacci scale from this first support juncture in the coming days.

US Dollar, DXY, H1 & H4 chart

However, the hourly picture is less bullish and a test of the 50% mean reversion mark could lead to another jolt to the downside before the week is out. On the other hand, profit-taking ahead of the weekend could ensure and leave the US dollar hanging over the edge of the abyss at around current support 107.50/ 108.20 and put to 109.00:

-

23:50

Japan Producer Price Index (YoY) above expectations (8.8%) in October: Actual (9.1%)

-

23:50

Japan Producer Price Index (MoM) in line with forecasts (0.6%) in October

-

23:50

Silver Price Analysis: XAGUSD bulls keep $22.50 on radar despite latest inaction

- Silver price remains sidelined around 4.5-month high, pares the biggest daily jump in a week.

- Nearly overbought RSI suggests limited upside unless crossing June’s peak.

- Sellers need validation from $21.50 for fresh entry, $20.00 appears the key support.

Silver price (XAGUSD) struggles to defend buyers around the highest levels since late June, marked the previous day, while taking rounds to $21.70-65 during Friday’s Asian session.

In doing so, the bright metal dribbles above the key $21.50 resistance-turned-support confluence including the 200-DMA and an upward-sloping trend line from early August.

Even if the $21.50 breakout keeps the commodity buyers hopeful, nearly overbought RSI (44) conditions challenge the quote’s further advances, which in turn highlight the 50% Fibonacci retracement level of the metal’s April-September downside, near $21.90.

Also acting as the near-term upside hurdle for the XAGUSD is the June 2022 peak surrounding $22.50.

It’s worth noting that the 61.8% Fibonacci retracement level appears the last defense of the Silver bear before directing the price towards the late March swing low of around $24.00.

Alternatively, a downside break of the $21.50 resistance-turned-support will need validation from the tops marked during October and September, around $21.25 and $20.85 in that order, to convince silver bears. Following that, a downward trajectory toward $20.00 can’t be ruled out.

Silver: Daily chart

Trend: Limited upside expected

-

23:45

NZDUSD rebounds from 0.6000 amid a bloodbath in US yields, US Michigan CSI in focus

- NZDUSD has witnessed fresh demand around 0.6000 amid euphoria in the risk profile.

- Fed policymakers still favor the continuation of policy tightening despite a noteworthy decline in US CPI.

- Kiwi bulls have not reacted much to the downbeat Business NZ PMI data.

The NZDUSD pair has recovered after a mild correction to near the psychological support of 0.6000 in the early Asian session. The corrective move has provided an opportunity to smart money to get injected amid the euphoric market mood. Noteworthy signs of a cool down in red-hot US inflation have improved the risk appetite of the market participants significantly.

A sheer decline in the US Consumer Price Index (CPI) has brought a bloodbath in the US Treasury yields. Investors went strongly for loading US government bonds, which dragged the 10-year US Treasury yields to 3.8%. Meanwhile, the US dollar index (DXY) is eyeing an establishment below 108.00 as investors are expecting a slowdown in the current pace of policy tightening by the Federal Reserve (Fed).

On contrary, Fed policymakers are of the view that the Fed will continue its restrictive policy measures given the persistent nature of inflation. San Francisco Fed President Mary Daly and Dallas Fed President Lorie Logan cheered a slowdown in the price growth but still warn that fight against inflation is far from over.

On Friday, US markets will remain closed on account of Veterans Day. Investors will focus on the release of the US Michigan Consumer Sentiment Index (CSI) data, which is seen lower at 59.5 vs. the prior release of 59.9. It seems that vulnerable inflationary pressures have impacted consumers’ sentiment.

Meanwhile, downbeat Business NZ PMI data has failed to impact the Kiwi bulls. In early Asia, the economic data landed at 49.3, lower than the projections of 52.7 and the prior release of 51.7. Going forward, investors will keep an eye on Business NZ Services data, which will release on Monday.

-

23:24

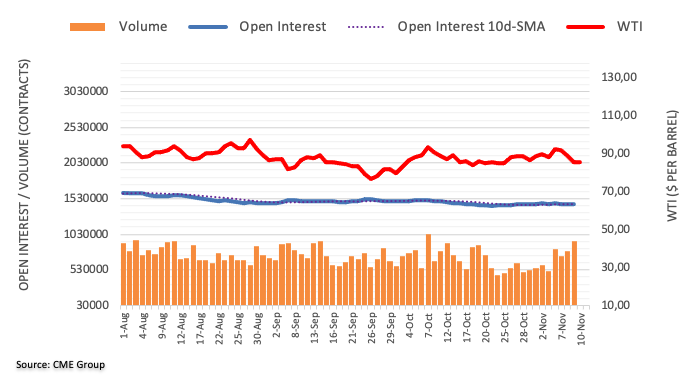

WTI fades US CPI-led recovery around mid $85.00s amid mixed demand-supply concerns

- WTI Crude Oil fails to defend the rebound from the lowest levels in 12 days.

- Covid woes in China, easy headlines over Russia-Ukraine war challenge energy buyers.

- Softer US inflation, fears surrounding EU’s “correction mechanism” probe sellers.

- Risk catalysts will be more important for near-term directions.

WTI buyers relinquish control, following the black gold’s bounce off a two-week low, as traders seek fresh clues to defend the US inflation-led recovery during early Friday. That said, the energy benchmark retreats to $85.50 by the press time.

In addition to a lack of major data/events, as well as the US bank holiday, mixed signals surrounding the demand-supply matrix also challenge the WTI buyers to extend the post-US Consumer Price Index (CPI) run-up.

Among them, concerns surrounding China’s coronavirus conditions act as a major drawback. The dragon nation reported a slight decline in the daily covid figures the previous day but the outcome still remained near the highest levels in six months. Also, multiple lockdowns and fears of worsening virus conditions, as well as the zero-covid policy, highlight fears of lesser demand from the world’s biggest commodity user.

Elsewhere, Russia’s retreat from Kherson and a lack of major negatives over the previously dominant geopolitical fears seem to also weigh on the black gold prices. It should be noted that the increase in weekly oil inventories and looming fears of global recession also exert downside pressure on the black gold.

That said, a surprise eight-month low in US CPI triggered the WTI’s run-up the previous day as the US Dollar Index (DXY) dropped towards the lowest levels in two months after the inflation data pushed back the hawkish Fed bets.

Further, the European Union’s (EU) readiness to curb the gas price, despite witnessing mixed responses for its method citing a firm price cap, suggests further action from Russia and may help the oil prices. The European Commission will propose a gas price "correction mechanism" to the 27 EU states on Friday, a measure aimed at easing price spikes but not the firm cap sought by many countries, according to sources and documents seen by Reuters.

It’s worth noting that the risk-on mood keeps the oil buyers hopeful but the US bank holiday and a light calendar test the traders of late.

Technical analysis

WTI buyers need to provide a daily closing beyond the support-turned-resistance line from late September, around $87.15 by the press time, to regain the market’s confidence.

-

23:10

GBPJPY Price Analysis: Sellers in charge, as head-and-shoulders pattern emerged

- GBPJPY trims some of its Thursday losses as the Asian session starts.

- A head-and-shoulders chart pattern in the GBPJPY daily chart targets a fall to 158.40.

- GBPJPY Price Analysis: A rise above 169.00 would invalidate the pattern; otherwise, the downtrend will resume.

The GBPJPY extended its losses for three consecutive days following the release of the US inflation report, which triggered a US Dollar (USD) sell-off. Therefore, the USDJPY sank more than 500 pips and weighed on the Pound Sterling, which weakened 0.71% vs. the Japanese Yen (JPY) on Thursday. As the Asian session begins, the GBPJPY trades at 165.76 and stages a comeback, pairing some of Thursday’s losses.

GBPJPY Price Analysis: Technical outlook

On Thursday, the GBPJPY pierced the 50-day Exponential Moving Average (EMA) but bounced off, achieving a daily close above 165.00. GBPJPY price action during the last 30 days formed a head-and-shoulders chart pattern, though, at the time of typing, the cross exchanges hands above the neckline. Nevertheless, to invalidate the pattern, the GBP needs to lift the cross above the right-shoulder swing high at 169.00. Otherwise, if the GBPJPY resumes its downward path below the neckline, which passes at around 165.30, it would validate the head-and-shoulders chart pattern.

Therefore, the GBPJPY’s first support would be the psychological 165.00 figure. Break below will expose the 50-day EMA at 164.80, followed by the November 10 swing low at 164.36, ahead of the 164.00 mark. Once cleared, the following demand area will be the 100-day EMA at 163.95, on its way, towards the head-and-shoulders target of 158.00.

GBPJPY Key Technical Levels

-

23:09

USDCAD declines towards 1.3300 amid BOC’s hawkish commentary, solid market mood

- USDCAD is eyeing more weakness towards the 1.3300 cushion as red-hot US inflation cools down.

- The risk profile has turned solid as the Fed may not continue its 75 bps rate hike cycle.

- Loonie bulls have strengthened on hawkish BOC Macklem’s commentary and a recovery in oil prices.

The USDCAD pair is declining towards the round-level cushion of 1.3300 in the early Asian session. The Greenback bulls have faced a massive sell-off on soft October’s inflation report released on Thursday. This sent the US Treasury yields extreme towards the south and put the positive market sentiment into the driving seat.

The 10-year US Treasury yields plummeted to 3.8% as the Fed may continue its 75 basis points (bps) rate hike spell, according to probability from the CME FedWatch tool. S&P500 witnessed a juggernaut rally as a significant decline in odds of a bigger rate hike by the Federal Reserve (Fed) in its December monetary policy trimmed sharply.

The mighty US dollar index (DXY) nose-dived to near a two-month low at around 107.68. A significant rise in bets for a 50 bps rate has trimmed the safe-haven’s appeal. Minting cool down in red-hot inflationary pressures has delighted Fed policymakers. San Francisco Fed President Mary Daly and Dallas Fed President Lorie Logan have cheered a note-worth slowdown in the price growth but still warn that fight with the inflation monster is far from over.

Cleveland Fed Bank President Loretta Mester supported the view of other Fed policymakers and believes that the restrictive policy measures should continue given the persistent nature of inflation.

Meanwhile, Loonie investors are supporting their domestic currency on hawkish commentary from Bank of Canada (BOC) Governor Tiff Macklem. BOC Governor cited that “Canadians should expect even more rate hikes to come on top of six that have already happened this year,” during an interview with CBC News in the late New York session.

He further added that layoffs will increase and the growth rate may come to zero in the next few quarters, and the central bank is fine with a mild recession as a price to bring down inflation to desired levels.

On the oil front, the price of fossil fuels rebounded after dropping to near $84.00 as softer inflationary pressures have infused optimism in oil bulls. This has also strengthened the Canadian dollar as Canada is a leading exporter of oil to the US.

It is worth noting that the US and Canadian markets are closed on Friday on account of Veterans Day and Remembrance Day respectively.

-

22:56

USDCHF Price Analysis: All eyes on 200-DMA support above 0.9600

- USDCHF remains sidelined after falling to the seven-week low.

- Clear break of 100-DMA, three-month-old ascending support line favor bears.

- RSI conditions suggest another bounce off the key 200-DMA.

USDCHF bears take a breather around two-month low as it seesaws near 0.9635-40 during Friday’s initial Asian session, following a biggest daily fall in five months.

Even so, the Swiss currency (CHF) pair sellers remain hopeful as the quote broke important supports, namely the 100-DMA and an ascending trend line from August, during the previous day’s slump.

As a result, the quote appears vulnerable to testing the 200-DMA support, around 0.9625 by the press time.

However, the nearly oversold RSI conditions seem to challenge the USDCHF pair’s downside past the 200-DMA.

Also acting as a downside filter is the eight-month-old support line and September’s low, respectively around 0.0.9490 and 0.9480.

Meanwhile, recovery remains elusive unless the quote stays below the support-turned-resistance line from August, around 0.9685 by the press time. Following that the 100-DMA level near 0.9745 could challenge the USDCHF buyers.

Overall, the USDCHF pair’s downside break of the previously key support levels confirms its further declines. However, the RSI (14) appears to challenge the quote’s heavy fall, which in turn highlights the 200-DMA as a crucial support.

USDCHF: Daily chart

Trend: Limited downside expected

-

22:40

AUDUSD seesaws around seven-week high above 0.6600 after US inflation-led rally

- AUDUSD bulls take a breather after rising the most in 11 years.

- Hawkish Fed bets recede on softer US inflation, the US Dollar drowned.

- Equities also cheered downbeat US CPI for October and underpinned the run-up.

- Preliminary readings of the US Michigan Consumer Sentiment Index for November will be important for fresh impulse.

AUDUSD stays defensive around 0.6620, following the heaviest daily run-up since October 2011, as bulls seek more clues to extend the previous day’s rally during early Friday. That said, the Aussie pair jumped the most in 11 years on Thursday after the US Consumer Price Index (CPI) pushed back hawkish expectations from the US Federal Reserve (Fed).

US CPI for October surprised markets by declining to 7.7% YoY, the lowest since last March, versus 8.0% expected and 8.2% prior. More importantly, the Core CPI dropped to 6.3% compared to 6.5% market forecasts and 6.6% previous readings.

Following the data, Dallas Federal Reserve President Lorie Logan said that October CPI inflation data is a welcome relief while adding that (it) may soon be appropriate to slow pace of rate increases. On the same line, Federal Reserve Bank of Philadelphia President Patrick Harker said on Thursday that the US Federal Reserve could slow the rate hike pace in the coming months, as reported by Reuters. It should be noted that Kansas City Federal Reserve President Esther George, Federal Reserve Bank of Cleveland President Loretta Mester and San Francisco Fed President Mary Daly also recently promoted easy rate hikes for future meetings.

The much-needed fall in the US inflation triggered a rally on Wall Street as S&P 500 rose 5.54% and Nasdaq rallied 7.35% on a day, not to forget the 3.70% daily gains of the Dow Jones. On the other hand, the US 10-year Treasury yields slumped to a five-week low of 3.80%, which in turn drowned the US Dollar Index (DXY) towards testing the lowest levels in two months. It’s worth mentioning that the chance of the Fed’s 50 basis points (bps) rate hike in December now has around 80% probability, as per the CME’s FedWatch Tool, versus around 55% just following the last week’s Fed meeting.

Alternatively, multiple officials from the Reserve Bank of Australia (RBA) confirmed the need for softer rate hikes the previous day and teased AUDUSD bears. Additionally challenging the pair buyers are the looming covid concerns in China. However, Australia’s Consumer Inflation Expectations rose to 6.0% for November versus 5.7% expected and 5.4% prior.

Moving on, the first readings of the US Michigan Consumer Sentiment Index (CSI) for November, expected 59.5 versus 59.9 prior, will be closely eyed for clear AUDUSD directions amid a light calendar at home.

Technical analysis

AUDUSD stays on the bull’s radar, despite the latest inaction, unless it drops back below the 0.6500 support confluence, comprising the previous resistance line from August and the 50-DMA.

-

22:27

GBPUSD marches towards two-month high at 1.1740 amid euphoric market mood, UK GDP eyed

- GBPUSD is advancing towards 1.1738 as a decline in US inflation has trimmed hawkish Fed bets.

- Bloodbath in US Treasury yields and cheerful market mood have underpinned risk-sensitive currencies.

- Going forward, the UK GDP data will be of utmost importance.

The GBPUSD pair is advancing firmly to kiss the two-month high at 1.1738 in the early Tokyo session. A significant drop in the US inflationary pressures has infused an adrenaline rush into risk-sensitive assets. Euphoria in the market mood has improved the risk appetite of investors vigorously.

S&P500 soared like there is no tomorrow as mounting price pressures in the US economy have been hammered. A meaningful decline in price growth has trimmed downside risks to economic projections and the risk of a recession situation. Earlier, economists were expecting that continuous policy tightening measures by the Federal Reserve (Fed) would shift the US economy into a recession. And, when the US sneezes, developing countries catch a cold.

Meanwhile, the US dollar index (DXY) nose-dived to 107.80 as every chance of a risk-off impulse in the market was kicked-off. The returns on US government bonds remained a major victim as long-term bonds’ yields have witnessed a bloodbath and have dropped to 3.8%.

The headline Consumer Price Index (CPI) has dropped to 7.7% vs. the projections of 8.0% and the core CPI declined to 6.3% against the expectations of 6.5%. This has paused chatters of a higher terminal rate by the Fed as price pressures have displayed signs of significant exhaustion. Also, rumors of recession and bleak economic outlook may dim as Fed chair Jerome Powell won’t continue the 75 basis points (bps) rate hike cycle.

On Friday, US markets will remain closed on account of Veterans Day.

Talking on the UK front, investors are focusing on the UK Gross Domestic Product (GDP) data, which will release on Friday. The GDP data on an annual basis is seen lower at 2.1% vs. the prior release of 4.4%. And, the quarterly regime is expected to display negative growth by 0.5% against an expansion of 0.2%.

-

22:24

EURUSD surges above 1.0200 after a soft US CPI report

- CPI data in the United States cooled down, weighing on the American Dollar.

- US Treasury bond yields plummeted as traders expected a less aggressive Federal Reserve.

- Fed officials remain committed to tackling inflation after welcoming October’s report.

- European Central Bank policymakers to keep raising rates, albeit recession fears increased.

The Euro rallies sharply amid broad US Dollar (USD) weakness, spurred by a softer US October Consumer Price Index (CPI) report. Increasing speculations during the week that the Federal Reserve (Fed) might slow the pace of rate hikes was further confirmed by investors’ reaction, with US equities rallying while US Treasury bond yields plunged. The EURUSD is trading at 1.0209, above its opening price by 2%.

US CPI bolsters the EUR to the USD detriment

Before Wall Street opened, the US Department of Labor reported that headline inflation, as reported by the CPI, rose by 7.7% YoY, below estimates of 7.9%. Even though the CPI continued its downtrend for the fourth last months, the core CPI bucked the trend. Nevertheless, October’s core CPI, which exclude volatile items inflation, like food and energy, fell to 6.3% YoY, vs. 6.5% expected and beneath the previous month’s 6.6% reading. Traders reacted, and the Euro soared more than 200 pips after the release, toward 1.0150, while the USD tanked.

The US Dollar Index (DXY), a gauge that measures the American Dollar value against six currencies, including the EUR, dives almost 2.50%, down from 110.992 to 107.804. It’s the DXY’s most significant drop since March 18, 2009, when it fell by 3%.

Meanwhile, additional US data crossed newswires. The US Initial Jobless Claims for the week ending on November 5 rose by 225K, exceeding estimates of 220K, signaling that the labor market might be easing.

US Treasury yields sank

Given that inflation in the US eased, the US Treasury yields plunged severely. The US 10-Treasury bond yield tumbled 28 bps, from 4.117% to 3.814%, as traders began to reprice gradual interest-rate increases by the Fed. The CME FedWatch Tool shows that the odds for a 50 bps rate hike by the Fed’s December meeting are at 80.6%, up from Wednesday’s 50%.

Fed policymakers cheered the inflation report

Meanwhile, some Fed officials welcomed October’s CPI report, though they acknowledged there’s more work to do. The Dallas Fed President Lore Logan said, “there is still a long way to go.” Meanwhile, San Francisco Fed President Mary Daly said, “stepping down is an appropriate thing to think about,” while foreseeing the Federal Funds rate (FFR) to peak at 4.90%.

Cleveland’s Fed President Loretta Mester said that inflation will moderate and reach the Fed’s target by 2025. Mester added that the US economy’s behavior would determine how high the Fed needs to go.

ECB members remained hawkish, although recession fears arose

Elsewhere, some European Central Bank (ECB) speakers led by the German Bundesbank President Joachim Nagel crossed wires. Joachim Nagel said that there is potential for interest rate hikes. Echoing his comments was the ECB Governing Council (GC) member Isabel Schnabel, saying that inflation is gaining traction and it’s stickier. She commented that rates need to be raised into restrictive territory, even though recession risks have increased.

EURUSD Price Analysis: Technical outlook

Given the abovementioned backdrop, from a technical perspective, the EURUSD is neutral-to-upward biased. Of note, EUR buyers reclaimed the 100-day Exponential Moving Average (EMA) at 1.0028, and it’s aiming toward 1.0300. The break above will expose the August 10 high at 1.0368, ahead of the 1.0400 figure. Once cleared, the next stop would be the 200-day EMA at 1.0437. On the other hand, key support levels lie at 1.0200, which, once cleared, would open the door towards 1.0100, followed by a re-test of the 100-day EMA at 1.0028.

-

22:12

BOC’s Macklem: Canadians should expect even more rate hikes to come

“Canadians should expect even more rate hikes to come on top of six that have already happened this year,” said Bank of Canada (BOC) Governor Tiff Macklem during an interview with CBC News late Thursday.

Also read: BoC’s Macklem: Canadian economy in excess demand, inflation too high

Additional comments

Layoffs are likely to increase in the coming months.

Labor market is very tight.

We think growth is going to be close to zero for the next few quarters, until about the middle of next year.

A mild recession may be the price the bank is willing to pay to bring down inflation.

Monetary policy works.

USDCAD stays pressured

USDCAD bears take a breather at a seven-week low, around 1.3323 by the pres time, after witnessing the US inflation-inspired slump.

-

21:56

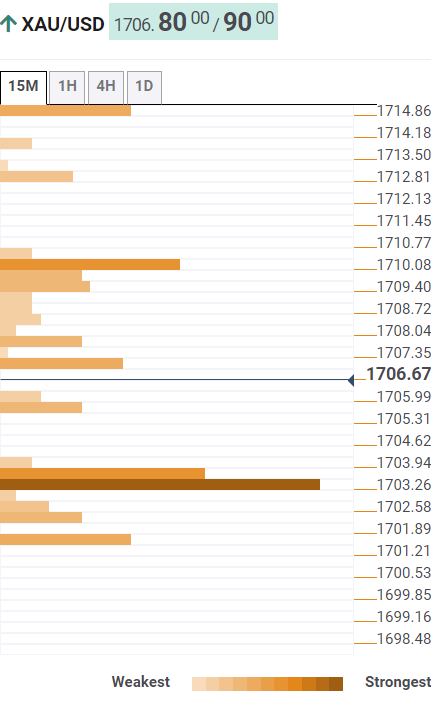

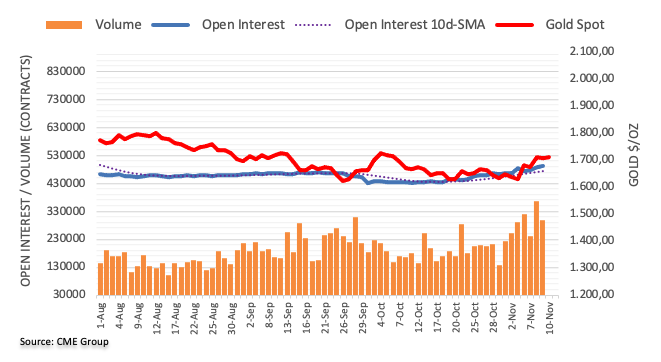

Gold Price Forecast: XAUUSD aims to recapture a 10-week high around $1,770 as less-hawkish Fed bets soar

- Gold price is marginally from the 200-EMA as Fed may slow down the current pace of rate hikes.

- The 10-year US Treasury yields have witnessed a bloodbath as bets over 75 bps rate hike have plummeted.

- A sheer decline in consumer spending is responsible for lower-than-projected US CPI data.

Gold price (XAUUSD) has witnessed a juggernaut rally after a sheer decline in US inflation figures on Thursday. The precious metal gained around 3% from Wednesday’s closing price and is now expected to recapture a 10-week high at $1,765.58 ahead.

Meanwhile, the US dollar index (DXY) nose-dived to 107.80 as a bumper decline in the US Consumer Price Index (CPI) has accelerated the odds for a less-hawkish commentary from Federal Reserve (Fed) policymakers for December monetary policy meeting. The 10-year US Treasury yields have witnessed a bloodbath and have dropped to 3.8% as chances for a fifth consecutive 75 basis point (bps) rate hike have plummeted below 15%, as per the CME FedWatch tool.

Thanks to the sheer decline in consumer spending in the third quarter of CY2022 that the headline CPI dropped to 7.7% and core CPI declined to 6.3%. Now, chatters over increasing peak for the terminal rate by the Fed may pause for a while and Fed chair Jerome Powell will also discuss supporting the economic prospects too to safeguard the economy from a recession situation.

The market participants should be aware of the fact that the US markets will remain closed on Friday on account of Veterans Day.

Gold technical analysis

On the daily scale, the gold price is marginally far from kissing the 200-period Exponential Moving Average (EMA) at $1,758.00 for the first time in the past five months. The horizontal resistance placed from August 10 high at $1,807.93 will act as major hurdle ahead.

The Relative Strength Index (RSI) (14) has overstepped 60.00 for the first time in seven months, showing no signs of divergence and overbought.

Gold daily chart

-

21:45

New Zealand Food Price Index (MoM) registered at 0.8% above expectations (0%) in October

-

21:39

New Zealand Business NZ PMI came in at 49.3, below expectations (52.7) in October

-

20:55

NZDUSD bulls moving in for the kill and eye daily price imbalances

- NZDUSD bulls remain in play as the greenback keeps shedding ground.

- US CPI surprised to the downside and the relief rally in high beta currencies is in play.

NZDUSD rallied on Thursday on the back of the US inflation data which was a relief to markets as it missed the mark and fanned the flames of a Federal Reserve pivot. As per the past series of technical analyses on NZDUSD this week, NZD/USD Price Analysis: Bears move in from key highs for the week, and the more recent, NZDUSD Price Analysis: Bears in control with eyes on daily trendline, the trajectory was adhered to ahead of the CPI and downside extremes reached as follows:

NZDUSD prior analysis

As for the daily chart, the price was bounded by resistance and it was stated that the doji could turn out to be pivotal for the pair and week:

It was stated, if the bears were to commit, then there would be prospects of a test of the broader trendline and a move into the key Fibonacci near 0.5850 in a 50% mean reversion:

The engulfment of the doji was noted as a potentially significant feature.

For the hourly template, this meant a continuation was in order:

Update:

The target was reached before US CPI sent the bird on a tear through all of the mark-down.

Where now?

We need to bring up the daily chart again:

As seen, the trendline has been respected as we are clearing through resistance and we are now moving in on a price imbalance between 0.6026/85:

Such a continuation would coincide with a further downside in the US dollar vs. a basket of currencies:

The price of the US dollar index keeps falling on the day and while there could be more to go, we have the 107.86 target in as a possible support considering it made up a foundation for the highs of the cycle when last visited as support. A break there could be significant but the M-formation is a reversion pattern and a correction to the resistance near 109.63 could be in play if the bulls commit strong hands over the course of the coming days. Nevertheless, a vulnerable US Dollar gives the commodity complex fuel and the bird can glide higher on that.

-

20:02

GBPJPY Price analysis: Testing the neckline of an “H&S” pattern at 165.00

- The Pound fails at 167.10 and returns to the support area at 165.00.

- Below 165.00 the pair may activate an "H&S" pattern targeting 160.00 or lower.

The Pound headed south against the Japanese Yen for the third consecutive day on Thursday, extending its reversal from Monday’s high at 169.05 to test the neckline of a Head & Shoulders pattern at 165.00.

The Yen surged after US CPI data

The mild recovery attempt seen during the Asian and early European sessions lacked follow-through above 167.00, and the pair dropped sharply during the early US trading session, with the Japanese Yen skyrocketing after the release of US inflation data.

Yen strength has pulled the pair to test an important support level at 165.00, where the October 14 and 21 and November 3 and 4 lows meet the 50-day SMA.

Hourly charts show the pair close to overbought levels, which might favor some consolidation before further movement takes place.

A confirmation below 165.00 would increase negative pressure and send the pair to test the 100-day SMA, now at 164/05 area, and the 200-day SMA, at 162.10 before aiming for October’s low at 159.80.

On the flip side, the pair should breach intra-day resistance at 167.50 to ease negative pressure, and extend towards November 6 and 7 high at 167.11, which closes the path to the 170.00 psychological level.

GBP/JPY daily chart

Technical levels to watch

-

20:01

Forex Today: Dollar hurt by optimism

What you need to take care of on Friday, November 11:

The American Dollar plummeted on Thursday against all of its major rivals as market participants rushed to price in a pivot in the US Federal Reserve monetary policy as soon as next December. The October Consumer Price Index unexpectedly declined by more than anticipated, as annual inflation rose by 7.7%. The core reading, which excludes volatile food and energy prices, resulted at 6.3%, easing from 6.6% in September.

Following the release, the CME Group FedWatch Tool showed that markets are pricing in an 80% probability of a 50 basis points rate hike in December, compared to 52% just before the release. Time for the US Federal Reserve to pivot.

Optimism returned. Stocks soared, yields plunged, and risk-on flows came back to life. US indexes are up over 3% each, with the Nasdaq Composite adding a whopping 6%. On the other hand, Treasury yields shed over 20 bps, with the 10-year Treasury note currently yielding 3.83%.

EURUSD trades near a monthly high of 1.0184, while GBPUSD extends its gains ahead of the US close, now approaching 1.1700. The AUDUSD pair is about to challenge the 0.6600 area, while USD/CAD is down to 1.3350. Finally, The USDJPY pair trades around 141.80, while USDCHF is down to 0.9660.

Gold soared to fresh three-month highs, now trading at around $1,754 a troy ounce. Crude oil prices remained subdued, barely recovering some ground after the latest slump. WTI is currently changing hands at around $86.40 a barrel.

On a down note, the Politburo Standing Committee (PSC) of the Chinese Communist Party held a coronavirus-related meeting and urged to stick to the zero-covid policy. Another negative sentiment factor is the collapse of the crypto exchange FTX earlier this week, said to have a black hole of $ 6 billion. The crisis is spreading like wildfire in the crypto world, and the end is yet to be seen. Investors, however, hardly paid attention to the headlines after the CPI release, which even support the crypto market.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:45

United States 30-Year Bond Auction: 4.08% vs 3.93%

-

19:25

AUDUSD’s rally hits resistance at 0.6600, pulls back to 0.6555

- Australian Dollar's rally from the 0.6385 area, capped at 0.6600.

- The pair remains 2.2% up on the day, consolidating above 0.6540 previous resistance level.

- Greenback's weakness after US CPI data has boosted the AUD.

The Australian Dollar’s rally from session lows at 0.6385 has been capped at a fresh six-week high a few pips shy of 0.6600, although the pair remains steady in the upper range of the 0.6500s.

On the daily chart, the pair moves 2,2% above the opening levels. The Aussie surged on Thursday’s early US session, following the release of US CPI data to break the top of the last six weeks’ trading range, at 0.6545.

The US Dollar plunges on weak CPI data

US inflation slowed down beyond expectations in October, which sent US Treasury yields and the Greenback lower, and boosted equity markets on hopes that the Federal Reserve might shift to softer interest rate hikes over the next months.

The overall CPI increased at a 0.4% pace, unchanged from September, against market expectations of an acceleration to 0.6%. The Core inflation, the Fed’s preferred inflation gauge, slowed down to 0.3% from 0.6% over the previous month.

Furthermore, US weekly jobless claims showed an increment of 225,000 claims in the week of November 4, up from 228,000 claims over the previous week and above the market expectations of 220,000. These figures suggest a certain loosening in the labor market and provide additional reasons to expect some easing on the Fed’s tightening plan.

Technical levels to watch

-

19:14

Mexico central bank sets benchmark interest rate at 10.0%

Reuters reported that the Bank of Mexico hiked its key interest rate by 75 basis points to a record 10.00% on Thursday, in line with forecasts and following in the footsteps of the U.S. Federal Reserve's own recent three-quarter of a percentage point increase.

''In a departure from recent decisions, the bank's five board members did not vote unanimously for the increase, with deputy governor Gerardo Esquivel voting to hike the key rate by 50 basis points.''

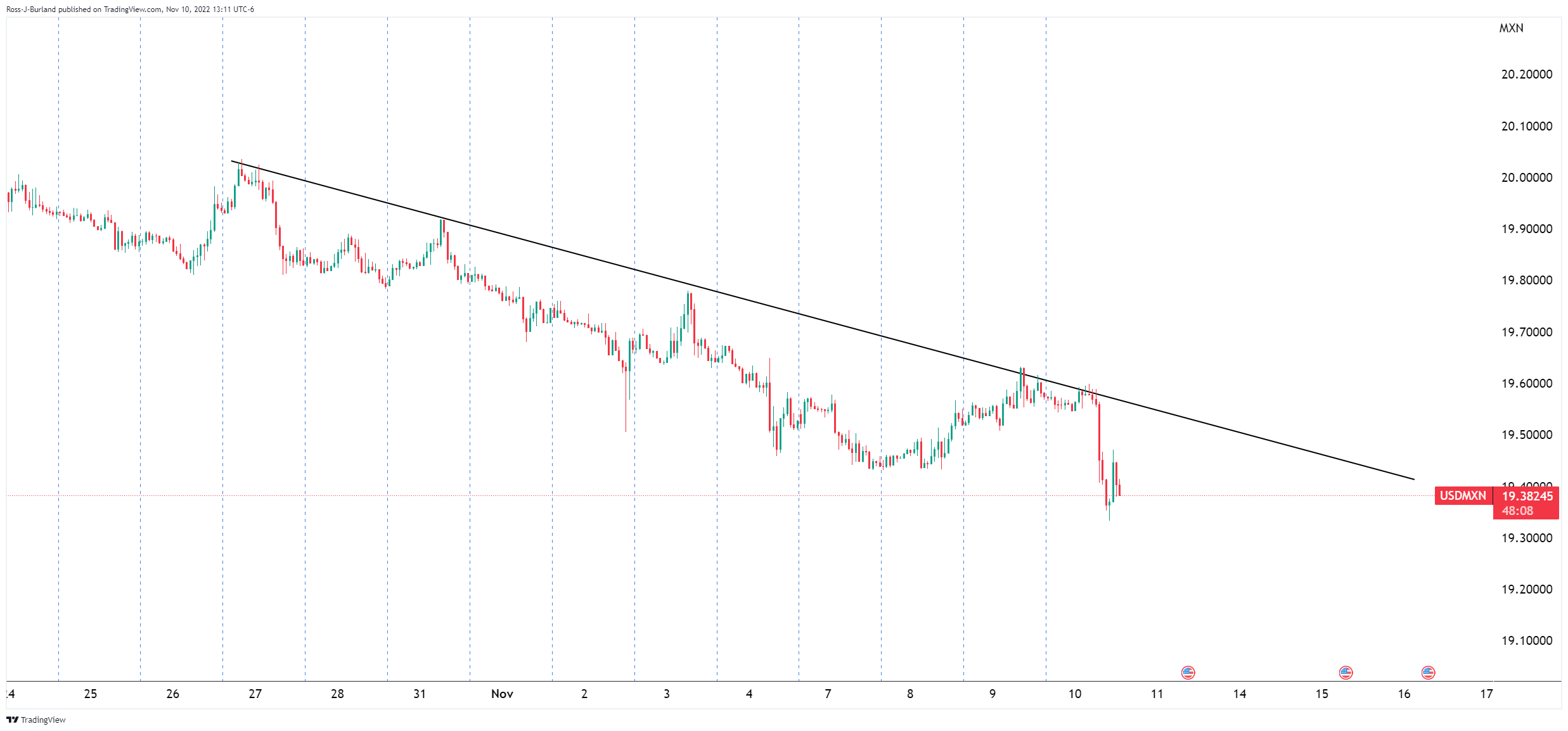

USDMXN bears in play

Meanwhile, USDMXN is down around 1% on the day following a move lower in the greenback, supporting the emerging market complex:

DXY is offered below daily support on US inflation data miss on Thursday:

-

19:00

United States Monthly Budget Statement registered at $-88B above expectations ($-90B) in October

-

19:00

Mexico Central Bank Interest Rate in line with forecasts (10%)

-

18:51

Fed George: Calls for 'more measured' pace of rate hikes

Reuters reported that the Kansas City Federal Reserve President Esther George on Thursday reiterated her support for a slower pace of US interest rate increases, calling for a "more measured" approach that allows the central bank time to judge how the rises in borrowing costs are affecting the economy.

"I continue to see several advantages for a steady and deliberate approach to raising the policy rate," George said in remarks prepared for delivery to an energy conference co-hosted by her regional bank and the Dallas Fed.

Key quotes

"Without question, monetary policy must respond decisively to high inflation to avoid embedding expectations of future inflation."

"A more measured approached to rate increases may be particularly useful as policymakers judge the economy's response to higher rates."

"As the tightening cycle continues, now is a particularly important time to avoid unduly contributing to financial market volatility, especially as volatility stresses market liquidity with the potential to complicate balance sheet run-off plans."

"The degree of tightening necessary will only be determined by observing the dynamics of the economy and inflation and cannot be predetermined by theory or pre-pandemic benchmarks."

US dollar update

Meanwhile, the greenback has crumbled below a key level of daily support on the DXY index, measuring the currency vs. a basket of currencies:

Should investors be of the mind that even when Fed policy rates peak, that they are likely to remain higher for longer, then the greenback could be seen as a discount near the upper quarter of the 107 area as illustrated above. The M-formation is also a reversion pattern so the resistance could be revisited in the coming days.

-

18:42

WTI is struggling to regain $87.00 on soft US inflation data

- Oil prices bounce up from $84.70 lows to reach levels past $87.00.

- The Dollar plunges on soft US CPI data.

- Hopes of Fed easing have boosted risk appetite.

WTI prices appreciated on Thursday to hit session highs right above $87 following a 7.5% sell-off over the last three days. The US Oil benchmark, however, has been rejected at $87.25 before pulling back to the $86.50 area.

The Dollar plummets on soft US CPI figures

Consumer inflation eased beyond expectations in October. The monthly CPI increased 0.4%, unchanged from September, against market expectations of a 0.6% advance. Yearly inflation increased by 7.7%, down from 8.2% in September, while the market had anticipated an 8% reading.

The Core CPI, a gauge closely observed by the Federal Reserve to assess inflation trends, accelerated at a 0.3% pace, from 0.6% in September. Year-on-year, the core inflation increased 6,3% from 6.5% in September, while the market has forecasted a softer deceleration, to 6.5%.

These figures suggest that inflation might have peaked and provide some room for the Federal Reserve to consider slowing down its monetary tightening plan. This has brought back the idea of a softer rate hike in December, which has hurt the US dollar, boosting equity markets across the world.

At the same time, the US weekly jobless claims data revealed that 225,000 workers filed for unemployment benefits in the week of November 4, up from 218,000 in the previous month and above the 220,000 expected. These figures add to the evidence that labor market conditions might be loosening, offering further reasons for the Fed to lift its foot off the rate hike pedal.

Technical levels to watch

-

18:41

Silver Price Forecast: XAGUSD clears the 200-DMA and stays nearby 4-1/2 month highs, around $21.60s

- Silver reached a fresh four-and-half-month high, around $21.83, after a soft US inflation report.

- October’s inflation in the US was lower than estimated, increasing the likelihood of lower-interest-rate increases by the Federal Reserve.

- US initial jobless claims jumped the most, flashing that the labor market is beginning to ease.

Silver price is skyrocketing to a fresh four-and-half-month high, in the mid-North American session, following a US inflation report that came softer than economists’ expectations, and weighed on the US Dollar, while US Treasury yields plunged, a tailwind for precious metals prices. The XAGUSD is trading at $21.63.

US economic data portrays the effect of the Fed’s aggressive policy as inflation gets down and unemployment claims rise

The US Consumer Price Index (CPI) report for October showed that inflation is finally easing, with headline CPI figures jumping 7.7% YoY, below expectations of 7.9%, while the core CPI, which excludes volatile items like food and energy, fell to 6.3% YoY, below estimates of 6.5%. That said, the US Dollar weakened across the board, while US Treasury bond yields plunged, with the 10-year down 24 bps at 3.857%.

At the time of typing, US equities are rallying sharply, led by the Nasdaq, up by almost 6%. The US Dollar Index, which tracks the greenback’s value vs. a basket of peers, slides 1.71% at 108.527, a tailwind for the white metal.

At the same time, the US labor market updated the unemployment claim figures, which were overshadowed by the US inflation report. Initial Jobless Claims for the last week rose by 225K vs. 220K estimates

Aside from this, Fed officials crossed newswires after the release of US economic data. Dallas Fed President Logan said that October CPI data is welcomed, but there’s a long way to go. She added that the process of cooling the economy is just getting started. Of late, the San Francisco Fed President Mary Daly said October’s CPI was good and is just one “example of encouraging data.” She favors slow, steady rises to the Federal Funds rate (FFR), expecting it would peak at around 4.9%.

Silver (XAGUSD) Key Technical Levels

-

18:35

WTI is struggling to regain $87 on soft US inflation data

- Oil prices bounce up from $84.70 lows to reach levels past $87.00.

- The Dollar plunges on soft US CPI data.

- Hopes of Fed easing have boosted risk appetite.

WTI prices appreciated on Thursday to hit session highs right above $87 following a 7.5% sell-off over the last three days. The US Oil benchmark, however, has been rejected at $87.25 before pulling back to the $86.50 area.

The Dollar plummets on soft US CPI figures

Consumer inflation eased beyond expectations in October. The monthly CPI increased 0.4%, unchanged from September, against market expectations of a 0.6% advance. Yearly inflation increased by 7.7%, down from 8.2% in September, while the market had anticipated an 8% reading.

The Core CPI, a gauge closely observed by the Federal Reserve to assess inflation trends, accelerated at a 0.3% pace, from 0.6% in September. Year-on-year, the core inflation increased 6,3% from 6.5% in September, while the market has forecasted a softer deceleration, to 6.5%.

These figures suggest that inflation might have peaked and provide some room for the Federal Reserve to consider slowing down its monetary tightening plan. This has brought back the idea of a softer rate hike in December, which has hurt the US dollar, boosting equity markets across the world.

At the same time, the US weekly jobless claims data revealed that 225,000 workers filed for unemployment benefits in the week of November 4, up from 218,000 in the previous month and above the 220,000 expected. These figures add to the evidence that labor market conditions might be loosening, offering further reasons for the Fed to lift its foot off the rate hike pedal.

Technical levels to watch

-

18:33

USDCAD bears eye 1.32 over the horizon

- CAD is strong on US dollar weakness following CPI miss.

- The price is correcting into prior support with the 38.2% Fibonacci not far off.

- Bears eye 1.32 the figure as a downside initial swing target.

The Canadian Dollar strengthened on Thursday, hitting the best level against the greenback since September 20th. The moves were inspired by lower-than-expected inflation reading for the US in the day's Consumer Price Index data. This has increased bets the Fed will raise rates by a smaller 50bps next month.

The greenback fell sharply as the data pointed to underlying inflation has peaked. CPI rose 0.4% in October to match the prior month's increase, the Labor Department said. Economists polled by Reuters had forecast the CPI would advance 0.6%. Excluding volatile food and energy, core CPI increased 0.3% month-over-month after gaining 0.6% in September. the markets reacted in such a manner that this might allow the Federal Reserve to ease up on aggressively hiking interest rates. Money markets see a 70% chance that the central bank would hike its benchmark rate by 25 basis points rather than 50 basis points at its next policy decision on Dec. 7, up from about 50% before the US inflation data.

Meanwhile, in Canada, CPI figures are due next week. This brings the Bank of Canada to the fore. The BoC lifted rates by 50 bps on October 26th, a sixth consecutive rate hike. However, this was below a 100bps hike in July and a 75bps increase in September. Still, the central bank is expected to tighten further and raise rates by another 50bps in December as the inflation remains elevated. BoC Governor Tiff Macklem spoke before the Public Policy Forum today. He said the Canadian economy is in excess demand while inflation is too high. However, he added that wage growth ''now looks to be plateauing''.

Update:

BoC's Governor Macklem: ''As for the next rate announcement, it might be another larger-than-usual step or a return to the more routine 25 basis point range.''

Markets might have jumped the gun on CPI

While this is deemed to be good news for the Fed, central bank watchers will now have a series of other data to monitor leading up to the next meetings, primarily with a focus on the Fed. We will get one more jobs report and another set of inflation and Retail Sales data before the December 13-14 meeting. Fed's Cleveland President Loretta Mester spoke in recent trade and commented on the CPI data. She said, ''this morning’s October CPI report also suggests some easing in overall and core inflation,'' but added, “there continue to be some upside risks to the inflation forecast.” This type of rhetoric will guide the market to think that even when Fed policy rates peak, that they are likely to remain higher for longer. This could be significantly bullish for the greenback over the horizon of today's CPI data. Additionally, Fed's Daly spoke and said that there is no evidence of wage prices spiralling and that inflation is one of the most lagging variables, adding, the Fed needs ''policy to be sufficiently restrictive until see inflation is well on its way to 2%.''

USD/CAD and US Dollar technical analysis

Nevertheless, as the following analysis will show, the US dollar is under pressure and could be headed for more of a clearout across its major counterparts.

The US dollar, as measured by the DXY, is taking out a key trendline support and the impulse carries momentum. This puts the support at 107.80 in view. In such a followthrough, the CAD will set to gain ground but a micro correction is in play at the time of writing:

The price is correcting into prior support with the 38.2% Fibonacci not far off. Nevertheless, with continued headwinds for the greenback, for the meanwhile at least, there are going to be prospects of a downside continuation. Measuring the geometry of the recent range between 1.3570 and the prior lows of 1.3390, a 50% expansion meets close to the -0.618% Fibonacci around 1.32 the figure as a downside initial swing target.

-

17:48

EURGBP retreats to levels near 0.8700 after rejection at 0.8820

- The Euro pares gains on Thursday and dives to the 0.8700 area.

- A brighter market mood has eased negative pressure on the GBP.

- EURGBP to remain consolidating between 0.8600 and 0.8800 – Barclays.

The Euro is trading lower on Thursday, extending its reversal from the four-week highs at 0.8820 seen on Wednesday. Failure to breach 0.8800 during the early European session has increased negative pressure, pulling the pair to session lows right above 0.8700.

The Pound picks up amid a brighter risk sentiment

The Sterling has managed to pare losses on Thursday, shrugging off the negative witnessed over the previous days on the back of the Bank of England’s negative outlook for the UK economy.

In the absence of key macroeconomic data in the UK or the Eurozone, an improved risk sentiment, with world equity markets surging after the release of US CPI data, has contributed to easing negative pressure on the Pound.

In the Eurozone, European Central Bank Governing Council member, Isabel Schnabel, has reiterated the bank’s hawkish stance, affirming that “there is no time for monetary policy pause” as inflation expectations remain broadly anchored. The impact of these comments on the EURGBP, however, has been muted.

EURGBP expected to remain between 0.8600 and 0.8800 – Barclays

From a wider point of view, currency analysts at Barclays Research see the pair trapped within a consolidation range: “GBP received little support from the BoE last week which yet again pushed against what they see as excessive market pricing. Accordingly, the recent 0.86-0.89 range will likely continue to define the sterling path versus the EUR in the near term.”

Technical levels to watch

-

17:40

GBPUSD surges toward 1.1640s, after hitting a two-month high at around 1.1680s

- The Pound Sterling gets a respite and climbs more than 300 pips on soft US inflation data.

- US October CPI missed expectations, signaling inflation is easing, though slower than the Fed’s projections.

- Fed’s Daly: Expects the Federal Funds rate (FFR) to peak at around 4.9%.

The Pound Sterling soars toward the 100-day Exponential Moving Average (EMA) following a cooler-than-expected US inflation report, which weighed on the US Dollar amidst speculations that the Federal Reserve would tighten at a slower rhythm than 75 bps increases. At the time of writing, the GBPUSD is trading at 1.1647.

GBPUSD advanced sharply on lower-than-expected US inflation report

Thursday’s US Consumer Price Index (CPI) report for October showed that inflation is finally easing a touch. The headline CPI was 7.7% YoY, below estimates of 7.9%, while the core CPI, which excludes volatile items like food and energy, followed suit, at 6.3% YoY, below expectations of 6.5%. That said, the US Dollar weakened across the board, while US Treasury bond yields plunged, with the 10-year down 24 bps at 3.857%.

The US Dollar Index, which tracks the buck’s value vs. a basket of six rivals, edged down 1.91% at 108.332, a tailwind for the GBPUSD, which bounced 300 pips after hitting a daily low of 1.1345.

At the same time, the US labor market updated the unemployment claim figures, which were overshadowed by the US inflation report. Initial Jobless Claims for the last week rose by 225K vs. 220K estimates. Even though the last week’s Nonfarm Payrolls report added more jobs than economists foresaw, the unemployment rate ticked up to 3.7%, meaning that the labor market remains tight but begins to feel the impact of restrictive policy.

Aside from this, Fed officials crossed newswires after the release of US economic data. Philadelphia’s Fed Harker said inflation remains too high and added that rate hikes below 75 bps “are still significant.” He said that future policy decisions would be data-dependant. Of late, the Dallas Fed President Logan said that October CPI data is welcomed, but there’s a long way to go. She added that the process of cooling the economy is just getting started.

San Francisco Fed President Mary Daly said October’s CPI was good and is just one “example of encouraging data.” She favors slow, steady rises to the Federal Funds rate (FFR), expecting it would peak at around 4.9%.

On the UK front, the release of the UK’s GDP for the third quarter is scheduled for release on Friday, which would shed some light on the status of the British economy. Late in the next week, the UK fiscal statement announced on November 17 would be the next catalyst for GBPUSD traders.

GBPUSD Key Technical Levels

-

17:35

Fed's Mester cheered by CPI, but says big risks remain on inflation

Reuters reports that Federal Reserve Bank of Cleveland President Loretta Mester said Thursday that while there are some new hopeful signs of moderating inflation, the main risk still facing the US central bank is that it doesn’t act aggressively enough to tame very high price pressures.

“Given the current level of inflation, its broad-based nature, and its persistence, I believe monetary policy will need to become more restrictive and remain restrictive for a while in order to put inflation on a sustainable downward path to 2%,” Mester said in a speech text.

She said“despite the moves we have made so far, given that inflation has consistently proven to be more persistent than expected and there are significant costs of continued high inflation, I currently view the larger risks as coming from tightening too little.”

“This morning’s October CPI report also suggests some easing in overall and core inflation,” she said.

“There continue to be some upside risks to the inflation forecast.”

US Dollar update

Meanwhile, the greenback has crumbled below a key level of daily support:

The bulls could look to engage from deeper down around the upper quarter of the 107 area as illustrated above, should they be of the mind that even when Fed policy rates peak, that they are likely to remain higher for longer.

“There continue to be some upside risks to the inflation forecast,” could be the key comment to take away from Mester today.

-

17:21

BoC’s Macklem: Canadian economy in excess demand, inflation too high

The Canadian economy is in excess demand while inflation is too high although wage growth 'now looks to be plateauing', the Bank of Canada's Tiff Macklem explained.

More to come..

-

17:01

Gold Price Forecast: XAUUSD surges to 2 ½-month highs at $1,750 as the Dollar plunges

- Gold rallies to 2 1/2-month highs at $1,750 as the US Dollar tumbles.

- US CPI eased beyond expectations in October.

- Inflation data boosts hopes of a softer Fed rate hike in December.

Gold futures have shrugged off the soft tone seen earlier today to rally $40 higher and reach the mid-range of the $1,700s. The precious metal has been boosted by the broad-based US Dollar weakness following the release of US inflation data.

US Dollar dives after softer-than-expected CPI data

Consumer inflation rose at a slower-than-expected pace in the US, which has set the scene for the US Federal Reserve to ease its aggressive monetary policy path. This has spurred risk appetite, hammering the US Dollar and Treasury bonds and pushing precious metals higher.

US CPI increased by 0.4% in October, unchanged from the previous month, against market expectations of a 0.6% reading, according to data from the US Bureau of Labor Statistics. Year-on-year, the CPI cooled down to a 7.7% rate, beyond the consensus of 8%, and after an 8.2% increase in September.

The core CPI, the Federal Reserve’s preferred gauge for inflationary trends, has eased to 0.3% in October, from 0.6% in September, against expectations of a 0.5% increase. Year on year, the core CPI has retreated to 6.3% from 6.6% in September.

Furthermore, US weekly jobless claims increased above expectations in the week of November 4; 225,000 new claims against the 220,000 expected, from 218,00 in the previous month. This adds to evidence that labor market conditions are starting to loosen.

The US Dollar Index, which had appreciated more than 16% so far this year, buoyed by the Federal Reserve’s aggressive monetary tightening has retreated about 2.2% after the data. The benchmark US 10-yeat Treasury bonds have dropped 30 basis points to 3.83%.

Technical levels to watch

-

16:46

United States 4-Week Bill Auction down to 3.58% from previous 3.62%

-

16:45

Fed's Daly: Time is now to step down on rate hike pace

Commenting on the October Consumer Price Index (CPI) report, San Francisco Fed President Mary Daly noted that it was good news but added that one month of data was not enough to declare victory, as reported by Reuters.

Additional takeaways

"Inflation expectations have been remarkably well anchored."

"We are not hanging our hats on inflation expectations."

"We have to be resolute to bring inflation down."

"We are going to continue to adjust policy until that job is fully done."

"Labor market report showed easing, but not at all close to what we need."

"Job growth stronger than we need it to be."

"Policy is now modestly restrictive."

"We need to watch data, there is considerable uncertainty."

"Time is now to step down on rate hike pace."

"There's a lot of uncertainty about what will be the peak fed funds rate."

"Support a gradual pace of getting to the peak fed funds rate."

"Pausing is not a subject of discussion."

"The real conversation should be about the level at which we hold the interest rate."

"Likely some more rate hikes in our future."

"Would rather move a little too high on rates than not high enough."

"We don't want to overtighten, but do want to fully do the job."

"We need to make sure inflation doesn't get embedded."

Market reaction

The US Dollar selloff continues after these comments and the US Dollar Index was last seen losing nearly 2% on the day at 108.32.

-

16:41

USDCHF plummets below 0.9700 and breaks the 50-DMA after a softer US CPI report

- USDCHF plunges towards a fourth-month-old upslope support trendline, around 0.9680s.

- A softer US inflation report weakened the American Dollar, as investors expected the Federal Reserve to hike less aggressively.

- Fed officials commented that September’s rate hike projections need to move higher.

The USDCHF tumbled below the 50 and 100-day Exponential Moving Averages (EMAs) following the release of a much-awaited US inflation report which was lower-than-expected, spurring a risk-on impulse in the financial markets, as speculators priced in a less aggressive Federal Reserve policy stance. At the time of writing, the USDCHF is trading at 0.9676, below its opening price.

Inflation in the US eases, with headline inflation below 8%

A cooler-than-expected US inflation report revealed by the US Department of Labor weighed on the American Dollar. The US Consumer Price Index for October rose by 7.7% YoY, below estimates close to 7.9&. In the meantime, excluding volatile items like food and energy, the so-called core CPI increased by 6.3% YoY, below the 6.5% expected. Once the data crossed wires, the US Dollar Index, which tracks the buck’s value against six peers, plunged and, at the time of typing, extended its losses to 2%, at 108.222.

At the same time, the Initial Jobless Claims for the last week jumped more than estimated, portraying the Federal Reserve monetary policy’s effects on the labor market.

Following the release, the USDCHF dived towards a four-month-old upslope support trendline, drawn from the August 2022 lows that pass at around the 0.9670-80 area. The USD weakness was triggered due to Fed officials signaling the pace of interest-rate hikes would slow down at a specific time, so the October figures are opening the door towards its first 50 bps rate hike at the December meeting.

Meanwhile, the CME FedWatchTool showed that money market futures have priced in a 50 bps rate hike by the Federal Reserve, as odds are at 80%, while a day ago, the chances were at 50%.

Elsewhere. Fed officials crossing newswires said that even though the October inflation report was positive, the FOMC has to do all it can to tackle inflation, according to the Dallas Fed President Logan. Meanwhile, Cleveland’s Fed Daly and Philadelphia’s Harker said that the current Federal fund rates (FFR) are in the restrictive territory, though Daly said that rates need to be higher than September forecasts.

USDCHF Key Technical Levels

-

16:22

EUR/USD jumps to 1.0180 highs following soft US CPI data

- The euro bounces at 0.9930 and surges to 1.0180 after US CPI data.

- Cool inflation figures boost hopes of a "dovish pivot' by the Fed.

- The dollar plunges and equity markets soar.

The Euro has skyrocketed from session n lows at 0.9930 area to reach two-month highs at 1.0180 as the release of US inflation figures have sent the Greenback tumbling across the board.

US inflation eases beyond expectations

Consumer inflation increased by 0.4% in October, unchanged from the previous month, against market expectations of a 0.6% reading. The year-on-year figure slowed down to a 7.7% rate, beyond the consensus of 8%, after having risen by 8,2% in September.

The core CPI, which excludes the impact of volatile food and energy prices and is closely observed by the Federal Reserve to assess inflation trends has eased to 0.3% in October, from 0.6% in September, against expectations of a 0.5% increase. Year on year, the core CPI has retreated to 6.3% from 6.6% in September.

These figures suggest that inflation might have started to moderate and provide some leeway for the Federal Reserve to moderate its rate-hiking path over the next months.

With the market extremely sensitive to all news that might determine December’s monetary policy decision, these readings have sent the US Dollar and Treasury bond yields lower and equity markets sharply higher.

Technical levels to watch

-

16:05

US October CPI reduces the likelihood of another 75 bps hike at December – Wells Fargo

US inflation rose less than expected in October, triggered a rally in Wall Street and sent the Dollar sharply lower. According to analysts at Wells Fargo, the data reduces the likelihood of another 75 basis points rate hike at the December 14 FOMC meeting.

Key Quotes:

“The overall consumer price index (CPI) rose 0.4% in October, which was lower than expected. Gasoline prices helped to push up the overall CPI, but consumers caught a break with a smaller increase in food prices.”

“October's moderation in inflation is welcome, but there remains a long way to go before inflation returns to a rate the Fed will tolerate. Weaker goods prices are merely the low-hanging fruit for getting inflation back on track. The torrid rise in goods inflation since COVID has reflected the unique aspects of the pandemic-driven shock, with the degree of price increases in weighty sectors like autos unsustainable.”

“Today's news on inflation is certainly welcome, and it reduces the likelihood of another 75 bps rate hike at the December 14 FOMC meeting. That said, the core CPI rose at an annualized rate of 5.8% between July at October, which is still much too high for the Committee's liking. It likely will be a number of months yet until the FOMC feels confident that inflation is indeed receding back toward its target of 2%. In short, we expect that the Fed policymakers will remain biased toward over-tightening rather than under-tightening for the foreseeable future.”

-

15:59

EURJPY under pressure, testing 144.00 as Yen soars across the board

- Japanese yen soars after US CPI numbers on expectations of a less aggressive Fed.

- US Dollar tumbles, USDJPY is down more than 400 pips.

- EURJPY testing critical support area 144.00.

The EURJPY cross is having the biggest daily decline in months on the back of a stronger Japanese yen across the board amid lower US yields. It bottomed 143.98, the lowest since October 24.

The US October CPI showed numbers below expectations and triggered a rally in Wall Street and Treasuries. The sharp decline in US yields strengthened the Japanese Yen, the best performer on Thursday, with USDJPY falling more than 450 pips.

Acceleration below 144.00?

EURUSD’s rally is keeping losses limited in EURJPY. The cross is testing a critical support area around 144.00. A break lower would open the doors more losses. The euro needs to keep that level in order to avoid deterioration in the already negative technical outlook.

On the upside, resistance in EURJPY emerges at 145.50; although the cross needs to rise and hold above 147.00 for the euro to strengthen. If EURUSD keeps rising and risk appetite prevails, the on-course correction could find some reasons to slow down. The resumption of the uptrend would need US yields to turn to the upside again.

EURJPY daily chart

Technical levels

-

15:58

UK GDP Preview: Forecasts from six major banks, likely entry into recession in Q3

The UK growth numbers are slated for release on Friday, November 11 at 07:00 GMT as we get closer to the release time, here are forecasts from economists and researchers of six major banks regarding the upcoming Gross Domestic Product (GDP) data.

The British economy is set to contract by 0.5% inter-quarter in the three months to September. On an annualized basis, the GDP is likely to have risen by 2.1% in Q3, down by more than double from the 4.4% reported in the previous quarter. The September month GDP is expected to fall by 0.5% vs. -0.3% booked in August.

Danske Bank

“We expect UK GDP growth for Q3 will be in negative territory (-0.3% QoQ), marking an official start of the recession.”

TDS

“The cost-of-living crisis coupled with the Queen's passing likely weighed sharply on UK GDP in September. We think the services sector will be the hardest hit and forecast a 0.5% fall in output in the sector. Overall, we think this will leave Q3 GDP growth in line with the BoE's forecast of -0.5% QoQ, and moreover, expect this to mark the beginning of a UK recession.”

SocGen

“The GDP data for September will be biased downwards by the disruption to activity from the Queen’s funeral, leading to output falling by 0.4% MoM. The result for 3Q as a whole should be a fall in GDP of 0.5% QoQ which should signal the start of a recession that is likely to extend to the middle of next year.”

ING

“We forecast a 0.5% QoQ contraction, which should all but endorse the BoE’s more cautious approach.”

Citibank

“We expect UK Q3 GDP to print at -0.7% QoQ, below the Bank’s estimates of -0.5%. The primary driver is a sharper fall in output in September (-0.9% MoM) owing to a large Bank Holiday impact. Implication is growth in Q4 may be a little stronger than MPC expects (we expect a fall of -0.2% QoQ).”

Wells Fargo

“Consensus forecasts believe the UK economy contracted 0.4% QoQ in Q3. As far as our forecast, we are a bit more pessimistic and believe the UK economy declined 0.5% QoQ. In our view, the UK recession has started, and we agree with the Bank of England's outlook that the economic downturn will last for an extended period of time. With an economic outlook that is quite dire, we also believe BoE policymakers will probably not deliver on the amount of tightening currently priced by markets. In that sense, as markets adjust to a more gradual pace of tightening, depreciation pressures on the pound are likely to persist going forward.”

-

15:42

NZDUSD rallies to 0.6000 as the Greenback tanks on US CPI data

- The Kiwi bounces off 0.5840 and surges to 0.6000.

- Softer-than-expected US inflation data have crushed the USD.

- Stock markets rally on hopes of Fed easing over the coming months.

The New Zealand Dollar skyrocketed after the release of cooler-than-expected US inflation figures. The pair, which has been trading lower during the Asian and European sessions, bounced up at 0.5840 to hit session highs right above 0.6000.

The Dollar slumps as US inflation cools off

US inflation remained unchanged, at 0.4% against market expectations of a 0.6% reading, while year-on-year consumer prices eased to a 7.7% rate, well beyond the consensus 8%, following an 8,2% reading in September.

The core CPI, the Federal Reserve’s preferred gauge to assess inflationary pressures, which excludes volatile food and energy prices, has eased to 0.3% in October, from 0.6% in September, while the market had anticipated a softer decline to 0.5%. Year on year, the core CPI has retreated to 6.3% from 6.6% in September.

These figures increase evidence that inflation might have peaked, which eases the pressure for the Federal Reserve to maintain its aggressive monetary tightening cycle and boost expectations of a softer rate hike in December.

The USD and US Treasury bonds have dropped sharply. The US Dollar Index, which had appreciated more than 16% in 2022 so far, boosted by the US Fed’s hawkish stance, has lost about 2.2% after the data. Likewise, the benchmark US 10-year Treasury yield lost 30 basis points to 3.83%.

On the other hand, US stock markets have surged after the data, with the Dow Jones 2.5% up, the S&P500 appreciating 4% and the Nasdaq Index 5.42% above the opening levels.

Technical levels to watch

-

15:40

Far too soon to expect the USD to reverse course – Rabobank

Recent weeks had brought plenty of signs that investors have been looking for bargains in risky assets. However, economists at Rabobank do not see sufficient reason to move away from their bullish USD outlook.

USD may be approaching the later stages of its rally

“In addition to the outlook for rate increases, in our view, the USD is set to remain supported by safe-haven flows.”

“This year, higher US interest rates have been undermining the outlook for risky assets and promoted the attraction of the safe-haven USD. Simultaneously USD strength is a constraint on global trade and world growth which feeds back into demand for USDs.”

“The USD may be approaching the later stages of its rally, but we consider it far too soon to expect the USD to reverse course.”

-

15:36

USDCAD plunges more than 100 pips, below 1.3400 after US CPI

- The US Consumer Price Index (CPI) for October was lower-than-expected, which weighs on the US Dollar.

- US Treasury yields are plummeting, with the 10-year benchmark note, down by almost 30 bps.

- Fed’s Harker: Rates are in the restrictive territory, and the Fed could pause around 4.50%.

The Loonie extends its gains against the American Dollar, as shown by the USDCAD plummeting more than 1% following the release of the US inflation report, which showed that the Federal Reserve monetary policy is beginning to cool down inflation. At the time of writing, the USDCAD is trading at 1.3350 after hitting a daily high of 1.3571.

A cooler US CPI report weakens the US Dollar

US equities are skyrocketing, after the release of the US CPI, with the Nasdaq putting a staggering comeback, up by more than 5.50%. Inflation in the United States was lower-than-estimated as monetary policy is beginning to catch on to stubbornly high prices. The Consumer Price Index (CPI) for October rose by 7.7% YoY, below estimates of 7.9%. In the same tone, the core CPI, which excludes volatile items like food and energy, crept lower by 6.3% YoY, beneath the 6.5% foreseen by street analysts.

At the same time, the US Department of Labor released the Initial Jobless Claims for the last week, showing that the labor market is also easing. Claims jumped by 225K exceeding the 220K foreseen. It should be noted that the previous week’s US Nonfarm Payrolls report showed that the Unemployment Rate ticked up from 3.5% to 3.7%.

The USDCAD plunged at the release, after hoovering around the 1.3530 area down beneath the 1.3400 area, as the report would ease pressure on the Federal Reserve, as the US central bank prepares to slow the pace of interest-rate increases. Concerning the latter, the CME FedWatchTool reports that chances of a 50 bps jumped to 80%, vs. 56% a dar before.

Following the release, the US Treasury bond yields are plunging, with the US 10-year benchmark note rate at 3.812%, down 28 bps, a headwind for the US Dollar. The US Dollar Index, a gauge of the buck’s value against a basket of six peers, is down 1.93%, at 108.311.

At the time of typing, the Philadelphia Fed President Patrick Harker is crossing newswires, and he said that the restrictive Fed Policy stance is seen above 4% and added that rate hikes could pause when the Federal Funds rate (FFR) hits 4.5%. Harker said that monetary policy lags “about a year or so.”

USDCAD Key Technical Levels

-

15:30

United States EIA Natural Gas Storage Change below forecasts (84B) in November 4: Actual (79B)

-

15:26

USDMXN falls to lowest since March 2020 after US inflation and ahead of Banxico

- US Dollar drops dramatically after October US CPI data.

- Banxico to announce monetary policy decision: a dovish last hike?

- USDMXN consolidating bearish bias, 19.00 on the radar.

The USDMXN dropped from above 19.50 to 19.35, hitting a fresh cycle low. It is hovering around 19.40, under pressure after US CPI numbers that weighed on the Dollar and ahead of Banxico’s decision.

Peso strengthens, while Dollar tumbles

The US Consumer Price Index (CPI) climbed 0.4% in October below the 0.6% of market consensus. The annual reading fell to 7.7%, the lowest level since January. The greenback collapsed after the reports and equity prices jumped.

In Wall Street, the Dow Jones is up by 2.45% and the Nasdaq by 5.68%. US yields are falling by almost 6%. The US Dollar Index is losing 1.77%, at the lowest since mid-September.

The inflation numbers from the US are welcome news not only for the Fed and the White House but also should be cheered in Mexico. With the Fed being less aggressive in raising rates, Banxico could face less pressure.

The CPI report came out just as the Bank of Mexico holds its monetary policy meeting. A decision will be announced in a few hours. A 75 basis points rate hike is expected, bringing the key rate to 10%. A dovish tone seems likely, not only after inflation figures from the US and Mexico, but also as the Dollar tumbles across the board.

A dovish Banxico is not necessarily bad for the Mexican Peso. US yields and risk appetite are also key factors for the performance of MXN which so far during 2022 is among the biggest gainers.

Technical levels

-

15:18

Peso to struggle if Banxico decouples from the Fed’s moves – Commerzbank

The Mexican central bank (Banxico) is likely to mirror the Fed’s pace again today. Economists at Commerzbank expect the Peso to shrug off the decision if a 75 basis points hike is delivered.

Banxico likely to remain in sync with the Fed

“Banxico is expected to hike its key rate by 75 basis points to 10%. Moreover, we expect Banxico to signal further rate hikes.”

“We assume that the rate decision and statement will be in line with expectations thus not having much of an effect on the Peso.”

“If doubts were to arise on the market whether Banxico will continue to move in sync with the Fed or if participants were to find suggestions of an imminent end of the rate hike cycle, this is likely to put a dampener on the rate hike expectations, which have already gone a long way, thus putting pressure on the Peso.”

-

15:05

AUDUSD jumps to six-week highs after US CPI, break key resistance

- Annual US inflation rate drops to the lowest since January.

- US Dollar plummets on expectations of a less aggressive Fed.

- AUDUSD heads for the highest daily close since September 22.