Notícias do Mercado

-

16:35

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. retail sales and the Reuters/Michigan consumer sentiment index

The U.S. dollar traded mixed to higher against the most major currencies after the U.S. retail sales and the Reuters/Michigan consumer sentiment index. The U.S. retail sales climbed 0.6% in August, exceeding expectations for a 0.3% gain, after a 0.3% rise in July. July's figure was revised up from 0.0%. That was the fastest pace in four months.

Retail sales excluding automobiles rose 0.3% in August, beating expectations of a 0.2% increase, after a 0.3% gain in July. July's figure was revised up from a 0.1% increase.

The Reuters/Michigan consumer sentiment climbed to 84.6 in September from 82.5 in August, exceeding expectations for a rise to 83.2.

Import prices fell 0.9% in August, missing expectations for a 0.8% decrease, after a 0.2% drop in July.

The business inventories in the U.S. rose 0.4% in July, missing forecasts of a 0.5% gain, after a 0.4% rise in June.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

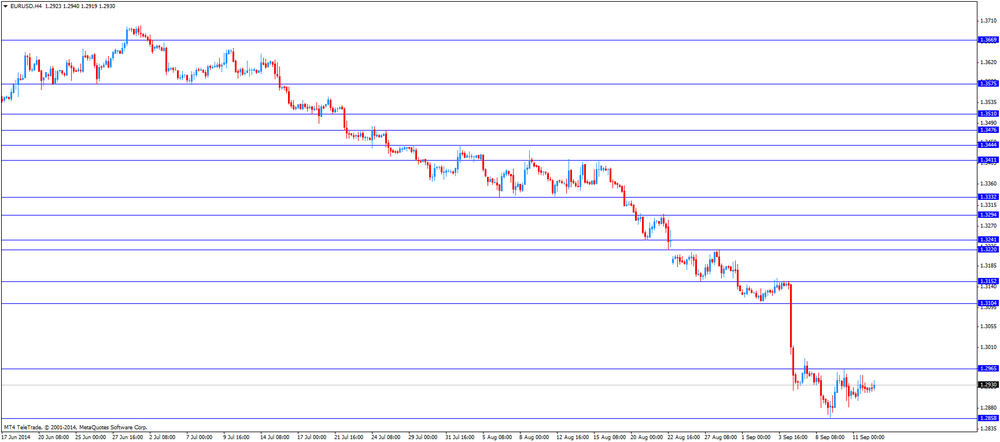

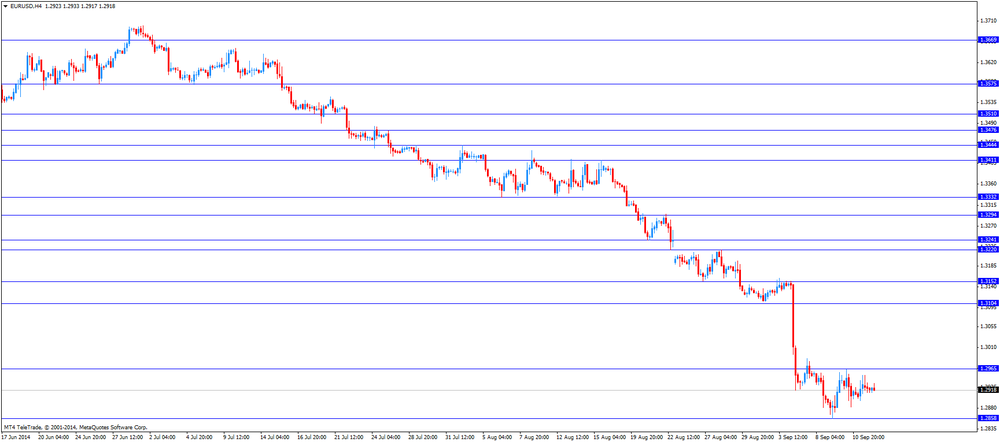

The euro traded slightly higher against the U.S. dollar. Eurozone's industrial production rose 1.0% in July, beating forecasts of a 0.6% gain, after a 0.3% decline in June.

On a yearly basis, the industrial production in the Eurozone climbed 2.2% in July, exceeding expectations for a 1.3%, after 0.0% in June.

Eurozone's employment change increased to 0.2% in the second quarter from 0.1% in the previous quarter. Analysts had expected a 0.1% rise.

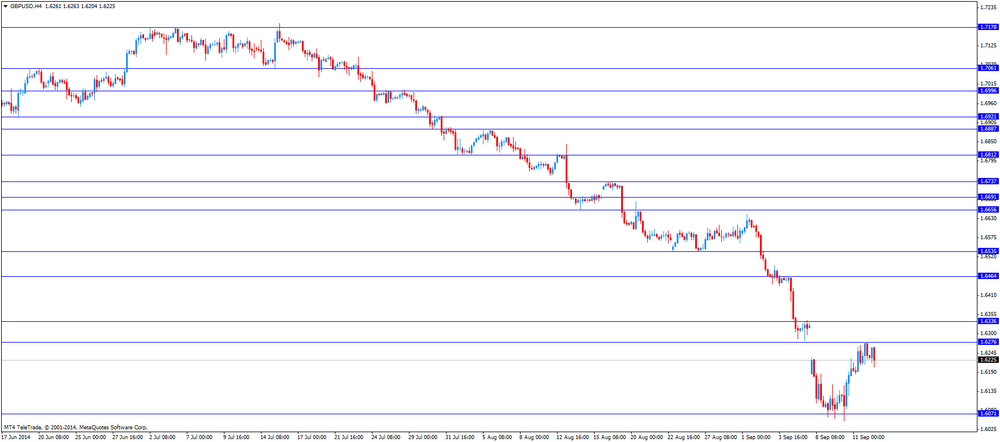

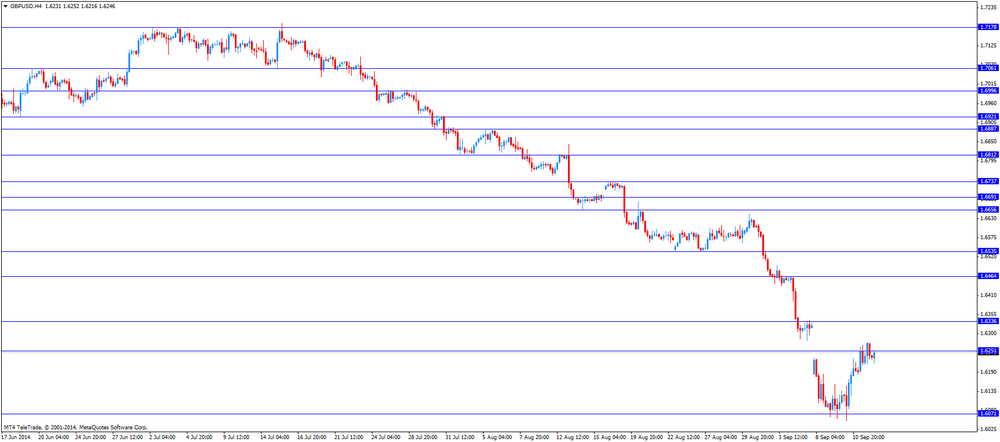

The British pound traded mixed against the U.S. dollar. Scotland's independence referendum continued to weigh on the pound. A Wednesday Scotland's independence poll showed 53% said "no" to independence.

The New Zealand dollar traded lower against the U.S dollar despite the solid economic data from New Zealand. The Business NZ purchasing managers' index climbed to 56.5 in August from 53.5 in July. July's figure was revised up from 53.0.

The food prices index rose 0.3% in August, after a 0.7% decline in July.

Wednesday's comments by the Reserve Bank of New Zealand (RBNZ) Graeme Wheeler still weighed on the kiwi. The RBNZ governor said the strength of the kiwi is still "unjustified and unsustainable". He added that the central bank expects further significant depreciation.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic data reports from Australia. The greenback put downward pressure on the Aussie.

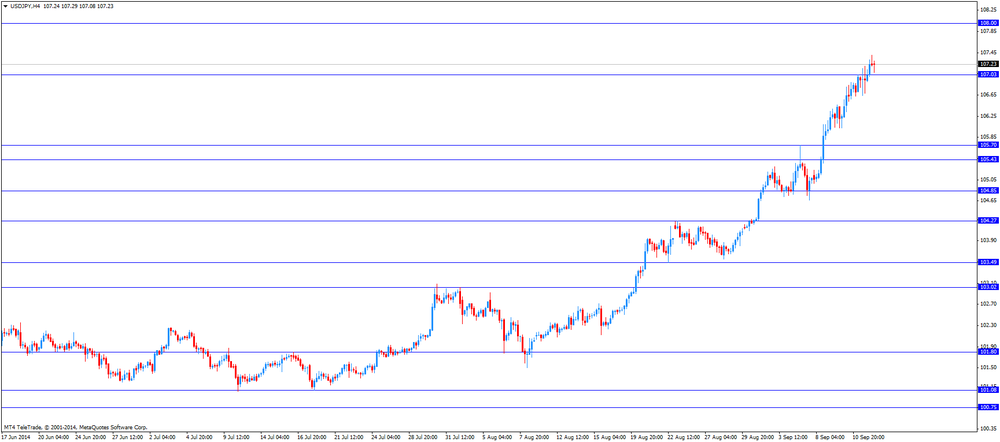

The Japanese yen traded near the lowest level since September 2008 against the U.S. dollar. The divergence between the monetary policies of the US and those of Japan weighed on the yen.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

The industrial production in Japan increased 0.4% in July, exceeding expectations for a 0.2% rise, after a 0.2% gain in June.

-

15:01

U.S.: Business inventories , July +0.4% (forecast +0.5%)

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, September 84.6 (forecast 83.2)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2850(E415mn), $1.2900(E1.6bn), $1.2960-65(E650mn), $1.3000(E2.2bn)

GBP/USD: $1.6175(stg150mn), $1.6310(stg306mn), $1.6330-40(stg309mn)

EUR/GBP: stg0.8050(E270mn)

AUD/USD: $0.9100(A$150mn), $0.9160(A$125mn), $0.9200(A$880mn)

NZD/USD: $0.8275(NZ$228mn), $8400(NZ$374mn)

USD/CAD: C$1.0905($1.0bn), C$1.0910($484mn), C$1.0955-60($396mn), C$1.0975($531mn), C$1.1000($807mn), C$1.1035($150mn), C$1.1050($210mn)

-

14:10

U.S. retail sales rose 0.6% in August

The U.S. Commerce Department released retail sales data today. The U.S. retail sales climbed 0.6% in August, exceeding expectations for a 0.3% gain, after a 0.3% rise in July. July's figure was revised up from 0.0%. That was the fastest pace in four months.

Retail sales excluding automobiles rose 0.3% in August, beating expectations of a 0.2% increase, after a 0.3% gain in July. July's figure was revised up from a 0.1% increase.

-

13:30

U.S.: Retail sales, August +0.6% (forecast +0.3%)

-

13:30

U.S.: Retail sales excluding auto, August +0.3% (forecast +0.2%)

-

13:30

U.S.: Import Price Index, August -0.9% (forecast -0.8%)

-

13:00

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead of the U.S. retail sales and the Reuters/Michigan consumer sentiment index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China New Loans August 385 710 702.5

04:30 Japan Industrial Production (MoM) (Finally) July +0.2% +0.2% +0.4%

04:30 Japan Industrial Production (YoY) (Finally) July -0.9% -0.9% -0.7%

06:05 Japan BOJ Governor Haruhiko Kuroda Speaks

09:00 Eurozone Industrial production, (MoM) July -0.3% +0.6% +1.0%

09:00 Eurozone Industrial Production (YoY) July 0.0% +1.3% +2.2%

09:00 Eurozone Employment Change Quarter II +0.1% +0.1% +0.2%

09:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. retail sales and the Reuters/Michigan consumer sentiment index. The U.S. retail sales are expected to rise by 0.3% in August.

Retail sales excluding automobiles are expected to increase by 0.2% in August.

The Reuters/Michigan consumer sentiment index is expected to climb to 83.2 in September from 82.5 in August.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The euro traded mixed against the U.S. dollar. Eurozone's industrial production rose 1.0% in July, beating forecasts of a 0.6% gain, after a 0.3% decline in June.

On a yearly basis, the industrial production in the Eurozone climbed 2.2% in July, exceeding expectations for a 1.3%, after 0.0% in June.

Eurozone's employment change increased to 0.2% in the second quarter from 0.1% in the previous quarter. Analysts had expected a 0.1% rise.

The British pound traded mixed against the U.S. dollar. Scotland's independence referendum continued to weigh on the pound. A Wednesday Scotland's independence poll showed 53% said "no" to independence.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Retail sales August 0.0% +0.3%

12:30 U.S. Retail sales excluding auto August +0.1% +0.2%

12:30 U.S. Import Price Index August -0.2% -0.8%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 82.5 83.2

14:00 U.S. Business inventories July +0.4% +0.5%

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD: $1.2850(E415mn), $1.2900(E1.6bn), $1.2960-65(E650mn), $1.3000(E2.2bn)

GBP/USD: $1.6175(stg150mn), $1.6310(stg306mn), $1.6330-40(stg309mn)

EUR/GBP: stg0.8050(E270mn)

AUD/USD: $0.9100(A$150mn), $0.9160(A$125mn), $0.9200(A$880mn)

NZD/USD: $0.8275(NZ$228mn), $8400(NZ$374mn)

USD/CAD: C$1.0905($1.0bn), C$1.0910($484mn), C$1.0955-60($396mn), C$1.0975($531mn), C$1.1000($807mn), C$1.1035($150mn), C$1.1050($210mn)

-

10:07

Eurozone: Industrial production, (MoM), July +1.0% (forecast +0.6%)

-

10:01

Eurozone: Industrial Production (YoY), July +2.2% (forecast +1.3%)

-

09:52

Foreign exchange market. Asian session: the New Zealand dollar hits 7-month low against the U.S dollar

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China New Loans August 385 710 702.5

04:30 Japan Industrial Production (MoM) (Finally) July +0.2% +0.2% +0.4%

04:30 Japan Industrial Production (YoY) (Finally) July -0.9% -0.9% -0.7%

06:05 Japan BOJ Governor Haruhiko Kuroda Speaks

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The New Zealand dollar hits 7-month low against the U.S dollar despite the solid economic data from New Zealand. The Business NZ purchasing managers' index climbed to 56.5 in August from 53.5 in July. July's figure was revised up from 53.0.

The food prices index rose 0.3% in August, after a 0.7% decline in July.

Wednesday's comments by the Reserve Bank of New Zealand (RBNZ) Graeme Wheeler still weighed on the kiwi. The RBNZ governor said the strength of the kiwi is still "unjustified and unsustainable". He added that the central bank expects further significant depreciation.

The Australian dollar declined toward 6-month low against the U.S. dollar in the absence of any major economic data reports from Australia. The greenback put downward pressure on the Aussie.

The Japanese yen reached the lowest level since September 2008 against the U.S. dollar. The divergence between the monetary policies of the US and those of Japan weighed on the yen.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

The industrial production in Japan increased 0.4% in July, exceeding expectations for a 0.2% rise, after a 0.2% gain in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose Y107.40

The most important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) July -0.3% +0.6%

09:00 Eurozone Industrial Production (YoY) July 0.0% +1.3%

09:00 Eurozone Employment Change Quarter II +0.1% +0.1%

09:00 Eurozone ECOFIN Meetings

12:30 U.S. Retail sales August 0.0% +0.3%

12:30 U.S. Retail sales excluding auto August +0.1% +0.2%

12:30 U.S. Import Price Index August -0.2% -0.8%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 82.5 83.2

14:00 U.S. Business inventories July +0.4% +0.5%

-

05:32

Japan: Industrial Production (MoM) , July +0.4% (forecast +0.2%)

-

03:03

China: New Loans, August 702.5 (forecast 710)

-

00:00

Currencies. Daily history for Sep 11'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2923 +0,06%

GBP/USD $1,6273 +1,06%

USD/CHF Chf0,9357 -0,10%

USD/JPY Y107,01 +0,17%

EUR/JPY Y138,29 +0,23%

GBP/JPY Y174,13 +0,61%

AUD/USD $0,9104 -0,58%

NZD/USD $0,8184 -0,17%

USD/CAD C$1,1035 +0,82%

-