Notícias do Mercado

-

23:45

New Zealand Food Price Index (MoM) above expectations (0.6%) in August: Actual (1.1%)

-

23:39

AUD/USD bulls attack 0.6900 with eyes on China’s return, US inflation data

- AUD/USD buyers keep reins at a two-week high, up for the third consecutive day.

- Firmer sentiment, US dollar weakness and hopes from upcoming data favored buyers.

- RBA versus Fed divergence, absence of China seemed to have probed bulls.

- Australia’s NAB sentiment data, US CPI will be crucial ahead of Thursday’s Aussie jobs report.

AUD/USD gains the buyer’s attention as it refreshes a fortnight high around 0.6900 ahead of the all-important US inflation data. Also keeping the Aussie pair on the watch is the return of China after a long weekend, as well as Thursday’s employment data from the Pacific major.

The Aussie pair cheered broad weakness in the US dollar, as well as the risk-on mood, to portray a positive start to the key week. The underlying reasons include geopolitical and stimulus-linked expectations/news surrounding China and Russia. Also keeping the quote positive were the hopes that the global policymakers will be able to overcome the latest economic pessimism, even at higher rates.

Chatters that Ukraine is gaining success in pushing back the Russian military from some of its battlegrounds seem to have underpinned the market’s cautious optimism, even as the same raised the fears of Russia’s harsh retaliation. On the same line could be the hopes of more stimulus from major economies like China, the US, the UK and Europe. Furthermore, the latest news from the Wall Street Journal (WSJ) suggesting that the US gas prices are down for the 13th consecutive week also eased the market’s pressure and favored the risk-on mood, as well as the gold price.

Additionally, upbeat prices of metals, especially iron ore and gold, seemed to have joined the firmer Wall Street to favor the AUD/USD bulls. It should be noted, however, that the yields were up but could not underpin the US dollar recovery and hence propelled the Aussie pair.

That said, the US Dollar Index (DXY) printed a four-day downtrend to fall to the lowest levels in a fortnight, around 108.30 at the latest.

Looking forward, the August month sentiment gauges from the National Australia Bank (NAB) could immediate direction to the AUD/USD prices. However, major attention will be given to the US Consumer Price Index (CPI) for the stated month and Thursday’s release of Australia’s employment data. The forecasts suggest the headline number ease to -0.1% MoM versus 0.0% prior while the CPI ex Food & Energy is likely to remain unchanged at 0.3% MoM.

Also read: US CPI Preview: Dollar set to climb on low core expectations, three scenarios

Technical analysis

A clear upside break of the one-month-old descending trend line, around 0.6865 by the press time, seeks validation from the 200-SMA hurdle surrounding 0.6920 to convince the AUD/USD bulls.

-

23:32

NZD/USD Price Analysis: Bulls prepare for an impulsive wave, 0.6160 a key hurdle

- Investors brace for a breakout of an Ascending Triangle for a sheer upside.

- A golden cross, represented by 50-and 200-EMAs at 0.6100, adds to the upside filters.

- The upside momentum will get triggered if the RSI (14) recaptures the 60.00-80.00 range.

The NZD/USD pair is displaying back-and-forth moves in a narrow range of 0.6132-0.6140 in the early Tokyo session ahead of the US Consumer Price Index (CPI) data. The asset displayed exhaustion signals on Monday after failing to sustain above the prior week’s high at 0.6152. Broadly, the asset is advancing sharply higher after printing a fresh two-year low around 0.6000 last week.

On an hourly scale, the major is on the verge of delivering a breakout of the Ascending Triangle chart pattern. The upward sloping trendline of the above-mentioned chart pattern is placed from Friday’s low at 0.6031 while the horizontal resistance is plotted from August 31 high at 0.6160. A breakout of the bullish-bias triangle pattern will expand volatility and will display wider ticks and heavy volume.

A golden cross, represented by the 50-and 200-period Exponential Moving Averages (EMAs) at 0.6100, has underpinned the kiwi bulls against the greenback.

The Relative Strength Index (RSI) (14) has slipped below the bullish range of 60.00-80.00, which warrants a mild correction so that more participants could ride with the impulsive wave.

Should the asset break above Monday’s high at 0.6159 decisively, the antipodean will drive the asset towards August 25 high at 0.6252. A breach of the latter will send the major towards the round-level hurdle at 0.6300.

On the flip side, the kiwi bulls could lose their grip if the asset drops below September 2 low at 0.6050. An occurrence of the same will drag the asset towards the psychological support at 0.6000, followed by 20 April 2020 low at 0.5910.

NZD/USD hourly chart

-637986186658811742.png)

-

23:23

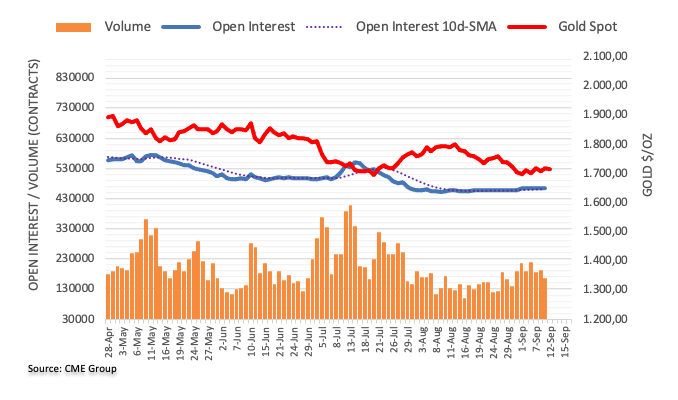

Gold Price Forecast: XAU/USD jostles with $1,730 hurdle ahead of US inflation

- Gold price remains firmer around fortnight high, pokes 21-DMA resistance.

- Risk-on mood, softer US dollar underpin XAU/USD recovery ahead of the key US CPI.

- Headlines surrounding Russia, light calendar and stimulus hopes favored risk-on mood.

- Firmer US inflation data could recall US dollar bulls but absence of Fedspeak may restrict the fall.

Gold price (XAU/USD) grinds higher around a fortnight top after a two-day uptrend to $1,725 as traders await the all-important US Consumer Price Index (CPI) on Tuesday. The metal’s latest gains could be linked to the market’s optimism and likely preparations for today’s inflation numbers.

Chatters that Ukraine is gaining success in pushing back the Russian military from some of its battlegrounds seem to have underpinned the market’s cautious optimism, even as the same raised the fears of Russia’s harsh retaliation. On the same line could be the hopes of more stimulus from major economies like China, the US, the UK and Europe. It’s worth noting that a holiday in China and a light calendar could also be linked to the XAU/USD’s rebound as the absence of covid/economic woes from Beijing may have helped the metal prices. Furthermore, the latest news from the Wall Street Journal (WSJ) suggesting that the US gas prices are down for the 13th consecutive week also eased the market’s pressure and favored the risk-on mood, as well as the gold price.

Elsewhere, the policymakers from the US Federal Reserve and the European Central Bank (ECB) remain hawkish but the recent softening of the headline economics and the inflation expectations seemed to have pushed back the gold bears amid a light calendar.

Amid these plays, Wall Street printed another day of gains even as the US Treasury yields were on the rise, up five basis points (bps) to 3.36% at the latest. The same weighed on the US Dollar Index (DXY) and drowned the greenback gauge towards printing the four-day downtrend.

Moving on, US CPI for August becomes crucial after the latest softness in the price pressure. The forecasts suggest the headline number ease to -0.1% MoM versus 0.0% prior while the CPI ex Food & Energy is likely to remain unchanged at 0.3% MoM. If the inflation numbers arrive softer the US dollar may have a further downside to track, which in turn can help the XAU/USD to remain firmer.

Also read: Gold forms a reversal

Technical analysis

Gold justifies an impending bull cross on the MACD and a price-positive trend line breakout of the RSI (14) as it pokes the 21-DMA hurdle surrounding $1,731.

With this, the XAU/USD prices are likely to overcome the immediate DMA resistance and aim for the 38.2% Fibonacci retracement level of April-July downside, near $1,756.

However, the metal’s upside past $1,756 appears doubtful as a three-month-old descending resistance line could challenge the gold buyers at around $1,768.

On the contrary, multiple supports around the $1,700 threshold could challenge the pair’s downside moves ahead of directing XAU/USD bears towards the yearly low near $1,680.

Following that, the 61.8% Fibonacci Expansion (FE) of the metal’s moves from late April to early August, around $1,660, will be in focus.

Gold: Daily chart

Trend: Further recovery expected

-

22:59

GBP/USD turns sideways after a downside move from 1.1700, US Inflation in focus

- GBP/USD is juggling around 1.1680 ahead of US Inflation and UK Employment data.

- The lower inflation situation will force the Fed policymakers to scale down their ‘hawkish tone.

- The UK jobless rate is seen as stable at 3.8% and an improvement in the labor cost index is music to the ears.

The GBP/USD pair is displaying a lackluster performance in the early Tokyo session as investors are awaiting the release of the US Consumer Price Index (CPI) data. The cable is oscillating in a narrow range of 1.1675-1.1685, followed by a decline after facing barricades around the critical resistance of 1.1700. The asset has displayed exhaustion signals while attempting to cross the round-level resistance of 1.1700, which indicates a minor correction ahead.

Considering the market estimates, the plain-vanilla CPI figure is seen at 8.1%, lower than the prior release of 8.5%. As gasoline prices have witnessed a serious decline, and the price pressures have started responding inversely to the higher interest rates, the forecasts for interest rates have trimmed dramatically. Adding to that, the core CPI that doesn’t inculcate food and energy prices is expected to rise to 6% vs. the 5.9% reported earlier.

There is no denying the fact that the Federal Reserve (Fed) will stick to its ‘hawkish’ stance on interest rates as the road destined to reach the desired inflation rate of 2% is far from over. However, a decline in the inflationary pressures will scale down the ‘hawkish’ tone as the Fed would have the luxury to go slow due to the decent response shown by the price rise index on interest rates.

On the UK front, investors are looking for employment data, which will have a significant impact on pound bulls. The Unemployment Rate is expected to remain unchanged at 3.8%. While the number of individuals claiming jobless benefits will decline by 9.2k. The Average Earnings data will improve significantly by 5% vs. 4.7%, which will support the households to offset the higher payouts led by soaring inflation.

-

22:19

Forex Today: US dollar longs squeezed ahead of US CPI

Here is what you need to know for Tuesday September 13:

It was a poor day for the greenback that fell to the worst level in more than two weeks against a basket of currencies at the start of the week. The dollar index, DXY, which measures the currency against six major counterparts, softened despite the firm anticipation that the Federal Reserve will hike interest rates by 75 basis points at its Sept. 20-21 meeting.

The sentiment had sent the index to a two-decade peak of 110.79 last Wednesday, but it fell to its lowest point since Aug. 26 at 107.81 ahead of Tuesday's US Consumer Price Index. The headline Consumer Price Index in the United States is expected to fall to 8% year on year in August, while the core measure, which excludes food and energy, is expected to rise.

Meanwhile, fueling the drop in the DXY, the euro climbed to more than a three-week high against the dollar, with European Central Bank officials calling for additional aggressive monetary tightening. Also, there was some news that Ukrainian forces have made significant progress in pushing back Russian troops and that too has supported a better tone across European markets. The European common currency rose around 1.5% to 1.0198, its highest since August. 17, and well up from a 20-year lows of 0.9862 scored last week.

AUD/USD started off the week better bid and is up some 0.61% in late North America trade after giving back territory from the highs scored at the start of the shift near 0.69 the figure. The currency pair rallied from 0.6824 and remains in bullish territory due to the softness of the greenback.

As for the yen, the greenback was up slightly against the Japanese currency with the pair meeting 143.50, but off its 24-year high of 144.99 hit last week. Traders are on the lookout for Japanese officials hinting at intervention to stop the currency from weakening further. On the weekend, a senior official of the government said in a local television interview that the administration must take steps as needed to counter excessive yen declines. However, the Bank of Japan's ultra-accommodative stance is expected to remain unchanged at its next scheduled meeting on Sept. 21-22.

The CAD rose to 1.2963 from 1.3045 and with no Canadian data that had been scheduled for release on Monday, the focus remained on the Bank of Canada's recent hike of 75 basis points. The central bank said more tightening will likely be needed to bring down inflation. The next BOC meeting is scheduled for Oct. 26.

As for the pound, this rose to 1.1710 from 1.1600. UK industrial production fell slightly in July after a larger June decline, though manufacturing output rebounded modestly after a June drop, data released earlier Monday showed. Looking ahead, UK employment data is scheduled for release on Tuesday followed by inflation data on Wednesday and retail sales on Friday. Those awaiting the Bank of England's monetary policy meeting will need to now hold on until Sept. 22 due to the 10-day mourning period following the passing of Queen Elizabeth II.

Elsewhere, The main US indexes have now risen four straight days. Cryptocurrency investment products and funds, on the other hand, saw total outflows for a fifth straight week, totalling $63 million in the week ended Sept. 9, according to a report from digital asset manager CoinShares on Monday. Cryptocurrency investment products and funds saw total outflows for a fifth straight week, totalling $63 million in the week ended Sept. 9.

The gold price, meanwhile, has rallied at the start of the week in a move that was forecasted in the weekly pre-open analysis here: Gold Price Forecast: XAU/USD bulls eye a 61.8% golden ratio daily target. At the time of writing, gold was 0.75% higher on the day having travelled from a low of $1,712.04 to a high of $1,735.18 so far, piercing into the 61.8% Fibonacci of the daily bear impulse.

-

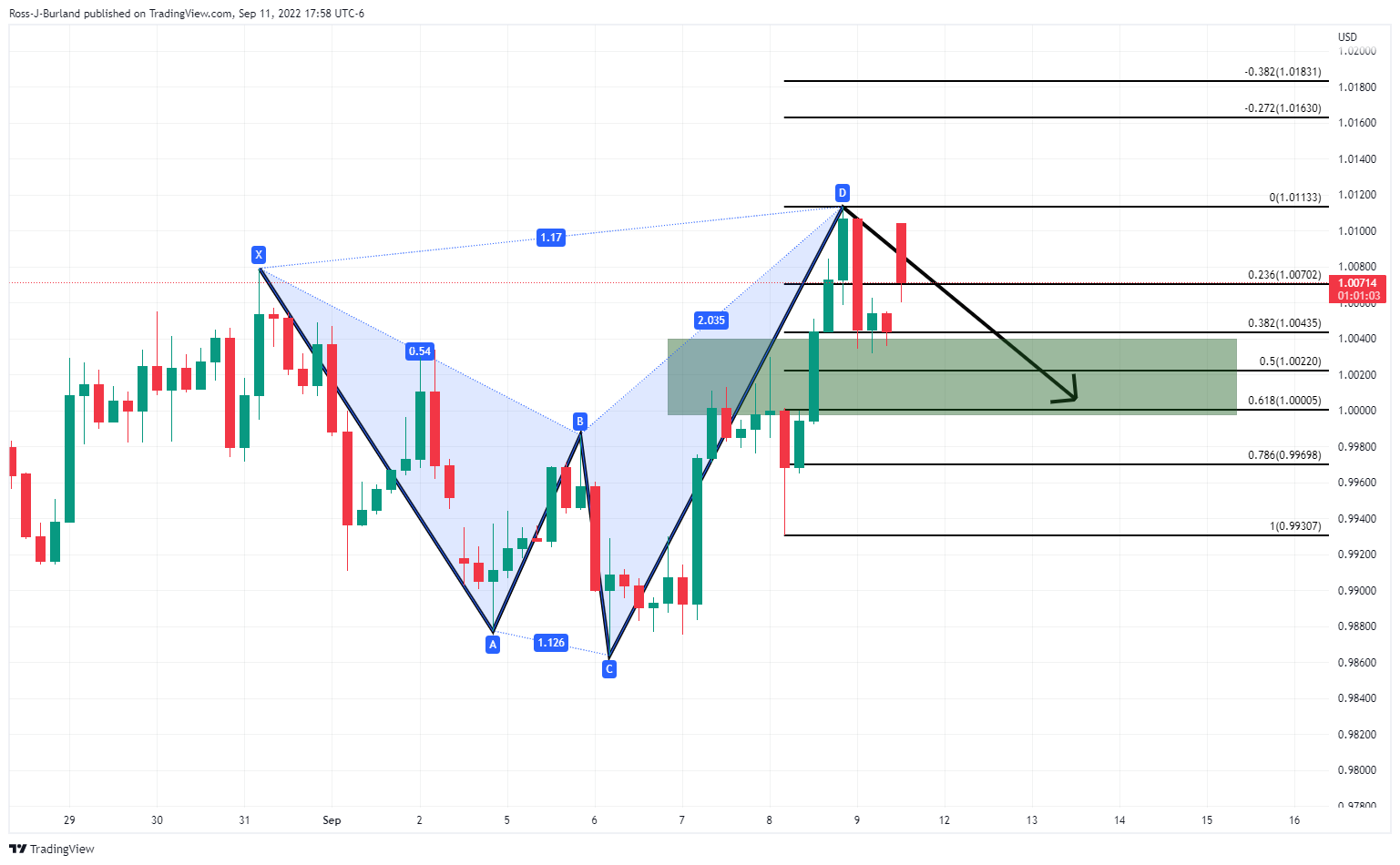

EUR/USD Price Analysis: Bears eye a move to 1.0050

-

AUD/USD bulls meet strong resistance at 0.69 the figure

- Gold Price Forecast: XAU/USD bulls are in control and take on a key resistance area

-

-

21:20

EUR/USD Price Analysis: Bears eye a move to 1.0050

- EUR/USD bears are lurking within a key peak formation.

- 1.0050 is eyed for the day ahead if the price remains below 1.0130.

EUR/USD has been higher by some 0.7% in late North American trade as the bulls commit to trendline support, so far. However, the single currency is well below the start of the week's highs and peak formations are being printed on the hourly chart. The following illustrates a bearish bias from a short-term perspective as markets await the US inflation data on Tuesday:

EUR/USD H1 chart

The price has formed a peak formation near 1.0200 and again at 1.0150 with the M-formations. While below 1.0130, this leaves the focus on the downside for the sessions ahead. The above chart illustrates the potential flight path for the single currency with 1.0050/35 eyed as a potential downside target and structure respectively.

First, 1.0105 needs to give. A retest of the current M-formation's neckline could be first in line and if that were to hold, the bears will have the ammunition required to take on the bull's commitments around 101 the figure.

-

20:36

AUD/USD bulls meet strong resistance at 0.69 the figure

- AUD/USD is back under pressure following an extension of the bullish correction.

- Bears eye a move below 0.6880 for the day ahead.

AUD/USD started off the week better bid and is up some 0.61% in late North America trade after giving back territory from the highs scored at the start of the shift near 0.69 the figure. The currency pair rallied from 0.6824 and remains in bullish territory due to the softness in the greenback that is enabling the commodity sector some airtime.

DXY recoiled further to its lowest level since late August and after trading at a new cycle high Wednesday near 110.786 as per the DXY index. It is down for the fourth straight day and trading near 108.30 at the time of writing, after falling from a high of 108.86 and printing a low of 107.81.

Risk sentiment remains strong as the week gets underway which is weighing on the US dollar. However, the mood has left some analysts scratching their heads. Those at Brown Brothers Harriman argued ''it’s hard to see a reason for buying risk assets when the ECB is adding to the global headwinds. With its 75 bp hike last week with more to come, this means global liquidity is being withdrawn even faster than before.''

The analysts noted that the Reserve Bank of Australia and the Bank of Canada also hiked big last week, while the Bank of England is expected to join the ranks of the jumbo movers this week. ''Global growth is undoubtedly slowing and it remains to be seen whether any of these banks can engineer a soft landing.''

Meanwhile, the Aussie calendar will be lit up this week by the employment report. ''After the huge disappointment last month, August jobs report may show some modest improvement as indicators of labour demand (e.g., job ads) remain strong'' analysts at TD Securities argued.

''However, we see downside risk if COVID-related disruptions on the labour market persist. A poor jobs report likely seals the outcome for a 25bps hike (TD: 25bps) in October after the Governor struck a dovish tone last week.''

AUD/USD technical analysis

As per the pre-market analysis at the start of the week, the Aussie has rallied from the 0.6820's:

In the prior analysis above, the 0.6820s was eyed as a potential support area from which AUD/USD bulls would be attracted in for a discount to take the price on for a deeper correction of the prior downtrend, as follows:

The price has made headway, but 0.6900 is standing in the way currently. From a 1-hour basis, a peak formation is forming and threatens to send the price into the 0.6850s for the day ahead on a break of 0.6880 structure:

The doji followed by the bearish engulfing is compelling as a topping formation that exposes the 61.8% Fibo of the prior bullish impulse that meets the prior resistance structure.

-

19:16

Gold Price Forecast: XAU/USD bulls are in control and take on a key resistance area

- Gold bulls are taking control as they move in on a critical technical level on the charts.

- The markets are awaiting the US CPI data on Tuesday for clues.

The gold price has rallied at the start of the week in a move that was forecasted in the weekly pre-open analysis here: Gold Price Forecast: XAU/USD bulls eye a 61.8% golden ratio daily target. At the time of writing, gold is 0.75% higher on the day having travelled from a low of $1,712.04 to a high of $1,735.18 so far, piercing into the 61.8% Fibonacci of the daily bear impulse.

A weaker USD saw commodity markets recover some of the losses at the start of this week and gold has been no exception, despite expectations of another aggressive rate hike by the Federal Reserve next week.

However, a weaker USD has improved investor appetite. US stocks rose along with gold and crude oil futures after midday on Monday, while government bond yields fell with the dollar index. The US 10-year rate slipped 3.262% intraday from 3.346% while the dollar index weakened against a basket of currencies, including the euro, falling 0.8% to 107.81.

With no data released on Monday, the focus is on Tuesday's US Consumer Price Index for August. Core prices likely stayed firm in August, with the series registering another 0.3% MoM gain, analysts at TD Securities expect. ''Our MoM forecasts imply 8.0%/6.0% YoY for total/core prices.'' That would be slower than the 8.5% pace in July.

Markets are seeking further evidence inflation has peaked in the US and the data will be important for the direction of yields, gold and the greenback. However, Federal Reserve officials said last week that more than a few months of consistently lower readings will be needed to assure that price increases have reliably slowed.

Fed officials are in the so-called quiet period through the Sept. 20-21 Federal Open Market Committee meeting. It remains in place until Chair Powell’s post-decision press conference on September 21. WIRP suggests over 90% odds of a 75 bp hike.

''Overall, we continue to expect that while rates markets appear to be nearing a fair pricing for Fed funds, precious metals' price action is still not consistent with their historical performance when hiking cycles enter into a restrictive rates regime,'' analysts at TD Securities said. ''Indeed, gold and silver prices have tended to display a systematic underperformance when markets expect the real level of the Fed funds rate to rise above the neutral rate, as estimated by Laubach-Williams. We expect continued outflows from money managers and ETF holdings to weigh on prices, which will ultimately raise the pressure on a small number of family offices and proprietary trading shops to capitulate on their complacent length in gold.''

Gold technical analysis

As per the per-open analysis, gold has moved higher into the key 61.8% golden ratio:

(Gold, daily chart: Before and after)

Gold weekly chart

The weekly outlook remains bullish as the price embarks on a test of the 38.2% Fibonacci level with potentially some more fuel left in the tank. There are prospects of a deeper correction towards $1,750 or even as high as the weekly 61.8% ratio near $1,763. However, signs of deceleration at this current confluence Fibo area could lead to a move lower and in any respect, the bears will be keen on a test of the $1,676 lows in due course.

-

18:18

United States 10-Year Note Auction climbed from previous 2.755% to 3.33%

-

17:14

US: August CPI to show consumers received further relief – Wells Fargo

On Tuesday, key inflation data is due in the US. The August CPI print will be watched closely by market participants ahead of the next FOMC meeting to be held September 20-21. According to analysts at Wells Fargo, the CPI will show a decline of 0.2% in August, on the back of a further plunge in gasoline prices.

Key Quotes:

“Consumer price inflation surprised to the downside in July, driven by a big drop in energy prices and a sharp slowdown in both core goods and services. We expect Tuesday's report to show consumers received further relief on the inflation front in August. Specifically, we look for prices to have declined 0.2% last month, which would be the largest monthly drop since the spring of 2020.”

“A further plunge in gasoline prices is expected to lead the headline lower, while additional giveback in travel services and used cars should help hold the core to a 0.4% month-over-month increase.”

“The FOMC has been singularly focused on inflation of late, and Tuesday's CPI print will be important in shaping the Fed's latest thinking ahead of its next meeting. While we expect the FOMC to be encouraged by the downshift in inflation since June, core prices continue to advance well ahead of the Fed's target. Lower commodity prices in recent months and easing of supply chain bottlenecks point to inflation cooling in the months ahead, but the still-strong rate of labor cost growth suggests that it will not be easy to return inflation to the Fed's target on a sustained basis.”

-

16:35

United States 3-Year Note Auction: 3.564% vs 3.202%

-

16:19

GBP/USD prints fresh weekly highs above 1.1700

- UK growth positive in July, but below expectations.

- Attention turns to US inflation numbers.

- GBP/USD up for the second day in a row, tests the 20-day SMA.

The GBP/USD is rising on Monday and during the American session climbed to 1.1709, reaching the highest level since August 30. Cable remains near the top, holding onto daily gains and a bullish bias in the very near term.

The pound continues to recover from multi-year lows against the US dollar. It is testing the 20-day Simple Moving Average and a consolidation above could open the doors to a more sustainable recovery.

Weak dollar ahead of CPIs

The US dollar is falling across the board on Monday hit by an improvement in risk sentiment and steady US yields. The DXY is falling by 0.75%, hovering around 0108.15. The US 10-year yield stands at 3.28% and the 2*-year at 3.52%. The Dow Jones rises by 0.90% and the S&P 1%, adding to last week’s gains.

On Tuesday, August US CPI numbers are due. A 0.1% decline is expected on the monthly reading and a slide in the annual rate from 8.5% to 8.1%. The report will be relevant for Federal Reserve rate hike expectations ahead of the FOMC meeting next week. The Bank of England will also have its meeting next week (postponed due the Queen’s death).

In the UK, July growth data showed a recovery from the 0.6% June contraction with a 0.2% expansion. The figure was below expectations. On Tuesday labor data is due and the CPI on Wednesday.

Technical levels

-

16:05

NY Fed: 1-year consumer inflation expectations fall to 10-month low of 5.75%

The Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US consumers' one-year inflation expectation declined to a new 10-month low of 5.7% in August from 6.2% in July, as reported by Reuters.

Consumers' 3-year inflation expectation declined to the lowest in nearly two years at 2.8% in August from 3.2% in July.

Moreover, the publication revealed that consumers saw a lower chance of losing a job in August than in July and a higher likelihood of finding a new job should they lose one. Additionally, consumers in August saw the lowest chance of quitting their current job since March 2021.

Market reaction

The greenback struggles to find demand after this report and the US Dollar Index was last seen losing 0.72% on a daily basis at 108.18.

-

15:59

US CPI Preview: Forecasts from 12 major banks, inflation begins to ease

The US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data for August on Tuesday, September 12 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 12 major banks regarding the upcoming US inflation print.

On a monthly basis, the CPI is expected to decline by 0.1%. The Core CPI, which excludes volatile food and energy prices, is forecast to stay unchanged at 0.3%. On a yearly basis, the CPI figure is expected to have eased to 8.1% in August, from 8.5% printed a month earlier. Meanwhile, the Core CPI is forecast at 6% from 5.9%.

ANZ

“We expect US core CPI to rise by 0.4% MoM in August and headline inflation to be flat for the second straight month with falling energy prices dragging headline down.”

Commerzbank

“Overall, we expect consumer prices to stagnate in August (consensus -0.1%). The annual inflation rate is thus likely to have fallen to 8.1%. Even though the peak in the inflation rate is probably behind us, it is nevertheless too early to sound the all-clear. This is because the recent decline in the inflation rate is mainly attributable to volatile components such as energy prices. By contrast, the sharp rise in rents, the most important component of the consumer price index, is likely to continue for the time being. As a result, the core rate of inflation should actually increase to 6.2% in August.”

ING

“CPI should show headline inflation being depressed by lower gasoline prices, but core inflation is likely to rise to 6.1% from 5.9%.”

TDS

“Our estimate for August is -0.2%/0.3% MoM for headline/core CPI; we see more risk of 0.2% than 0.4% for the core series (0.28% unrounded). On a YoY basis, we look for inflation to slow to 8.0% YoY for the headline, but to pick up slightly to 6.0% for the core.”

SocGen

“For August, we expect the headline CPI to fall 0.1% MoM due to a plunge in gasoline prices from a high. Early September gasoline prices are still falling, implying a weak headline figure for September too. Headline inflation rates peaked at 9.1% in June, fell to 8.5% in July and should register 8.1% in August. We expect the headline CPI to fall below 7% by year-end, but uncertainty over energy prices clouds that projection. Our core-CPI forecast is 0.4% MoM. That projection is based on a 0.6% shelter cost increase that is offset by weak pricing for apparel, motor vehicles and public transportation. These latter categories have been volatile. We expect weak auto pricing in the quarters ahead, but the still tight inventory readings, which have been limited by semiconductors, mean that the monthly forecasts are more uncertain.”

NBF

“Headline prices could have decreased 0.2% moM, their biggest drop since April 2020. If we’re right, the year-on-year rate should come down to 7.9% from 8.5%. Core prices, meanwhile, may have continued to be supported by rising rent prices and advanced 0.3%. This would translate into a two-tick increase of the 12-month rate to 6.1%.”

Westpac

“We forecast +0.2% for core and -0.2% for headline. If achieved though, it should not be assumed that October and beyond will see repeats, with volatility likely to persist.”

Deutsche Bank

“We expect a slight decline in the headline CPI number (-0.09% MoM) but an acceleration of +0.30% in core, which would continue the pattern from July's reading (unchanged and +0.3%, respectively) which came in lower than expected. We believe the YoY headline CPI should fall five-tenths to 8.0%, while core should tick up a tenth to 6.0%.”

CIBC

“The relief from higher prices at the pump extended into August and should result in cooling in annual inflation to 8.0%. While global indices of food prices have pulled back lately, that may take longer to feed through to the CPI. Although there was a sharp drop in used car prices, continued pressure from housing costs likely resulted in a 0.3% monthly rise in core prices, leaving the annual rate a tick hotter at 6.0%, magnified by base effects. We expect the annual inflation readings to look a touch softer than the consensus, but that won’t matter for the Fed given the still-elevated readings.”

BofA

“We look for headline CPI to decline by 0.1% MoM, its first decline since May 2020, and for core CPI to advance by 0.3% MoM. This would leave headline and core CPI up 8.2% and 6.0% YoY, respectively.”

Citibank

“US August CPI MoM – Citi: -0.1%, prior: 0.0%; CPI YoY – Citi: 8.0%, prior: 8.5%; CPI ex Food, Energy MoM – Citi: 0.4%, prior: 0.3%; CPI ex Food, Energy YoY – Citi: 6.1%, prior: 5.9%. In the last key CPI release ahead of the September FOMC meeting, it will be particularly important for this release to assess details underlying another ‘softer’ core inflation print, as there are notable downside risks relative to expectations. However, the data may not be enough to convince the Fed of sustainably slowing inflation which would leave another 75 bps hike on the table for the Sep 21 FOMC meeting.”

Wells Fargo

“We look for prices to have declined 0.2% last month, which would be the largest monthly drop since the spring of 2020. A further plunge in gasoline prices is expected to lead the headline lower, while additional giveback in travel services and used cars should help hold the core to a 0.4% month-over-month increase.”

-

15:52

USD/JPY erases daily gains, trades near 142.50

- USD/JPY erased its daily gains during the European trading hours.

- The dollar struggles to find demand as US stocks push higher.

- Focus shifts to US 10-year Treasury note auction.

USD/JPY gathered bullish momentum at the beginning of the week and climbed to the 143.50 area before reversing its direction during the European trading hours. As of writing, the pair was trading at 142.50, where it was virtually unchanged on a daily basis.

The risk-positive market environment during the Asian session made it difficult for the JPY to find demand. Japanese Deputy Chief Cabinet Secretary Seiji Kihara reiterated that the government will take necessary steps to counter excessive declines in the yen but the pair showed no reaction to these comments.

In the European morning, the greenback came under heavy selling pressure amid falling US Treasury bond yields and caused USD/JPY to turn south.

The US Dollar Index, which tracks the dollar's performance against a basket of six major currencies, was last seen losing 0.7% on the day at 108.22. In the meantime, Wall Street's three main indexes are up more than 1% after the opening bell, not allowing the USD to stage a rebound.

In the absence of high-impact macroeconomic data releases, investors will pay close attention to the outcome of the 10-year US Treasury note auction that is scheduled to take place at 1700 GMT. In case the high-yield comes in below the previous auction's 2.755%, the 10-year US T-bond yield could stretch lower and open the door for additional losses in USD/JPY.

Technical levels to watch for

-

15:35

GBP/USD: Break through mid/upper 1.17s should add to positive momentum – Scotiabank

GBP/USD climbs to the 1.1700 level. Further gains through mid/upper 1.17s should add more strength to the pound, economists at Scotiabank report.

Support aligns at 1.1575/00

“Cable closed positively last week (weekly bull ‘hammer’) and additional progress through the mid/upper 1.17s should add to positive momentum in the short/medium term.”

“Support is 1.1575/00.”

-

15:31

USD/CAD: Downside potential to the 1.2940 area in the short run – Scotiabank

USD/CAD continues losing ground for the fourth straight day. In the view of economists at Scotiabank, the Canadian dollar can extend gains to the low 1.29s against the US dollar.

Technical picture remains CAD-positive

“CAD gains on the USD have lagged somewhat but the technical picture remains CAD-positive following last week’s second rejection of the low 1.32 area and the USD’s break under the double top neckline at 1.3075.”

“USD/CAD dips have been reluctant to extend through the upper 1.29s again today, similar to Friday, but the double top pattern implies downside potential to the 1.2940 area in the short run.”

-

15:28

EUR/USD to turn technically bullihs on a sustained move above 1.02 – Scotiabank

EUR/USD rose from an opening level of around 1.0050 in Asian trade to near 1.02 in European dealing before drifting back. Economists at Scotiabank note that a break past 1.02 would technically be bullish.

Support aligns at 1.0050/55

“Strong EUR gains on the session brought spot to within a whisker of key trend resistance off the Feb high (1.0206) earlier. The EUR has retreated from the intraday high but short-term price dynamics remain positive for the pair, which maintains the strong, short-term uptrend that developed earlier last week.”

“We see support at 1.0050/55 intraday.”

“Solid gains above the 1.02 area would be technically bullish from a medium-term point of view.”

-

14:58

Gold Price Forecast: XAU/USD retreats from two-week high, still well bid around $1,725 area

- Gold climbs to a nearly two-week high, tough lacks follow-through buying.

- The risk-on impulse, a modest USD recovery act as a headwind for the metal.

- Sliding US bond yields cap the USD bounce and continues to offer support.

- Investors await the US CPI report on Tuesday for a fresh directional impetus.

Gold trims a part of its intraday gains to a nearly two-week high touched in the last hour and eases to the $1,725 area during the early North American session. The XAU/USD, however, manages to hold in the positive territory for the second straight day and remains at the mercy of the USD price dynamics.

A combination of factors fails to assist gold to capitalize on its early positive move and prompts some selling near the $1,733-$1,734 area on Monday. The risk-on impulse, as depicted by a generally positive tone around the equity markets, acts as a headwind for the safe-haven precious metal. Furthermore, a modest US dollar recovery from a fresh monthly low also contributes to capping the dollar-denominated commodity.

Adding to this, the prospects for a more aggressive policy tightening by major central banks force the non-yielding gold to retreat from the daily peak. That said, retreating US Treasury bond yields weighs on the USD. This, along with growing recession fears, amid economic headwinds stemming from COVID-19 curbs in China and the protracted Russia-Ukraine war, continues to lend some support to the safe-haven XAU/USD.

The mixed fundamental backdrop makes it prudent to wait for strong follow-through buying before traders start positioning for some meaningful upside for gold. In the absence of any major market-moving economic data from the US, the US bond yields will drive the USD demand. This, along with the broader risk sentiment, could produce short-term opportunities around gold ahead of the US consumer inflation figures on Tuesday.

The crucial US CPI report will play a key role in influencing the Fed's policy outlook and dictate the near-term USD trend. This, in turn, will help investors to determine the next leg of a directional move for gold. Heading into the key releases, traders might refrain from placing aggressive bets and prefer to move to the sidelines. This, in turn, could lead to a further consolidative price move for the XAU/USD.

Technical levels to watch

-

14:57

Silver Price Analysis: King Dollar's reversal is catalyzing a ferocious short squeeze – TDS

Strategists at TD Securities analyze the outlook of silver (XAG/USD). They note that a consolidation lower in the USD has sent participants rushing for the exits.

Short positioning has grown to its highest levels since 2019

“With money managers short positioning in silver having grown to its highest levels since 2019, a consolidation lower in the USD has sent participants rushing for the exits. However, the coincident rally in gold prices has been more limited, which suggests little has changed with respect to the investment appetite for precious metals.”

“With 54% of silver's demand tied to fabrication, silver remains highly sensitive to our deteriorating gauge of commodity demand.”

“We continue to expect that while rates markets appear to be nearing a fair pricing for Fed funds, precious metals' price action is still not consistent with their historical performance when hiking cycles enter into a restrictive rates regime.”

-

14:52

Malaysia: Labour market remains strong – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the recently published labour market report in Malaysia.

Key Takeaways

“Malaysia’s labour market recovery gained further traction in Jul with both employment and the size of labour force breaching new record levels. This helped bring the national unemployment rate lower for 12 months in a row to 3.7% in Jul (from 3.8% in Jun), moving closer to the pre-pandemic jobless rate of 3.3%.”

“The gain in total employment was primarily driven by persistent hiring in services (particularly food & beverages services, wholesale & retail trade, and administrative & support services activities), manufacturing (i.e. E&E, other plastic products, and refined petroleum products), and the construction sectors, which fully offset the decline in the agriculture and mining & quarrying sectors. The employment-to-population ratio, which indicates the ability of an economy to create employment, accelerated to 67.0% from 66.9% in Jun, above pre-pandemic levels for three straight months.”

“Despite lingering headwinds on the horizon, we think that the country’s transition to endemicity with a full reopening of economic and social activities as well as borders would continue to drive the labour market recovery for the rest of the year and into 2023. The government is also expected to unveil some positive measures to boost investment and employment in the coming Budget 2023 on 7 Oct. We tweak our year-end unemployment rate projections lower to 3.5% for this year (from 3.6% previously, BNM est: average ~4.0%) and 3.2% for 2023 (from 3.5% previously).”

-

14:43

EUR/USD Price Analysis: Sustained gains look likely above 1.0200

- EUR/USD rises to 4-week highs just below the 1.0200 mark.

- Extra upside appears in store once that level is cleared.

EUR/USD adds to Friday’s advance and tests fresh peaks near 1.0200 at the beginning of the week, an area coincident with the 7-month resistance line.

The pair now needs to leave behind that resistance area to see its downside pressure alleviated and allow at the same time a visit to the interim 100-day SMA at 1.0338 prior to the more relevant August high at 1.0368 (August 10).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0755.

EUR/USD daily chart

-

14:21

China: Lower inflation could support further PBoC easing – UOB

Economist at UOB Group Ho Woei Chen, CFA, assesses the latest inflation figures in China.

Key Takeaways

“Headline inflation unexpectedly eased from its 2-year high as it fell to 2.5% y/y in Aug (Bloomberg est: 2.8% y/y, Jul: 2.7%) with food and non-food prices moderating. Core inflation (excluding food & energy) was unchanged from Jul at 0.8% y/y as domestic demand stayed weak amid expanding COVID lockdowns across cities.”

“Producer Price Index (PPI) dropped sharply to 2.3% y/y in Aug (Bloomberg est: 3.2% y/y, Jul: 4.2%). Weaker PPI was attributed to lower international oil and commodity prices as well as weak market demand in some domestic industries.”

“With CPI averaging just 1.9% y/y in Jan-Aug, we now expect full-year inflation at 2.2% instead of our earlier forecast of 2.5% (2021: 0.9%). We also lower our PPI forecast to average 4%-5% in 2022 compared to our earlier estimate of 5%-6% (2021: +8.1%).”

“We continue to see scope for further monetary policy easing, with the 1Y LPR to move lower to 3.55% by end-4Q22 (from current 3.65%). After 35 bps cut YTD, the 5Y rate is still poised to fall further (from current 4.30%) as PBoC extends support to the property market.”

-

14:15

US Dollar Index Price Analysis: Further weakness could revisit 107.60

- DXY remains offered and probes the sub-108.00 region.

- If the index accelerates its losses, it could retest the 107.60/55 band.

DXY starts the week on the negative foot and briefly drops to multi-week lows in the sub-108.00 region.

Despite the ongoing weakness around the dollar, its short-term bullish view remains in place as long as it trades above the 7-month support line around 106.10.

If sellers push harder, then a potential test of the weekly low at 107.58 (August 26) could start emerging on the horizon just ahead of the interim 55-day SMA at 107.25.

Looking at the long-term scenario, the constructive view in DXY remains unchanged while above the 200-day SMA at 101.39.

DXY daily chart

-

14:01

USD/IDR faces some range bound trade near term – UOB

USD/IDR could extend its consolidative mood within the 14,770-14,920 range for the time being, notes Quek Ser Leang, FX Strategist at UOB Group’s Global Economics & Markets Research.

Key Quotes

“Our expectations for USD/IDR to advance last week did not materialize as it traded between 14,815 and 14,933. Upward pressure has eased and USD/IDR is likely to consolidate between 14,770 and 14,920 this week.”

-

13:13

EUR/USD to test August 10 high near 1.0370 on a clean breach of 1.02 – BBH

EUR/USD has traded as high as 1.02 earlier. A break above here would open up a move towards 1.0370, economists at BBH report.

European Central Bank sticks to hawkish stance

“A clean break above 1.02 would set up a test of the August 10 high near 1.0370.”

“ECB officials are sticking to the hawkish message. Taking a lesson from the Fed, the bank is trying to stay on message and so far, the markets like it. Despite these comments, we believe nothing has fundamentally changed. We think the ECB’s base case forecast of no recession is way too optimistic and that a downturn will eventually prevent the ECB from hiking that aggressively. That said, no one should stand in the way of this move, which is also being exaggerated by position skew going into the ECB meeting.”

-

13:08

AUD/USD ascends to 0.6900 neighbourhood, nearly two-week high amid weaker USD

- AUD/USD builds on last week’s late bounce and gains traction for the second straight day.

- Retreating US bond yields, a positive risk tone undermines the USD and extends support.

- Recession fears might cap the risk-sensitive aussie ahead of the US CPI report on Tuesday.

The AUD/USD pair catches some bids for the successive straight day on Monday and builds on last week's bounce from sub-0.6700 levels or the lowest since July 14. This also marks the third day of a positive move in the previous four and lifts spot prices to a more than one-week high, closer to the 0.6900 mark during the mid-European session.

A combination of factors force the US dollar to prolong its recent sharp pullback from a two-decade high, which, in turn, is seen lending support to the AUD/USD pair. The markets already seem to have priced in a supersized 75 bps rate hike by the Federal Reserve at the next policy meeting on September 20-21. Furthermore, a modest downtick in the US Treasury bond yields seems to weigh on the greenback.

Apart from this, a generally positive tone around the equity markets further undermines the safe-haven buck and benefits the risk-sensitive aussie. That said, growing recession fears, amid the prospects for a faster policy tightening by major central banks and economic headwinds stemming from fresh COVID-19 curbs in China could cap optimism. This, in turn, warrants some caution for bullish traders.

Investors might also refrain from placing aggressive bets and prefer to move to the sidelines ahead of the latest US consumer inflation figures, due for release on Tuesday. The crucial US CPI report for August will play a key role in influencing the Fed's policy outlook. This will drive the USD demand in the near term and help determine the next leg of a directional move for the AUD/USD pair.

In the meantime, spot prices are more likely to consolidate in a range amid absent relevant market-moving economic releases from the US on Monday. That said, the US bond yields, along with the broader risk sentiment, might provide some impetus to the greenback and allow traders to grab short-term opportunities around the AUD/USD pair.

Technical levels to watch

-

13:03

GBP/USD to remain on the back foot as the pound faces strong headwinds – Rabobank

UK economic data, guidance from the Bank of England (BoE) and, very importantly, direction from the Tory government and its new leadership will set the tone for the British pound. Economists at Rabobank expect further weakness for the GBP in the coming weeks.

PM Truss does have the potential to win back some investor confidence

“The promise of higher interest rates is not a guarantee of GBP strength when the economy is facing recession. To this end, news of another bank holiday this month is not encouraging for the pound given that it is set to detract from the GDP numbers for September.”

“If Truss can find a way to piece together a solution that strengthens relations with the EU, investors could take heart. This, however, will not be easy.”

“For now, the headwinds facing the pound are still very strong. We maintain our one-month forecast of GBP/USD 1.14.”

-

13:00

India Manufacturing Output dipped from previous 12.5% to 3.2% in July

-

13:00

India Cumulative Industrial Output below forecasts (11.9%) in June: Actual (10%)

-

13:00

India Industrial Output below expectations (4.3%) in July: Actual (2.4%)

-

12:56

EUR/GBP to extend its advance once key resistance at 0.8720 is reclaimed – SocGen

EUR/GBP picks up bids to reverse Friday’s losses. Economists at Société Générale expect the pair to extend its race higher on a break past 0.8720.

Short-term support aligns at 0.8560

“EUR/GBP recently gave a break above the descending trend line drawn since 2020 denoting potential upside. This is also highlighted by weekly MACD which is now firmly anchored within positive territory and above its trigger.”

“The pair is close to key graphical resistance of 0.8720. Once this is reclaimed, the up move is likely to extend towards projections of 0.8860 and perhaps even towards 0.8980/0.9010.”

“Last week's low of 0.8560 is short-term support.”

-

12:18

EUR/JPY Price Analysis: Next on the upside remains the 150.00 zone

- EUR/JPY prints new multi-year peaks past 145.00.

- Extra gains could extend to the 2014 high near 150.00.

EUR/JPY starts the week on the positive foot and records new highs near 145.60.

Extra gains in the cross appear well favoured for the time being. The next target, however, is not expected to emerge until the 2014 high at 149.78 (December 8).

While above the 200-day SMA at 134.93, the prospects for the pair should remain constructive.

Of note, however, is the current overbought condition of EUR/JPY, which could spark a technical drop in the near term.

EUR/JPY daily chart

-

12:02

United Kingdom NIESR GDP Estimate (3M) came in at -0.2% below forecasts (0.1%) in August

-

11:56

Germany's Ifo: German economy to contract by 0.3% in 2023

Germany's Ifo Institute announced on Monday that it revised its 2023 growth forecast to -0.3% from 3.5% in June. The institute further noted that the annual inflation expectation for 2023 got revised higher to 9.3% from June's forecast of 6%.

For 2022, Ifo now sees the economy growing by 1.6%, down from 2.5% in June, and forecasts 8.1% inflation (6.8% in June), as reported by Reuters.

Market reaction

EUR/USD pair retreated from the multi-week high it set at 1.0198 after this report. Nevertheless, the pair was last seen trading at 1.0140, where it was still up 1% on a daily basis.

-

11:55

USD/MYR: Further upside remains on the cards but… - UOB

The continuation of the upside in USD/MYR is not ruled out, although a test of the 4.51 hurdle remains elusive for the time being, suggests Quek Ser Leang, FX Strategist at UOB Group’s Global Economics & Markets Research.

Key Quotes

“While we expected USD/MYR to strengthen last week, we were of the view that ‘the major resistance at 4.4980 is likely out of reach’. However, USD/MYR took out 4.4980 and rose to 4.5020. Upward momentum has improved, albeit not by much.”

“For this week, USD/MYR could advance further but the resistance at 4.5100 is unlikely to come into view for now. Support is at 4.4930 but only a break of 4.4900 would indicate that the current upward pressure has eased.”

-

11:27

Silver Price Analysis: XAG/USD bulls have the upper hand near 200-period SMA on 4-hour chart

- Silver gains traction for the fourth straight day and climbs to over a two-week high.

- The technical set-up favours bullish traders and supports prospects for further gains.

- A sustained break below the $18.60 region is needed to negate the positive outlook.

Silver prolongs its recent recovery move from the lowest level since June 2020 touched earlier this month and gains traction for the fourth successive day on Monday. This also marks the sixth day of a positive move in the previous seven and lifts the white metal to over a two-week high, around the $19.30 area during the first half of the European session.

Last week's sustained breakout through the top end of a nearly one-month-old descending channel and a subsequent strength beyond the 100-period SMA on the 4-hour chart was seen as a key trigger for bulls. Furthermore, technical indicators on the daily chart have just started moving in the positive territory and remain supportive of the strong follow-through move up.

That said, RSI (14) on hourly charts is already flashing overbought conditions and might hold back traders from placing fresh bullish bets around the XAG/USD. Hence, it is prudent to wait for some near-term consolidation or a modest pullback before positioning for any further appreciating move. The bias, meanwhile, still seems tilted firmly in favour of bullish traders.

A convincing breakthrough the $19.35-$19.40 hurdle will reaffirm the constructive outlook and allow the XAG/USD to accelerate the momentum towards reclaiming the $20.00 psychological mark. The next relevant resistance is pegged near the $20.25 horizontal zone, which if cleared should pave the way for additional gains.

On the flip side, the $19.00 round figure now seems to protect the immediate downside. Any further pullback might be seen as a buying opportunity and remain limited near the 100-period SMA on the 4-hour chart, around the $18.65-$18.60 region. This is followed by support near the $18.30 area. A convincing break below the latter will negate the near-term positive bias.

Silver 4-hour chart

-637985751324582175.png)

Key levels to watch

-

11:11

USD/THB: Tough support aligns at 36.10 – UOB

Quek Ser Leang, FX Strategist at UOB Group’s Global Economics & Markets Research, noted that further decline in USD/THB is likely to meet solid contention around 36.10.

Key Quotes

“Our view for USD/THB to ‘rise above 36.95’ last week was incorrect as it dropped below the rising trend-line support. Daily MACD is weakening rapidly and this coupled with the breach of the rising trend-lines support is likely to lead to a lower USD/THB this week.”

“That said, any weakness is expected to encounter solid support at 36.10. On the upside, resistance is at 36.60 but only a breach of 36.80 would indicate the current downward pressure has eased.”

-

11:01

Portugal Consumer Price Index (MoM) unchanged at -0.3% in August

-

11:00

Portugal Consumer Price Index (YoY) dipped from previous 9% to 8.9% in August

-

10:51

EUR/USD climbs to 4-week highs near 1.0200

- Renewed buying interest lifts EUR/USD to the vicinity of 1.0200.

- German 10-year Bund yields trade on the defensive below 1.70%.

- ECB’s De Guindos declined to comment on how high rates could go.

The European currency adds to Friday’s gains and pushes EUR/USD to fresh multi-week highs just below 1.0200 the figure at the beginning of the week.

EUR/USD up on weaker dollar

EUR/USD advances for the second session in a row and flirts with the 1.0200 neighbourhood in response to the intense sell-off in the greenback, which forces the US Dollar Index (DXY) to break below the 108.00 support and record new multi-week lows.

Extra gains in the pair seem to have picked up extra pace following the unprecedented 75 bps interest rate hike by the ECB at its event on September 8, while Monday’s market chatter around the probability that interest rates in the region could move to restrictive territory also lent legs to the single currency.

The strong rebound in the pair, however, comes in contrast to the corrective decline in the German 10-year Bund yields, which breach the 1.70% yardstick after poking with 1.80% at the end of last week.

Still around the ECB, Vice-President De Guindos said he does not know how high rates could climb at the time when he stressed that the recent 75 bps hike is expected to anchor inflation expectations.

In the domestic docket, a minor release includes Germany’s Current Account, while short-term bill auctions and medium-term note auctions are only due across the pond later in the NA session.

What to look for around EUR

EUR/USD pushes higher and briefly tested the key 7-month resistance line in the 1.0200 neighbourhood amidst the persistent selling pressure hitting the US dollar.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Final Inflation Rate, Germany/EMU ZEW Economic Sentiment (Tuesday) – EMU Industrial Production (Wednesday) – France Final Inflation Rate, EMU Balance of Trade (Thursday) – Italy, EMU Final Inflation rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is advancing 1.16% at 1.0160 and now faces the initial barrier at 1.0197 (weekly high September 12) followed by 1.0202 (August 17 high) and then 1.0338 (100-day SMA). On the flip side, the breakdown of 0.9863 (2022 low September 6) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2002 low).

-

10:43

USD/CAD drops to two-week low, further below 1.3000 amid weaker USD, rising oil prices

- USD/CAD continues losing ground for the fourth straight day and dives to a nearly two-week low.

- Rising oil prices underpin the loonie and exert heavy pressure amid broad-based USD weakness.

- Aggressive Fed rate hike bets should limit the USD downside and lend some support to the major.

The USD/CAD pair meets with a fresh supply following an early uptick to the 1.3040 area and turns lower for the fourth successive day on Monday. The downward trajectory drags spot prices to a nearly two-week low, around the 1.2980-1.2975 zone during the early European session and is sponsored by a combination of factors.

As investors look past Friday's disappointing Canadian employment details, a further recovery in crude oil prices from a multi-month low touched last week underpins the commodity-linked loonie. Apart from this, the heavily offered tone surrounding the US dollar exerts additional downward pressure on the USD/CAD pair and contributes to the intraday decline.

A symbolic output cut by OPEC+, along with Russia's threat to cut oil flows to any country that backs a price cap on its crude, raises concerns about tight global supply and offers support to oil prices. On the other hand, a generally positive tone around the equity markets drags the safe-haven greenback further away from a two-decade high touched last week.

That said, concerns that a deeper global economic downturn, along with fresh COVID-19 curbs in China, could curb fuel demand should cap oil prices. This, along with elevated US Treasury bond yields, bolstered by the prospects for more aggressive rate hikes by the Fed, should offer some support to the buck and help limit losses USD/CAD pair, at least for now.

The markets seem convinced that the Fed will continue to tighten its monetary policy at a faster pace to tame inflation. That said, a supersized 75 bps rate hike at the September FOMC meeting is already priced in. Hence, the USD bulls might now wait for the release of the latest US consumer inflation figures, due on Tuesday, before placing fresh bets.

In the meantime, the broader market risk sentiment and the US bond yields will continue to play a key role in driving the USD demand on Monday. Apart from this, oil price dynamics will be looked upon for some short-term trading opportunities around the USD/CAD pair amid absent relevant market-moving economic releases, either from the US or Canada.

Technical levels to watch

-

10:07

GBP/USD climbs to 1.1700 mark, nearly two-week high amid sustained USD selling bias

- GBP/USD gains traction for the second straight day and climbs to a nearly two-week high.

- A positive risk tone, subdued US bond yields weigh on the USD and remain supportive.

- The disappointing UK macro data adds to recession fears and might cap any further gains.

The GBP/USD pair catches fresh bids near the 1.1600 mark on Monday and climbs to a near two-week high during the first half of the European session. The pair is currently trading around the 1.1700 round figure and is looking to build on its recent bounce from the lowest level since 1985 touched last week.

The US dollar prolongs its sharp retracement slide from a two-decade high and remains under intense selling pressure on the first day of a new week. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, dives to a fresh monthly low. This turns out to be a key factor pushing the GBP/USD pair higher for the second successive day.

Given that the markets have already priced in a supersized 75 bps rate hike at the next FOMC meeting on September 20-21, a generally positive tone around the equity markets is seen weighing on the safe-haven greenback. Apart from this, the ongoing USD corrective decline lacks any obvious fundamental catalyst and is more likely to remain limited amid elevated US Treasury bond yields.

Furthermore, the worsening outlook for the UK economy might further contribute to keeping a lid on any further gains for the GBP/USD pair. The worries were further fueled by the mostly disappointing UK macro data released earlier this Monday. The UK Office for National Statistics reported that the economy expanded by 0.2% in July, less than consensus estimates for a 0.5% growth.

Separately, the UK Manufacturing and total Industrial Production fell short of expectations, arriving at 0.1% MoM in July and -0.3%, respectively. This warrants caution before positioning for any further gains. Nevertheless, the GBP/USD pair has now rallied nearly 300 pips from the 1.1400 neighbourhood, or a 35-year low set last Wednesday and remains at the mercy of the USD price dynamics.

Investors might also refrain from placing aggressive bets and prefer to move to the sidelines ahead of the US consumer inflation figures, due on Tuesday. Traders will further take cues from this week's key UK macro releases, including the crucial CPI report on Wednesday. This, in turn, will play a key role in influencing the GBP/USD pair and help determine the next leg of a directional move.

Technical levels to watch

-

09:50

ECB’s de Guindos: I don't know how much rates will climb

European Central Bank (ECB) Vice President Luis de Guindos said on Monday, “I don't know how much rates will climb.”

Additional comments

“Governments, not the ECB, should resolve rising state debt.”

“Any GDP contraction will be less than in the euro crisis.”

“The German economy is very adaptable to energy shocks.”

-

09:28

USD/CNH is now expected to trade within 6.9000-6.9700 range – UOB

According to FX Strategists at UOB Group Quek Ser Leang and Peter Chia, USD/CNH is now seen trading between 6.9000 and 6.9700 in the next few weeks.

Key Quotes

24-hour view: “Last Friday, we expected USD to ‘consolidate further’. In other words, we did not expect the sharp drop in USD to 6.9180 and the subsequent strong bounce from the low. The strong bounce amidst oversold conditions suggests USD is unlikely to weaken much further. For today, USD is more likely to trade between 6.9150 and 6.9450.”

Next 1-3 weeks: “We have held a positive view in USD since the middle of last month. In our latest narrative form last Wednesday (07 Sep, spot at 6.9770), we indicated that as long as 6.9300 is not breached, there is still chance for USD to break 7.0000. USD subsequently rose to 6.9967 before easing off. Last Friday, USD lurched lower and cracked the ‘strong support’ at 6.9300. The break of the ‘strong support’ indicates that the month-long rally in USD has ended. USD appears to have moved into a consolidation phase and is likely to trade between 6.9000 and 6.9700 for now.”

-

09:27

EUR/USD to extend its race higher as long as 1.0160 holds

EUR/USD has gathered bullish momentum to start the week. As FXStreet’s Eren Sengezer notes, the pair's technical outlook points to a bullish tilt in the near term.

EUR/USD could stage a technical correction before stretching higher

“EUR/USD pierced through the 200-period SMA on the four-hour chart and the 20-period SMA crossed above the 50-period and 100-period SMA's during the latest rally, reflecting the strong buying interest in the euro. However, that the Relative Strength Index on the same chart is about to rise above 70, suggesting that the pair could stage a technical correction before stretching higher.”

“On the downside, 1.0160 (Fibonacci 61.8% retracement level of the latest downtrend) aligns as key technical support. In case the pair manages to hold above that level, it could test 1.0200 (psychological level) and target 1.0245 (static level) and 1.0280 (static level) afterwards.”

“With a decline below 1.0160, sellers could show interest and drag the pair toward 1.0100 (200-period SMA, Fibonacci 50% retracement).”

-

09:23

US Dollar Index extends the pullback below 108.00

- The index loses further momentum and breaches 108.00.

- Extra improvement in the risk complex keeps weighing on the dollar.

- This week’s focus will largely by on US inflation figures.

Sellers remain well in control of the sentiment around the greenback and sponsor the ongoing sell-off to the sub-108.00 area when tracked by the US Dollar Index (DXY).

US Dollar Index focuses on inflation, Fed

The index loses ground for the second session in a row and extends further the corrective downside after last week’s 20-year peaks well north of the 110.00 mark.

The move lower in the dollar comes in tandem with a small downtick in US yields across the curve, as market participants appear to have already priced in a 75 bps interest rate hike at the Fed’s September 21 gathering.

On the latter, CME Group’s FedWatch Tool now sees the probability of such a rate raise at 90% from around 57% a week ago and 45% vs. a month ago.

No data releases in the US data space other than 3-month/6-month Bill Auctions and 3-year/10-year Note Auctions.

What to look for around USD

The index has embarked on a corrective path that has already broken below the key support at 108.00 at the beginning of last week.

Bolstering the dollar’s underlying positive stance appears the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market. This view was reinforced by Chair Powell’s speech at the Jackson Hole Symposium.

Looking at the more macro scenario, the greenback appears propped up by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Inflation Rate (Tuesday) – MBA Mortgage Applications, Producer Prices (Wednesday) – Retail Sales, Initial Claims, Philly Fed Manufacturing Index, Industrial Production, Business Inventories (Thursday) – Flash Michigan Consumer Sentiment, TIC Flows (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation over a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

US Dollar Index relevant levels

Now, the index is retreating 0.92% at 107.97 and faces the next support at 107.58 (weekly low August 26) seconded by 107.24 (55-day SMA) and then 104.63 (monthly low August 10). On the other hand, a break above 110.78 (2022 high September 7) would aim for 111.90 (weekly high September 6 2002) and then 113.35 (weekly high May 24 2002).

-

09:23

USD/INR to suffer a deeper pullback on a break under 78.70/78.50 – SocGen

USD/INR has started evolving within a pause after reaching 80 in July. 78.70/78.50 is short-term support – which should cushion the downside, in the view of economists at Société Générale.

Uptrend has paused

“Recent attempt at overcoming the 80 hurdle has failed, denoting the possibility of an elongated consolidation. Lower limit of recent range at 78.70/78.50 should be an important support near-term. Only a break below would mean a deeper pullback.”

“Once a move beyond 80 materializes, the pair is expected to resume its uptrend. Next targets are expected to be at projections of 80.30 and 81.00.”

-

09:20

AUD/USD: Revisit of 0.7130 not ruled out – SocGen

ADU/USD has defended the 0.6680/0.6650 support zone on a second attempt, triggering an initial bounce. Economists at Société Générale think the pair could now retest the 0.7130 mark.

Deeper downtrend on a break under 0.6680/0.6650

“A revisit of the neckline at 0.7130 which is also the 200-DMA is not ruled out. If this is overcome, an extended bounce could take shape towards 0.7280 and upper band of the channel at 0.7500.”

“Only if 0.6680/0.6650 gets violated would there be a deeper downtrend.”

-

09:17

S&P 500 Index: Defense of 3900/3890 to trigger further upside – SocGen

S&P 500 has so far defended the potential support zone at 3900/3890. Economists at Société Générale expect the index to test 4115/4160 and 4220 next.

Break below 3900/3890 to open up previous bullish gap at 3795

“Once a cross above the 50-DMA at 4020 materializes, a short-term up move is likely towards graphical levels of 4115/4160 and 4220.”

“Only if the index establishes itself below 3900/3890, there would be a risk of extension in pullback towards previous bullish gap at 3795 and the lows of June at 3636.”

-

09:15

Gold Price Forecast: XAU/USD jumps closer to Friday’s swing high amid notable USD supply

- Gold catches fresh bids on Monday and turns positive for the second successive day.

- The prevalent USD selling bias turns out to be a key factor boosting the commodity.

- A positive risk tone, the prospects for more aggressive central banks continue to cap.

Gold attracts some dip-buying near the $1,712 area on Monday and turns positive for the second straight day. The XAU/USD refreshes daily high, around the $1,726-$1,727 region during the European session and moves back closer to a one-and-half-week high touched on Friday.

The US dollar extends last week's sharp retracement slide from a two-decade high and remains under intense selling pressure on the first day of a new week. In fact, the USD Index, which measures the greenback's performance against a basket of currencies, dives to a fresh monthly low and offers support to the dollar-denominated gold.

Given that the markets have already priced in a 75 bps Fed rate hike move in September, subdued action around the US Treasury bond yields turns out to be a key factor weighing on the greenback. Apart from this, growing worries about a deeper global economic downturn further contribute to driving flows towards safe-haven gold.

That said, a positive risk tone - as depicted by a generally upbeat mood around the equity markets - could act as a headwind for the precious metal. Furthermore, the prospects for a more aggressive policy tightening by major central banks warrant some caution before positioning for any further appreciating move for the non-yielding gold.

Investors might also prefer to move to the sidelines ahead of the latest US consumer inflation figures, due for release on Tuesday. The crucial US CPI report will influence the Fed's policy outlook and dictate the near-term USD trajectory. This, in turn, will help investors to determine the next leg of a directional move for gold.

In the meantime, the XAU/USD is more likely to enter a consolidation phase amid absent relevant market-moving economic data from the US. That said, the US bond yields, the USD price dynamics, along with the broader risk sentiment, might still provide some impetus to gold and allow traders to grab short-term opportunities.

Technical levels to watch

-

09:00

Italy Industrial Output s.a. (MoM) came in at 0.4%, above forecasts (0.3%) in July

-

09:00

Italy Industrial Output w.d.a (YoY) below expectations (-0.4%) in July: Actual (-1.4%)

-

08:40

USD/JPY trims intraday gains, back below 143.00 amid broad-based USD weakness

- USD/JPY struggles to capitalize on its intraday positive move to the 143.50 area.

- The ongoing USD slide to a fresh monthly low and acts as a headwind for the pair.

- A combination of factors could undermine the safe-haven JPY and offer support.

- Investors might also move to the sidelines ahead of the US CPI report on Tuesday.

The USD/JPY pair retreats nearly 90 pips from the daily high and drops back closer to mid-142.00s during the early European session on Monday.

The US dollar prolongs its recent sharp corrective pullback from a two-decade high touched last week and remains under heavy selling pressure on Monday. This, in turn, acts as a headwind for the USD/JPY pair. Furthermore, speculations that authorities may soon step in to arrest a freefall in Japanese yen also contribute to capping the upside for the major. In fact, Japanese Deputy Chief Cabinet Secretary Seiji Kihara urged the government to take necessary steps to counter excessive declines in the yen.

That said, a combination of factors should help limit the downside for the USD/JPY pair and support prospects for the resumption of a one-month-old strong bullish trajectory. A generally positive tone around the equity markets, along with a big divergence in the policy stance adopted by the Bank of Japan and the Federal Reserve, might undermine the safe-haven JPY. It is worth mentioning that the BoJ has been lagging behind other major central banks in the process of policy normalisation and remains committed to continuing with its monetary easing. In contrast, the Fed is expected to tighten its policy at a faster pace.

The markets, however, already seem to have priced in a supersized 75 bps rate hike move at the next FOMC meeting on September 20-21. Hence, the USD bulls might wait for the crucial US consumer inflation figures on Tuesday before placing fresh bets, which will play a key role in influencing the Fed's policy outlook. This, in turn, will drive the USD demand and provide a fresh directional impetus to the USD/JPY pair. In the meantime, traders might prefer to move to the sidelines amid absent relevant market-moving economic releases from the US.

Technical levels to watch

-

08:21

USD to weaken once the end of US monetary tightening campaign is in sight – NBF

The trade-weighted US dollar was back to a post-recession high against a basket of 26 currencies on September 2. For now, the most compelling argument for higher interest rates made by the Fed is the resilience of labor markets. Economists at the National Bank of Canada think things are about to change.

Easing of China's "zero COVID" policy to limit USD appreciation

“Full-time employment, meanwhile, has stagnated since the beginning of 2022. This suggests that companies may be on the verge of cutting back on hiring in the coming months. If we are right, the FOMC may soon recognize that the end of US monetary tightening campaign is in sight, a development that could weaken the greenback.”

“An easing of China's ‘zero COVID’ policy would also help limit the appreciation of the US currency.”

-

08:17

Gold Price Forecast: XAU/USD to rebound on soft US inflation report

Last week, gold failed to make a convincing move in either direction. August inflation data from the US next week could have a significant impact on gold’s valuation, FXStreet’s Eren Sengezer reports.

August inflation data from the US could trigger a significant reaction

“The US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data for August on Tuesday. FOMC policymakers refrained from confirming a 75 bps rate hike in September and a soft inflation report could cause the probability of a 50 bps rate increase to rise. In that scenario, US T-bond yields are likely to fall sharply and trigger a decisive rally in gold. On the flip side, stronger-than-expected CPI prints could cement a 75 bps rate hike and not allow XAU/USD to turn north.”

“On Friday, August Industrial Production and Retail Sales data from China will be looked upon for fresh impetus. If these figures disappoint, gold could have a hard time finding demand, with investors losing hope for a steady recovery in gold’s demand and vice versa.”

“The University of Michigan’s flash September Consumer Sentiment Index report will be released on Friday. A decline in 5-10 year consumer inflation expectations should hurt the dollar, while an unexpected increase could help the currency gather strength and weigh on XAU/USD.”

-

08:13

USD/CAD: Loonie to appreciate on the back of higher policy rate – NBF

The Canadian dollar remains the best performing G10 currency against the US dollar so far in 2022 but is still down 3.9%. Economists at the National Bank of Canada still expect the CAD to appreciate against the greenback.

USD/CAD could breach 1.32

“The loonie is still down 3.9% despite a better performing economy, a current account surplus, the best terms of trade on record and a hawkish central bank. Even then, 1.32 USD/CAD is in danger of being breached.”