Notícias do Mercado

-

23:26

Currencies. Daily history for Dec 13’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1825 +0,72%

GBP/USD $1,3416 +0,74%

USD/CHF Chf0,98541 -0,60%

USD/JPY Y112,53 -0,90%

EUR/JPY Y133,08 -0,18%

GBP/JPY Y150,975 -0,15%

AUD/USD $0,7636 +1,04%

NZD/USD $0,7023 +1,29%

USD/CAD C$1,2813 -0,40%

-

23:02

Schedule for today, Thursday, Dec 14’2017 (GMT0)

00:00 Australia Consumer Inflation Expectation December 3.7%

00:30 Australia Changing the number of employed November 3.7 19.2

00:30 Australia Unemployment rate November 5.4% 5.4%

02:00 China Industrial Production y/y November 6.2% 6.2%

02:00 China Retail Sales y/y November 10.0% 10.3%

02:00 China Fixed Asset Investment November 7.3% 7.2%

04:30 Japan Industrial Production (YoY) (Finally) October 2.6% 5.9%

04:30 Japan Industrial Production (MoM) (Finally) October -1.0% 0.5%

07:45 France CPI, y/y (Finally) November 1.1% 1.2%

07:45 France CPI, m/m (Finally) November 0.1% 0.1%

08:00 France Services PMI (Preliminary) December 60.4 59.9

08:00 France Manufacturing PMI (Preliminary) December 57.7 57.2

08:15 Switzerland Producer & Import Prices, y/y November 1.2%

08:30 Germany Services PMI (Preliminary) December 54.3 54.6

08:30 Germany Manufacturing PMI (Preliminary) December 62.5 62.0

08:30 Switzerland SNB Interest Rate Decision -0.75% -0.75%

09:00 Eurozone Manufacturing PMI (Preliminary) December 60.1 59.7

09:00 Eurozone Services PMI (Preliminary) December 56.2 56.0

09:00 Switzerland SNB Press Conference

09:30 United Kingdom Retail Sales (YoY) November -0.3% 0.3%

09:30 United Kingdom Retail Sales (MoM) November 0.3% 0.4%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 435 435

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.50%

12:45 Eurozone Deposit Facilty Rate -0.4% -0.4%

12:45 Eurozone ECB Interest Rate Decision 0% 0%

13:30 Eurozone ECB Press Conference

13:30 Canada New Housing Price Index, YoY October 3.8%

13:30 Canada New Housing Price Index, MoM October 0.2% 0.2%

13:30 U.S. Continuing Jobless Claims December 1908 1900

13:30 U.S. Retail Sales YoY November 4.6%

13:30 U.S. Retail sales November 0.2% 0.3%

13:30 U.S. Retail sales excluding auto November 0.1% 0.6%

13:30 U.S. Import Price Index November 0.2% 0.7%

13:30 U.S. Initial Jobless Claims December 236 239

14:45 U.S. Manufacturing PMI (Preliminary) December 53.9 54.0

14:45 U.S. Services PMI (Preliminary) December 54.5 55.0

15:00 U.S. Business inventories October 0% -0.1%

17:25 Canada BOC Gov Stephen Poloz Speaks

21:30 New Zealand Business NZ PMI November 57.2

23:50 Japan BoJ Tankan. Manufacturing Index Quarter IV 22 24

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter IV 23 23

-

19:00

U.S.: Fed Interest Rate Decision , 1.5% (forecast 1.5%)

-

17:55

-

15:41

U.S. commercial crude oil inventories decreased by 5.1 million barrels from the previous week

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.1 million barrels from the previous week. At 443.0 million barrels, U.S. crude oil inventories are in the middle of the average range for this time of year.

Total motor gasoline inventories increased by 5.7 million barrels last week, and are in the upper half of the average range. Both finished gasoline inventories and blending components inventories increased last week. Distillate fuel inventories decreased by 1.4 million barrels last week and are in the lower half of the average range for this time of year. Propane/propylene inventories increased by 0.2 million barrels last week, and are in the middle of the average range. Total commercial petroleum inventories decreased by 2.6 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, December -5.117 (forecast -3.759)

-

14:27

U.S Federal Reserve expected today to raise the interest rate by 0.25% to 1.50%. Decision at 19:00 GMT, press conference - 19:30 GMT. Buy the rumors sell the news scenario?

-

13:51

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.1650 (EUR 535m) 1.1675 (715m) 1.1700 (1.5bn)1.1750 (990m)1.1800-05 (1.2bn) 1.1825-30 (835m) 1.1845-50 (950m) 1.1870-75 (695m) 1.1890-00 (1.5bn)

USDJPY: 111.00 (USD 915m) 112.00 (850m) 112.40-50 (1.8bn) 112.70 (425m) 113.00-05 (615m) 113.30 (270m) 113.45-50 (1.7bn) 114.00 (965m) 115.00 (1.5bn) 115.50 (520m)

GBPUSD: 1.3300 (GBP 150m) 1.3350 (240m) 1.3400 (220m)

EURGBP: 0.8675 (EUR 420m) 0.8775 (1.3bn) 0.8805-07 (580m)

USDCHF: 0.9900 (USD 120m) 1.0000 (260m)

USDCAD: 1.2680-85 (USD 625m) 1.2810 (155m) 1.2860 (150m)

AUDUSD: 0.7530 (AUD 215m) 0.7600 (155m)

-

13:46

U.S CPI rose less than expected last month

November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.2 percent.

The energy index rose 3.9 percent and accounted for about three-fourths of the all items increase. The gasoline index increased 7.3 percent, and the other

energy component indexes also rose. The food index was unchanged in November, with the index for food at home declining slightly.

The index for all items less food and energy increased 0.1 percent in November. The shelter index continued to rise, and the indexes for motor vehicle insurance,used cars and trucks, and new vehicles also increased. The indexes for apparel, airline fares, and household furnishings and operations all declined in November. -

13:30

U.S.: CPI, m/m , November 0.4% (forecast 0.4%)

-

13:30

U.S.: CPI, Y/Y, November 2.2% (forecast 2.2%)

-

13:30

U.S.: CPI excluding food and energy, Y/Y, November 1.7% (forecast 1.8%)

-

13:30

U.S.: CPI excluding food and energy, m/m, November 0.1% (forecast 0.2%)

-

11:54

EUR/USD Analysis - update

EUR/USD is getting close to the support zone which might be interesting to see how the price reacts on that zone.

If the price breaks below the support level then we can expect a strong bearish movement.

Otherwise, if the price starts rejecting the support zone then we might see a slight correction on the price.

-

11:04

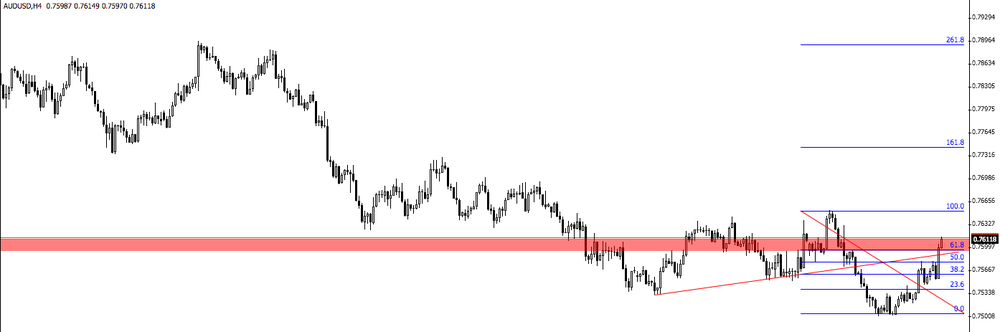

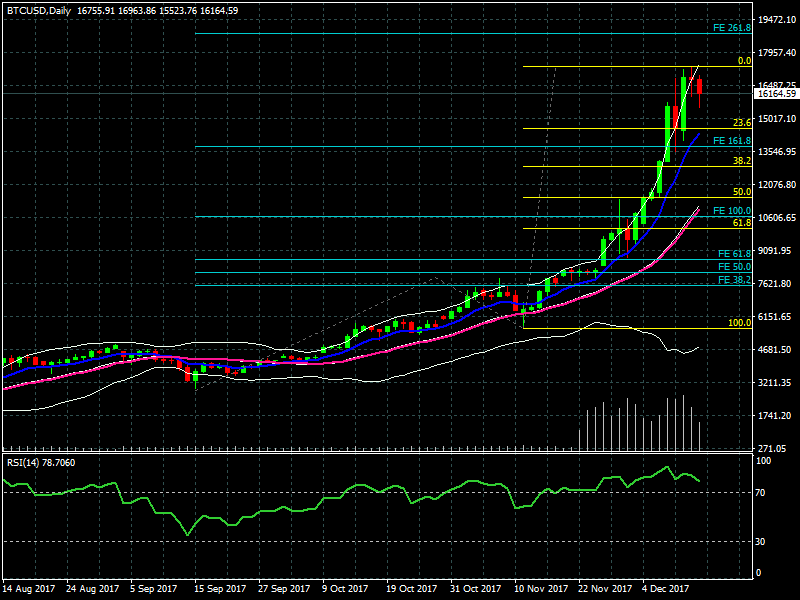

ANALISE BTC/USD - Gráfico Diário

Para nossa análise utilizamos os seguintes indicadores técnicos:

*Média móvel exponencial de 9 períodos (azul)

*Média móvel simples de 21 períodos (magenta)

*Bandas Bollinger

*RSI

*Volume

*Extensão (azul) e retração (amarela) de Fibonacci sobre tendência

Conforme acompanhamos na última semana os volumes de compra ficaram todos acima da média jogando o ativo para patamares acima da extensão de Fibonacci de 161.8% (nosso alvo da análise passada). Essa alta ainda é reflexo das noticias da adoção de futuros de bitcoin em grandes bolsas de negociação mundial. Percebe-se que ambas as médias móveis ainda estão direcionadas para cima seguindo a tendência de alta que se confirma, pois, a média de 9 períodos continua acima da média de 21 períodos. Contudo, o RSI esta acima dos 70 e virado para baixo aponta uma possível sobre compra no preço do ativo. Após romper as bandas Bollinger superiores provavelmente o ativo irá recuar até a média móvel de 9 períodos para tomar fôlego e voltar a subir.

*Apontamos a média móvel exponencial de 9 períodos como um bom ponto de entrada caso o preço recue um pouco.

*O stop Loss para esta operação fica um pouco abaixo do nível 38.2% da retração de Fibonacci

* Se a tendencia de alta for mantida temos nosso alvo (Profit) no nível 261.8% da extensão de Fibonacci

-

10:43

BoJ Gov Kuroda: hope Japan's economy remains stable, prices and wages rise gradually next year

-

Flexible mindset becomes increasingly important in guiding monetary policy

-

Japan's economy in "very good shape"

-

Will guide monetary policy appropriately reflecting state of economy

-

-

10:08

Euro area industrial production rose more than expected in October

In October 2017 compared with September 2017, seasonally adjusted industrial production rose by 0.2% in the euro area (EA19) and by 0.3% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In September 2017, the industrial production fell by 0.5% in both zones. In October 2017 compared with October 2016, industrial production increased by 3.7% in the euro area and by 4.2% in the EU28.

-

10:06

Employment increased by 0.4% in the euro area (EA19) and by 0.3% in the EU28 in Q3

The number of persons employed increased by 0.4% in the euro area (EA19) and by 0.3% in the EU28 in the third quarter of 2017 compared with the previous quarter, according to national accounts estimates published by Eurostat, the statistical office of the European Union. In the second quarter of 2017, employment increased by 0.4% in the euro area and by 0.5% in the EU28. These figures are seasonally adjusted. Compared with the same quarter of the previous year, employment increased by 1.7% in the euro area and by 1.8% in the EU28 in the third quarter of 2017 (after +1.6% and +1.7% respectively in the second quarter of 2017)

-

10:00

Eurozone: Industrial production, (MoM), October 0.2% (forecast 0.0%)

-

10:00

Eurozone: Industrial Production (YoY), October 3.7% (forecast 3.5%)

-

10:00

Eurozone: Employment Change, Quarter III 0.4% (forecast 0.4%)

-

09:35

UK average weekly earnings rose 2.5% in October

Latest estimates show that average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.5% including bonuses and by 2.3% excluding bonuses, compared with a year earlier.

Latest estimates show that average weekly earnings for employees in Great Britain in real terms (that is, adjusted for price inflation) fell by 0.2% including bonuses, and fell by 0.4% excluding bonuses, compared with a year earlier.

-

09:33

UK unemployment rate up 0.1% vs estimates to 4.3%

Estimates from the Labour Force Survey show that, between May to July 2017 and August to October 2017, the number of people in work fell, the number of unemployed people also fell, and the number of people aged from 16 to 64 not working and not seeking or available to work (economically inactive) increased.

There were 32.08 million people in work, 56,000 fewer than for May to July 2017 but 325,000 more than for a year earlier.

There were 1.43 million unemployed people (people not in work but seeking and available to work), 26,000 fewer than for May to July 2017 and 182,000 fewer than for a year earlier.

The unemployment rate (the proportion of those in work plus those unemployed, that were unemployed) was 4.3%, down from 4.8% for a year earlier and the joint lowest since 1975.

-

09:30

United Kingdom: Average Earnings, 3m/y , October 2.5% (forecast 2.5%)

-

09:30

United Kingdom: Average earnings ex bonuses, 3 m/y, October 2.3% (forecast 2.2%)

-

09:30

United Kingdom: ILO Unemployment Rate, October 4.3% (forecast 4.2%)

-

09:30

United Kingdom: Claimant count , November 5.9 (forecast 3.2)

-

09:18

Italian industrial production rose less than expected in October

In October 2017 the seasonally adjusted industrial production index increased by 0.5% compared with the previous month. The percentage change of the average of the last three months with respect to the previous three months was +0.8.

The calendar adjusted industrial production index increased by 3.1% compared with October 2016 (calendar working days being 22 versus 21 days in October 2016); in the period January-October 2017 the percentage change was +2.9 compared with the same period of 2016.

The unadjusted industrial production index increased by 6.4% compared with October 2016.

-

09:16

Russian deputy foreign minister says Russia welcomes U.S. Tillerson's statement about readiness to hold direct dialogue North Korea - Interfax

-

09:02

Forex option contracts rolling off today at 14.00 GMT:

EUR/USD: 1.1650 (531 m), 1.1675 (707 m), 1.1700 (1.4 b), 1.1750 (990 m), 1.1800-05 (1.1 b), 1.1825-30 (834 m), 1.1845-50 (950 m), 1.1870-75 (692 m), 1.1890-00 (1.4 b)

USD/JPY: 111.00 (915 m), 112.00-12 (842 m), 112.40-50 (1.7 b), 112.68-70 (421 m), 113.00-05 (615 m), 113.30 (270 m), 113.45-50 (1.7 b), 114.00 (965 m), 115.00 (1.4 b), 115.50 (520 m)

GBP/USD: 1.3300 (141 m), 1.3350 (240 m), 1.3400 (216 m)

USD/CHF: 0.9900 (120 m), 1.0000 (256 m)

USD/CAD: 1.2680-85 (621 m), 1.2810 (155 m), 1.2860-61 (150 m)

AUD/USD: 0.7530 (211 m), 0.7600 (153 m)

EUR/GBP: 0.8675 (420 m), 0.8775 (1.3 b), 0.8805-07 (580 m)

-

08:35

Major stock exchanges in Europe trading in the red zone: FTSE 7493.87 -6.54 -0.09%, DAX 13152.60 -30.93 -0.23%, CAC 5413.41 -13.78 -0.25%

-

07:36

Options levels on wednesday, December 13, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1909 (3842)

$1.1861 (1024)

$1.1835 (616)

Price at time of writing this review: $1.1744

Support levels (open interest**, contracts):

$1.1672 (4174)

$1.1632 (3539)

$1.1589 (2170)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 92479 contracts (according to data from December, 12) with the maximum number of contracts with strike price $1,1800 (4776);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3483 (2100)

$1.3437 (1430)

$1.3389 (507)

Price at time of writing this review: $1.3325

Support levels (open interest**, contracts):

$1.3259 (1614)

$1.3230 (2413)

$1.3196 (2164)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 30110 contracts, with the maximum number of contracts with strike price $1,3500 (3796);

- Overall open interest on the PUT options with the expiration date January, 5 is 29285 contracts, with the maximum number of contracts with strike price $1,2900 (2426);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from December, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:35

U.S. 10-year treasuries yield at 2.399 percent vs U.S. close of 2.403 percent on tuesday

-

07:33

Democrat Doug Jones wins election as U.S. senator from Alabama @ AP

-

07:32

German selling prices in wholesale trade increased by 3.3% y/y

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade increased by 3.3% in November 2017 from the corresponding month of the preceding year. In October 2017 and in September 2017 the annual rates of change were +3.0% and +3.4%, respectively.

From October 2017 to November 2017 the index rose by 0.5%.

-

07:30

German CPI up 0.3% in november

Consumer prices in Germany were 1.8% higher in November 2017 than in November 2016. This means that the inflation rate as measured by the consumer price index was again slightly up, after standing at +1.6% in October 2017 (September and August 2017: +1.8% each). Compared with October 2017, the consumer price index increased by 0.3% in November 2017. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 29 November 2017.

-

07:00

Germany: CPI, m/m, November 0.3% (forecast 0.3%)

-

07:00

Germany: CPI, y/y , November 1.8% (forecast 1.8%)

-