Notícias do Mercado

-

19:21

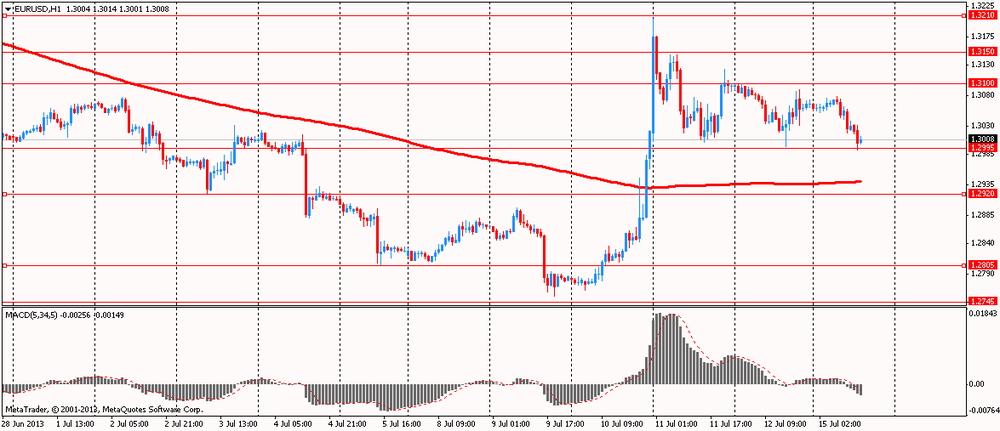

American focus: the euro regained previously lost ground

The euro rose against the dollar after all, despite the significant decline that was recorded earlier. Add that such dynamics provoked U.S. data, which were worse than expected.

As it became known, U.S. consumers spent more on gasoline and cars in June, but showed little interest in the other goods, which raises concern that personal spending will cause a leisurely recovery.

Total retail sales increased by 0.4% last month to a seasonally adjusted $ 422.79 billion, the Commerce Department said Monday. But excluding autos and gasoline retail sales were down 0.1%.

The overall increase was below the forecast of economists had expected growth of 0.7%. Retail sales and food sales rose 5.7% from a year earlier.

U.S. retail sales are growing steadily, despite the depth of the economic crisis. Consumer spending accounts for over two-thirds of the total demand in the U.S.

Sales of auto dealers rose 1.8%, continuing a strong picture of this year's sales, which grew by more than 11% year on year. But excluding the automotive sector retail sales were unchanged.

The volume of retail sales, which exclude gasoline, automobiles, and construction was 0.15% higher.

The cost of the Swiss franc fell against the U.S. dollar, which helped to data from the Federal Statistical Office, which showed that producer prices in Switzerland and import prices rose 0.2 percent year on year in June, offsetting a decline of 0.2 percent in May. According to forecasts, the index had increased by 0.3 percent.

On a monthly index measuring the Producer and Import Prices rose 0.1 percent in June, replacing the 0.3 percent fall in the previous month. The rate of growth was lower than expected 0.2 percent growth.

Producer prices and import prices rose by 0.1 percent each in June compared with May. While producer prices rose 0.5 percent year on year, import prices fell 0.3 percent, the data showed.

Australian dollar rose against most of its 16 major, thus restoring most of the positions lost earlier. Note that momentum trading significantly affected by the economic data showing that China's economic slowdown in the 2nd quarter was not as steep as some had feared. According to these data, China's GDP in the 2nd quarter grew by 7.5% compared with the same period last year, after rising 7.7% in the 1st quarter. China is the largest trading partner of Australia, which is becoming impressive volumes of iron ore and coal for its infrastructure projects. As a result, the Australian dollar is highly dependent on the state of China's economy. According to analysts, after the Chinese Finance Ministry on Friday said that "GDP at 6.5% will not make the problem", the markets were expecting weak data, regardless of the subsequent retraction / clarification.

Recall also that the Reserve Bank of Australia on Tuesday to publish the minutes of its meeting on July 2. Investors believe that the probability of the next lower key interest rate in August was 60%, as the government is likely to intensify efforts to revive activity in the economy in sectors not related to the mining industry. Now the key interest rate RBA is at 2.75%.

-

15:15

Australia new motor vehicle sales up 4.0% in June

The total number of new motor vehicle sales in Australia was up a seasonally adjusted 4.0 percent on month in June, the Australian Bureau of Statistics said on Monday, standing at 97,687.

That follows the flat reading in May.

On a yearly basis, new motor vehicle sales jumped 7.1 percent after adding just 0.2 percent in the previous month.

By category, sales of passenger vehicles added 3.7 percent on month, while sports utility vehicle sales gained 2.7 percent and sales of other vehicles jumped 6.6 percent.

By region, Queensland saw the largest percentage increase (5.3 percent), followed by New South Wales (4.9 percent) and the Tasmania (4.6 percent). Over the same period, the Northern Territory decreased by 4.1 percent.

-

15:00

U.S.: Business inventories , May +0.1% (forecast +0.2%)

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.2875, $1.2950, $1.2975, $1.3040, $1.3075, $1.3080, $1.3150, $1.3200

USD/JPY Y98.00, Y98.50, Y99.00, Y99.50, Y100.00, Y101.00

EUR/JPY Y125.80

GBP/USD $1.5100, $1.5225, $1.5275

EUR/GBP stg0.8650

USD/CHF Chf0.9665

EUR/CHF Chf1.2450, Chf1.2500

AUD/USD $0.9000, $0.9075, $0.9110, $0.9150

USD/CAD C$1.0375

-

13:30

U.S.: NY Fed Empire State manufacturing index , July 9.46 (forecast 5.2)

-

13:30

U.S.: Retail sales, June +0.4% (forecast +0.7%)

-

13:30

U.S.: Retail sales excluding auto, June 0.0% (forecast +0.5%)

-

13:20

European session: the dollar rose

07:15 Switzerland Producer & Import Prices, m/m June -0.3% +0.3% +0.1%

07:15 Switzerland Producer & Import Prices, y/y June -0.2% +0.3% +0.2%

The U.S. dollar strengthened against the major currencies in anticipation of the report on retail sales. According to the forecasts of economists, retail sales in the U.S. in June, is likely to have grown by 0.7% m / m, after rising 0.6% in May, buoyed by good sales of cars and decent weather. Experts believe that sales excluding autos rose 0.4%, while sales excluding motor vehicles and gasoline - by 0.3%.

Australian dollar strengthened early in the session against most of its 16 major counterparts after the publication of data showing that China's economic slowdown in the 2nd quarter was not as steep as some had feared. According to these data, China's GDP in the 2nd quarter grew by 7.5% compared with the same period last year, after rising 7.7% in the 1st quarter. China is the largest trading partner of Australia, which is becoming impressive volumes of iron ore and coal for its infrastructure projects. As a result, the Australian dollar is highly dependent on the state of China's economy. According to analysts, after the Chinese Finance Ministry on Friday said that "GDP at 6.5% will not make the problem", the markets were expecting weak data, regardless of the subsequent retraction / clarification.

The Reserve Bank of Australia on Tuesday to publish the minutes of its meeting on July 2. Investors believe that the probability of the next lower key interest rate in August was 60%, as the government is likely to intensify efforts to revive activity in the economy in sectors not related to the mining industry. Now the key interest rate RBA is at 2.75%. Published last week, the data indicated a low level of business confidence and rising unemployment to a peak of four years. This year, interest rates were dropped to record lows, as Australia is struggling with the effects of falling commodity prices and slowing economic growth in China.

EUR / USD: during the European session, the pair fell to $ 1.2992

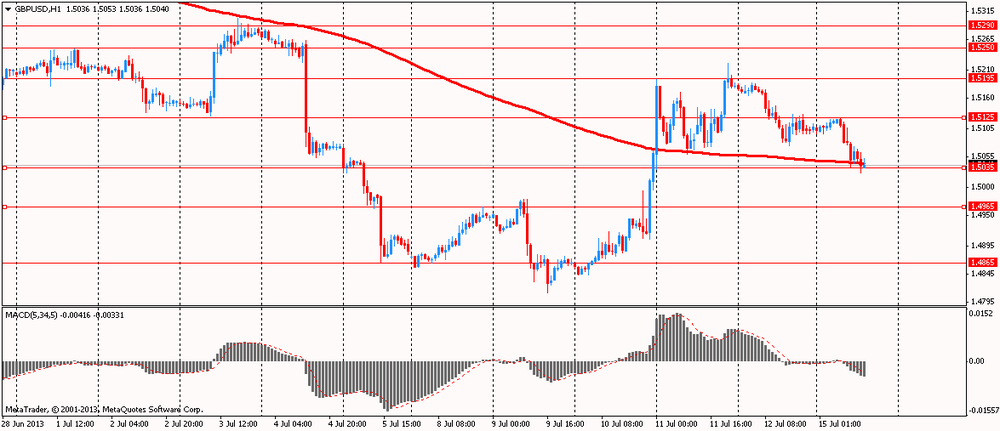

GBP / USD: during the European session, the pair fell to $ 1.5026

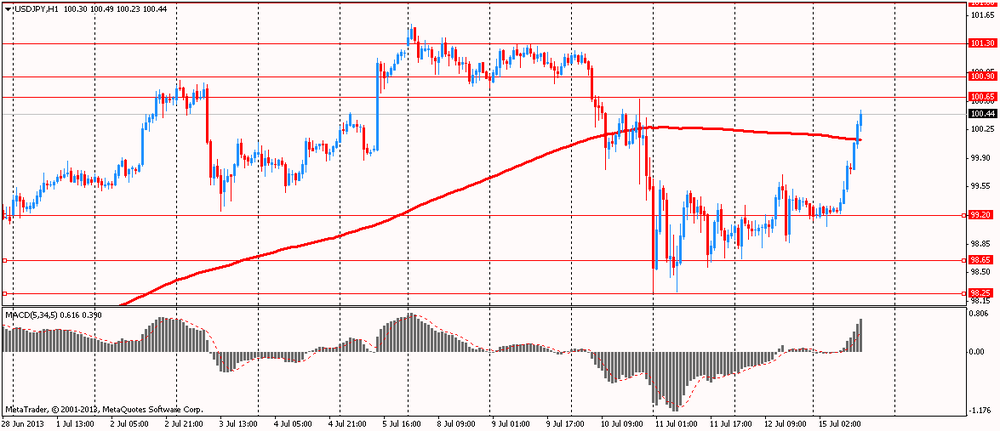

USD / JPY: during the European session, the pair rose to Y100.49

U.S. at 12:30 GMT will publish the change in retail sales, the change in retail sales excluding auto sales, changes in the volume of retail trade sales, excluding cars and fuel for June, Empire Manufacturing manufacturing index for July at 14:00 GMT - the change in volume Business Inventories for May. End the day at 22:45 GMT New Zealand data on the consumer price index for the 2nd quarter.

-

13:00

Orders

EUR/USD

Offers $1.3170/80, $1.3145/50, $1.3120/25, $1.3085

Bids $1.3020, $1.3005/00, $1.2985/75, $1.2950, $1.2930/20

GBP/USD

Offers $1.5250/60, $1.5220/25, $1.5200/05, $1.5185/90, $1.5145/50, $1.5100

Bids $1.5020, $1.5000, $1.4970/65, $1.4950/40

AUD/USD

Offers $0.9200, $0.9160/70, $0.9150, $0.9120/25

Bids $0.9050/45, $0.9025/20, $0.8990/80, $0.8950

EUR/GBP

Offers stg0.8740/45, stg0.8715/20, stg0.8700/05, stg0.8690/95, stg0.8660/65

Bids stg0.8615-00, stg0.8575/65

EUR/JPY

Offers Y131.00, Y130.80, Y130.45/50

Bids Y129.65/60, Y129.10/00, Y128.80, Y128.50

USD/JPY

Offers Y100.90/00, Y100.75/80, Y100.50, Y100.20/30, Y100.00

Bids Y99.25/20, Y99.00, Y98.55/50, Y98.25/20

-

11:02

Swiss producer and import prices rise less than expected

Switzerland's producer and import prices rose 0.2 percent year-on-year in June, offsetting the 0.2 percent decrease in May, the Federal Statistical Office reported Monday. It was forecast to increase by 0.3 percent.

Month-on-month, the producer and import price index edged up 0.1 percent in June, reversing last month's 0.3 percent fall. The rate of growth was below the expected 0.2 percent rise.

Producer prices and import prices gained 0.1 percent each in June from May. While producer prices rose 0.5 percent annually, import prices dipped 0.3 percent, data showed.

-

10:47

China GDP growth slows further in Q2

China's economic growth slowed in the second quarter amid weaker industrial production and investment growth, the latest figures from the National Bureau of Statistics revealed Monday.

The gross domestic product rose 7.5 percent year-on-year in the second quarter, in line with expectations. This was slower than the 7.7 percent growth recorded in the first three months. In the first half of the year, GDP rose 7.6 percent compared with the same period last year.

A separate report from the statistical office showed that industrial production grew 8.9 percent annually in June. This was weaker than May's 9.2 percent growth and the 9.1 percent expansion forecast.

Fixed asset investment rose 20.1 percent in the January-June period, slower than the 20.4 percent gain between January and May, the statistical office said in another report. This was also below expectation of a 20.2 percent increase.

The data adds to evidence that economy is facing downward pressure from sluggish external demand and economic restructuring. Going forward, the ongoing squeeze on credit growth is also likely weigh on growth.

The authorities have recently indicated that they are ready to tolerate slower economic growth and go ahead with more economic reforms to achieve sustainable and balanced growth in the long-term.

Nevertheless, a separate data showed that retail sales growth was better than expected. Sales increased 13.3 percent year-on-year in June, faster than the 12.9 percent rise forecast. In May, sales were up 12.9 percent.

China's economy is going through a rebalancing exercise, moving away from exports and investment to make growth more consumption-driven.

The Customs Department data released last week showed that exports declined 3.1 percent year-on-year in June and imports slipped 0.7 percent.

Earlier this month, the International Monetary Fund lowered its growth forecast for the Chinese economy to 7.8 percent this year from the 8 percent predicted in April. For 2014, the growth is seen at 7.7 percent, much slower than the previous projection of 8.2 percent.

-

10:37

Option expiries for today's 1400GMT cut

EUR/USD $1.2875, $1.2950, $1.2975, $1.3040, $1.3080, $1.3150, $1.3200

USD/JPY Y98.00, Y98.50, Y99.00, Y99.50, Y100.00, Y101.00

EUR/JPY Y125.80

GBP/USD $1.5100, $1.5225, $1.5275

EUR/GBP stg0.8650

AUD/USD $0.9000, $0.9150

USD/CAD C$1.0375

-

08:15

Switzerland: Producer & Import Prices, m/m, June +0.1% (forecast +0.3%)

-

08:15

Switzerland: Producer & Import Prices, y/y, June +0.2% (forecast +0.3%)

-

07:03

Asian session: The dollar held gains

01:30 Australia New Motor Vehicle Sales (MoM) June 0.0% 4.0%

01:30 Australia New Motor Vehicle Sales (YoY) June +0.2% 7.1%

02:00 China Retail Sales y/y June +12.9% +12.9% +13,3%

02:00 China Fixed Asset Investment June +20.4% +20.3% +20.1%

02:00 China Industrial Production y/y June +9.2% +9.1% +8.9%

02:00 China GDP y/y Quarter II +7.7% +7.7% +7.5%

The dollar held gains against the yen and euro from the end of last week before U.S. data on retail sales today that may add to the case for the Federal Reserve to reduce monetary stimulus. The U.S. Commerce Department is likely to say today that retail sales rose 0.8 percent in June, according to the median estimate of economists surveyed by Bloomberg News. It would be the fastest gain since February.

The Bloomberg Dollar Index last week posted its first drop in a month after Fed Chairman Ben S. Bernanke signaled that bond buying won’t be dialed back soon. He is scheduled to speak on monetary policy this week.

Australia’s dollar rose against major peers as Chinese data showed growth slowed in line with economist forecasts. China’s economy, the world’s second biggest, grew 7.5 percent in the April-June period, the National Bureau of Statistics said in Beijing today, matching the median estimate of economists in a Bloomberg poll. It expanded 7.7 percent in the first quarter.

The pound was near a four-month low versus the euro before the Bank of England releases minutes on July 17 of its policy meeting held this month. After its first policy meeting led by new BOE Governor Mark Carney, the central bank said on July 4 that “the implied rise in the expected future path of bank rate was not warranted by the recent developments” in the U.K. economy. In the poll of 43 analysts, 23 said the governor will opt to link a pledge on loose policy to economic data.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3050/75

GBP / USD: during the Asian session the pair traded in the range of $ 1.5095/25

USD / JPY: during the Asian session the pair traded in the range of Y99.05/35

There is a very light calendar on Monday, with no data set for release in Europe and only limited central bank speakers. Markets are largely on hold, as the appearance on Capitol Hill later in the week from Fed Chairman Ben Bernanke is the main focus. ECB Executive Board member Joerg Asmussen is slated to give a lecture on "European perspectives in EMU Economic and Financial Policy", in Schwerin, Germany, at 1500GMT. Later, at 2000GMT, the Treasury Under Secretary for Intl Affairs Lael Brainard discusses G20 finance ministers meeting in Russia.

-

06:01

Schedule for today, Monday July 15’2013:

01:30 Australia New Motor Vehicle Sales (MoM) June 0.0%

01:30 Australia New Motor Vehicle Sales (YoY) June +0.2%

02:00 China Retail Sales y/y June +12.9% +12.9%

02:00 China Fixed Asset Investment June +20.4% +20.3%

02:00 China Industrial Production y/y June +9.2% +9.1%

02:00 China GDP y/y Quarter II +7.7% +7.7%

07:15 Switzerland Producer & Import Prices, m/m June -0.3% +0.3%

07:15 Switzerland Producer & Import Prices, y/y June -0.2% +0.3%

12:30 U.S. NY Fed Empire State manufacturing index July 7.84 5.2

12:30 U.S. Retail sales June +0.6% +0.7%

12:30 U.S. Retail sales excluding auto June +0.3% +0.5%

14:00 U.S. Business inventories May +0.3% +0.2%

22:45 New Zealand CPI, q/q Quarter II +0.4% +0.3%

22:45 New Zealand CPI, y/y Quarter II +0.9% +0.8%

-