Notícias do Mercado

-

23:29

Currencies. Daily history for Feb 17'2014:

(pare/closed(GMT +2)/change, %)

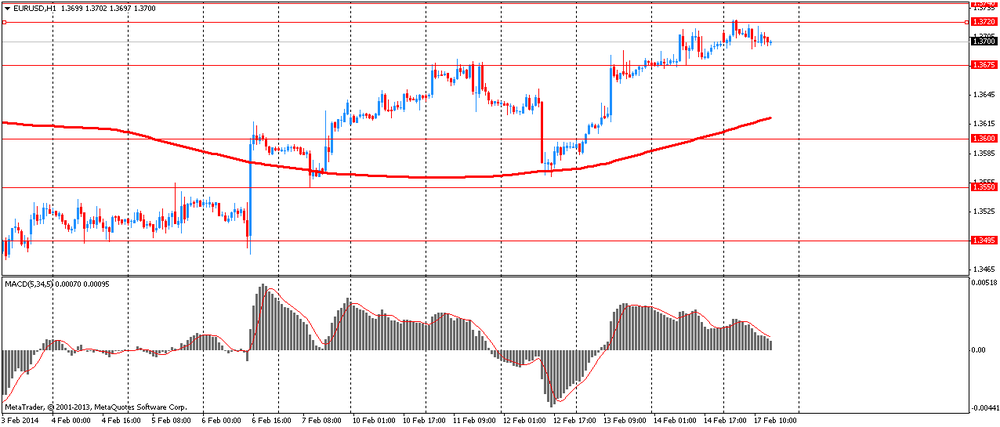

EUR/USD $1,3706 +0,06%

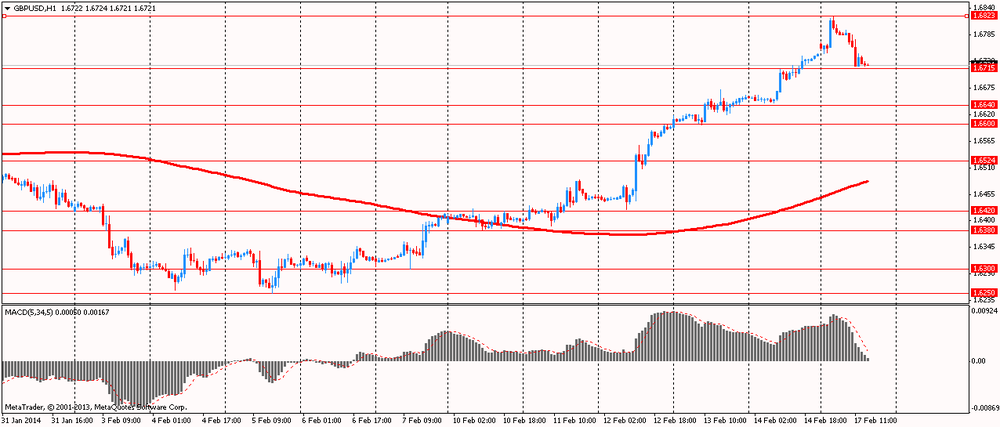

GBP/USD $1,6712 -0,20%

USD/CHF Chf0,8910 -0,08%

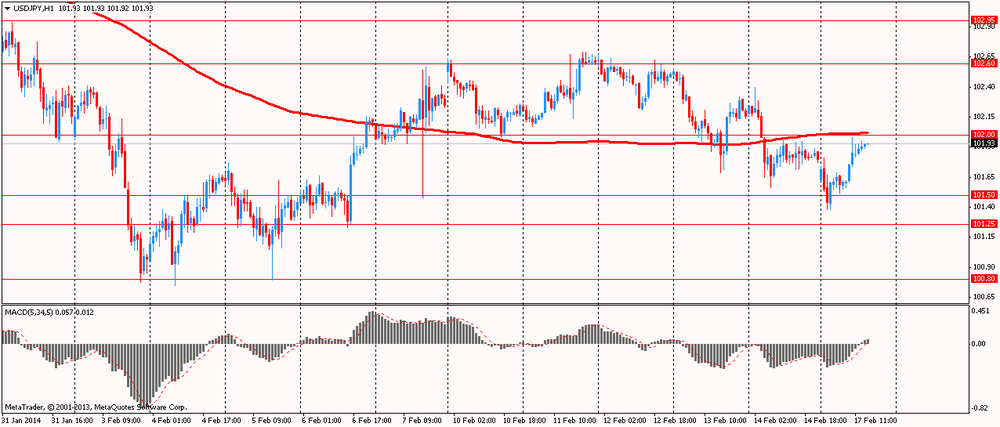

USD/JPY Y 101,91 +0,12%

EUR/JPY Y 139,34 -0,07%

GBP/JPY Y 170,31 -0,08%

AUD/USD $ 0,9031 -0,03%

NZD/USD $ 0,8366 -0,04%

USD/CAD C$1,0963 -0,16%

-

23:02

Schedule for today, Tuesday, Feb 18’2014:

00:30 Australia RBA Meeting's Minutes

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270

03:00 Japan BoJ Monetary Policy Statement

07:30 Japan BOJ Press Conference

09:00 Eurozone Current account, adjusted, bln December 23.5 19.8

09:00 Eurozone ECOFIN Meetings

09:30 United Kingdom Retail Price Index, m/m January +0.5% -0.5%

09:30 United Kingdom Retail prices, Y/Y January +2.7% +2.7%

09:30 United Kingdom RPI-X, Y/Y January +2.8%

09:30 United Kingdom Producer Price Index - Output (MoM) January 0.0% +0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) January +1.0% +0.8%

09:30 United Kingdom Producer Price Index - Input (MoM) January +0.1% -0.4%

09:30 United Kingdom Producer Price Index - Input (YoY) January -1.2% -2.9%

09:30 United Kingdom HICP, m/m January +0.4% -0.6%

09:30 United Kingdom HICP, Y/Y January +2.0% +2.0%

09:30 United Kingdom HICP ex EFAT, Y/Y January +1.7% +1.9%

10:00 Eurozone ZEW Economic Sentiment February 73.3 73.9

10:00 Germany ZEW Survey - Economic Sentiment February 61.7 61.3

13:30 Canada Foreign Securities Purchases December 8.66 9.97

13:30 U.S. NY Fed Empire State manufacturing index February 12.51 9.9

14:00 U.S. Net Long-term TIC Flows December -29.3 -24.7

14:00 U.S. Total Net TIC Flows December -16.6

15:00 U.S. NAHB Housing Market Index February 56 56

23:00 Australia Conference Board Australia Leading Index December +0.2% -

13:15

European session: the pound retreated from four-year high

09:00 Eurozone Eurogroup Meetings

The British pound retreated from four-year highs against the dollar reached on housing data . Housing prices in Britain have risen markedly in February , registering with the largest increase in the last seven years . This was stated in the data, which were released on site estate Rightmove.

According to the report , average house prices across England and Wales increased in February to £ 251,964 , which was 6.9 percent higher than the same period last year , as demand from potential buyers continued to strengthen . Add that last jump was the highest ( in annual terms ) since November 2007.

In addition, it was reported that prices in London rose by 11.2 per cent per annum, in connection with which the average price was at around £ 541,313 . In the north- east cost of housing has risen by only 0.1 per cent , against which the average price was £ 142,372 . In Wales , house prices rose by 2.3 percent year on year , reaching £ 165,055 on average.

After several years of uncertainty , more people are thinking about moving . Over the past four weeks , the number of new homes that were for sale on the website , averaged 27,768 units , an increase of 18 percent compared with the same period last year.

Growing supply increases demand from buyers , which indicates that the number of homes sold in 2014 may be more than last year, according to Rightmove.

Japanese Yen lost scored during the Asian session positions against the dollar after data on GDP and industrial production. According to the report submitted by the Cabinet Office in Tokyo, annualized gross domestic product grew by only 1 % compared to the previous quarter . Thus, the figure fell short of the most pessimistic estimates of economists in 1.1% , while the average forecast assumes a 2.8% increase . The economic slowdown in Japan emphasizes the risks to recovery, especially before the rise of the sales tax in April to 8% from 5% . " Inevitably, the fact that the economy has weakened in the period from April to June because of the negative reaction to the demand," - said Yoshimasa Maruyama , chief economist at the Institute for Economic Research Itochu. Despite the fact that capital spending rose by the maximum value for two years, and consumption growth rose, external demand is still negatively affected GDP data . In January-March GDP growth is likely to accelerate, but some economists careful because higher wages can not support the costs after raising taxes. Relatively weak exports could also have a negative impact on growth.

The volume of industrial production in Japan grew weaker pace in December than previously assumed . This was stated in the final data , which were presented today by the Ministry of Economy, Trade and Industry. According to the report , industrial production grew by 7.1 percent in December compared with the same month last year, which was slightly less than the increase of 7.3 percent , which was reported on January 30. However, growth in December was significantly higher than in November - at the level of 4.8 percent. Seasonally adjusted industrial production rose by 0.9 percent compared with the previous month . Recall that in November industrial output fell by 0.1 percent. Preliminary data reported growth in December by 1.1 percent.

EUR / USD: during the European session, the pair fell to $ 1.3693

GBP / USD: during the European session, the pair fell to $ 1.6720

USD / JPY: during the European session, the pair rose to Y101.98

At 15:00 GMT the United States will make the Fed chief Janet Yellen .

-

10:30

Option expiries for today's 1400GMT cut

USD/JPY Y100.85-95, Y101.00, Y101.25, Y101.35, Y101.40, Y101.85, Y102.45, Y103.05

EUR/USD $1.3635, $1.3650, $1.3780

GBP/USD $1.6500, $1.6800

EUR/GBP stg0.8100, stg0.8200, stg0.8300

AUD/USD $0.8975, $0.9000, $0.9100

USD/CAD C$1.0900, C$1.1100

-

06:20

Asian session: The dollar fell

00:01 United Kingdom Rightmove House Price Index (MoM) February +1.0% +3.3%

00:01 United Kingdom Rightmove House Price Index (YoY) February +6.3% +6.9%

00:30 Australia New Motor Vehicle Sales (MoM) January +1.4% Revised From +1.7% -3.5% -3.5%

00:30 Australia New Motor Vehicle Sales (YoY) January -0.1% Revised From +0.1% -3.0%

04:30 Japan Industrial Production (MoM) (Finally) December +1.1% +1.1% +0.9%

04:30 Japan Industrial Production (YoY) (Finally) December +7.3% +7.3% +7.1%

The dollar fell against most of its major counterparts as traders weighed whether weaker U.S. economic data will spur the Federal Reserve to consider a slower pace in tapering stimulus. U.S. factory production unexpectedly declined in January by the most since May 2009, according to a report released on Feb. 14, adding to evidence severe winter weather is weighing on the economy.

The British pound reached the highest since November 2009 after a report showed U.K. house prices rose the most since October 2012. Rightmove Plc said asking prices for U.K homes rose 3.3 percent this month from January, when they gained 1 percent.

The yen gained after Japan’s economic growth unexpectedly slowed. Japan’s gross domestic product expanded at an annualized 1 percent pace in the final three months of 2013, down from 1.1 percent growth in the preceding quarter, the Cabinet Office said today. The median estimate of analysts surveyed by Bloomberg News was for a 2.8 percent expansion.

Australia’s currency rose after the People’s Bank of China said in a Feb. 15 statement that aggregate financing, the broadest measure of credit, increased to an unprecedented 2.58 trillion yuan ($425.5 billion) in January.

The Fed on Feb. 19 releases minutes of its last gathering.

Markets in the U.S. will be closed for a holiday today.

EUR / USD: during the Asian session, the pair rose to $ 1.3720

GBP / USD: during the Asian session, the pair rose to $ 1.6820

USD / JPY: on Asian session the pair fell to Y101.40

Volumes are see as light, with US markets closed.

-

04:32

Japan: Industrial Production (YoY), December +7.1% (forecast +7.3%)

-

04:31

Japan: Industrial Production (MoM) , December +0.9% (forecast +1.1%)

-

00:31

Australia: New Motor Vehicle Sales (MoM) , January -3.5% (forecast -3.5%)

-